Saudi Arabia Frozen Dessert Market Size, Share, Trends and Forecast by Product Type, Category, Distribution Channel, and Region, 2026-2034

Saudi Arabia Frozen Dessert Market Summary:

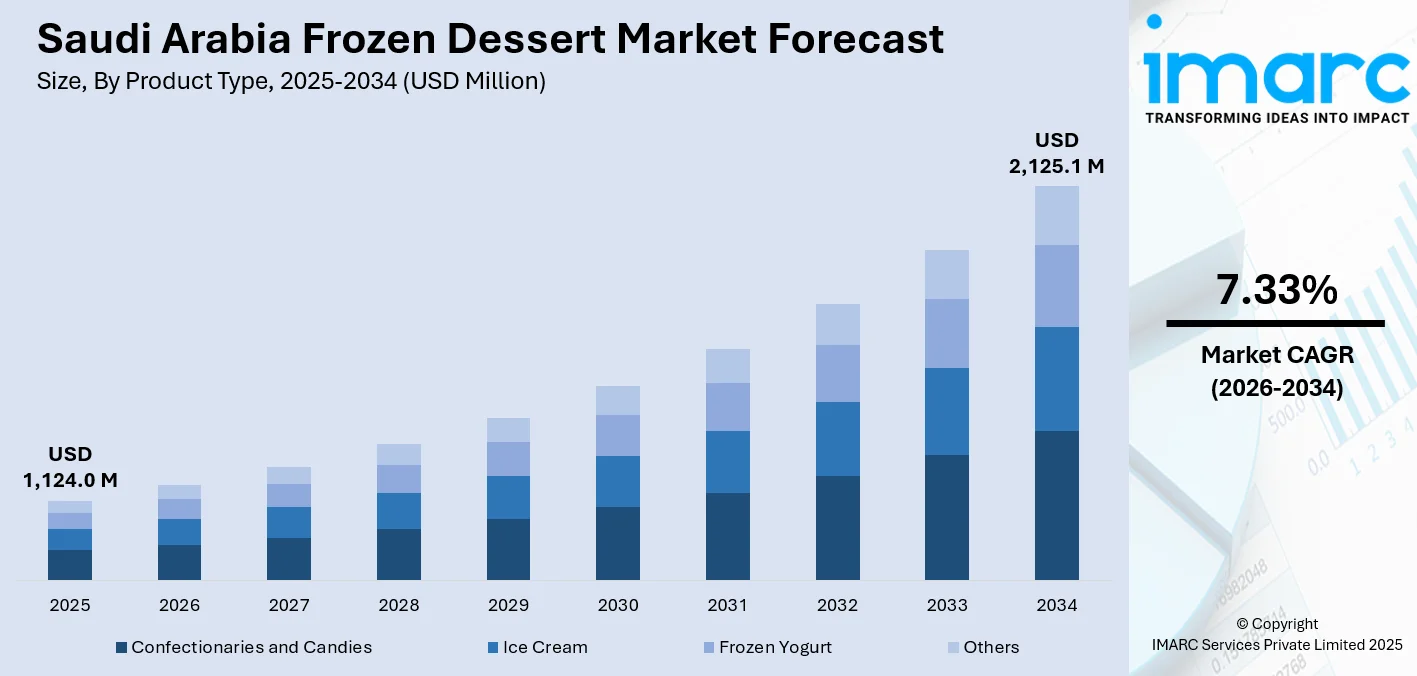

The Saudi Arabia frozen dessert market size was valued at USD 1,124.0 Million in 2025 and is projected to reach USD 2,125.1 Million by 2034, growing at a compound annual growth rate of 7.33% from 2026-2034.

The Saudi Arabia frozen dessert market is experiencing robust expansion, driven by the Kingdom's hot climatic conditions, evolving consumer preferences, and thriving tourism sector. Urbanization and increasing disposable incomes are accelerating demand for premium and innovative frozen treats. The young demographic profile, coupled with expanding modern retail infrastructure and rising health consciousness, continues to reshape consumption patterns and fuel market growth across Saudi Arabia.

Key Takeaways and Insights:

- By Product Type: Ice cream dominates the market with a share of 45% in 2025, owing to its versatility, wide flavor range, and cultural preference for creamy indulgent treats. Rising temperatures and expanding retail accessibility are fueling sustained consumption growth.

- By Category: Conventional leads the market with a share of 73% in 2025. This dominance reflects consumer familiarity with traditional dairy-based formulations and widespread availability across retail channels. Established brand presence and competitive pricing reinforce market leadership.

