Saudi Arabia Handbag Market Size, Share, Trends and Forecast by Product Type, Material Type, Distribution Channel, and Region, 2026-2034

Saudi Arabia Handbag Market Summary:

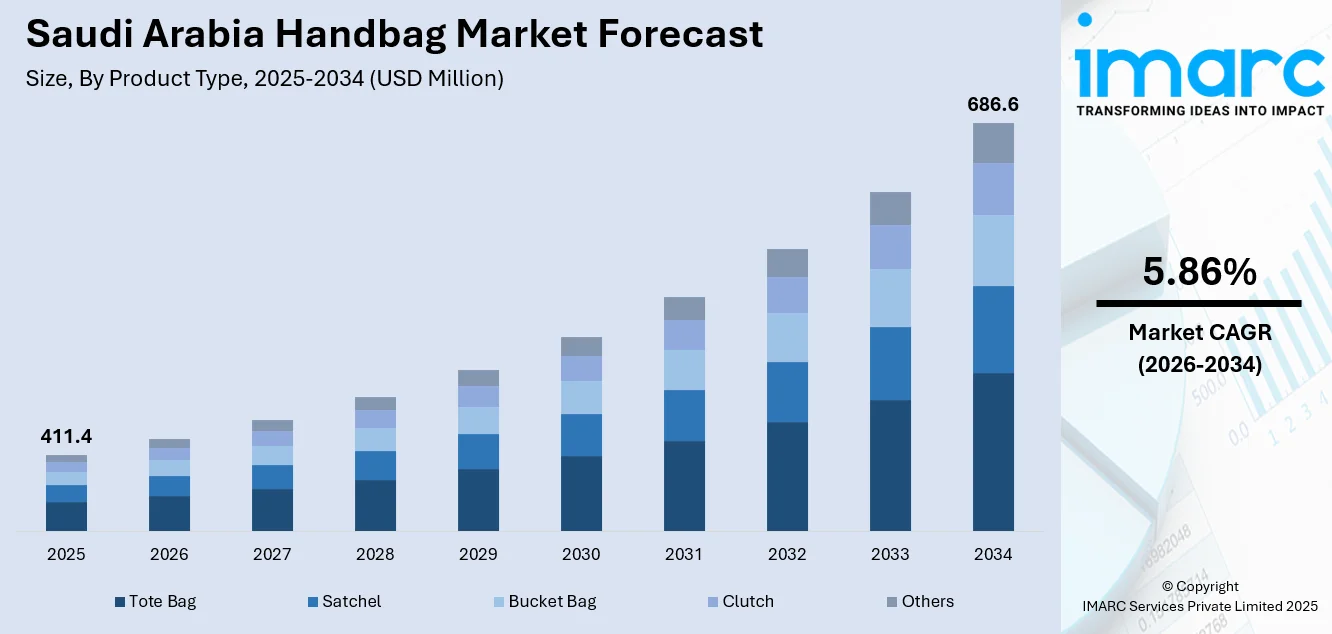

The Saudi Arabia handbag market size was valued at USD 411.4 Million in 2025 and is projected to reach USD 686.6 Million by 2034, growing at a compound annual growth rate of 5.86% from 2026-2034.

The Saudi Arabia handbag market is experiencing robust expansion driven by the evolving consumer preferences, increasing female workforce participation, and growing demand for premium fashion accessories. Economic diversification initiatives under Vision 2030 have fostered retail sector development, while rising disposable incomes among urban consumers continue to fuel demand for stylish and high-quality handbags across diverse product categories and distribution channels.

Key Takeaways and Insights:

- By Product Type: Tote bag dominates the market with a share of 32% in 2025, due to its adaptability, roomy design, and fit for both formal and informal settings. The market is further expanding owing to the increasing number of working women looking for stylish yet functional accessories.

- By Material Type: Leather leads the market with a share of 49% in 2025. This dominance is driven by consumer preference for premium quality, durability, and the timeless elegance associated with genuine leather products in the luxury fashion segment.

