Saudi Arabia Food Safety Testing Market Size, Share, Trends and Forecast by Type, Food Tested, Technology, and Region, 2026-2034

Saudi Arabia Food Safety Testing Market Overview:

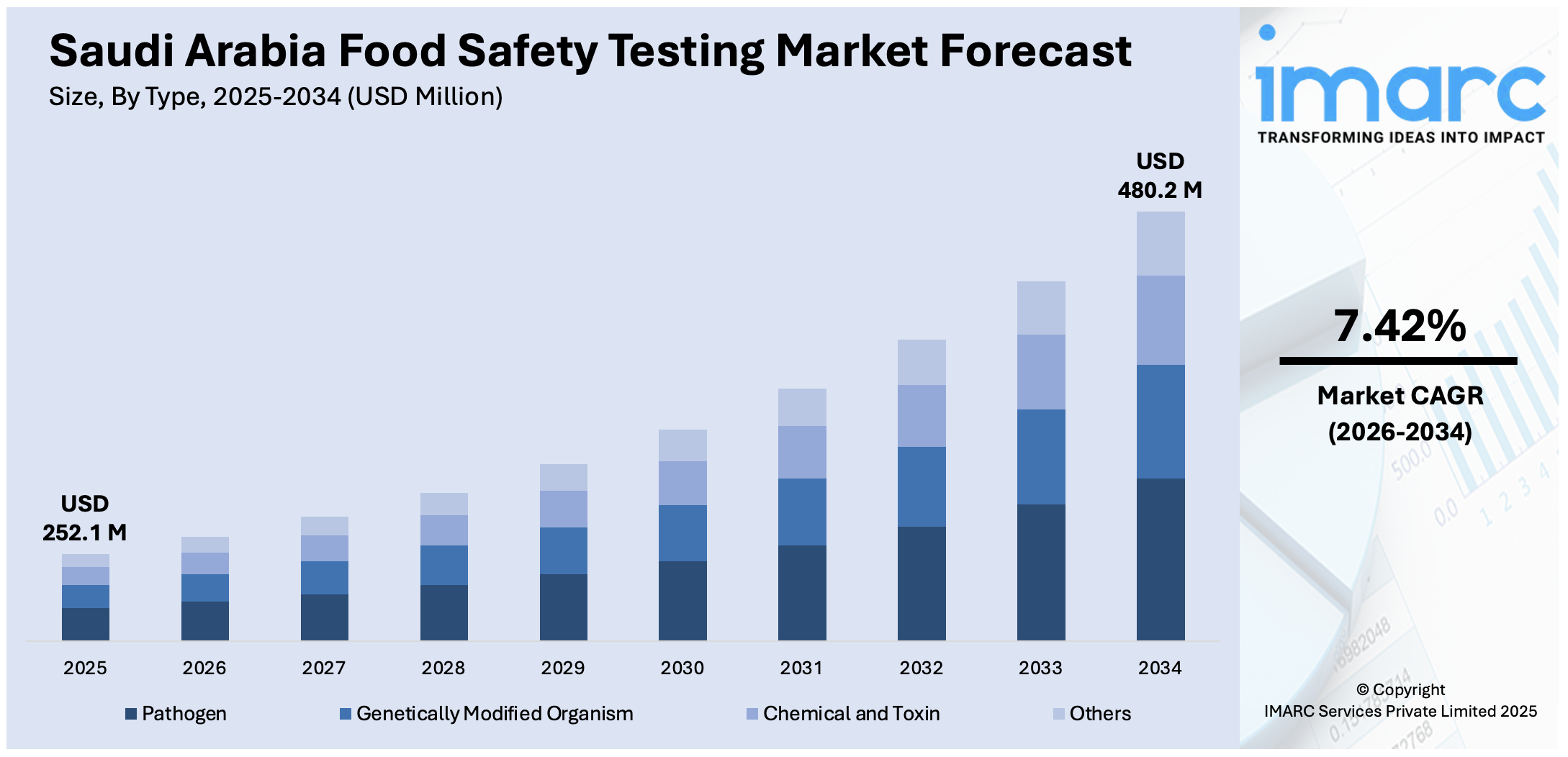

The Saudi Arabia food safety testing market size reached USD 252.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 480.2 Million by 2034, exhibiting a growth rate (CAGR) of 7.42% during 2026-2034. Saudi Arabia is investing in modern food safety infrastructure, enhancing laboratories, testing sites, and research institutions to ensure the safety of both local and imported food products. Furthermore, the rising number of e-commerce and online food delivery services is reshaping food safety dynamics, with a focus on preventing contamination during packaging, transportation, and delivery. These factors are driving the need for stringent safety measures to maintain consumer trust and public health, thus increasing the Saudi Arabia food safety testing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 252.1 Million |

| Market Forecast in 2034 | USD 480.2 Million |

| Market Growth Rate 2026-2034 | 7.42% |

Saudi Arabia Food Safety Testing Market Trends:

