Saudi Arabia Green Hydrogen Market Size, Share, Trends and Forecast by Technology, Application, Distribution Channel, and Region, 2026-2034

Saudi Arabia Green Hydrogen Market Summary:

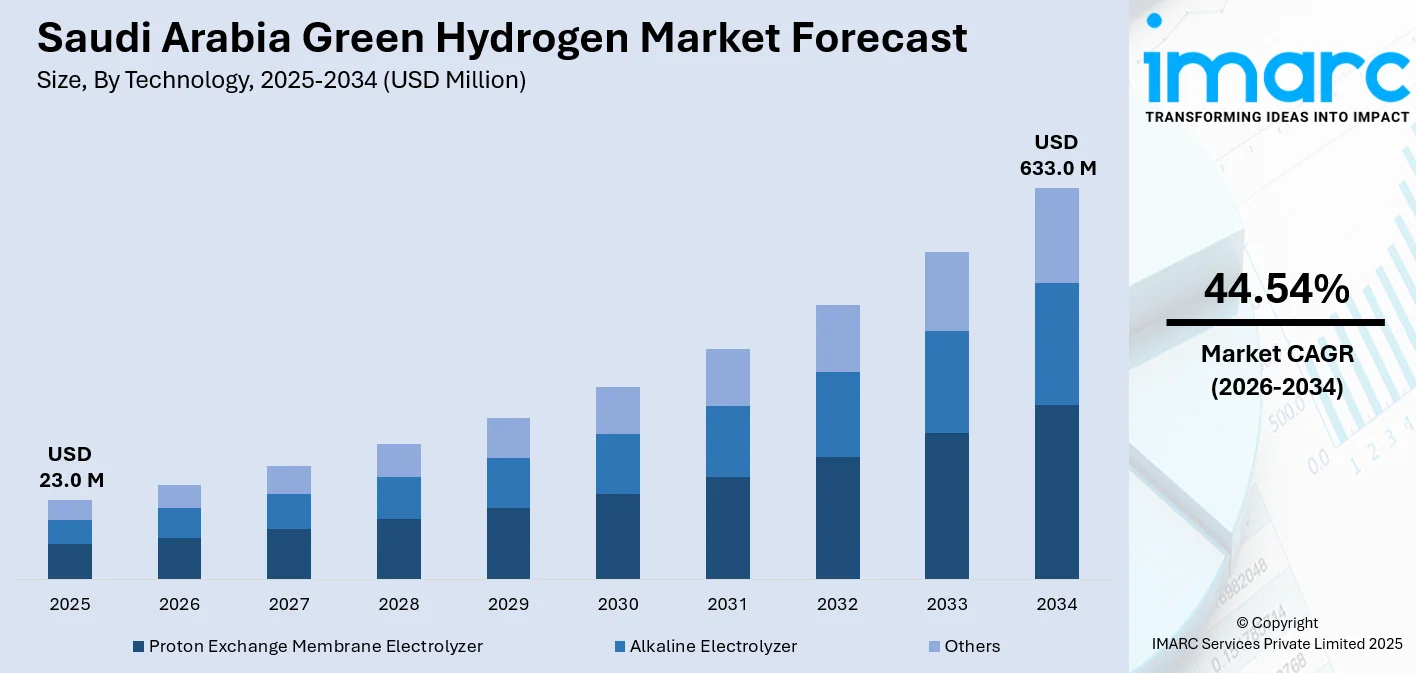

The Saudi Arabia green hydrogen market size was valued at USD 23.0 Million in 2025 and is projected to reach USD 633.0 Million by 2034, growing at a compound annual growth rate of 44.54% from 2026-2034.

Saudi Arabia is positioning green hydrogen as a cornerstone of its economic diversification strategy, leveraging abundant solar resources and strategic geographic positioning to establish itself as a future energy export powerhouse. The market is characterized by significant government investment in renewable energy infrastructure, ambitious national targets for hydrogen production capacity, and growing collaboration between domestic entities and international technology providers to develop large-scale electrolyzer facilities and export-oriented projects, thereby expanding the Saudi Arabia green hydrogen market share.

