Saudi Arabia Gaming Market Report by Device Type (Consoles, Mobiles and Tablets, Computers), Platform (Online, Offline), Revenue (In-Game Purchase, Game Purchase, Advertising), Type (Adventure/Role Playing Games, Puzzles, Social Games, Strategy, Simulation, and Others), Age Group (Adult, Children), and Region 2026-2034

Saudi Arabia Gaming Market Size:

Saudi Arabia gaming market size reached USD 2,387.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 4,957.2 Million by 2034, exhibiting a growth rate (CAGR) of 8.46% during 2026-2034. The market is primarily driven by supportive government policies and investment, the rising popularity of e-sports, and the notable growth of small and medium-sized businesses (SMEs), which foster an environment that is favorable to gaming and encourages growth and involvement in the industry throughout the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 2,387.7 Million |

|

Market Forecast in 2034

|

USD 4,957.2 Million |

| Market Growth Rate 2026-2034 | 8.46% |

Saudi Arabia Gaming Market Analysis:

- Major Market Drivers: The rapid technological advancements in mobile gaming and VR/AR technologies are driving market growth. Also, the increasing disposable incomes and a youthful population with a high affinity for digital entertainment are significant drivers.

- Key Market Trends: The growing popularity of e-sports and online multiplayer games among Saudi youth. Also, the widespread adoption of cloud gaming services and subscriptions, offering convenient access to a wide range of games.

- Competitive Landscape: The market is dominated by numerous players and mobile gaming giants, along with the emerging local developers and publishers gaining traction, focusing on culturally relevant content across the region.

- Challenges and Opportunities: Cultural sensitivities and regulatory restrictions impacting game content and distribution across the region. According to the Saudi Arabia gaming market insights, untapped potential in educational and serious gaming segments, and the increasing interest in gamification for various sectors like healthcare and education are influencing the market growth.

Saudi Arabia Gaming Market Trends:

Government Initiatives and Investments

HRH Prince Faisal bin Bandar bin Sultan Al Saud, the Chairman of the Federation of E-sports and Gaming, states Saudi Arabia targets to establish itself as a major global hub for gaming and esports by 2030, generating an estimated $13.3 Billion in economic benefits and over 35,000 new employments. Additionally, job prospects significantly improved with the growth of the gaming sector, especially in game creation, esports event management, and streaming. Besides, a multipurpose theater with 5,155 seats and six separate volumes, is part of the ambitious development plans for gaming and esports facilities in Qiddiya City, Saudi Arabia. Also, the venue is intended to hold big events year-round and draw up to 10 million people. Along with this, Saudi Arabia's $45 Million investment in partnership with UAE-based esports network True Gamers to establish 150 centers emphasizing its strategic intent to position the Kingdom as a global focal point in the rapidly growing esports and gaming sectors. This strategy demands significant expenditures and programs intended to improve the gambling industry's talent development and infrastructure. Hence, the government's proactive stance is established by its financing of projects to construct cutting-edge gaming centers, host international competitions, and assist regional game producers across the region.

Growing Popularity of E-Sports

According to reports from various media sources, a significant majority, approximately 67% of Saudi citizens, are involved in e-sports and gaming activities to some extent. The Social Development Bank (SDB) collaborated with the Saudi E-sports Federation to advance and offer numerous solutions in this pivotal economic sector. Additionally, several financing applications covering 300 million riyals, or 40% of the money allotted by the National Development Fund for the Gaming and E-sports Sector Financing Program, have been evaluated by the Social Development Bank (SDB). Besides this, the fund hopes to position Saudi Arabia as a significant global leader by fostering and enabling Saudi talent. Along with this, it promotes professional and emerging e-sports teams to compete in international competitions, boosting the gross domestic product (GDP) of the country and offering a variety of interesting career opportunities to those who want to succeed in this field. As esports grow in popularity, they provide a stage for competition, enjoyment, and community involvement, opening up new business and digital entertainment options in Saudi Arabia's changing cultural scene.

