Saudi Arabia Gear Oil Market Size, Share, Trends and Forecast by Product Type, End Use Industry, and Region, 2026-2034

Saudi Arabia Gear Oil Market Summary:

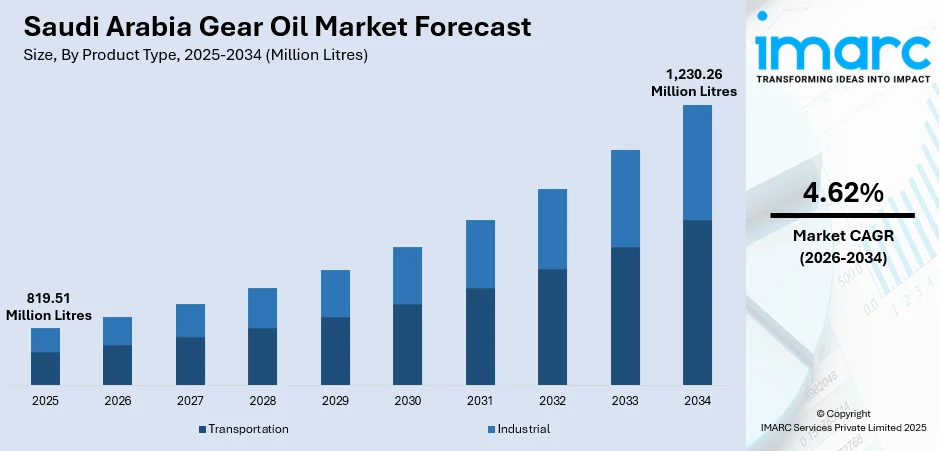

The Saudi Arabia gear oil market size reached 819.51 Million Litres in 2025 and is projected to reach 1,230.26 Million Litres by 2034, growing at a compound annual growth rate of 4.62% from 2026-2034.

The Saudi Arabia gear oil market is expanding steadily, supported by rising automotive activity, sustained industrial output, and ongoing infrastructure development. Growing demand for efficient lubrication in heavy machinery, commercial fleets, and manufacturing equipment is shaping consumption patterns. Increasing preference for high-performance synthetic formulations, supported by stricter maintenance requirements and a shift toward advanced machinery, is further influencing market growth. Additionally, expanding transportation networks and steady investments in industrial projects continue to reinforce overall market demand.

Key Takeaways and Insights:

- By Product Type: Transportation dominates the market with a share of 56% in 2025, driven by the expanding automotive sector and rising vehicle ownership rates across the Kingdom.

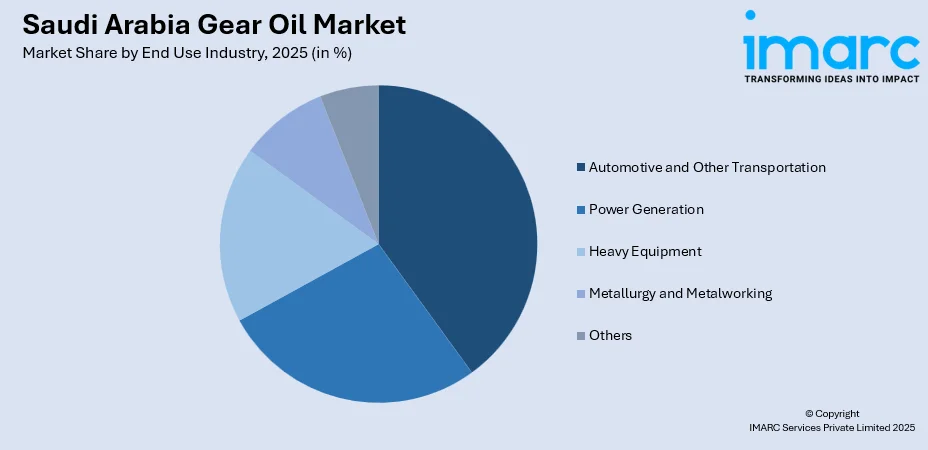

- By End Use Industry: Automotive and other transportation leads the market with a share of 40% in 2025, supported by increasing commercial fleet expansion and logistics sector growth.

- Key Players: The Saudi Arabia gear oil market exhibits a moderately consolidated competitive structure, with established multinational lubricant manufacturers competing alongside regional players. Market participants focus on product innovation, strategic partnerships with OEMs, and expanding distribution networks through service centers and digital channels.