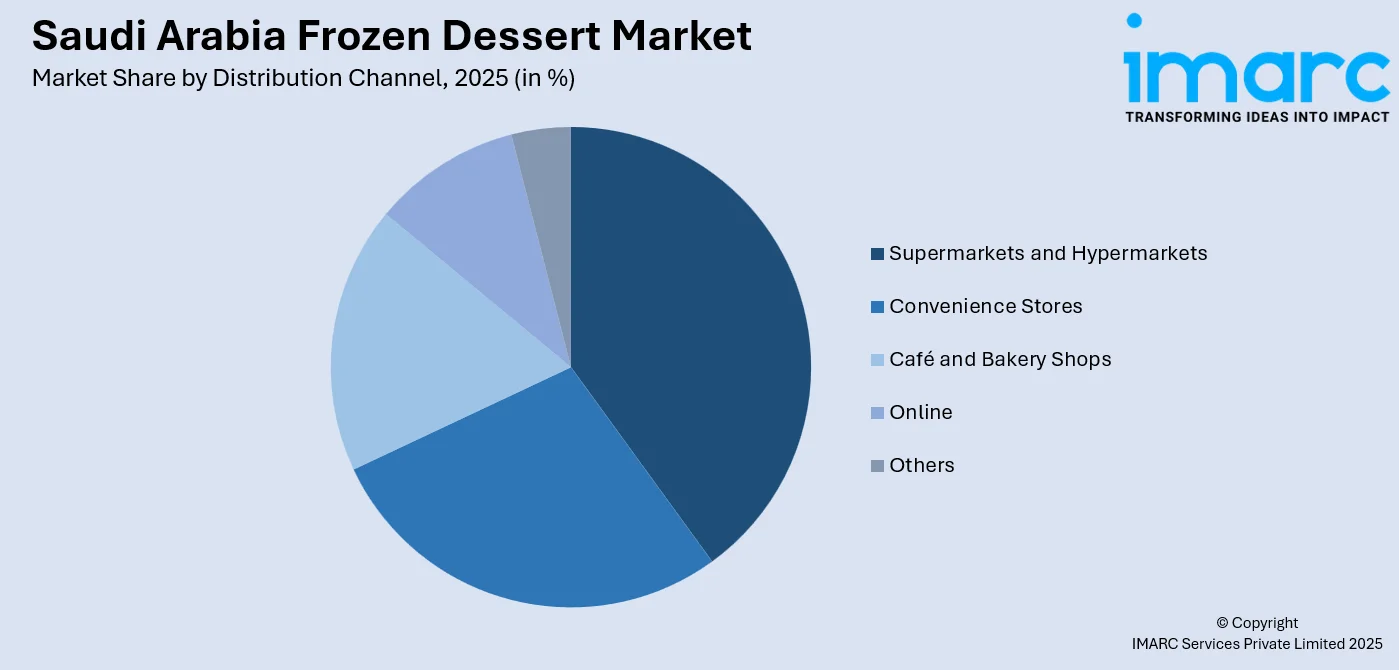

- By Distribution Channel: Supermarkets and hypermarkets comprise the largest segment with a market share of 39% in 2025, driven by one-stop shopping convenience, extensive product assortments, and temperature-controlled storage facilities ensuring product quality.

- By Region: Northern and Central Region represents the largest region with 30% share in 2025, reflecting the concentration of population in Riyadh metropolitan area, higher purchasing power, and dense modern retail infrastructure supporting frozen dessert consumption.

- Key Players: Key players drive the Saudi Arabia frozen dessert market by expanding product portfolios, enhancing flavor innovations, and strengthening distribution networks. Their investments in marketing, premium offerings, and partnerships with retail chains boost brand visibility and market penetration across diverse consumer segments.

To get more information on this market Request Sample

The Saudi Arabia frozen dessert market is undergoing significant transformation, propelled by shifting consumer lifestyles and strategic government initiatives under Vision 2030. The Kingdom's hot climate creates sustained year-round demand for frozen desserts, as consumers seek refreshing relief. The youthful demographic structure, with approximately 71% of the population below age 35 according to the 2024 Saudi Family Statistics Report, is driving demand for innovative flavors and premium offerings. Health consciousness is reshaping preferences towards sugar-free and plant-based alternatives, while e-commerce broadening enables convenient home delivery, broadening market reach. Expanding tourism and entertainment sectors are further boosting out-of-home consumption across cafés, restaurants, and leisure destinations. Retail infrastructure development, including modern supermarkets and convenience stores, is improving product visibility and accessibility. Additionally, rising disposable incomes and premiumization trends are encouraging consumers to experiment with artisanal and imported frozen dessert brands.