Significant Expansion in the Small and Medium Enterprises (SMEs)

The e-gaming sector in Saudi Arabia is growing quickly and will reach a milestone of 10 billion riyals by 2026. The Gaming and Esports Financing Program helped four business owners last year out of a group of twenty-one startups and small and medium-sized companies (SMEs) with a total worth of 167 million riyals. The program authorized 18 million riyals in investments in 2024, including finance for two new clients and improved financing for an already-existing client. Supporting small and medium-sized enterprises (SMEs) in Saudi Arabia is essential for promoting innovation and economic growth, especially in developing industries like e-sports and gaming. Furthermore, programs like the Gaming and Esports Financing Program demonstrate the government's dedication to offering resources and financial assistance that are specifically suited to the requirements of SMEs. These initiatives seek to lower entrance barriers, make it easier to get capital through specialized financing plans, and provide mentorship and strategic advice to develop entrepreneurial ability. Furthermore, with the help of this support system, SMEs are encouraged to innovate, increase their market share, and make a substantial contribution to the Kingdom's Vision 2030 initiatives to diversify its economy.

Saudi Arabia Gaming Market Growth Drivers:

Improved Gaming Infrastructure

Saudi Arabia's investment in enhancing its gaming infrastructure, including the creation of advanced data centers, enhanced internet connectivity, and the growth of 5G networks, are facilitating more seamless and dependable online gaming experiences. For instance, in 2025, Zain KSA began its rollout of 5G Standalone (5G SA) on the 600 MHz spectrum to enhance coverage in Riyadh and Jeddah, with a full commercial launch expected by the end of the year. The expansion will improve connectivity, enabling next-gen services. Fast internet and minimal latency are essential for competitive gaming, multiplayer engagement, and streaming high-quality content. These infrastructure improvements guarantee that Saudi gamers can reach the newest games, eSports tournaments, and international platforms without encountering major delays or technical obstacles. Moreover, the establishment of gaming centers, leisure amenities, and gaming lounges further enhances this infrastructure, providing areas for social gaming.

Growing Interest in Virtual Reality (VR) and Augmented Reality (AR)

The development of virtual reality (VR) and augmented reality (AR) technologies are providing captivating gaming experiences that attract tech enthusiasts and early adopters. With the declining prices of VR and AR devices and the increasing accessibility of content, a growing number of gamers in Saudi Arabia are delving into these sophisticated types of interactive entertainment. The increasing fascination with these technologies is leading to a heightened emphasis on creating specialized games and applications that include VR and AR, thereby broadening the gaming market beyond conventional gaming experiences. Local and international developers collaborating on VR and AR projects are set to propel the next stage of expansion in Saudi Arabia's gaming sector. In 2025, Sandbox VR announced its upcoming launch in Saudi Arabia, offering immersive virtual reality adventures where players can explore different worlds with full-body motion capture. Popular experiences, including ones based on Squid Game and Rebel Moon, will be featured.

Increasing Popularity of Gaming Consoles

The growing popularity of gaming consoles, especially newer versions, are playing a crucial role in the growth of the Saudi Arabia gaming market. These systems provide improved graphics, quicker processing speeds, and a vast collection of exclusive games, making them the top choice for dedicated gamers. The high-quality, immersive experiences they offer are resulting in greater acceptance among different demographics in Saudi Arabia. Moreover, the incorporation of gaming consoles with streaming platforms, social media tools, and entertainment applications has broadened their capabilities beyond gaming, establishing them as central centers for various types of digital entertainment. This increasing demand is clear, as Saudi Arabia brought in more than 2.4 million video game consoles in 2024 and 2025, based on information from the Zakat, Tax, and Customs Authority. This demand, bolstered by regional gaming packages and promotional deals, persists in strengthening growth in the nation’s gaming sector, reinforcing the position of consoles in Saudi Arabia’s entertainment scene.

Saudi Arabia Gaming Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on device type, platform, revenue, type, and age group.

Breakup by Device Type:

To get more information on this market, Request Sample

- Consoles

- Mobiles and Tablets

- Computers

The report has provided a detailed breakup and analysis of the market based on the device type. This includes consoles, mobiles and tablets, and computers.

