Saudi Arabia Food Logistics Market Size, Share, Trends and Forecast by Transportation Mode, Product Type, Service Type, Segment, and Region, 2026-2034

Saudi Arabia Food Logistics Market Overview:

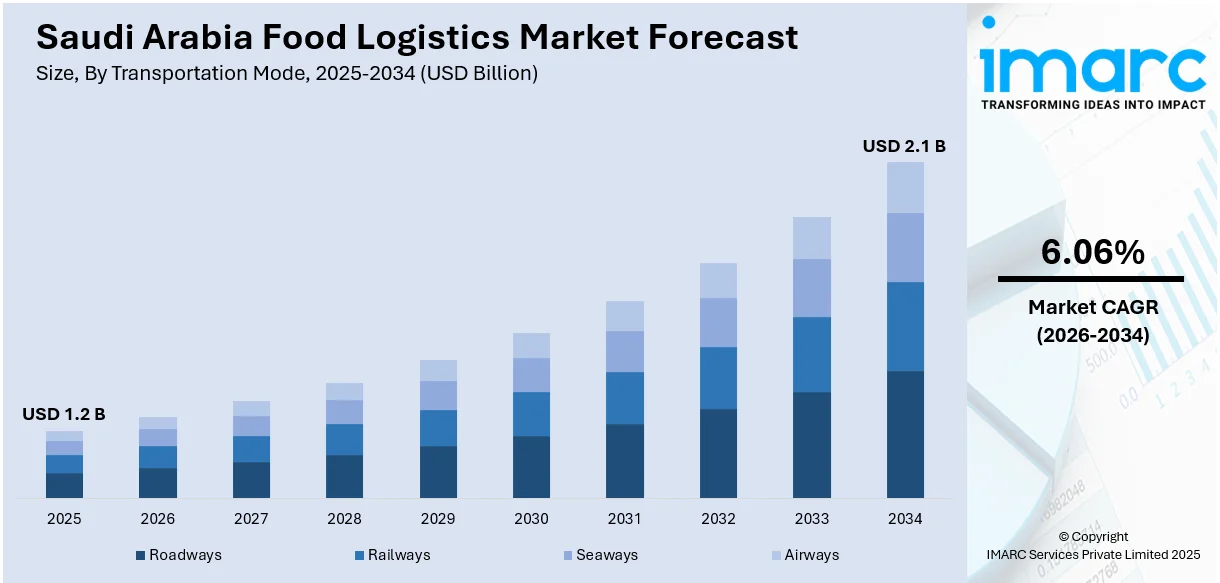

The Saudi Arabia food logistics market size reached USD 1.2 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 2.1 Billion by 2034, exhibiting a growth rate (CAGR) of 6.06% during 2026-2034. The market is fueled by the increasing demand for imported and perishable foodstuffs, retail and foodservice sector growth, government efforts such as Vision 2030, technological innovation and cold chain evolution, and growing e-commerce penetration.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.2 Billion |

| Market Forecast in 2034 | USD 2.1 Billion |

| Market Growth Rate 2026-2034 | 6.06% |

Saudi Arabia Food Logistics Market Trends:

Growing Demand for Cold Chain Logistics

One of the trends increasing the Saudi Arabia food logistics market share is escalating demand for cold chain logistics. As the consumption of fresh and frozen food, including dairy, seafood, and read-to-eat food, picks up pace, demand for transportation and storage within a controlled temperature has increased greatly. The growth of the food import business in the Kingdom due to rising populations and urbanization further supports the need for consistent cold chain facilities. Firms are investing in advanced refrigeration technologies, real-time temperature tracking, and automating warehouses to maintain food safety and quality. Besides, initiatives from governments such as Vision 2030, which promote the expansion of logistics infrastructure, are propelling the growth of this segment. With stringent regulations on health and food safety, the cold chain industry is poised to experience continued growth, with its role playing an essential part in sustaining supply chain effectiveness and responding to the increased standards of consumers and regulators alike.

To get more information on this market Request Sample

Digitization and Smart Logistics Solutions

Digitization is revolutionizing the Saudi Arabia food logistics market outlook through increased operational effectiveness, traceability, and supply chain transparency. Businesses are turning to technologies like GPS tracking, Internet of Things (IoT), blockchain, and cloud-based logistics platforms to maximize route optimization, track real-time delivery status, and provide integrity for perishable items. These intelligent logistics solutions minimize spoilage and delays and assist businesses in following food safety requirements by keeping accurate reports and automating critical processes. Further, the combination of AI and data analytics is also making predictive demand planning, dynamic inventory management, and quicker decision-making possible. With governmental drives aimed at embracing digitalization in Vision 2030, logistics services are being urged to modernize and invest in technologically advanced infrastructure. With ongoing expansion of e-commerce and online shopping with delivery of food, the demand for smart, technology-driven logistics systems becomes crucial, and hence digitization is a hallmark trend of the Saudi food logistics sector.

