Saudi Arabia Gluten Free Food Market Size, Share, Trends and Forecast by Product Type, Source, Sales Channel, and Region, 2026-2034

Saudi Arabia Gluten Free Food Market Overview:

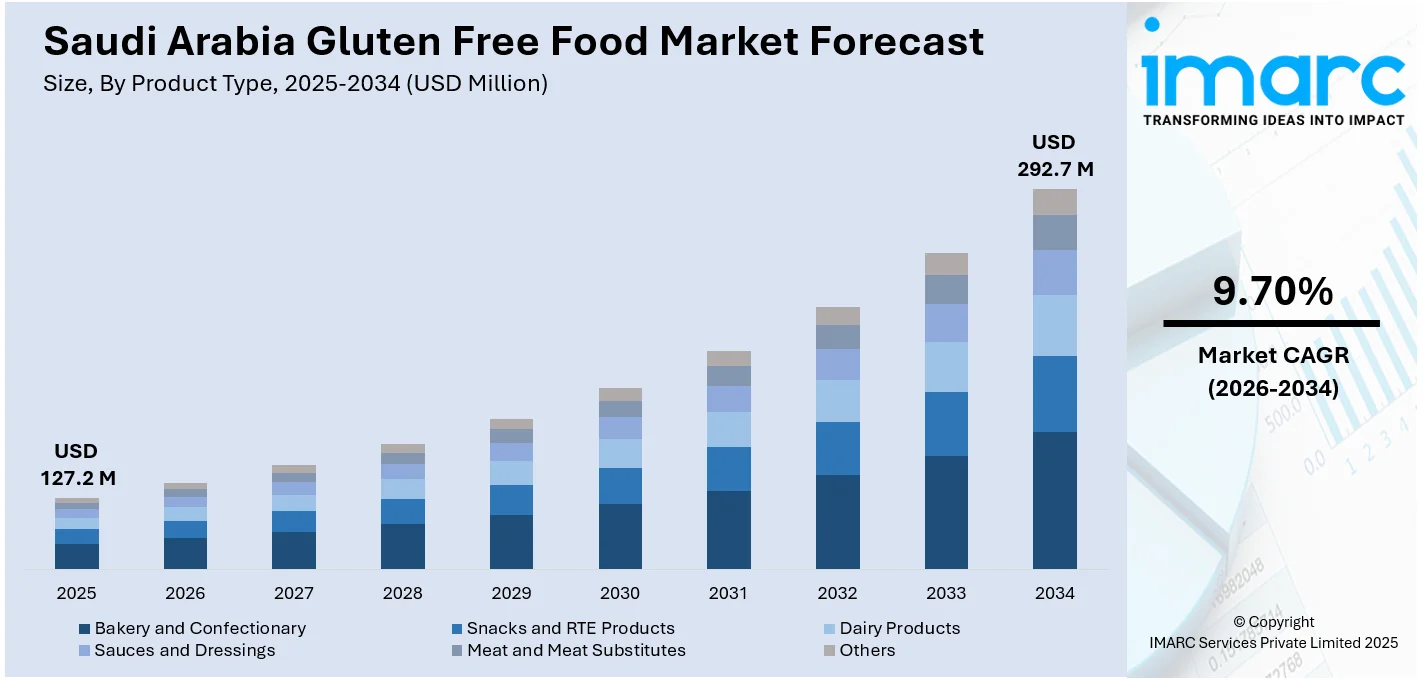

The Saudi Arabia gluten free food market size reached USD 127.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 292.7 Million by 2034, exhibiting a growth rate (CAGR) of 9.70% during 2026-2034. The market is experiencing steady growth, driven by increasing health awareness, rising diagnoses of gluten-related disorders, and growing trend toward healthier eating habits. Consumers seeking gluten-free alternatives for medical reasons and perceived health benefits is also improving product accessibility. Government initiatives promoting healthier lifestyles, and the expansion of retail outlets and e-commerce platforms is further enhancing the overall Saudi Arabia gluten free food market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 127.2 Million |

| Market Forecast in 2034 | USD 292.7 Million |

| Market Growth Rate 2026-2034 | 9.70% |

Saudi Arabia Gluten Free Food Market Trends:

Expansion of Gluten-Free Product Offerings

Retailers and food manufacturers in Saudi Arabia are increasingly diversifying their product offerings to cater to the growing demand for gluten-free foods. As health awareness and the prevalence of gluten sensitivities rise, there has been a noticeable expansion in the availability of gluten-free options across various categories, including snacks, baked goods, pasta, and ready-to-eat meals. For instance, in June 2023, British snack brand Pri Bakes is expanding its presence in the Middle East, launching at Tamimi stores in Saudi Arabia and Spinneys in Dubai. Known for its vegan and gluten-free products, the brand focuses on health-conscious snacks, using regional ingredients and boasting 75% less sugar than traditional treats. Major food retailers and supermarkets are now selling a vast range of gluten-free foods, allowing consumers to access suitable alternatives more easily. Manufacturers are also spending time creating new, innovative gluten-free recipes that are both healthy and full of flavour, so that the taste and consistency of normal foods are not affected. This change in product development is not just serving people who are gluten intolerant, but also health-conscious consumers who see gluten-free dieting as part of a healthy lifestyle.

To get more information on this market Request Sample

Growth in E-Commerce

The rise of e-commerce has significantly contributed to the growth of the Saudi Arabia gluten-free food market. According to data from the International Trade Administration (ITA), by 2024, it is anticipated that there will be 33.6 million e-commerce users in the country, with smartphone penetration reaching 97%. As online grocery shopping becomes increasingly popular, consumers now have easy access to a wider variety of gluten-free food products, which may not be available in traditional brick-and-mortar stores. E-commerce platforms are offering the convenience of home delivery, allowing customers to shop for gluten-free snacks, baked goods, pasta, and ready-to-eat meals from the comfort of their homes. The variety of gluten-free options available online also appeals to consumers who may have limited access to specialized health food stores. Additionally, e-commerce enables consumers to compare prices, read reviews, and explore new products, enhancing the overall shopping experience. This growing online presence is expected to continue driving Saudi Arabia gluten-free food market growth as more people turn to digital platforms for their grocery needs.

Saudi Arabia Gluten Free Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type, source, and sales channel.

Product Type Insights:

- Bakery and Confectionary

- Snacks and RTE Products

- Dairy Products

- Sauces and Dressings

- Meat and Meat Substitutes

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes bakery and confectionary, snacks and RTE products, dairy products, sauces and dressings, meat and meat substitutes, and others.

Source Insights:

- Plant-Based

- Animal-Based

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes plant-based and animal-based.