Saudi Arabia Frozen Dessert Market Trends:

Rising Demand for Premium and Artisanal Frozen Desserts

The Saudi Arabia frozen dessert market is witnessing growing consumer preference for premium, artisanal, and gourmet products. Contemporary dessert boutiques and specialty ice cream parlors are proliferating across major cities like Riyadh and Jeddah, offering visually appealing creations that attract younger demographics. Social media influence and experiential dining trends are amplifying demand for unique textures, exotic flavors, and customizable dessert options. Consumers are willing to pay a premium for high-quality ingredients, clean-label formulations, and locally inspired flavors. This shift is encouraging brands to focus on differentiation, storytelling, and upscale presentation to capture evolving consumer tastes.

Growing Health Consciousness Driving Product Innovation

Health and wellness trends are reshaping frozen dessert formulations as consumers increasingly seek low-sugar, dairy-free, and plant-based alternatives. As per IMARC Group, the Saudi Arabia health and wellness market size reached USD 38,747.7 Million in 2025. Vegan ice creams made from almond milk, coconut milk, and cashew bases are gaining popularity among health-conscious consumers. Manufacturers are responding with fortified products containing probiotics and functional ingredients, while sugar-free varieties appeal to the growing diabetic population seeking guilt-free indulgence.

Digital Transformation and E-commerce Expansion

Digital channels are revolutionizing frozen dessert distribution in Saudi Arabia, with online food delivery services creating new consumption occasions. Quick commerce platforms have gained significant traction in urban areas, supported by advanced cold-chain logistics. The Saudi Central Bank indicated that electronic payments accounted for 79% of all retail payments in 2024. This digital transformation enables frozen dessert brands to reach broader audiences while providing convenience to time-pressed consumers, particularly younger demographics who increasingly prefer doorstep delivery.

How Vision 2030 is Transforming the Saudi Arabia Frozen Dessert Market:

Vision 2030 is transforming the Saudi Arabia frozen dessert market by reshaping consumer lifestyles, retail infrastructure, and tourism activity across the Kingdom. Economic diversification initiatives are accelerating the development of entertainment zones, malls, and dining destinations, increasing impulse consumption of ice creams and frozen desserts. Rising tourism, driven by giga-projects and relaxed visa policies, is expanding demand from hotels, cafés, and quick-service restaurants. Vision 2030 also promotes healthier lifestyles, encouraging manufacturers to introduce low-sugar, dairy-free, and premium frozen dessert options aligned with evolving consumer preferences. Investments in cold chain logistics and modern retail formats are improving product availability beyond major cities, supporting wider market penetration. Additionally, local manufacturing incentives under Vision 2030 are strengthening domestic production capabilities, reducing import reliance and enabling faster innovation.

Market Outlook 2026-2034:

The Saudi Arabia frozen dessert market demonstrates strong growth prospects, underpinned by demographic advantages and strategic economic diversification. Continued urbanization will expand modern retail access and consumption opportunities. The market generated a revenue of USD 1,124.0 Million in 2025 and is projected to reach a revenue of USD 2,125.1 Million by 2034, growing at a compound annual growth rate of 7.33% from 2026-2034. Vision 2030 tourism initiatives will significantly boost consumption at hospitality venues. Product innovations, focusing on health-conscious formulations and local flavor profiles, will capture evolving consumer preferences, while cold-chain infrastructure investments ensure product quality across expanding distribution networks. Additionally, increasing participation of international brands and strategic partnerships with local distributors will intensify competition across the Kingdom.

Saudi Arabia Frozen Dessert Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Ice Cream |

45% |

|

Category |

Conventional |

73% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

39% |

|

Region |

Northern and Central Region |

30% |

Product Type Insights:

- Confectionaries and Candies

- Ice Cream

- Frozen Yogurt

- Others

Ice cream dominates with a market share of 45% of the total Saudi Arabia frozen dessert market in 2025.

Ice cream maintains its dominant position in the Saudi frozen dessert market, driven by its universal appeal across all age groups and versatile consumption occasions. The product's creamy texture, diverse flavor profiles ranging from traditional vanilla and chocolate to regional favorites like mango and date, and various formats including cones, cups, bars, and tubs cater to diverse consumer preferences. Saudi Arabia's extreme temperatures create sustained demand for refreshing frozen treats throughout the year.

The segment benefits from continuous product innovations and premiumization trends reshaping consumer expectations. Domestic players are strengthening their market positions by introducing new ranges of ice creams spanning multiple formats, including sandwiches, cones, sticks, and tubs across various flavors. International and local brands are expanding their portfolios with artisanal offerings, organic variants, and health-conscious formulations to capture evolving consumer preferences, particularly among younger demographics seeking social media worthy dessert experiences.