Console is defined by specific game devices like Nintendo, Xbox, and PlayStation models. Additionally, casual and die-hard gamers may enjoy the high-performance gaming experiences that these platforms provide due to their cutting-edge visuals and processing power. Furthermore, console games are frequently platform-exclusive, which promotes brand loyalty and industry competitive dynamics. It gains from robust development ecosystems and well-known brands that promote recurring purchases and continuous involvement. Besides, console producers frequently add digital downloads and online services to their portfolios to supplement physical game sales. For instance, in February 2023, a Saudi sovereign wealth fund bought an 8.26% interest in Nintendo, making it the largest foreign investor in the well-known Japanese video game business, according to a recent corporate filing. This investment is in line with Saudi Arabia's Public Investment Fund policy, which aims to diversify the economy away from oil income reliance by focusing on industries like video games, where large investments have already been made.

Gaming on mobiles and tablets is gaining immense traction due to the ease of access and the growing capabilities of mobile and tablet devices. It is distinguished by its ease of use and accessibility, enabling players to play games whenever and wherever they choose. Furthermore, numerous players, from casual gamers to ardent enthusiasts, are attracted to mobile games, which vary from straightforward puzzle games to complex strategy games. Premium game versions, in-app purchases, and advertisements are some of the monetization techniques. Furthermore, the prevalence of freemium games and ongoing advancements in mobile technology have fueled the growth of mobile gaming, making it a vital force in the gaming industry.

Besides this, PC gaming appeals to a dedicated fan base that demands a high level of graphical quality, control, and customization. Additionally, upgrading hardware elements like graphics cards allows PC gamers to improve their gaming experience. This platform is preferred for genres like first-person shooters, massively multiplayer online games, and real-time strategy games that need accurate controls and high-performance visuals. Along with this, indie developers and modding groups use PC gaming as a center to provide a wealth of material that is frequently unavailable on consoles or mobile devices. A vast ecosystem of game distribution systems, such as Steam, Origin, and the Epic Games Store, is made possible by the open nature of PC gaming.

Breakup by Platform:

- Online

- Offline

A detailed breakup and analysis of the market based on the platform have also been provided in the report. This includes online, and offline.

Online gaming has seen significant growth due to increasing internet penetration, advancements in digital technology, and the rising popularity of e-sports. It includes games played over internet connections, allowing for multiplayer environments, streaming of games, and digital downloads. It appeals to a broad demographic, from casual players who enjoy social gaming to competitive players in structured e-sports leagues. Moreover, the convenience of accessing games from various devices, such as PCs, consoles, and mobile phones, enhances its appeal. Additionally, online platforms continuously update and evolve, offering new content and experiences, which helps maintain player engagement and contributes to market growth.

Offline gaming pertains to games that do not require an internet connection and are typically played on consoles or personal computers. It includes traditional single-player games and local multiplayer games that provide physical or downloadable content. Moreover, offline gaming appeals to those who prefer the tactile experience of owning physical copies of games or those with limited internet access. It also includes audiences who favor immersive single-player experiences without the interruptions of online connectivity. Furthermore, offline gaming maintains a steady market due to its dedicated user base and the unique experiences it offers, such as story-driven games and the ability to play without ongoing internet dependencies.

Breakup by Revenue:

- In-Game Purchase

- Game Purchase

- Advertising

The report has provided a detailed breakup and analysis of the market based on the revenue. This includes in-game purchases, game purchases, and advertising.

Game purchases constitute a major segment of the gaming market revenue, which involves consumers buying games directly. This revenue model primarily benefits from the sale of physical copies and digital downloads of games across various platforms, including PC, consoles, and mobile devices. Traditionally, this segment has been the backbone of the industry, with blockbuster titles often driving significant upfront sales. However, the rise of digital distribution has shifted consumer preferences towards direct downloads, reducing the market share of physical game sales. Companies like Electronic Arts, Nintendo, and Sony capitalize on this segment by offering a diverse portfolio of games ranging from indie titles to major AAA releases. This segment is influenced by factors such as game quality, brand loyalty, and the effectiveness of marketing campaigns.