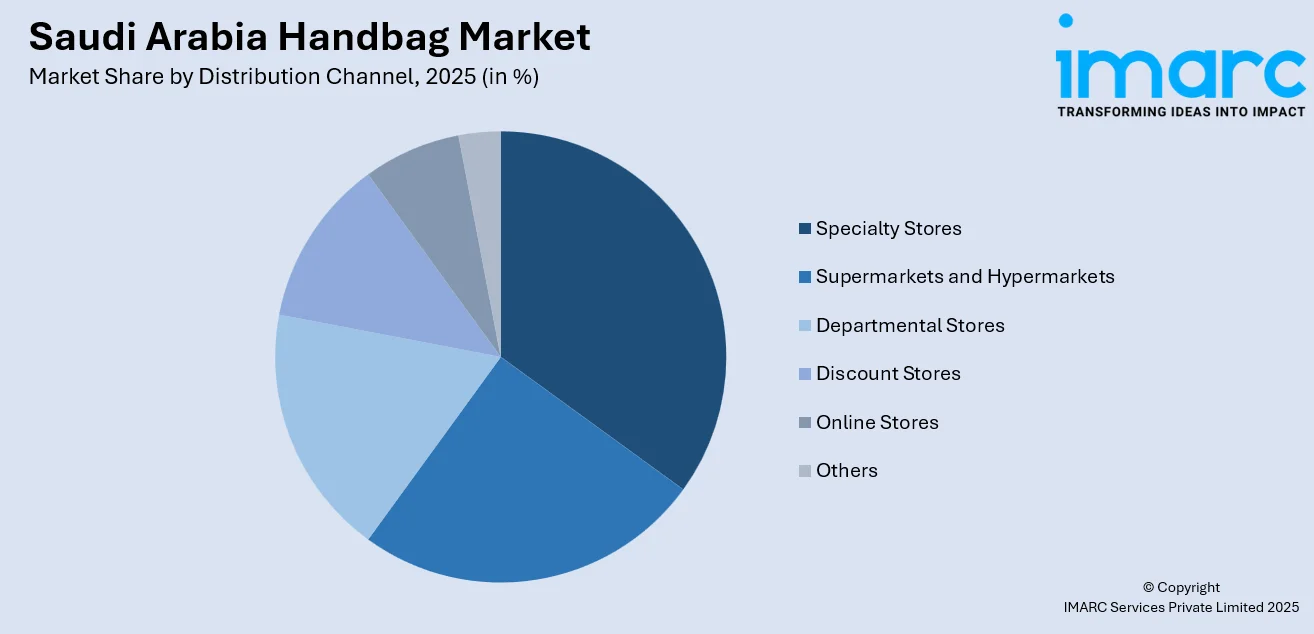

- By Distribution Channel: Specialty stores represent the largest segment with a market share of 28% in 2025, reflecting consumer preference for dedicated retail environments offering curated product selections, personalized service, and authentic shopping experiences.

- By Region: Northern and Central Region comprises the largest region with 40% share in 2025, driven by the concentration of affluent consumers in Riyadh metropolitan area, extensive luxury retail infrastructure, and higher disposable incomes enabling premium purchases.

- Key Players: Key players drive the Saudi Arabia handbag market by expanding retail presence, introducing innovative product designs, and strengthening distribution networks. Their investments in marketing, brand positioning, and partnerships with retail chains enhance consumer awareness and accessibility across diverse market segments.

To get more information on this market Request Sample

The Saudi Arabia handbag market continues to demonstrate strong growth momentum, supported by favorable macroeconomic conditions and evolving consumer lifestyles. The kingdom's young, fashion-conscious population, with approximately 65 percent under 40 years of age, drives demand for trendy and stylish handbag designs across price segments. Economic reforms under Vision 2030 have accelerated female workforce participation, with the labor force participation rate of Saudi females reaching 36.2% in the third quarter of 2024 according to the official government website, significantly boosting purchasing power among women consumers. The expansion of luxury retail infrastructure, including the development of premium shopping destinations in Riyadh and Jeddah, has enhanced accessibility to international and domestic handbag brands. Additionally, the rapid growth of e-commerce platforms has transformed consumer purchasing behavior, enabling convenient access to diverse handbag collections. Social media influence and digital marketing strategies employed by brands continue to shape consumer preferences, particularly among younger demographics seeking fashionable and functional handbag options.

Saudi Arabia Handbag Market Trends:

Rising Demand for Locally Designed Handbags

The Saudi Arabia handbag market is witnessing increasing consumer interest in locally designed products that reflect cultural heritage and national identity. Government initiatives supporting domestic manufacturing and creative industries have encouraged the emergence of homegrown fashion labels offering unique designs incorporating traditional patterns and contemporary aesthetics. Luxury institutions are actively mentoring Saudi designers through programs like the Chalhoub Group Fashion Lab, providing retail visibility and business development support to nascent local brands seeking to establish their presence in the competitive handbag market.