To get more information on this market Request Sample

The Saudi Arabia gear oil market is experiencing consistent growth, driven by expanding automotive ownership, rising industrial production, and continuous infrastructure development across the country. Demand is increasing from sectors such as construction, mining, manufacturing, and transportation, where heavy duty machinery and fleet vehicles require reliable lubrication to ensure smooth operation and reduced downtime. In November 2025, twelve firms were qualified for Saudi Arabia's USD 179 Million mining exploration program, aiming to boost the sector as a key economic pillar. With 38 licenses approved, the initiative will cover 3,000 sq. km, creating 63 jobs and promoting local content, while focusing on critical minerals like copper and lithium.on, aligning with Saudi Arabia’s USD 100 Billion mining investment roadmap aimed at attracting global exploration partners by 2035. The market is also witnessing a gradual shift toward high performance synthetic gear oils, supported by evolving maintenance standards, improved equipment efficiency needs, and a growing focus on reducing operational costs. Additionally, the government’s investments in economic diversification, industrial zones, and logistics infrastructure are broadening the application base for gear oils. As machinery complexity increases and end users prioritize longer service intervals, the consumption of premium formulations is expected to rise, strengthening the long term growth outlook of the Saudi Arabia gear oil market

Saudi Arabia Gear Oil Market Trends:

Adoption of Synthetic Gear Oils

The Saudi Arabia gear oil market is witnessing rising adoption of synthetic and semi synthetic formulations as industries and fleet operators seek better thermal stability, oxidation resistance, and protection under high load conditions. These products offer longer service intervals, reduced wear, and improved overall equipment reliability, making them suitable for modern machinery. Their ability to enhance operational efficiency and lower maintenance costs is accelerating their preference across key end use sectors.

Focus on Energy Efficiency

Energy efficiency and equipment optimisation are becoming central priorities for industries in the country as sustainability initiatives gain momentum. Saudi Arabia aims for 50% of its power to come from renewable sources by 2030. The Kingdom is launching initiatives to reduce emissions through investments in new energy, enhancements in energy efficiency, and the development of carbon capture and storage programs. Advanced gear oil formulations help reduce friction, improve power transmission, and maintain consistent performance, supporting these goals. As companies seek to minimise energy consumption and extend machinery lifespan, high performance lubricants are increasingly being adopted to improve productivity and operational efficiency.

Preference for Eco-Friendly Lubricants

Sustainability goals are shaping lubricant choices as companies seek environmentally compatible gear oils with lower toxicity, reduced emissions, and improved biodegradability. The shift aligns with rising awareness of environmental protection and responsible waste management practices. Market participants are introducing ecofriendly formulations that deliver strong performance without compromising environmental standards. This trend is gaining traction in sectors aiming to meet internal sustainability targets while ensuring effective machinery protection.

How Vision 2030 is Transforming the Saudi Arabia Gear Oil Market:

Saudi Arabia’s Vision 2030 is reshaping the gear oil market by accelerating industrial diversification, infrastructure development, and transportation modernization. As the country expands manufacturing zones, logistics hubs, and construction initiatives, demand for high performance gear oils is rising across heavy machinery, commercial fleets, and advanced industrial equipment. The push toward operational efficiency and reduced downtime is also encouraging wider adoption of synthetic formulations with longer service intervals. Additionally, the program’s emphasis on sustainability and improved regulatory standards is driving interest in eco-friendly and energy efficient lubricants, supporting a more competitive, technology driven, and forward-looking gear oil market.

Market Outlook 2026-2034:

The Saudi Arabia gear oil market outlook remains positive, supported by steady industrial growth, expanding automotive fleets, and continued investment in infrastructure and logistics projects. Rising adoption of synthetic formulations, driven by performance efficiency and longer service life, is expected to further shape demand patterns. As machinery becomes more advanced and maintenance practices grow more sophisticated, end users are likely to prioritise high quality lubricants. Overall, sustained economic development and increasing equipment utilisation will reinforce long term market expansion. The market reached 819.51 Million Litres in 2025 and is projected to reach 1,230.26 Million Litres by 2034, growing at a compound annual growth rate of 4.62% from 2026-2034.

Saudi Arabia Gear Oil Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Transportation | 56% |

| End Use Industry | Automotive and Other Transportation | 40% |

Product Type Insights:

- Transportation

- Manual Gearbox

- Automatic Gearbox

- CVT

- DCT

- Axle Oils

- Industrial

The transportation dominates with a market share of 56% of the total Saudi Arabia gear oil market in 2025.