In-game purchases, also known as microtransactions, represent a rapidly growing segment of gaming revenue. This model allows players to buy virtual goods or benefits within a game, such as cosmetic items, character upgrades, or new content. Games like Fortnite and League of Legends have successfully leveraged this model, generating substantial revenue from a free-to-play format. The attractiveness of this segment lies in its ability to continually monetize a game beyond the initial purchase through engaging and dynamic content. As gamers invest time into a game, their likelihood of spending on in-game items increases. This model is particularly prevalent in mobile gaming but is also significant in PC and console gaming, reshaping how developers and publishers plan their revenue strategies.

Advertising revenue in the gaming market comes from displaying ads within games, particularly in mobile and browser-based games. This segment has grown as more developers adopt the free-to-play model, which relies on advertising as a key revenue source instead of direct sales. Advertisements can range from banner ads and interstitials to rewarded videos that offer in-game bonuses for viewing. This model is particularly attractive for developers of casual games, where barriers to entry are low and the volume of players can be vast. The effectiveness of advertising revenue depends on the game’s ability to retain a large active user base, making user engagement and retention critical metrics for success in this segment. Moreover, advancements in ad technology have allowed for more targeted and less intrusive ad formats, enhancing the player experience while optimizing revenue generation.

Breakup by Type:

- Adventure/Role Playing Games

- Puzzles

- Social Games

- Strategy

- Simulation

- Others

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes adventure/role-playing games, puzzles, social games, strategy, simulation, and others.

According to the Saudi Arabia gaming market forecast, adventure and RPGs are widely known for their deep storytelling, complex characters, and immersive worlds. These games often involve questing, exploring, and interacting with game characters and environments. Additionally, players are typically drawn into elaborate narratives where choices and character development have significant impacts on the game's outcome. This genre is popular across various platforms, from PCs to consoles to mobile devices, appealing to gamers who enjoy narrative depth and the ability to influence the game world.

Puzzle games are designed to challenge the intellect and problem-solving skills of the player. It includes numerous game types, from traditional jigsaw puzzles and crosswords to more dynamic concepts like physics-based puzzles and match-three games. Additionally, puzzle games are highly accessible, often requiring minimal hardware capabilities, making them popular on mobile platforms and traditional consoles and PCs. They appeal to a broad demographic, including casual gamers who seek quick, engaging gameplay sessions with titles like Tetris, Candy Crush, and Portal showcasing the versatility and wide appeal of puzzle games.

Social games are primarily designed to be played on social networks or platforms that support community interaction. These games encourage collaboration, competition, and social interaction among players, often integrating with social media to enable sharing and connectivity. They range from simple farm management games to more complex casino or card games. Additionally, social games are especially popular on mobile and web platforms, with games like Farmville and Words with Friends attracting Millions of users who enjoy gaming as a way to connect with friends.

Strategy games require players to utilize tactical thinking, planning, and decision-making skills. This genre includes both real-time strategy (RTS) and turn-based strategy (TBS) games, where players control resources, manage units, and construct bases or empires. Additionally, strategy games are celebrated for their depth of gameplay and the intellectual challenge they provide. They appeal to players who enjoy control and intricate planning, with titles like StarCraft and Civilization standing out as benchmarks in the genre, thus escalating gaming demand in the Saudi Arabia market. Hence, key players are acquiring advanced gaming variants to meet these needs. For instance, in July 2023, Savvy Games Group finalized the acquisition of Scopely for $4.9 Billion. Public Investment Fund (PIF) subsidiary, Savvy Games Group, has concluded its largest investment to date with the acquisition of Scopely, a prominent games publisher and developer, for $4.9 Billion. This strategic move, finalized after obtaining regulatory clearances, underscores PIF's commitment to innovation and its broader goal of fostering unique opportunities across various sectors. According to Savvy's CEO, this long-term investment aims to support Scopely in sustaining its leadership in game industry innovation, highlighted by recent successes such as the global hit game MONOPOLY GO! launched in April 2023. Scopely is renowned for its popular free-to-play franchises like Star TrekTM Fleet Command, Yahtzee With Buddies, and Stumble Guys.