Digital Transformation and E-commerce Expansion

The digital revolution is reshaping the Saudi Arabia handbag market as consumers increasingly embrace online shopping platforms for fashion accessories. High internet penetration rates and widespread smartphone adoption have made mobile commerce the preferred shopping channel, particularly among younger consumers. Fashion e-commerce platforms offer extensive product selections, competitive pricing, and convenient delivery options, enabling consumers to explore diverse handbag collections from international and local brands without visiting physical stores, thereby expanding market reach and accessibility. According to the Communications, Space, and Technology Commission (CST), internet penetration in Saudi Arabia reached 99% by the end of 2024, with mobile phone internet usage accounting for 99.4% of all internets.

Growing Interest in Luxury Resale and Pre-owned Handbags

The Saudi Arabia handbag market is experiencing emerging interest in authenticated luxury resale, driven by consumer desire for exclusive vintage pieces and sustainable shopping alternatives. The entry of global auction houses into the Saudi market has legitimized the secondary luxury market, providing access to rare and collectible handbags for sophisticated consumers. This convergence of luxury and sustainability appeals to environmentally conscious buyers seeking premium products while supporting circular economy principles, establishing new consumption patterns in the kingdom's evolving fashion landscape. In February 2025, Sotheby's hosted Saudi Arabia's first-ever international auction titled "Origins" in Diriyah, featuring luxury items including Hermès handbags alongside art, jewelry, and watches, with a third of bidders under the age of 40, indicating a high level of youth involvement in luxury collecting.

How Vision 2030 is Transforming the Saudi Arabia Handbag Market:

Saudi Arabia's Vision 2030 has reshaped the outlook of the handbag market by diversifying the economy away from oil dependency and positioning the Kingdom as a regional fashion and luxury retail hub. Such regulatory reforms as full foreign ownership for licensed retail businesses, the Made in Saudi program that supports domestic manufacturing, and the streamlining of e-commerce regulations have boosted investor confidence and attracted global luxury brands to establish direct market presence. Demand for high-end fashion accessories is accelerated by the Kingdom's predominately young population, rising female labor force participation rates, and rising disposable incomes. Meanwhile, upscale retail developments like Diriyah Square and Solitaire Mall Riyadh create sophisticated shopping destinations that elevate the handbag-buying experience.

Market Outlook 2026-2034:

The Saudi Arabia handbag market outlook remains positive, supported by continued economic diversification, expanding retail infrastructure, and evolving consumer preferences toward premium fashion accessories. Strategic investments in luxury retail developments, including major shopping destinations in Riyadh and Jeddah, are enhancing brand accessibility and consumer engagement. The growing female workforce participation and rising disposable incomes continue to drive demand across product segments, while digital transformation initiatives expand market reach through e-commerce channels and social commerce platforms. The market generated a revenue of USD 411.4 Million in 2025 and is projected to reach a revenue of USD 686.6 Million by 2034, growing at a compound annual growth rate of 5.86% from 2026-2034.

Saudi Arabia Handbag Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Tote Bag | 32% |

| Material Type | Leather | 49% |

| Distribution Channel | Specialty Stores | 28% |

| Region | Northern and Central Region | 40% |

Product Type Insights:

- Satchel

- Bucket Bag

- Clutch

- Tote Bag

- Others

Tote bag dominates with a market share of 32% of the total Saudi Arabia handbag market in 2025.

The tote bag segment commands the largest share of the Saudi Arabia handbag market, driven by its exceptional versatility and practicality for modern lifestyles. Saudi women increasingly prefer tote bags for their spacious interiors that accommodate professional essentials, personal items, and shopping needs. The segment benefits from the growing female population participation in the kingdom, where working women seek stylish yet functional accessories suitable for office environments and daily activities. Fashion brands continuously introduce innovative tote bag designs incorporating premium materials and contemporary aesthetics to capture consumer attention.

The popularity of tote bags in Saudi Arabia extends across diverse consumer demographics, from young professionals to established career women seeking reliable everyday accessories. Major retail destinations in Riyadh and Jeddah showcase extensive tote bag collections from international luxury brands and emerging local designers. The Mall of Arabia in Jeddah, featuring over 400 stores including prominent fashion retailers, exemplifies the retail infrastructure supporting tote bag accessibility. Consumer preference for multifunctional designs that transition seamlessly from workplace to social settings continues driving segment expansion throughout the kingdom.

Material Type Insights:

- Leather

- Fabric

- Rubber

- Others

Leather leads with a share of 49% of the total Saudi Arabia handbag market in 2025.

