Saudi Arabia Green Data Center Market Report by Component (Solutions, Services), Data Center Type (Colocation Data Centers, Managed Service Data Centers, Cloud Service Data Centers, Enterprise Data Centers), Industry Vertical (Healthcare, BFSI, Government, Telecom and IT, and Others), and Region 2025-2033

Market Overview:

Saudi Arabia green data center market size reached USD 817 Million in 2024. Looking forward, the market is anticipated to reach USD 3,879 Million by 2033, exhibiting a growth rate (CAGR) of 18.9% during 2025-2033. The inflating need among organizations for achieving a more sustainable and eco-friendly operation is primarily driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 817 Million |

| Market Forecast in 2033 | USD 3,879 Million |

| Market Growth Rate (2025-2033) | 18.9% |

A green data center is an ecologically conscious facility crafted to enhance energy efficiency and minimize its ecological footprint. It incorporates a range of technologies and methodologies aimed at prioritizing resource conservation, including the utilization of renewable energy sources, advanced cooling systems, and optimized server operations. The benefits of green data centers are manifold; notably, they play a crucial role in significantly reducing carbon emissions, aligning with global initiatives to address climate change. Additionally, these facilities result in substantial cost savings on energy expenditures due to their streamlined operations. Furthermore, by demonstrating a dedication to environmental responsibility, green data centers contribute to enhancing a company's reputation, appealing to customers and investors who prioritize eco-friendly practices.

Saudi Arabia Green Data Center Market Trends:

Increasing Need for Green IT Infrastructure

The Saudi Arabia green data center market is witnessing growth because of the rising need for sustainable information technology (IT) infrastructure. Companies are focusing on energy-efficient solutions to lower their carbon footprint and increase operational sustainability. The government itself is encouraging eco-friendly technologies, offering incentives to those businesses that embrace green data centers. This trend is playing a vital role in the growth in the adoption of energy-efficient cooling solutions, renewable energy technologies, and virtualization products. As companies realize the significance of being environment-friendly, they are shifting towards greener options, which is fueling the growth of the market. Companies are now also looking for data centers that meet global environmental standards and certifications, which confirms that their operations are not just efficient but also eco-friendly. The IMARC Group predicts that the Saudi Arabia IT infrastructure management market is projected to attain USD 1.80 Billion by 2033.

Government Initiatives and Regulations

As per the Saudi Arabia green data center market report, the government of Saudi Arabia is playing a crucial role in shaping the market by adopting supportive policies and regulations. As part of the Vision 2030 program, there is a concentration on sustainability and diversification, and so the government is establishing carbon emissions reduction targets and encouraging clean energy. The government of Saudi Arabia is encouraging the growth of green data centers with tax incentives, grants, and investment in renewable energy infrastructure. The regulatory landscape is constantly changing, with new guidelines and standards being introduced that help businesses to embrace energy-saving practices. These government-imposed programs are driving local and multinational companies to set up green data centers in the country. Consequently, the market is being drawn to investments by different stakeholders seeking to align operations with these regulations. The government is also conducting various exhibitions and discussion forums to bring changes in data center development. For instance, the Data Center XPO is scheduled to take place on 30th September 2025 at Voco Riyadh.

Shift Toward Renewable Energy Sources

The recurring trend of adopting renewable energy resources is offering a favorable market outlook in Saudi Arabia. Saudi Arabia is heavily relying on solar and wind power, and they are likely to be a prominent source of data center power in the future. As renewable energy becomes more available and affordable, data center operators are moving towards shifting their energy procurement plans to adopt these green energy options. This shift is not only lowering the cost of operations but also aiding the world in curbing climate change. The blending of renewable energy with data center operations is making carbon-neutral data centers possible, which is now an appealing option for companies looking to enhance their footprint environmentally. This is quickly becoming a phenomenon in Saudi Arabia, which is leading to market expansion. Projects related to renewable energy are a key emphasis of the budget plan for 2025. Saudi Arabia has designated 1,862 square kilometers of land for a solar energy initiative and 260 square kilometers for a wind energy project. These efforts aim to boost the share of renewable energy within the national energy mix.

Saudi Arabia Green Data Center Market Growth Drivers:

Technological Developments in Cooling Solutions

Technological innovation in cooling technologies is a prime driver of the market. Among data center operations, cooling is one of the most power-hungry processes, and innovative technologies are now assisting in cutting energy consumption in this function. Liquid cooling, free-air cooling, and hybrid cooling systems are increasingly being implemented to enhance efficiency. These technologies allow data centers to maximize energy efficiency with optimal operating conditions. Due to the mounting pressure to minimize operational expenditure and enhance sustainability, operators of data centers are investing in these high-end cooling systems to improve performance and minimize environmental footprint. The speedy upsurge in the adoption and innovation of energy-efficient cooling technologies is fueling the demand for the green data center market in Saudi Arabia.