Key Takeaways and Insights:

- By Technology: Proton exchange membrane electrolyzer dominates the market with a share of 46.1% in 2025, driven by superior efficiency in converting renewable electricity into hydrogen, faster response times to fluctuating solar power generation, and higher purity output suitable for industrial applications.

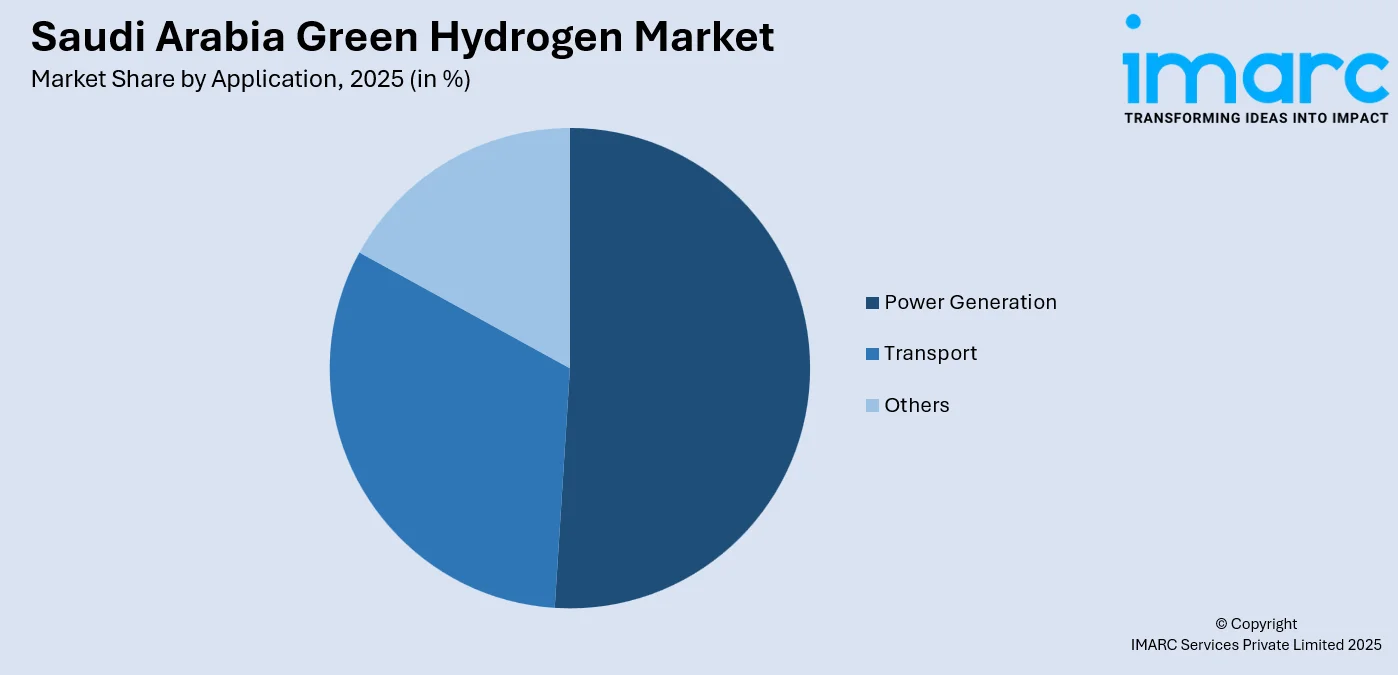

- By Application: Power generation leads the market with a share of 51.02% in 2025, reflecting the Kingdom's strategic emphasis on integrating hydrogen into energy security frameworks, balancing intermittent renewable sources, and creating flexible power generation assets for domestic consumption and regional export.

- By Distribution Channel: Cargo represents the largest segment with a market share of 63.05% in 2025, underscoring Saudi Arabia's strategic focus on positioning itself as a global hydrogen exporter, leveraging existing petroleum logistics expertise, and developing specialized maritime infrastructure for international hydrogen trade.

- By Region: Northern and central region accounts for 31% of the market in 2025, benefiting from proximity to mega renewable energy projects, established industrial clusters requiring hydrogen feedstock, and strategic positioning along future hydrogen corridor routes connecting production sites with consumption centers and export terminals.