Leather leads other materials in the market in Saudi Arabia in recognition of its popularity among consumers who prefer quality materials associated with sophistication and class. Consumers in Saudi Arabia perceive high-quality leather handbags as something durable, elegant, and status-reflecting, leading to wide popularity in the market. Consumers in the kingdom are willing to pay for superior-quality leather materials from popular across the globe established manufacturers, while fashion-conscious citizens further boost purchases of leather handbags in the market.

The leather handbags market receives a boost from the development of infrastructure for luxury shopping centers in Saudi Arabia, featuring complete collections from leading producers of leather goods. International luxury brands are expanding their influence in Saudi Arabia, providing unique designs for leather handbags that appeal to regional tastes. Saudi buyers are becoming interested in full-grain and high-quality leathers that display impressive workmanship and modern designs. The market growth trend is in line with the development of the luxury industry in Saudi Arabia, driven by increased affluence and fashion consciousness among Saudi women.

Distribution Channel Insights:

To get detailed segment analysis of this market Request Sample

- Supermarkets and Hypermarkets

- Departmental Stores

- Specialty Stores

- Discount Stores

- Online Stores

- Others

Specialty stores exhibit a clear dominance with a 28% share of the total Saudi Arabia handbag market in 2025.

The specialty stores segment leads the Saudi Arabia handbag distribution landscape, offering dedicated retail environments where consumers experience curated product selections and personalized service. Saudi shoppers prefer specialty stores for purchasing handbags due to the authentic shopping experience, expert product knowledge, and exclusive brand collections unavailable through other channels. Premium shopping malls across the kingdom host numerous specialty handbag boutiques from international luxury houses and established fashion brands. Solitaire Mall in Riyadh exemplifies this trend, featuring flagship stores from prestigious brands and other luxury fashion houses.

Specialty stores continue attracting Saudi consumers seeking premium handbag purchases through sophisticated retail environments and attentive customer service. These retailers invest significantly in store ambiance, visual merchandising, and comprehensive staff training to create memorable shopping experiences that justify premium price positioning. The curated product selections and personalized assistance offered by specialty boutiques foster strong customer loyalty and repeat purchases. The ongoing expansion of next-generation retail destinations featuring dedicated luxury wings further strengthens specialty store dominance in handbag distribution across the kingdom.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region represents the leading segment with a 40% share of the total Saudi Arabia handbag market in 2025.

The Northern and Central Region dominates the Saudi Arabia handbag market, anchored by Riyadh, the capital city and primary commercial hub. The region benefits from the highest concentration of affluent consumers, extensive luxury retail infrastructure, and substantial participation by females. Premium shopping destinations throughout Riyadh showcase diverse handbag collections from international luxury brands and emerging local designers. Strong economic activity, urbanization trends, and sophisticated consumer preferences collectively position this region as the market leader. Jawharat Riyadh, featuring over 300 brands, including 75+ flagships and 10+ first to KSA brands, exemplifies the premium retail development driving regional market leadership.

Riyadh's emergence as a luxury retail destination attracts major international fashion houses and supports domestic designer growth. The Diriyah Square development encompasses extensive mixed-use retail space featuring global fashion houses alongside emerging Saudi brands, creating a comprehensive lifestyle destination. Rising disposable incomes among urban consumers and expanding career opportunities for women continue driving handbag demand throughout the Northern and Central Region's diverse retail landscape. Strategic infrastructure investments position the region as the kingdom's premier fashion and accessories hub.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Handbag Market Growing?

Rising Female Workforce Participation and Economic Empowerment

The Saudi Arabia handbag market is experiencing significant growth driven by increasing female workforce participation and economic empowerment initiatives under Vision 2030. Government reforms have removed barriers to women's employment, enabling greater financial independence and purchasing power among Saudi women. The labor force participation rate of Saudi females has demonstrated remarkable progress, surpassing national targets according to the General Authority for Statistics, reflecting ongoing national efforts to integrate women into the economy. This increased workforce participation translates directly into higher demand for professional accessories including handbags suitable for office environments. Women entering diverse professional fields require stylish yet practical handbags that complement their career aspirations while reflecting personal fashion preferences. The growing financial autonomy among Saudi women enables investment in premium handbag brands that serve both functional needs and status signaling purposes.