Category Insights:

- Conventional

- Sugar-free

Conventional leads with a share of 73% of the total Saudi Arabia frozen dessert market in 2025.

Conventional maintains market leadership through established consumer familiarity with traditional dairy-based formulations and widespread retail availability. Conventional products leverage proven recipes and manufacturing processes that deliver consistent taste profiles appealing to mainstream consumers. Competitive pricing strategies and extensive distribution networks ensure accessibility across urban and suburban markets, reinforcing category dominance in the Saudi market landscape. Manufacturers continue to invest in conventional product innovations to retain consumer interest and market share.

Brand collaborations and limited-edition flavor launches create excitement and drive impulse purchases, while family-sized packaging options cater to household consumption patterns. Enhanced cold-chain infrastructure ensures product quality maintenance across expanding retail touchpoints. As per IMARC Group, the Saudi Arabia cold chain market size reached USD 2.94 Million in 2024. High penetration of supermarkets and convenience stores further supports steady sales volumes for conventional frozen desserts. Moreover, strong brand loyalty and frequent promotional activities help manufacturers sustain demand amid rising competition from premium and alternative product segments.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Café and Bakery Shops

- Online

- Others

Supermarkets and hypermarkets exhibit a clear dominance with a 39% share of the total Saudi Arabia frozen dessert market in 2025.

Supermarkets and hypermarkets serve as the primary distribution channel for frozen desserts, benefiting from one-stop shopping convenience and extensive product assortments. These modern retail formats provide temperature-controlled storage facilities essential for maintaining frozen product quality. Major cities, including Riyadh, Jeddah, and Dammam, feature dense concentrations of these outlets, ensuring widespread consumer accessibility. High footfall and frequent shopping trips enable consistent impulse purchases, particularly during weekends and festive periods.

Channel expansion continues to accelerate in Saudi Arabia, with leading retailers announcing aggressive growth plans. Saudi retailer, Panda Retail Co. earmarked 20 new stores for 2025 alone, emphasizing Riyadh and remote areas to extend market reach. Hypermarkets and supermarkets gradually overshadow traditional retail as packaged food demand rises. Strategic in-store promotions, dedicated freezer displays, and sampling activities enhance product visibility and stimulate consumer trial, driving frozen dessert category growth.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region represents the leading region with a 30% share of the total Saudi Arabia frozen dessert market in 2025.

Northern and Central Region, anchored by Riyadh, commands the largest market share reflecting population concentration and economic activity. The Royal Commission for the City of Riyadh's official announcement states that the area aspires to accommodate 15 Million residents by 2030, creating substantial consumption potential. The capital serves as the Kingdom's commercial hub with the highest concentration of modern retail outlets, restaurants, and entertainment venues. Rising disposable incomes and urban lifestyles drive premium frozen dessert consumption.

Government-led entertainment initiatives significantly boost frozen dessert consumption in the region. Development of the hospitality infrastructure, such as hotels, restaurants, and entertainment centers, increases points of consumption. Cold-chain logistics networks centered in Riyadh ensure efficient distribution across the wider Northern and Central Region. This area gains from youthful, cosmopolitan consumers who tend to look for new flavors and international brands of desserts. Events and seasonal attractions within this region increase impulse buying of frozen desserts.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Frozen Dessert Market Growing?

Thriving Tourism and Hospitality Sectors Expansion

Saudi Arabia's ambitious tourism development under Vision 2030 is significantly accelerating frozen dessert market growth. Inbound tourism receipts climbed to SAR 168.5 Billion in 2024, representing a vigorous 19% rise from 2023. Hotels, resorts, and tourism sites are introducing upscale frozen dessert options to cater to international visitors who have varied food preferences. A huge presence of modern dessert boutiques and ice cream parlors is observed in major urban areas, such as Riyadh and Jeddah. Fun activities and entertainment occasions like Riyadh Season and Winter at Tantora Festival in AlUla provide a huge consumption occasion for food sellers, who are attempting to take advantage of massive visitor traffic. Theme parks, beach developments, and tourism sites further increase the demand for frozen desserts by expanding foodservice operations.

Young Demographics and Evolving Consumer Preferences

Saudi Arabia’s youthful population structure serves as a strong demand catalyst for frozen desserts, shaped by evolving tastes and indulgence-driven consumption habits. Young consumers look for innovation, superior quality, and attractive dessert experiences, with social media culture and experiential dining behavior driving their pursuit. This demographic shows a high willingness to experiment with international flavors, artisanal formats, and limited-edition offerings, moving beyond traditional options. Expanding exposure to global cuisines through travel, digital media, and tourism is further influencing flavor preferences and consumption patterns. Rising female workforce participation under Vision 2030 is increasing household purchasing power, supporting discretionary spending on premium food and beverage (F&B) products. In the second quarter of 2025, women's involvement in the economy of Saudi Arabia hit 34.5%. Leisure-oriented lifestyles, supported by the growth of entertainment zones, festivals, and social gatherings, are creating frequent consumption occasions for frozen desserts.