- Key Players: The Saudi Arabia green hydrogen market features a collaborative ecosystem where government-backed entities partner with international electrolyzer manufacturers, energy companies, and engineering firms to develop integrated production facilities, with competition centered on technological capabilities, production scale efficiency, and export infrastructure development.

To get more information on this market Request Sample

The Saudi Arabian green hydrogen sector represents a transformative shift in the Kingdom's energy paradigm, moving beyond hydrocarbon dependency toward renewable energy leadership. Vision 2030 has catalyzed unprecedented investment in solar and wind infrastructure specifically designed to power green hydrogen production, with the government establishing dedicated economic zones for hydrogen development. The NEOM Green Hydrogen Project exemplifies this ambition, aiming to produce hydrogen at scales previously unseen in the region, demonstrating Saudi Arabia's commitment to becoming a major player in the emerging global hydrogen economy through strategic deployment of its renewable energy potential and existing energy sector expertise. The Kingdom's commitment is exemplified by the NEOM Green Hydrogen Project, a groundbreaking initiative designed to produce up to 600 tons of carbon-free hydrogen daily by harnessing solar and wind power across vast desert expanses, demonstrating Saudi Arabia's determination to transition from a petroleum-based economy to a clean energy leader. This transformative project, representing an investment exceeding USD 8.4 billion, involves integrating over 4 gigawatts of renewable energy capacity with the world's largest electrolyzer installation, creating a fully integrated hydrogen production ecosystem that will power transportation fleets, industrial processes, and export markets. In 2025, Acwa Power Co. of Saudi Arabia announced its plans to construct the nation's second multibillion-dollar green hydrogen facility, even though it faces challenges in marketing the production from the initial project. Acwa Power has chosen Tecnicas Reunidas SA and China's Sinopec Guangzhou Engineering to execute a front-end engineering design contract for the project, the firm based in Madrid.

Saudi Arabia Green Hydrogen Market Trends:

Emergence of Giga-Scale Hydrogen Production Facilities

Saudi Arabia is witnessing the development of world-class hydrogen production complexes that integrate massive renewable energy installations with advanced electrolyzer arrays, creating vertically integrated hydrogen value chains. These facilities are designed to achieve economies of scale that reduce production costs below critical thresholds for commercial viability, incorporating innovative approaches to water sourcing, purification systems, and hydrogen storage solutions tailored to desert environments. The trend reflects a strategic decision to leapfrog incremental development in favor of transformational infrastructure that positions the Kingdom as a cost-competitive hydrogen supplier capable of meeting anticipated global demand. The biggest green hydrogen facility globally, currently being built in Saudi Arabia, is scheduled to start production in December 2026. The facility will depend solely on solar and wind energy to operate a 2.2 gigawatt electrolyzer, aimed at producing hydrogen without interruption.

Integration of Hydrogen into Industrial Decarbonization Pathways

Saudi Arabian industries are increasingly evaluating green hydrogen as a replacement for conventional fossil fuel inputs, particularly in sectors where emissions reduction faces technical challenges through electrification alone. The primary objective for the environment in the Kingdom, following the increased use of renewable energy, is to reduce carbon emissions from its industrial sectors. To modify heavy industries such as petrochemicals, steel, cement, and aluminium production, it would require over $25 billion to reduce emissions by 130 million tonnes of CO2 annually by 2030. Refineries, petrochemical complexes, and cement production facilities are exploring hydrogen adoption to maintain competitive advantages while meeting evolving environmental standards and corporate sustainability commitments. This industrial transition is being facilitated by government incentives that encourage early adoption, technical feasibility studies examining hydrogen compatibility with existing equipment, and pilot projects demonstrating operational viability across diverse industrial processes.

Development of Specialized Hydrogen Export Infrastructure

The Kingdom is investing in purpose-built infrastructure designed specifically for hydrogen transportation and export, including specialized port facilities, liquefaction plants, and carrier vessels capable of safely transporting hydrogen or ammonia derivatives to international markets. This infrastructure development reflects strategic planning to capture value across the entire hydrogen supply chain, from production through delivery to end customers, while establishing technical standards and operational protocols that could influence global hydrogen trade practices. The infrastructure investments are being coordinated with bilateral agreements securing long-term offtake commitments from energy-importing nations. In 2025, Saudi Arabia announced plans for globally leading green hydrogen hub in Yanbu, developed by ACWA Power and Germany's EnBW. The Yanbu Green Hydrogen Hub plans to feature an impressive 4 gigawatts (GW) of electrolysis capacity, aiming for an annual output of 400,000 tons of green hydrogen. This hydrogen will subsequently be transformed into green ammonia, designated for international export.