Increasing Investment in Food Safety Infrastructure

Saudi Arabia is investing heavily in its food safety systems to tackle the growing complexity of worldwide food supply chains and enhance national food security. These initiatives focus on creating contemporary laboratories, testing sites, and research institutions that can enhance advanced food safety testing throughout the entire supply chain. The modernization plan of the governing body involves increasing the number of accredited laboratories and incorporating advanced testing technologies, which are crucial for guaranteeing the safety of food products, both locally produced and imported. This infrastructure enables more regular, accurate, and thorough testing, enhancing the overall dependability of food safety systems in the Kingdom. A significant example illustrating this trend took place in March 2025, when AGQ Labs revealed the inauguration of a new lab in Al Khobar. The event, conducted in collaboration with AmCham on April 10, represented a strategic initiative to provide advanced analytical and consulting services in food safety for the wider Middle East region. This facility showcases the dedication of Saudi Arabia’s to drawing in global expertise and improving domestic skills. The development of food safety infrastructure, via partnerships with international industry leaders, establishes Saudi Arabia as a regional center for food quality assurance. With the rise in testing capacity and the expansion of infrastructure, the need for food safety services also rises, prompting both local producers and international exporters to conform to the Kingdom’s developing safety and compliance regulations. This persistent investment remains a key factor in strengthening the Saudi Arabia food safety testing market growth.

To get more information on this market Request Sample

E-commerce and Online Food Delivery Growth

The growing popularity of e-commerce and online food delivery services in Saudi Arabia is introducing new dynamics to the food safety testing market. With the growing prevalence of digital platforms in the food retail sector, guaranteeing the safety and quality of food directly delivered to consumers is emerging as a significant issue. The dangers of contamination during packaging, transportation, and final delivery are leading to stringent regulatory scrutiny and the implementation of stricter safety measures, such as cold chain management, hygiene adherence, and real-time tracking systems. The International Trade Administration (ITA) estimates that by 2024, the number of Saudi internet users participating in e-commerce will grow to 33.6 million, a 42% rise compared to 2019. Boasting a smartphone penetration rate of 97%, some of the quickest internet speeds globally, and 72% of individuals over 15 years old holding bank accounts, Saudi Arabia is distinctly poised for ongoing expansion in digital commerce. These technological progressions are enhancing accessibility and convenience, while also requiring increased accountability from food suppliers and delivery services. In a fiercely competitive marketplace, companies face pressure to maintain food safety standards to establish trust and keep clients. With an increasing number of consumers depending on digital platforms for food buying, the importance of thorough food safety testing grows in safeguarding public health and upholding consumer trust.

Saudi Arabia Food Safety Testing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, food tested, and technology.

Type Insights:

- Pathogen

- Genetically Modified Organism

- Chemical and Toxin

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes pathogen, genetically modified organism, chemical and toxin, and others.