The transportation segment leads the Saudi Arabia gear oil market, driven by the country’s growing vehicle base and expanding commercial fleets. The Saudi Arabia truck market size reached USD 69.61 Billion in 2024, and is expected to reach USD 130.80 Billion, which further amplifies lubricant demand. Strong reliance on road mobility, along with rising use of passenger cars, trucks, and buses, continues to support consistent consumption. Increasing maintenance needs and a focus on reliable transmission and axle performance reinforce the segment’s importance.

This segment is further strengthened by expanding logistics activity and the growing adoption of advanced transmission technologies in newer vehicles. As fleet operators prioritise smoother operation, reduced wear, and longer service intervals, the need for high performance gear oils continues to accelerate. The broad range of transmission systems, including manual, automatic, CVT, and DCT, contributes to sustained demand for transportation related lubrication across the market.

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Power Generation

- Automotive and Other Transportation

- Heavy Equipment

- Metallurgy and Metalworking

- Others

The automotive and other transportation leads with a share of 40% of the total Saudi Arabia gear oil market in 2025.

The automotive and other transportation segment remains the leading end use category, supported by growing road transportation needs and expanding vehicle utilisation across both passenger and commercial applications. In July 2025, six road projects were launched in Riyadh, totaling 112 kilometers and costing 380 Million Riyals. The initiatives aim to enhance mobility and infrastructure, with an overarching investment of USD 1.1 Trillion for Saudi Arabia's Vision 2030 by 2038. Higher movement of goods, rising mobility requirements, and regular servicing cycles contribute to sustained demand for gear oils within this segment.

Its strong position is further reinforced by the country’s expanding logistics networks and the increasing deployment of fleets across delivery services, construction, and public transport operations. As end users aim to enhance efficiency, maintain smoother vehicle performance, and reduce downtime, the importance of high-quality gear oils becomes more significant. Continuous upgrades in vehicle transmission systems further support rising consumption in this dominant end-use industry.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Northern and Central Region shows steady gear oil demand driven by expanding industrial activities, rising vehicle usage, and ongoing infrastructure development. Growth in construction, transportation, and logistics operations supports consistent consumption across both automotive and heavy machinery applications in this region.

The Western region reflects growing gear oil requirements supported by high vehicle density, thriving commercial activity, and increasing dependence on transportation networks. Industrial expansion, tourism-driven mobility, and rising maintenance needs for fleets and machinery contribute to sustained demand across various end-use sectors.

The Eastern region maintains strong gear oil consumption due to its concentration of industrial hubs, energy-related operations, and large-scale manufacturing activity. Heavy machinery usage, commercial fleet movement, and stringent maintenance requirements continue to drive steady adoption of high-performance lubricants.

The Southern region experiences stable gear oil demand supported by regional infrastructure development, rising transportation activity, and the use of machinery across construction and local industries. Growing mobility needs, along with regular servicing of vehicles and equipment, contribute to ongoing lubricant consumption in this area.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Gear Oil Market Growing?

Automotive Ownership and Fleet Growth

Rising automotive ownership and the steady expansion of commercial fleets are significantly increasing the demand for reliable gear lubrication across Saudi Arabia. Passenger cars, light commercial vehicles, and heavy-duty trucks require high-quality gear oils to ensure smooth transmission performance and reduced wear. Saudi Arabia aims to manufacture 350,000 vehicles by 2030, with investments of SAR 90 Billion. Lucid, Ceer, and Hyundai lead production efforts, starting in 2023, 2026, and 2027 respectively, as the Kingdom shifts from importing 830,000 vehicles annually. As mobility needs grow and logistics activities expand, the requirement for frequent maintenance and long-lasting lubricants is strengthening overall consumption. This trend is reinforced by higher vehicle utilisation and growing dependence on road transportation.

Industrial Expansion in Key Sectors

Strong industrial activity in construction, mining, and manufacturing is driving substantial demand for heavy machinery lubricants in the country. In January 2025, Saudi Arabia allocated SR10 Billion (USD 2.66 Billion) to launch the Standard Incentives Program, offering up to 35% project funding. Targeting transformative industries, it aims to generate SR23 billion annually in GDP, supporting Vision 2030’s economic diversification goals. These sectors operate equipment under high stress and harsh conditions, increasing the reliance on durable gear oils that provide superior load carrying capacity and thermal stability. As industrial output rises and project volumes increase, the need for consistent lubrication to protect machinery, reduce downtime, and extend component life continues to support market growth across multiple heavy-duty applications.