Growing Recognition of Environmental Footprint

The increasing recognition of the environmental footprint of data centers is one of the chief drivers of demand for green data centers in Saudi Arabia. Customers and businesses alike are becoming more aware of the carbon footprint created by conventional data centers and looking for greener alternatives. Businesses are increasingly under pressure from stakeholders, such as customers and investors, to minimize their ecological footprint. This realization is promoting a greater focus on energy-efficient technologies and methodologies in the data center sector. Due to this reason, operators are implementing green building codes, energy-efficient technologies, and renewable sources of energy to address sustainability objectives. The growing corporate and public need for green practices is facilitating the expansion of the green data centers in the region.

Cost Efficiency and Long-Term Savings

Cost-effectiveness is another key impetus for the expansion of the green data centers in Saudi Arabia. With companies still grappling with increasing energy costs, adopting energy-efficient data centers are becoming a viable investment. Green technologies like efficient cooling systems, virtualization, and renewable energy procurement assist companies in minimizing electricity usage and reducing operational costs. Furthermore, the decrease in energy usage also results in lower maintenance expenses and extended equipment lifespan. Gradually, companies are realizing that the initial excess investment in green technology is counteracted by long-term cost savings. These economic benefits are encouraging more Saudi Arabian companies to turn towards green data centers, catalyzing the demand for sustainable and cost-effective data infrastructure in the nation.

Saudi Arabia Green Data Center Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, data center type, and industry vertical.

Component Insights:

- Solutions

- Power Systems

- Servers

- Monitoring and Management Systems

- Networking Systems

- Cooling Systems

- Others

- Services

- System Integration Services

- Maintenance and Support Services

- Training and Consulting Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solutions (power systems, servers, monitoring and management systems, networking systems, cooling systems, and others) and services (system integration services, maintenance and support services, and training and consulting services).

Data Center Type Insights:

- Colocation Data Centers

- Managed Service Data Centers

- Cloud Service Data Centers

- Enterprise Data Centers

A detailed breakup and analysis of the market based on the data center type have also been provided in the report. This includes colocation data centers, managed service data centers, cloud service data centers, and enterprise data centers.

Industry Vertical Insights:

- Healthcare

- BFSI

- Government

- Telecom and IT

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes healthcare, BFSI, government, telecom and IT, and others.