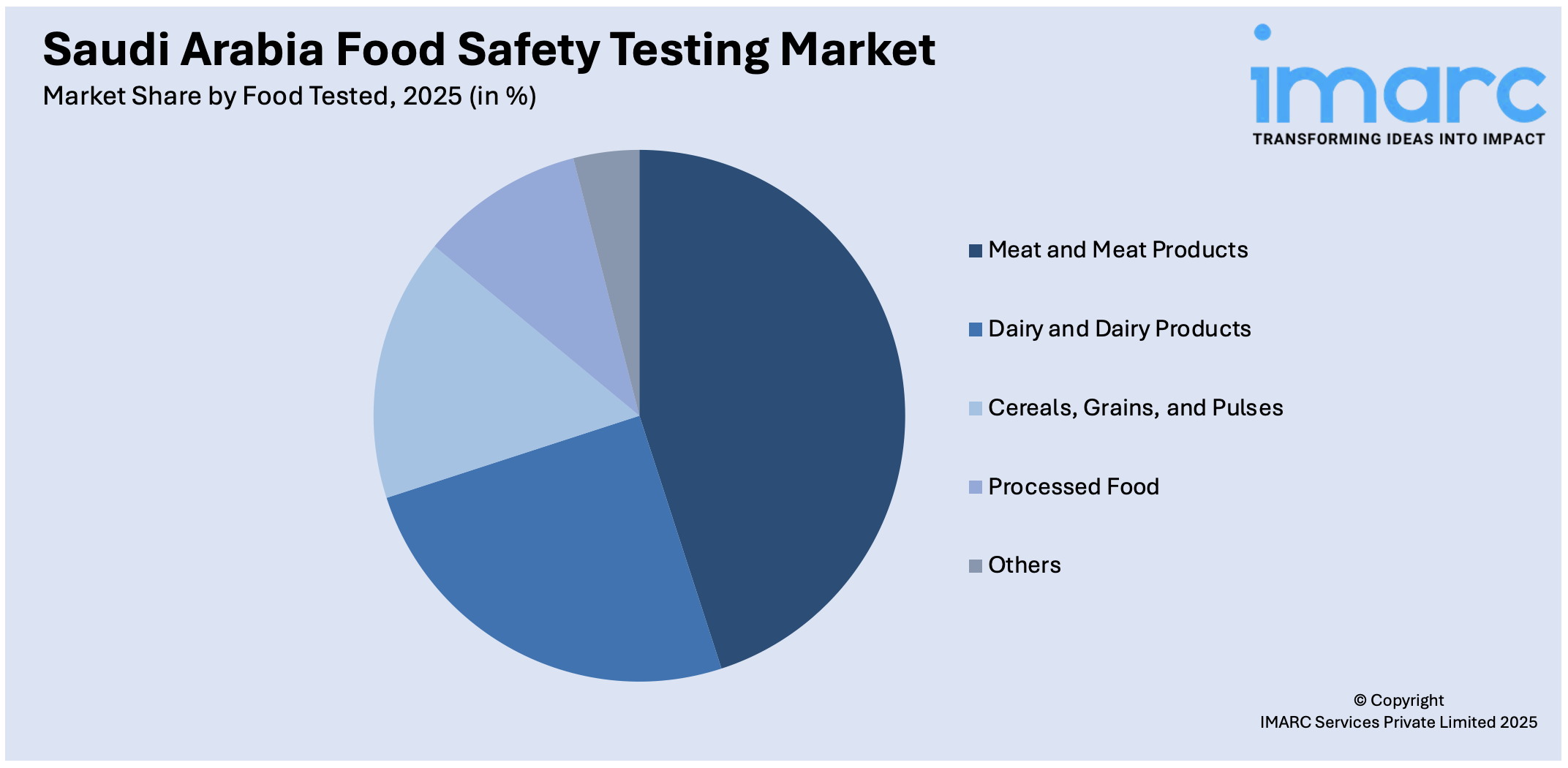

Food Tested Insights:

Access the comprehensive market breakdown Request Sample

- Meat and Meat Products

- Dairy and Dairy Products

- Cereals, Grains, and Pulses

- Processed Food

- Others

A detailed breakup and analysis of the market based on the food tested have also been provided in the report. This includes meat and meat products, dairy and dairy products, cereals, grains, and pulses, processed food, and others.

Technology Insights:

- Agar Culturing

- PCR-based Assay

- Immunoassay-based

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes agar culturing, PCR-based assay, immunoassay-based, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Food Safety Testing Market News:

- In September 2024, Bureau Veritas KSA's Conformity Assessment Establishment License was renewed by the SFDA to operate in food conformity assessment. This ensured that food products exported to Saudi Arabia comply with SFDA regulations.

- In January 2024, the Saudi Food and Drug Authority (SFDA) extended mandatory halal certification for various food products, including meat, processed foods, and compounds with meat content. Importers must ensure halal certificates came from recognized certification bodies, such as SGS Gulf Ltd, which is accredited by the Saudi Halal Center. This step aimed to maintain halal integrity for food imports into Saudi Arabia.

Saudi Arabia Food Safety Testing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Pathogen, Genetically Modified Organism, Chemical and Toxin, Others |

| Food Tested Covered | Meat and Meat Products, Dairy and Dairy Products, Cereals, Grains, and Pulses, Processed Food, Others |

| Technologies Covered | Agar Culturing, PCR-based Assay, Immunoassay-based, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia food safety testing market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia food safety testing market on the basis of type?

- What is the breakup of the Saudi Arabia food safety testing market on the basis of food tested?

- What is the breakup of the Saudi Arabia food safety testing market on the basis of technology?

- What is the breakup of the Saudi Arabia food safety testing market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia food safety testing market?

- What are the key driving factors and challenges in the Saudi Arabia food safety testing market?

- What is the structure of the Saudi Arabia food safety testing market and who are the key players?

- What is the degree of competition in the Saudi Arabia food safety testing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia food safety testing market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia food safety testing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia food safety testing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)