How Vision 2030 is Transforming the Saudi Arabia Green Hydrogen Market:

Saudi Arabia’s Vision 2030 has turned green hydrogen from a long-term idea into an active industrial push. The plan ties clean hydrogen directly to energy diversification, export revenue, and lower dependence on crude oil. Flagship projects like NEOM’s green hydrogen facility show how serious the shift is, combining large-scale solar and wind with electrolysis to produce hydrogen and ammonia for global markets. Policy support under Vision 2030 has reduced entry barriers for global developers through foreign investment incentives, land access, and fast-track approvals. Public players like ACWA Power and Saudi Aramco are partnering with international technology firms, bringing scale and execution speed that few countries can match. At the same time, infrastructure investments in ports, pipelines, and export terminals are being aligned with hydrogen trade ambitions. The result is a market moving beyond pilots toward commercial volumes, positioning Saudi Arabia as a future supplier of green hydrogen to Europe and Asia.

Market Outlook 2026-2034:

Saudi Arabia's green hydrogen market is poised for exponential expansion as the Kingdom executes its renewable energy roadmap, brings major production facilities online, and establishes itself as a preferred hydrogen supplier to markets prioritizing energy security and decarbonization. The convergence of declining renewable electricity costs, improving electrolyzer economics, strengthening international hydrogen demand, and sustained government support creates favorable conditions for sustained market growth throughout the forecast period. The market generated a revenue of USD 23.0 Million in 2025 and is projected to reach a revenue of USD 633.0 Million by 2034, growing at a compound annual growth rate of 44.54% from 2026-2034. The progressive commissioning of large-scale facilities throughout the forecast period will establish operational track records that inform subsequent project optimization, drive cost reductions through lessons learned, and demonstrate Saudi Arabia's capability to reliably produce and deliver hydrogen at competitive prices to global markets.

Saudi Arabia Green Hydrogen Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Technology |

Proton Exchange Membrane Electrolyzer |

46.1% |

|

Application |

Power Generation |

51.02% |

|

Distribution Channel |

Cargo |

63.05% |

|

Region |

Northern and Central Region |

31% |

Technology Insights:

- Proton Exchange Membrane Electrolyzer

- Alkaline Electrolyzer

- Others

Proton exchange membrane electrolyzer dominates with a market share of 46.1% of the total Saudi Arabia green hydrogen market in 2025.

Proton exchange membrane (PEM) electrolyzer technology has emerged as the preferred choice for Saudi Arabian hydrogen projects due to its exceptional compatibility with the variable output characteristics of solar photovoltaic installations that dominate the Kingdom's renewable energy portfolio. These systems offer rapid response capabilities that allow them to efficiently convert electricity into hydrogen even as solar generation fluctuates throughout the day, maximizing utilization of available renewable energy without requiring extensive battery storage as an intermediary. The technology's compact footprint relative to production capacity proves particularly advantageous for projects in remote desert locations where land availability is abundant but minimizing infrastructure complexity reduces operational challenges.

The high-purity hydrogen output from PEM electrolyzers aligns perfectly with the stringent quality requirements of industrial applications and international export specifications, eliminating or reducing the need for downstream purification processes that add cost and complexity. Saudi developers recognize that PEM technology, despite higher initial capital requirements compared to alkaline alternatives, delivers superior operational flexibility and lower maintenance demands that improve long-term project economics. The Kingdom's strategic partnerships with leading PEM electrolyzer manufacturers from Europe and Asia are facilitating technology transfer, local manufacturing capabilities, and continuous innovation in system efficiency that further strengthens the competitive position of this technology segment.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Power Generation

- Transport

- Others

Power generation leads with a share of 51.02% of the total Saudi Arabia green hydrogen market in 2025.