Simulation games are designed to replicate real-world activities in a virtual environment. These games can cover a wide range of themes, from everyday activities like farming and city building to more specialized simulations like flight or space exploration. Additionally, the appeal of simulation games lies in their ability to provide an immersive experience that mirrors reality, offering entertainment and educational value. and detailed, interactive environments, thus propelling the Saudi Arabia gaming market growth.

Breakup by Age Group:

- Adult

- Children

The report has provided a detailed breakup and analysis of the market based on the age group. This includes adults and children.

The adult encompasses a wide age range from young adults in their early 20s to those in middle age and beyond. This group tends to gravitate toward games that offer complex storylines, deep gameplay mechanics, and high levels of interactivity. Additionally, several adult gamers prefer genres such as action, strategy, role-playing, and simulation, which provide immersive experiences and substantial content depth. Also, the rise of e-sports has significantly influenced this demographic, with many adults actively participating in or following competitive gaming scenes. Furthermore, this segment often has more disposable income, influencing their purchasing decisions toward premium games and hardware, including high-end PCs, consoles, and virtual reality (VR) equipment. Besides, the preferences of adult gamers for multi-player and social gaming experiences have led to the development of expansive online communities around popular titles, thus influencing Saudi Arabia gaming market share.

The children include individuals from the ages of about three to twelve. Games targeted at this demographic are often educational, focusing on learning and skill development through play. Additionally, popular genres for children include puzzle, adventure, and simple role-playing games that encourage creativity, problem-solving, and social interaction. These games are typically designed to be safe, non-violent, and family-friendly, with many offering parental controls to monitor activity. Moreover, the rise of mobile gaming has significantly impacted this segment, as children gain access to tablets and smartphones. Furthermore, educational institutions and parents often recognize the value of gamification in learning, leading to partnerships between educational content developers and game developers to create engaging and educational content tailored for young learners, thus creating a positive Saudi Arabia gaming market outlook.

