Saudi Arabia Frozen Potato Products Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End-Use, and Region, 2026-2034

Saudi Arabia Frozen Potato Products Market Overview:

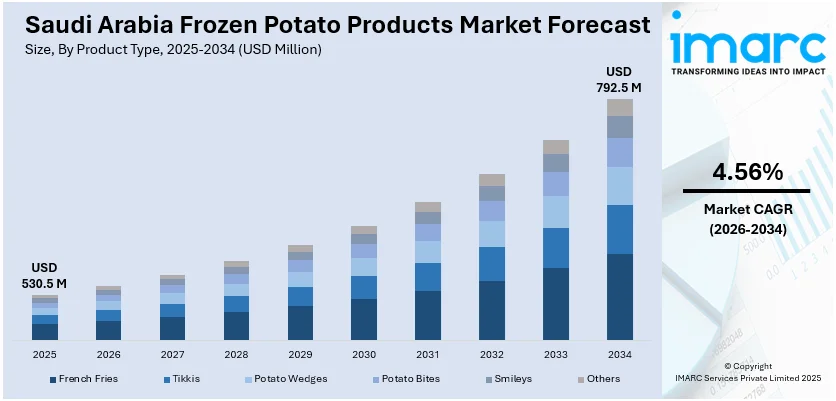

The Saudi Arabia frozen potato products market size reached USD 530.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 792.5 Million by 2034, exhibiting a growth rate (CAGR) of 4.56% during 2026-2034. The rising demand for convenient foods, the expansion of quick-service restaurants, increasing urbanization, and a youthful, high-income population embracing Western dining trends are some of the main factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 530.5 Million |

| Market Forecast in 2034 | USD 792.5 Million |

| Market Growth Rate 2026-2034 | 4.56% |

Saudi Arabia Frozen Potato Products Market Trends:

Expansion of Domestic Potato Production and Onshore Processing Infrastructure

Saudi Arabia has made remarkable progress in boosting domestic potato production and processing capacity, reducing reliance on imports, and capturing more value locally. In 2023, potato production surged by 47%, reaching 621,750 tons, up from 423,770 tons in 2021, increasing the self-sufficiency rate to 86%, compared to under 70% two years earlier. This growth was driven by expanded cultivation areas, rising from 15,890 ha in 2021 to over 17,000 ha in 2023, and the adoption of improved seed varieties and precision irrigation. To capitalize on this production boom, the kingdom is also investing in large-scale processing infrastructure. A notable example is the USD 100 million collaboration between the Agricultural Growth and Processing Company (AGPC) and Farm Frites International, which is building Saudi Arabia’s largest frozen French fries facility in Sudair Industrial City. Designed to process 70,000 tons annually, the plant is expected to lower import tariffs and shipping costs while enabling localized product customization. These initiatives align with Saudi Vision 2030, boosting food security and positioning the kingdom as a regional exporter of value-added frozen potato products.

To get more information on this market Request Sample

QSR-Led Demand Surge and Rising Frozen-Potato Imports

The rapid expansion of quick-service restaurants (QSRs) and growing consumer preference for convenient dining options are key factors propelling the growth of Saudi Arabia’s frozen potato products market. Notable players include Herfy, with 360+ outlets and McDonald’s 350+, both of which prominently feature frozen fries on their menus. This QSR boom has directly contributed to the growth of the Saudi French fries segment, which was valued at USD 461.0 million in 2024 and is expected to reach USD 1,090.5 million by 2033, exhibiting a growth rate (CAGR) of 9.54% during 2025-2033. To keep pace with rising demand and broaden product variety, Saudi Arabia is ramping up its imports of frozen potato products, including fries, wedges, and hash browns. Consequently, the continued QSR proliferation, higher disposable incomes, and innovations in premium and health-conscious potato offerings are presenting lucrative opportunities for the market growth.

Saudi Arabia Frozen Potato Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product type, distribution channel, and end-use.

Product Type Insights:

- French Fries

- Tikkis

- Potato Wedges

- Potato Bites

- Smileys

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes French fries, tikkis, potato wedges, potato bites, smileys, and others.

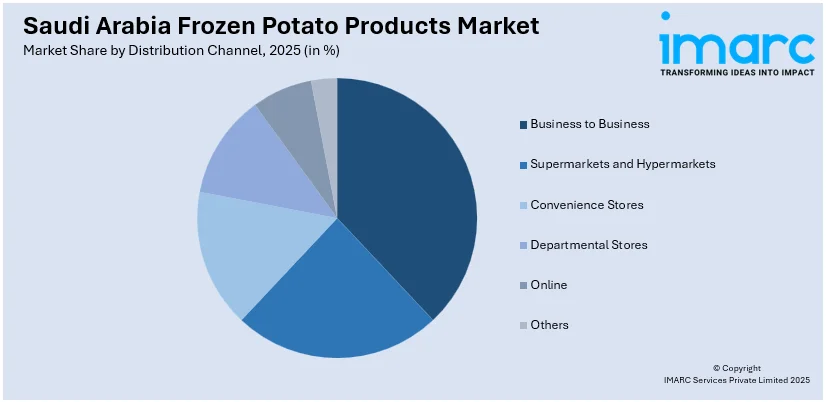

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Business to Business

- Supermarkets and Hypermarkets

- Convenience Stores

- Departmental Stores

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes business to business, supermarkets and hypermarkets, convenience stores, departmental stores, online, and others.

End-Use Insights:

- Food Services

- Retail

A detailed breakup and analysis of the market based on the end-use have also been provided in the report. This includes food services and retail.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Frozen Potato Products Market News:

- November 2024: Americana Foods and Farm Frites announced that they would invest USD 100 million (SAR 375 million) to establish a frozen French fries manufacturing plant in Riyadh's Sudair Industrial and Business City. Scheduled to commence operations in early 2026, the facility will have an initial annual production capacity of 70,000 metric tons, reportedly making it the largest producer of frozen fries in the MENA region.

- October 2024: SABIC, Lamb Weston, and OpackGroup collaborated to create sustainable packaging for frozen potato products. This innovative packaging is made from at least 60% bio-renewable polyethylene derived from used cooking oil (UCO), reducing the carbon footprint by approximately 30%. The lightweight, ISCC PLUS-certified multilayer film maintains product quality and complies with food safety standards.

Saudi Arabia Frozen Potato Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | French Fries, Tikkis, Potato Wedges, Potato Bites, Smileys, Others |

| Distribution Channels Covered | Business to Business, Supermarkets and Hypermarkets, Convenience Stores, Departmental Stores, Online, Others |

| End-Uses Covered | Food Services, Retail |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia frozen potato products market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia frozen potato products market on the basis of product type?

- What is the breakup of the Saudi Arabia frozen potato products market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia frozen potato products market on the basis of end-use?

- What is the breakup of the Saudi Arabia frozen potato products market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia frozen potato products market?

- What are the key driving factors and challenges in the Saudi Arabia frozen potato products market?

- What is the structure of the Saudi Arabia frozen potato products market and who are the key players?

- What is the degree of competition in the Saudi Arabia frozen potato products market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia frozen potato products market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia frozen potato products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia frozen potato products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)