Expansion of Retail and Foodservice Sectors

The swift expansion of the foodservice and retail sectors in the country is strongly impacting the Saudi Arabia food logistics market growth. With the proliferation of hypermarkets, supermarkets, convenience stores, and e-grocery platforms, there has been a growing need for efficient and timely food distribution. Similarly, the proliferation of restaurants, cafes, and quick-service restaurants spurred by lifestyle changes, rising disposable incomes, and a youth bulge creates demands for strong supply networks. Logistics companies are reacting by increasing last-mile delivery capacity, adding warehouse space, and making significant investments in sophisticated fleet management systems. Additionally, the growing demand for foreign cuisines and imported foods necessitates a streamlined logistics solution that can provide diverse categories of products with different storage and handling requirements. Government initiatives to attract foreign investment and position the Kingdom as a regional logistics hub further underpin this trend. The expansion of the foodservice and retail sectors is therefore a primary force behind logistics innovation and infrastructure development.

Saudi Arabia Food Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on transportation mode, product type, service type, and segment.

Transportation Mode Insights:

- Roadways

- Railways

- Seaways

- Airways

The report has provided a detailed breakup and analysis of the market based on the transportation mode. This includes roadways, railways, seaways, and airways.

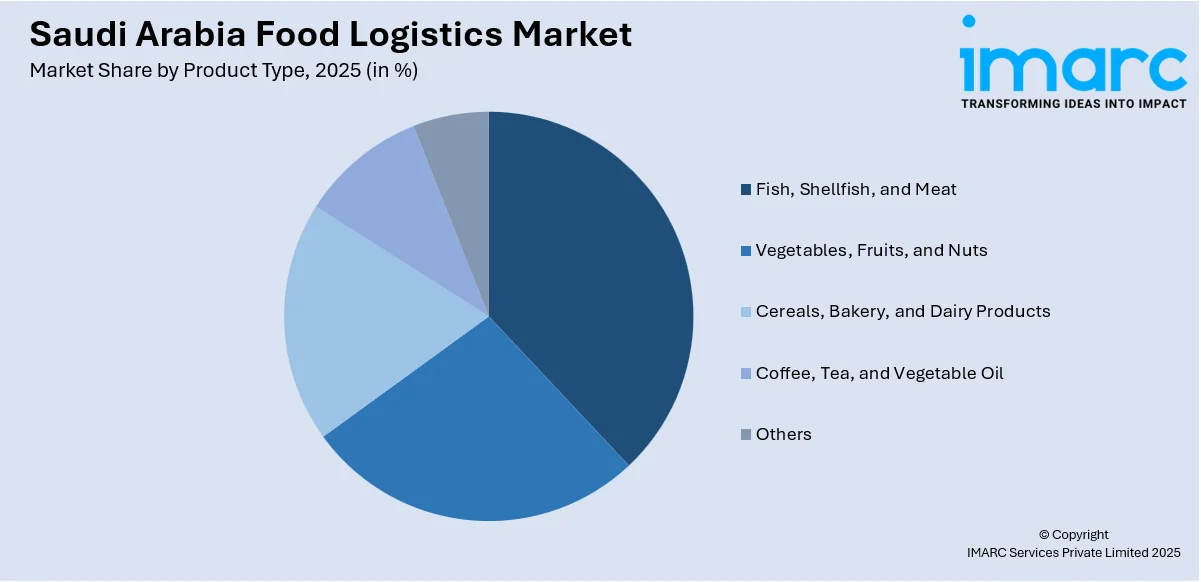

Product Type Insights:

Access the comprehensive market breakdown Request Sample

- Fish, Shellfish, and Meat

- Vegetables, Fruits, and Nuts

- Cereals, Bakery, and Dairy Products

- Coffee, Tea, and Vegetable Oil

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes fish, shellfish, and meat, vegetables, fruits, and nuts, cereals, bakery, and dairy products, coffee, tea, and vegetable oil, and others.

Service Type Insights:

- Cold Chain

- Non-Cold Chain

The report has provided a detailed breakup and analysis of the market based on the service type. This includes cold chain and non-cold chain.

Segment Insights:

- Transportation

- Packaging

- Instrumentation

The report has provided a detailed breakup and analysis of the market based on the segment. This includes transportation, packaging, and instrumentation.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Food Logistics Market News:

- In December 2024, Saudia Dairy and Foodstuff Company, referred to as SADAFCO, and Hyperview Logistics Company, which is under Hyperview Mobility (Shanghai) Company Ltd., signed a non-binding innovative memorandum of understanding to promote the use of hydrogen-powered logistics in Saudi Arabia. This partnership represents an important move toward realizing sustainable transportation and is in line with the objectives of Saudi Vision 2030.

Saudi Arabia Food Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Transportation Modes Covered | Roadways, Railways, Seaways, Airways |

| Product Types Covered | Fish, Shellfish, and Meat, Vegetables, Fruits, and Nuts, Cereals, Bakery, and Dairy Products, Coffee, Tea, and Vegetable Oil, Others |

| Service Types Covered | Cold Chain, Non-Cold Chain |

| Segments Covered | Transportation, Packaging, Instrumentation |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia food logistics market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia food logistics market on the basis of transportation mode?

- What is the breakup of the Saudi Arabia food logistics market on the basis of product type?

- What is the breakup of the Saudi Arabia food logistics market on the basis of service type?

- What is the breakup of the Saudi Arabia food logistics market on the basis of segment?

- What is the breakup of the Saudi Arabia food logistics market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia food logistics market?

- What are the key driving factors and challenges in the Saudi Arabia food logistics market?

- What is the structure of the Saudi Arabia food logistics market and who are the key players?

- What is the degree of competition in the Saudi Arabia food logistics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia food logistics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia food logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia food logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)