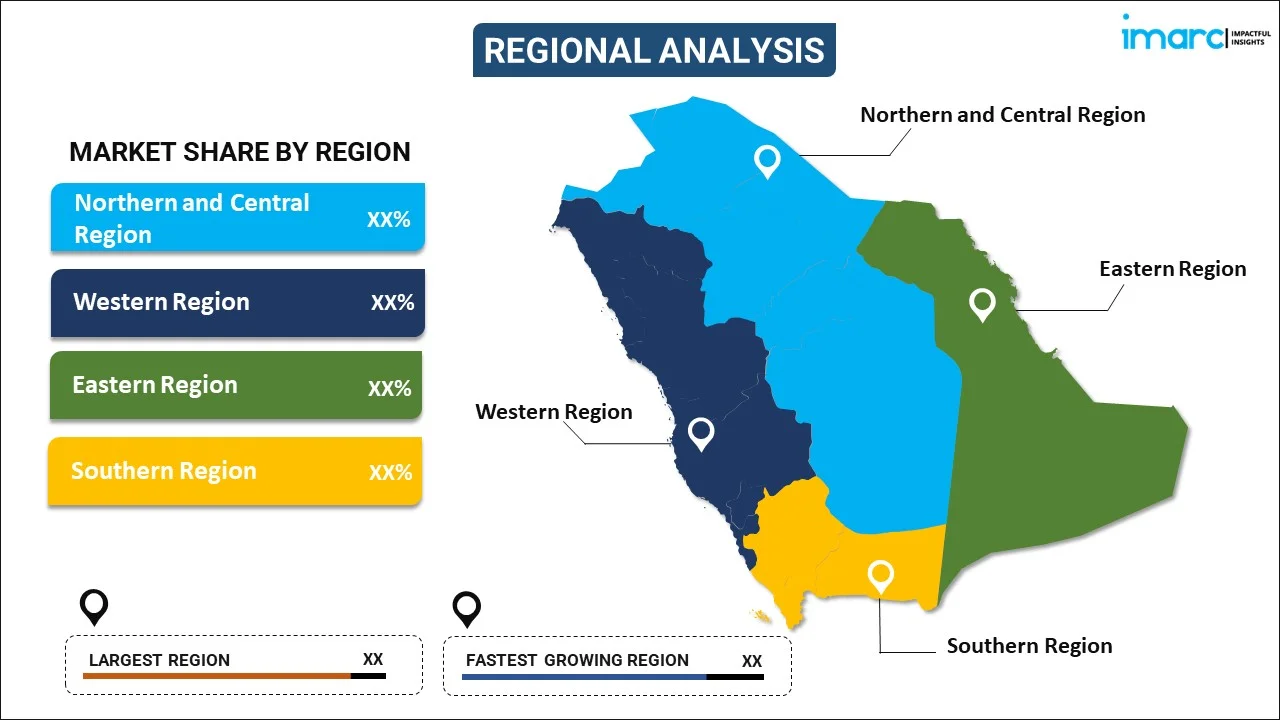

Breakup by Region:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major markets in the region, which include the Northern and Central Region, Western Region, Eastern Region, and Southern Region.

As per the Saudi Arabia gaming market scope, the Northern and Central regions of Saudi Arabia, particularly focusing on the capital city of Riyadh. This region is characterized by a high concentration of wealth and a young population that is increasingly engaged with digital entertainment and technology. Moreover, the easy availability of high-speed internet and the presence of several gaming cafes and hubs also contribute to the prominence of gaming here. The region benefits from government initiatives like the Saudi Vision 2030, which aims to diversify the economy and boost the entertainment sector. These policies encourage local and international investments in gaming infrastructure and events, further solidifying Riyadh and its surrounding areas as key players in the gaming industry. For instance, in May 2024, Saudi Arabia's Crown Prince Mohammed bin Salman announced the launch of the E-sports World Cup, scheduled to commence annually in Riyadh in the summer of 2024.

Western region of Saudi Arabia, which includes major cities like Jeddah and Mecca, represents a culturally rich and economically vibrant segment of the gaming market. Jeddah, known for its more liberal social atmosphere, hosts a diverse population that is very receptive to modern entertainment forms, including video games. The region's demographic consists largely of youth and expatriates, thus escalating the demand for varied gaming genres from sports and adventure to strategy and simulation. Moreover, the region sees a significant amount of tourism due to Mecca, which potentially offers seasonal boosts in gaming activities as visitors seek leisure activities during their stays. Along with this, the local government’s encouragement of entertainment and leisure sectors ensures ongoing growth and investment in the gaming industry.

In Saudi Arabia's Eastern region, cities like Dammam and Khobar are essential to the gaming market. This area is known for its oil-based economy which provides a substantial disposable income to its residents, thereby increasing their expenditure capability on leisure activities such as gaming. Additionally, the population in this region has a strong inclination toward technology and digital innovations, making it a fertile ground for the growth of online and multiplayer gaming communities. Gaming tournaments and esports events are becoming increasingly popular, reflecting a growing recognition and formalization of gaming as a key component of the regional entertainment landscape. Moreover, the proximity to other Gulf countries facilitates cross-border gaming events and collaborations.

The Southern region of Saudi Arabia, including areas like Najran and Jizan, is relatively less urbanized and developed compared to other parts of the country and still holds potential in the gaming market. The young individuals here are gradually gaining access to better internet connectivity and technological resources, driving an increase in mobile and online gaming. While the market segment here is smaller and less developed, there is a significant opportunity for growth as infrastructural and economic development continues under broader national initiatives. Furthermore, community-focused gaming activities and localized gaming events could help stimulate the market in this region, promoting gaming as a form of entertainment and as a potential career, particularly in the burgeoning field of e-sports, thus contributing to the market growth.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have been provided.