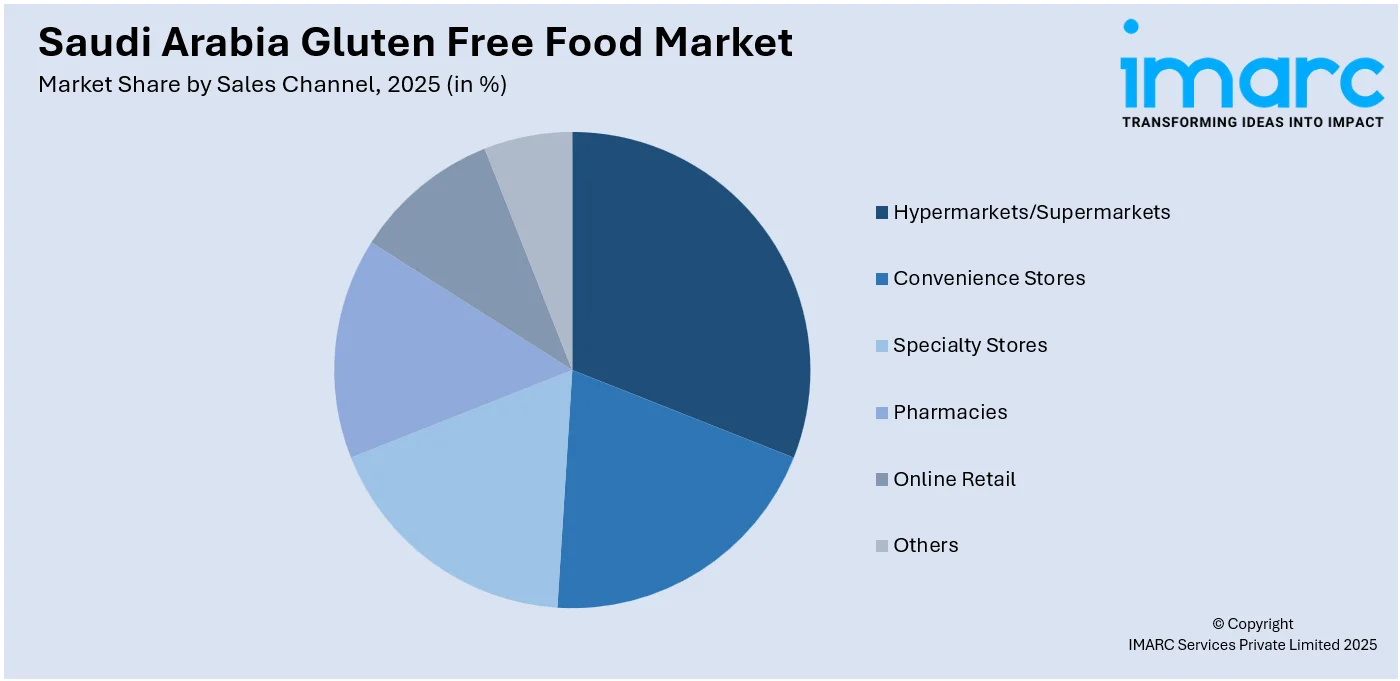

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- Hypermarkets/Supermarkets

- Convenience Stores

- Specialty Stores

- Pharmacies

- Online Retail

- Others

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes hypermarkets/supermarkets, convenience stores, specialty stores, pharmacies, online retail, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Gluten Free Food Market News:

- In February 2025, Ola Kayal announced its plans to launch Nabati Eatery in Jeddah's Al Rawdah district, offering a unique plant-based dining experience. The restaurant focuses on sustainability and healthy eating, featuring gluten-free, organic dishes. Kayal aims to showcase delicious plant-based cuisine while collaborating with local farms for fresh ingredients.

- In December 2023, Modern Mills Company launched a new range of Saudi-branded gluten-free flours in response to rising consumer demand, particularly from individuals with Celiac Disease and gluten-free lifestyle adopters. The products are set to debut in major retailers across Saudi Arabia, supporting the company's commitment to food security and innovation.

Saudi Arabia Gluten Free Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Bakery and Confectionary, Snacks and RTE Products, Dairy Products, Sauces and Dressings, Meat and Meat Substitutes, Others |

| Sources Covered | Plant-Based, Animal-Based |

| Sales Channels Covered | Hypermarkets/Supermarkets, Convenience Stores, Specialty Store, Pharmacies, Online Retail, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia gluten free food market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia gluten free food market on the basis of product type?

- What is the breakup of the Saudi Arabia gluten free food market on the basis of source?

- What is the breakup of the Saudi Arabia gluten free food market on the basis of sales channel?

- What is the breakup of the Saudi Arabia gluten free food market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia gluten free food market?

- What are the key driving factors and challenges in the Saudi Arabia gluten free food market?

- What is the structure of the Saudi Arabia gluten free food market and who are the key players?

- What is the degree of competition in the Saudi Arabia gluten free food market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia gluten free food market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia gluten free food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia gluten free food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)