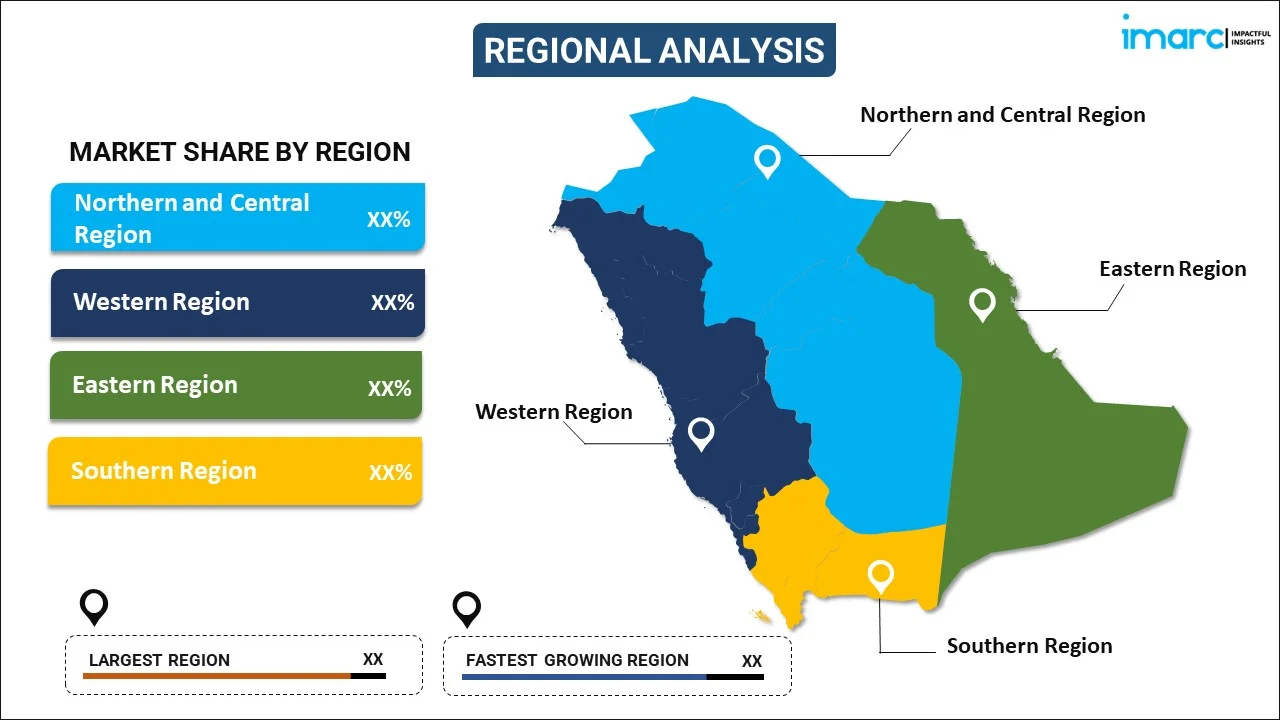

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Green Data Center Market News:

- February 2025: NEOM, the sustainable zone under development in northwest Saudi Arabia, and DataVolt, an international developer, investor and operator of data centers headquartered in Saudi Arabia, signed today a historic agreement that represents a major step toward making the Kingdom's vision for a data-driven, sustainable economy a reality.

- February 2025: Group AMANA, the Middle East's leading design-build construction company, and Al Moammar Information Systems (MIS) have signed a strategic Memorandum of Understanding (MoU) during LEAP 2025 to accelerate Saudi Arabia's evolution into a world digital powerhouse in support of Vision 2030 through high-performance, eco-friendly data centers.

- April 2025: Engie Solutions, a pioneering company in sustainable energy and facilities management solutions, has announced its presence at the forthcoming DCD Connect MENA 2025, the Middle East's leading data center industry conference being held April 15-16, 2025, in Dubai. Engie Solutions will showcase its creative strategies for addressing the specific challenges of managing data center facilities in the region, where it oversees several data centers with a combined capacity exceeding 320 MW in Saudi Arabia and the UAE.

- June 2025: Schneider Electric, the digital transformation of energy management and automation leader, organized its recent Innovation Talks event in Riyadh on the theme "Innovation Talks: Partnering for AI Data Centers & Advanced Liquid Cooling." At the event, Schneider Electric revealed the acquisition of Motivair, an international liquid cooling systems leader for high-performance computing, a strategic business move to enhance the company's vision for global sustainable, AI-powered data center solutions. The project is well aligned with Saudi Arabia's Vision 2030, which seeks to create a dynamic digital economy and make the Kingdom a prominent regional hub for data centers and AI.

- May 2025: Turkcell reported that its group company, TDC Veri Hizmetleri (TDC), has raised EUR100 million murabaha financing in a strategic deal with Emirates NBD Bank, one of the region's leading banking groups in the Middle East and Turkiye (MENAT) region. The five-year funding deal is aimed at empowering Turkcell Group's data center investments through TDC, speeding up its digital infrastructure development, and in line with its long-term strategic growth plans. This deal strengthens Emirates NBD’s position as a reliable financial partner providing customized solutions that promote sustainable growth.

- October 2025: Kyriba, the world leader in liquidity management performance, announced it will be opening a cutting-edge data center in the Kingdom of Saudi Arabia in Q1 2025. The new investment is in support of the Kingdom's 2030 vision initiative and reaffirms Kyriba's dedication to digital transformation, innovation, and sustainable regional development.

Saudi Arabia Green Data Center Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered |

|

| Data Center Types Covered | Colocation Data Centers, Managed Service Data Centers, Cloud Service Data Centers, Enterprise Data Centers |

| Industry Verticals Covered | Healthcare, BFSI, Government, Telecom and IT, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia green data center market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia green data center market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia green data center industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A green data center is an environmentally conscious facility designed to enhance energy efficiency and minimize its ecological footprint. It integrates technologies such as renewable energy sources, advanced cooling systems, and optimized server operations, aiming to reduce carbon emissions, conserve resources, and lower energy costs while supporting sustainability goals.

The Saudi Arabia green data center market was valued at USD 817 Million in 2024.

The Saudi Arabia green data center market is projected to exhibit a CAGR of 18.9% during 2025-2033, reaching a value of USD 3,879 Million by 2033.

The key factors driving the Saudi Arabia green data center market include the growing emphasis on sustainability, government initiatives such as Vision 2030, the shift towards renewable energy sources, advancements in energy-efficient technologies, rising awareness about environmental impact, and the demand for cost-efficient, eco-friendly data storage solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)