- Saudi Arabia's gaming market companies are actively enhancing market growth by investing in infrastructure, hosting international gaming tournaments, and promoting local talent through esports leagues. They are collaborating with global gaming giants to bring new titles and technologies to the Saudi market, catering to the increasing demand for diverse gaming experiences. These companies are leveraging social media and digital platforms to engage with a young, tech-savvy audience, driving awareness and participation in gaming activities. For instance, in May 2024, Saudi Arabia is investing significantly to establish a prominent position in the gaming industry. Under Crown Prince Mohammed bin Salman's Vision 2030 program, Saudi Arabia has already committed substantial funds, amounting to $38 Billion, toward expanding its presence in the gaming industry. This initiative forms a crucial component of the kingdom's strategy to reduce economic dependence on oil through diversification efforts.

Saudi Arabia Gaming Market News:

- In August 2025, Fahy Studios, a Saudi-based game development studio, secured a $1.75 million investment from Impact46 and Merak Capital. The funding will accelerate the development of hybrid-casual mobile games, including titles like RAWR, Footy Traps, and Heist Party. Fahy aims to position Saudi Arabia as a global hub for mobile gaming.

- In August 2025, Impact46 invested over $6.6 million in five gaming studios—Fahy, NJD, Game Cooks, Starvania, and Alpaka—as part of its $40 million Gaming Fund. The studios span mobile, PC, console, and VR development, contributing to Saudi Arabia's Vision 2030. This investment expands Impact46's portfolio to seven active gaming companies.

- In July 2025, Lenovo became the official PC & Gaming Hardware partner of the Esports World Cup 2025 in Saudi Arabia. The brand will showcase its Legion gaming devices at Riyadh’s Content Creator Park, emphasizing inclusive gaming and high-performance tech. Lenovo’s investment in the Kingdom includes a manufacturing hub to produce “Saudi Made” gaming devices, contributing to the Vision 2030 goals.

- In July 2025, GTA V and GTA Online officially launched in Saudi Arabia and the UAE. The game remains uncensored with a 21+ age rating, except for disabled gambling content due to local laws. This release paves the way for the GTA VI launch in 2026 in the region.

- In July 2025, Savvy Games Group partnered with UK-based Side to support its expansion into Saudi Arabia’s gaming sector. Side plans to open a studio in Riyadh by Q4 2025, offering co-development services for MENA developers. The move aligns with Saudi Vision 2030 to boost digital entertainment and local talent.

- In March 2024, Saudi Arabia's National Development Fund (NDF) and Social Development Bank (SDB) launched two venture capital funds worth $120 million to accelerate growth in the gaming and esports sectors. Managed by IMPACT46 and Merak Capital, the funds aimed to boost local content production and attract international investment. This initiative supported Saudi Arabia’s Vision 2030 for economic diversification.

- In July 2024, Saudi Arabia and IOC collaborated for 12 years to host the Esports Olympic, which will be launched next year. Esports Olympic games, aligned as a part of the Vision 2030 program, will be held regularly for retaining young fans and audiences.

- In August 2024, Xsolla and Savvy Games partnered for opening a game development academy in Saudi Arabia to make economic opportunities for Middle Eastern developers. As per this deal, Xsolla will create 3,600 new jobs by the end of the year 2030.

Saudi Arabia Gaming Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered | Consoles, Mobiles and Tablets, Computers |

| Platforms Covered | Online, Offline |

| Revenues Covered | In-Game Purchase, Game Purchase, Advertising |

| Types Covered | Adventure/Role Playing Games, Puzzles, Social Games, Strategy, Simulation, Others |

| Age Groups Covered | Adult, Children |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia gaming market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia gaming market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia gaming industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The gaming market in Saudi Arabia was valued at USD 2,387.7 Million in 2025.

The Saudi Arabia gaming market is projected to exhibit a CAGR of 8.46% during 2026-2034, reaching a value of USD 4,957.2 Million by 2034.

The Saudi Arabian gaming market is primarily driven by a young, tech-savvy population, high internet penetration, increasing disposable income, and a growing interest in digital entertainment. Government support for the digital economy, alongside cultural acceptance of gaming, further contribute to the market growth, positioning the Kingdom as a regional hub for gaming innovation and investment.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)