Power generation applications dominate the market as the Kingdom strategically positions hydrogen as a critical enabler of its renewable energy transition, providing long-duration energy storage capabilities that complement intermittent solar and wind resources. Hydrogen-fueled power generation offers the ability to dispatch electricity during periods of peak demand or when renewable generation is insufficient, creating a reliable baseload alternative that reduces dependence on natural gas while maintaining grid stability. This application directly supports Saudi Arabia's commitment to achieving substantial renewable energy penetration in its electricity mix without compromising the reliability standards expected by industrial consumers and residential populations.

The Kingdom's power generation sector views green hydrogen as a pathway to repurpose existing natural gas infrastructure and turbine assets through hydrogen blending or conversion, protecting previous infrastructure investments while accelerating decarbonization timelines. Saudi Arabia is developing hydrogen-capable power plants specifically designed to provide flexible generation capacity that can scale with growing hydrogen production, creating anchor demand that justifies continued investment in upstream production facilities. The strategic emphasis on power generation reflects recognition that establishing robust domestic hydrogen consumption provides market stability that complements export ambitions, demonstrating technology viability and creating operational experience that strengthens the Kingdom's position in international hydrogen markets.

Distribution Channel Insights:

- Pipeline

- Cargo

Cargo exhibits a clear dominance with a 63.05% share of the total Saudi Arabia green hydrogen market in 2025.

Cargo-based hydrogen distribution channels dominate the Saudi Arabian market due to the Kingdom's strategic vision of becoming a leading global hydrogen exporter, requiring transportation solutions capable of delivering hydrogen to international customers across continents and oceans. The geography of hydrogen demand, concentrated in energy-importing nations of East Asia and Europe, necessitates maritime transportation as the only economically viable solution for the volumes Saudi Arabia aims to export. The Kingdom is investing heavily in specialized cargo infrastructure including ammonia conversion facilities that allow hydrogen to be transported in a more energy-dense form, reducing shipping costs and improving the economics of long-distance hydrogen trade.

Saudi Arabia's extensive experience in global energy commodity logistics, developed through decades of oil and natural gas exports, provides a competitive advantage in establishing hydrogen cargo operations, with existing port infrastructure, international shipping relationships, and regulatory expertise being adapted to accommodate hydrogen's unique handling requirements. The development of dedicated hydrogen export terminals along the Red Sea coast positions Saudi Arabia to efficiently serve both European and Asian markets, with cargo routes being optimized based on seasonal demand patterns, shipping costs, and regional hydrogen price dynamics. The emphasis on cargo distribution reflects realistic assessment of pipeline limitations for international hydrogen trade, with pipeline networks viewed as regional solutions rather than transcontinental infrastructure, making cargo the inevitable choice for Saudi Arabia's export-oriented hydrogen strategy.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and central region leads with a share of 31% of the total Saudi Arabia green hydrogen market in 2025.

The northern and central region's leadership in Saudi Arabia's green hydrogen market stems from its concentration of mega-renewable energy projects specifically designed to power large-scale hydrogen production, with vast desert areas providing ideal conditions for solar installations that generate the clean electricity required for electrolysis. NEOM and other strategic development zones within this region have been designated as hydrogen production hubs, benefiting from master-planned infrastructure that integrates renewable generation, water supply systems, electrolyzer facilities, and export infrastructure in coordinated developments that optimize project economics. The region's proximity to the Red Sea coast facilitates hydrogen export through purpose-built maritime terminals, reducing transportation costs between production sites and international shipping routes.

The northern and central region benefits from government prioritization that channels investment, regulatory support, and international partnerships toward projects in this geographic area, creating concentration effects that attract equipment suppliers, engineering firms, and skilled workforce development initiatives. Established industrial presence in cities like Riyadh provides access to technical expertise, maintenance services, and ancillary industries that support hydrogen project development and operations, while planned transportation corridors will eventually connect northern production facilities with consumption centers in central industrial zones. The region's leadership position is reinforced by its role in demonstrating Saudi Arabia's hydrogen capabilities to international stakeholders, with flagship projects serving as showcases for the Kingdom's technological sophistication, production scale, and commitment to the hydrogen economy.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Green Hydrogen Market Growing?