Infrastructure and Logistics Investment Impact

Government investments in infrastructure, industrial zones, and logistics corridors are broadening the application scope for gear oils in Saudi Arabia. Expanding road networks, warehouses, and transport hubs are increasing the use of machinery, commercial fleets, and handling equipment that require advanced lubrication solutions. In February 2025, Riyadh's Royal Commission initiated the USD 2.1 Billion second phase of its Ring and Main Road Development Program, featuring eight projects over three years. Key upgrades include 6 km of Prince Turki Road and enhancements to Dirab Road, targeting 340,000 vehicle capacity. As construction intensity rises and supply chain operations become more complex, demand for high performance gear oils is growing steadily. These developments are also promoting long term consumption, supported by continuous machinery deployment and fleet expansion.

Market Restraints:

What Challenges the Saudi Arabia Gear Oil Market is Facing?

High Cost of Premium Formulations

The rising cost of synthetic and high-performance gear oils can limit adoption, particularly among small industries and budget-conscious fleet operators. Higher prices often lead to reliance on conventional lubricants, slowing the shift toward advanced formulations. This cost sensitivity can restrict overall market growth despite the long-term benefits of premium products.

Inconsistent Maintenance Practices

Irregular maintenance schedules and limited awareness of proper lubrication practices hinder optimal gear oil usage. Many end users delay oil changes or use non-recommended products, reducing equipment efficiency and increasing wear. These gaps in maintenance culture can negatively impact lubricant demand and restrict the adoption of high-quality oils across industrial and automotive sectors.

Fluctuations in Raw Material Availability

Variability in base oil supply and fluctuations in additive costs can disrupt production and pricing stability. These challenges create uncertainties for manufacturers and distributors, affecting product availability and influencing end user purchasing decisions. Supply chain constraints may also lead to delayed deliveries, limiting the market’s ability to meet rising demand consistently.

Competitive Landscape:

The competitive landscape of the Saudi Arabia gear oil market is shaped by the presence of established lubricant producers, regional suppliers, and expanding local manufacturers focusing on high-quality formulations. Competition is driven by product performance, distribution reach, pricing strategies, and the ability to offer tailored solutions for automotive and industrial applications. Companies are strengthening their portfolios with synthetic and semi-synthetic variants to meet rising demand for advanced lubrication. An increased focus on educating customers, providing after-sales support, and offering technical assistance heightens competition in the market, as companies strive to set themselves apart in a performance-oriented and fast-changing landscape.

Recent Developments:

- In March 2025, Al Jomaih & Shell Lubricating Oil Company partnered with United International Transportation Company to supply Shell lubricants for Budget Saudi Arabia and Auto World's fleets across the Kingdom. This collaboration aims to enhance vehicle performance, efficiency, and sustainability, supporting their commitment to customer satisfaction and aligning with Vision 2030.

- In May 2025, PETRONAS Lubricants International partnered with Abdul Latif Jameel for Oils Company Limited to enhance the distribution of PETRONAS-branded lubricants in Saudi Arabia. This strategic agreement aims to meet the growing demand for high-performance lubricants, leveraging Abdul Latif Jameel's established network to serve both passenger and commercial vehicles.

Saudi Arabia Gear Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Litres |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| End Use Industries Covered | Power Generation, Automotive and Other Transportation, Heavy Equipment, Metallurgy and Metalworking, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia gear oil market size reached 819.51 Million Litres in 2025.

The Saudi Arabia gear oil market is expected to grow at a compound annual growth rate of 4.62% from 2026-2034 to reach 1,230.26 Million Litres by 2034.

The transportation segment held the largest share, driven by expanding vehicle usage, growing commercial fleets, and consistent demand for transmission and axle lubrication across passenger and heavy-duty vehicles. Rising maintenance needs further reinforce its leading position in the market.

Key factors driving the Saudi Arabia gear oil market include expanding automotive activity, strong industrial operations, and rising investments in infrastructure and logistics. Increasing adoption of advanced machinery and growing preference for high-performance synthetic lubricants also contribute to sustained market growth.

Major challenges include fluctuating raw material costs, inconsistent maintenance practices, and the higher price of premium lubricant formulations. Supply chain constraints and limited awareness regarding proper gear oil selection also restrict broader adoption across industrial and automotive applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)