Expansion of Luxury Retail Infrastructure

The rapid expansion of luxury retail infrastructure across Saudi Arabia is propelling handbag market growth by enhancing brand accessibility and consumer engagement opportunities. Major shopping mall developments in Riyadh and Jeddah feature dedicated luxury wings hosting international fashion houses and premium handbag brands previously unavailable in the kingdom. In April 2025, Chalhoub Group launched multiple flagship stores at Solitaire Mall in Riyadh, introducing prestigious brands including Loewe, Celine, Fendi, Dior, and Louis Vuitton to Saudi consumers seeking luxury handbag options. These retail developments create sophisticated shopping environments where consumers experience curated handbag collections, personalized service, and exclusive product offerings. The establishment of premium retail destinations supports handbag market expansion by attracting both domestic consumers and international visitors seeking luxury shopping experiences. Strategic investments in retail infrastructure align with Vision 2030 objectives to position Saudi Arabia as a global lifestyle destination.

Government Economic Diversification Initiatives

Government economic diversification initiatives under Vision 2030 are creating favorable conditions for handbag market growth by stimulating retail sector development and supporting domestic manufacturing capabilities. The Made in Saudi program encourages local production of fashion goods including handbags, reducing import dependency while fostering domestic entrepreneurship. These initiatives provide aspiring Saudi designers with resources, mentorship, and market access opportunities to develop commercially viable handbag brands. The government's commitment to transforming the kingdom into a global retail and tourism destination drives infrastructure investments benefiting the fashion accessories sector. Tourism promotion efforts attract international visitors who contribute to handbag market demand through retail spending. Additionally, regulatory reforms enabling full foreign ownership of retail businesses have attracted international fashion brands seeking to establish direct presence in the Saudi market, expanding consumer access to diverse handbag collections.

Market Restraints:

What Challenges the Saudi Arabia Handbag Market is Facing?

Market Saturation from International and Local Brand Influx

The Saudi Arabia handbag market faces challenges from increasing saturation as numerous international luxury brands and local fashion labels compete for consumer attention. The influx of handbag offerings across price segments creates intense competition, making brand differentiation and customer loyalty increasingly difficult to establish. Companies must invest substantially in marketing, promotional activities, and retail experiences to maintain visibility and capture market share in the crowded competitive landscape.

Prevalence of Counterfeit Products

Counterfeit handbags pose significant challenges to legitimate market participants by undermining brand value and consumer confidence in the Saudi Arabia market. The availability of imitation products through informal channels and online platforms affects purchasing decisions among price-sensitive consumers, potentially diverting sales from authentic brands. Addressing counterfeiting requires coordinated efforts among brand owners, regulatory authorities, and retail stakeholders to protect intellectual property and ensure product authenticity.

High Dependency on Imported Products

The Saudi Arabia handbag market exhibits substantial dependency on imported products, exposing stakeholders to currency fluctuations, international supply chain disruptions, and import-related cost pressures. Limited domestic manufacturing capacity constrains local value addition and employment generation within the handbag industry. Developing robust local production capabilities requires significant investments in manufacturing infrastructure, skilled workforce development, and quality assurance systems to meet consumer expectations.

Competitive Landscape:

The competitive landscape of the Saudi Arabia handbag market is fragmented in nature, with international luxury brands, global fast-fashion retailers, and local emerging designers. Competition among market players is on product differentiation, brand positioning, enhancement of retail experience, and digital engagement. Key competitive factors include design innovation, material quality, brand heritage, and distribution network strength. Flagship store openings, exclusive collections, and partners with influencers are used by leading players to establish further presence in the market. The competitive landscape keeps changing because new entrants come up with fresh perspectives, while old brands adjust their strategies according to the changing trend of consumer preference across diversified market segments.

Saudi Arabia Handbag Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Satchel, Bucket Bag, Clutch, Tote Bag, Others |

| Material Types Covered | Leather, Fabric, Rubber, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Departmental Stores, Specialty Stores, Discount Stores, Online Stores, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia handbag market size was valued at USD 411.4 Million in 2025.

The Saudi Arabia handbag market is expected to grow at a compound annual growth rate of 5.86% from 2026-2034 to reach USD 686.6 Million by 2034.

Tote bag dominated the market with a share of 32%, driven by its versatility, spacious design, and suitability for professional environments among working women.

Key factors driving the Saudi Arabia handbag market include rising female workforce participation, expansion of luxury retail infrastructure, government economic diversification initiatives, and growing consumer preference for premium fashion accessories.

Major challenges include market saturation from international and local brand influx, prevalence of counterfeit products, high import dependency, intense competition among market players, and evolving consumer preferences requiring continuous product innovation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)