Government Vision and Strategic National Commitment to Energy Transition

Saudi Arabia's green hydrogen market expansion is fundamentally driven by the Kingdom's Vision 2030 framework, which explicitly prioritizes economic diversification away from oil dependence and establishes hydrogen as a strategic pillar of the nation's future energy landscape. The government has committed substantial financial resources to hydrogen infrastructure development, creating dedicated investment vehicles and establishing regulatory frameworks that provide long-term policy certainty for project developers and international partners. This top-down commitment manifests in streamlined project approval processes, dedicated economic zones with favorable business conditions, and coordinated planning across government entities that eliminates bureaucratic obstacles typically encountered in emerging technology sectors. In 2025, through a groundbreaking $32 billion investment pipeline, the Kingdom is preparing to emerge as a worldwide leader in sustainable energy by 2030.

Exceptional Renewable Energy Resources and Production Cost Advantages

The Kingdom possesses world-class solar irradiation levels across vast desert territories, enabling photovoltaic installations to generate electricity at remarkably low costs that translate directly into competitive hydrogen production economics. Saudi Arabia's renewable electricity generation costs have reached levels that make green hydrogen economically viable compared to conventional hydrogen production methods, with ongoing technology improvements and scale economies expected to further reduce costs throughout the forecast period. The abundance of available land for renewable installations eliminates site acquisition challenges and allows projects to achieve scales that optimize equipment utilization and spread fixed costs across large production volumes. Saudi Arabia's established energy sector expertise, including project management capabilities, engineering talent, and operational experience with large-scale energy infrastructure, reduces development risks and accelerates the timeline from project conception to commercial operation. In 2025, Stargate Hydrogen, a manufacturer of green hydrogen and deep-tech technologies originating from Europe, has entered into a Memorandum of Understanding (MoU) with RDI - Research, Development, and Innovation Authority of Saudi Arabia. The agreement speeds up Stargate Hydrogen’s operations in the Middle East as the firm establishes its regional headquarters in Riyadh.

Growing International Demand and Strategic Export Market Positioning

Global decarbonization commitments are creating substantial anticipated demand for clean hydrogen from nations lacking domestic renewable resources sufficient to meet their hydrogen requirements, with Saudi Arabia strategically positioning itself as a reliable supplier to these energy-importing markets. The Kingdom's geographic location between Europe and Asia, combined with existing energy trade relationships built over decades of petroleum exports, provides established channels for hydrogen market development and customer relationship cultivation. International agreements and memoranda of understanding signed with major hydrogen-importing nations provide concrete demand signals that justify continued investment in Saudi production capacity, with long-term offtake commitments reducing market risk for project developers. The emerging regulatory frameworks in target markets, including carbon border adjustments and clean fuel standards, are creating preferential treatment for green hydrogen that enhances its competitiveness relative to fossil fuel alternatives and conventionally-produced hydrogen. Saudi Arabia's strategy of developing export infrastructure concurrently with production facilities ensures that growing domestic capacity can be efficiently delivered to international customers, capturing value across the entire supply chain and establishing the Kingdom as an indispensable node in the global hydrogen economy. In 2026, Investment Minister announced that Saudi Arabia became the inaugural nation to export blue hydrogen to Japan and is gearing up to commence exports of green hydrogen shortly from ACWA Power's largest green hydrogen facility in NEOM. During the Saudi–Japanese Ministerial Investment Forum, Al-Falih stated that the Kingdom will maintain its role as a dependable energy supplier to Japan, encompassing clean energy initiatives.

Market Restraints:

What Challenges the Saudi Arabia Green Hydrogen Market is Facing?

High Capital Requirements and Project Financing Complexity

Green hydrogen projects demand substantial upfront investment spanning renewable energy installations, electrolyzer equipment, water infrastructure, storage facilities, and distribution systems, creating financing challenges even in a capital-rich environment. The emerging nature of the hydrogen market introduces uncertainty regarding future revenue streams, hydrogen pricing dynamics, and technology performance over multi-decade operational periods that complicate financial modeling and risk assessment for lenders and investors. Despite government support, individual projects must demonstrate economic viability and competitive returns to justify capital allocation decisions by both public and private sector participants.