Expansion of Modern Retail Infrastructure and Distribution Channels

The rapid expansion of modern retail formats is significantly improving frozen dessert accessibility across Saudi Arabia. Hypermarkets and supermarkets are increasingly replacing traditional retail outlets as consumer demand for packaged frozen foods continues to rise. Leading retail chains are pursuing aggressive store expansion strategies, strengthening nationwide distribution and improving shelf visibility for frozen dessert brands. The entry of new international retailers is intensifying competition while enhancing product variety and quality standards. Simultaneously, online grocery platforms and quick-commerce services are reshaping purchasing behavior by offering convenient, rapid delivery of frozen desserts to households. These digital channels are particularly appealing to urban consumers seeking speed and convenience. Investments in cold-chain infrastructure, including temperature-controlled storage facilities and refrigerated delivery fleets, are supporting consistent product quality across physical and online channels.

Market Restraints:

What Challenges the Saudi Arabia Frozen Dessert Market is Facing?

Cold Chain Infrastructure Limitations in Remote Areas

Maintaining frozen product quality across Saudi Arabia's vast geography presents logistical challenges. Temperature control during transportation across extensive distances between cities and remote areas requires substantial infrastructure investments. Ensuring cold chain integrity from manufacturing facilities through distribution to retail freezers demands coordination among multiple stakeholders. Power supply reliability and refrigeration equipment maintenance in less-developed regions constrain market expansion opportunities.

Intense Competition and Price Sensitivity

The frozen dessert market faces mounting challenges, as local and international players compete vigorously for consumer attention. Price-sensitive purchasing behavior is putting pressure on profit margins, prompting frequent promotions and discounting that can undermine long-term profitability. Additionally, market saturation in major urban centers makes it increasingly difficult for brands to stand out. To sustain growth and maintain competitive positioning, manufacturers must invest in differentiation strategies, such as innovative flavors, premium offerings, unique packaging, and engaging consumer experiences, rather than relying solely on price-based competition.

Regulatory Compliance and Food Safety

Strict food safety regulations and labeling requirements in Saudi Arabia pose challenges for frozen dessert producers. Compliance with hygiene standards, ingredient disclosures, and import regulations demands significant operational oversight and quality control investment. Any lapses can result in recalls, reputational damage, and financial losses. Manufacturers must implement robust monitoring, training, and documentation processes to ensure regulatory adherence while maintaining efficiency and product consistency across the supply chain.

Competitive Landscape:

The Saudi Arabia frozen dessert market exhibits a competitive landscape, featuring both established local manufacturers and international brands. Key players focus on product portfolio expansion, flavor innovations, and distribution network strengthening to capture market share. Strategic investments in manufacturing capacity, cold-chain logistics, and marketing initiatives characterize competitive dynamics. Companies emphasize premium positioning, health-conscious formulations, and local flavor adaptations to differentiate offerings. Partnerships between frozen dessert manufacturers and retail chains enhance product visibility and accessibility. Brand collaborations with popular confectionery and beverage companies create co-branded products appealing to diverse consumer segments.

Saudi Arabia Frozen Dessert Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Confectionaries and Candies, Ice Cream, Frozen Yogurt, Others |

| Categories Covered | Conventional, Sugar-free |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Café and Bakery Shops, Online, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia frozen dessert market size was valued at USD 1,124.0 Million in 2025.

The Saudi Arabia frozen dessert market is expected to grow at a compound annual growth rate of 7.33% from 2026-2034 to reach USD 2,125.1 Million by 2034.

Ice cream dominated the market with a share of 45%, due to its broad consumer appeal, wide variety of flavors, and consistent year-round demand driven by the Kingdom’s hot climate and evolving indulgence-oriented consumption patterns.

Key factors driving the Saudi Arabia frozen dessert market include thriving tourism sector expansion, youthful demographic structure, and growing modern retail infrastructure. Additionally, increasing interest in premium and artisanal frozen desserts is fueling innovations and expanding consumer choice.

Major challenges include rising health consciousness shifting preferences towards sugar-free alternatives, cold chain infrastructure limitations in remote areas, intense market competition, and price sensitivity among consumers. Additionally, seasonal demand fluctuations strain manufacturers’ operational and marketing strategies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)