Water Resource Constraints in Arid Environment

Hydrogen production through electrolysis requires substantial volumes of purified water, presenting supply challenges in Saudi Arabia's desert climate where freshwater resources are limited and heavily utilized by existing agricultural, industrial, and municipal consumers. While desalination provides a potential water source, it adds significant cost and energy consumption to hydrogen projects, impacting overall production economics and creating dependency on coastal locations with seawater access. The environmental implications of large-scale water consumption for hydrogen production require careful management to ensure sustainability and maintain social license for project development.

Technology Maturity and Operational Risk Factors

Large-scale green hydrogen production remains a relatively nascent industry sector with limited operational history at the scales Saudi Arabia is pursuing, creating uncertainties regarding long-term equipment reliability, maintenance requirements, and performance degradation over time. The integration of multiple complex systems including renewable generation, electrolyzers, storage, and conversion facilities introduces operational interdependencies where failures in one component can impact the entire production chain, requiring sophisticated management capabilities. The harsh environmental conditions of Saudi Arabia's desert climate, including extreme temperatures, dust exposure, and limited water availability for cooling systems, present operational challenges that require equipment adaptations and operational protocols still being developed through practical experience.

Competitive Landscape:

The Saudi Arabia green hydrogen market operates through a collaborative ecosystem where government-backed development entities partner with international technology providers, engineering firms, and energy companies to execute large-scale projects that establish the Kingdom's hydrogen production infrastructure. Competition centers on securing project development rights in strategic locations, accessing the most efficient and cost-effective electrolyzer technology, and establishing relationships with international offtakers that provide long-term revenue certainty. The market structure reflects the capital-intensive and strategically important nature of hydrogen development, with major projects typically involving consortiums that combine local knowledge, government support, international expertise, and financial resources required for successful execution. Competitive dynamics are influenced less by traditional market share considerations and more by capabilities in project development, technology deployment, operational excellence, and integration across the hydrogen value chain from production through export delivery.

Recent Developments:

- In October 2025, Saudi Arabia held the first Hydrogen Arabia Summit & Exhibition on 8 to 9 December 2025 at the Crowne Plaza Riyadh RDC, establishing the Kingdom as a center for hydrogen and clean energy partnerships. Introduced to the area by RX, a worldwide leader in exhibitions and events and the organizer of the influential World Hydrogen Summit, Hydrogen Arabia will feature a prominent conference agenda along with a specialized showcase, uniting high-ranking officials, international energy executives, investors, and innovators in the hydrogen field.

- In February 2025, Hysata, the top electrolyser firm in Australia, has today revealed a new deal with ACWA Power to provide large-scale demonstrations of its high-efficiency capillary-fed electrolysis technology (consuming just 41.5 kWh of electricity to generate one kilogram of hydrogen) in Saudi Arabia. The accord will expedite the advancement of Hysata’s highly efficient electrolysers and utilize ACWA Power’s extensive experience in major capital projects, including its 2.2-gigawatt NEOM green hydrogen initiative in Saudi Arabia.

Saudi Arabia Green Hydrogen Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Proton Exchange Membrane Electrolyzer, Alkaline Electrolyzer, Others |

| Applications Covered | Power Generation, Transport, Others |

| Distribution Channels Covered | Pipeline, Cargo |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia green hydrogen market size was valued at USD 23.0 Million in 2025.

The Saudi Arabia green hydrogen market is expected to grow at a compound annual growth rate of 44.54% from 2026-2034 to reach USD 633.0 Million by 2034.

Proton exchange membrane electrolyzer technology dominated the market with a share of 46.1% in 2025, driven by its superior efficiency in converting renewable electricity, rapid response capabilities matching solar generation variability, and high-purity hydrogen output meeting stringent industrial and export specifications.

Key factors driving the Saudi Arabia green hydrogen market include the government's strategic Vision 2030 commitment establishing hydrogen as an economic diversification priority, exceptional solar resources enabling low-cost renewable electricity generation, growing international demand from energy-importing nations, and the Kingdom's strategic positioning as a future global hydrogen exporter.

Major challenges include substantial capital requirements for integrated hydrogen production facilities, water resource constraints in the Kingdom's arid environment requiring desalination solutions, technology maturity concerns for large-scale operations, operational complexities of managing integrated renewable-hydrogen systems, and the need to establish international supply chains and market acceptance for Saudi hydrogen exports.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)