Saudi Arabia Heat Recovery Systems Market Size, Share, Trends and Forecast by Type, Technology, Industry, and Region, 2026-2034

Saudi Arabia Heat Recovery Systems Market Overview:

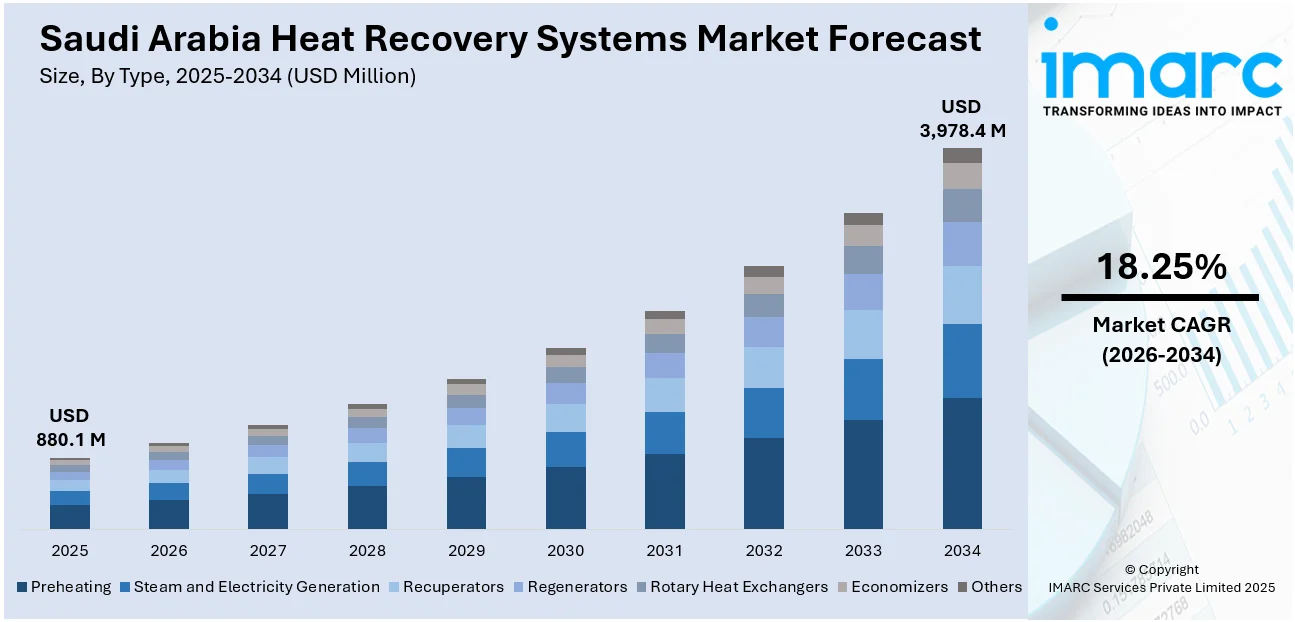

The Saudi Arabia heat recovery systems market size reached USD 880.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 3,978.4 Million by 2034, exhibiting a growth rate (CAGR) of 18.25% during 2026-2034. The market is driven by industrial modernization efforts aligning with Vision 2030 and energy efficiency mandates across large manufacturing hubs. Commercial buildings are rapidly integrating energy recovery technologies in response to national building codes and sustainability benchmarks, thereby fueling the market. The transformation of utilities and district cooling networks further embeds heat recovery into centralized energy frameworks, thus augmenting the Saudi Arabia heat recovery systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 880.1 Million |

| Market Forecast in 2034 | USD 3,978.4 Million |

| Market Growth Rate 2026-2034 | 18.25% |

Saudi Arabia Heat Recovery Systems Market Trends:

Industrial Energy Optimization Amid Vision 2030 Reforms

As part of the Kingdom’s Vision 2030 strategy, Saudi Arabia is intensifying efforts to improve industrial energy efficiency and reduce dependence on hydrocarbons. Energy-intensive sectors such as petrochemicals, cement, steel, and desalination are integrating heat recovery technologies to reduce thermal energy losses and improve operational cost structures. Industrial facilities are adopting waste heat recovery boilers (WHRBs), regenerative heat exchangers, and cogeneration units to capture and repurpose exhaust energy. The Saudi Energy Efficiency Center (SEEC) has mandated specific energy consumption benchmarks for industrial plants, compelling stakeholders to modernize thermal systems. On January 8, 2025, NEM Energy revealed it secured a contract to deliver two horizontal Heat Recovery Steam Generators (HRSGs) along with Exhaust Gas Bypass Systems (EGBSs) for a forthcoming combined cycle power facility in Saudi Arabia. The plant is projected to generate around 1,300 megawatts (~1.3 GW) and is scheduled to commence operations by late 2028, enhancing the Saudi Electricity Company's capacity to provide reliable and efficient power. This project highlights NEM Energy's advanced HRSG technology and its significant contribution to large-scale power plants across Saudi Arabia. These initiatives align with national targets to lower greenhouse gas emissions while enhancing industrial competitiveness. Engineering procurement and construction (EPC) companies are designing customized recovery modules for complex thermal systems across Jubail, Yanbu, and Ras Al Khair industrial zones. Additionally, energy service companies (ESCOs) are entering performance-based contracts to implement waste heat utilization frameworks across public-private facilities. In this context, manufacturers and utilities are increasingly prioritizing thermal optimization as part of their long-term asset strategy. These trends collectively represent a critical foundation for Saudi Arabia heat recovery systems market growth across industrial verticals.

To get more information on this market Request Sample

Government Mandates for Energy Efficiency in Buildings

The introduction of stricter building codes under the Saudi Building Code (SBC) has accelerated the deployment of energy-efficient technologies, including heat recovery ventilators (HRVs) and energy recovery ventilators (ERVs), across commercial and public infrastructure. Large-scale developments under the Public Investment Fund (PIF)—such as NEOM, Qiddiya, and King Salman Park—are designed to integrate advanced HVAC systems with thermal recovery to meet sustainability targets. Developers and MEP (Mechanical, Electrical, Plumbing) consultants are specifying heat recovery as standard in mixed-use buildings, airports, and educational facilities. Furthermore, the Saudi Energy Efficiency Program (SEEP) offers regulatory and financial support to stakeholders incorporating energy-saving technologies. On May 26, 2025, Johnson Controls Arabia has officially launched the largest YORK air-cooled chiller production line in Saudi Arabia at the YORK Manufacturing Complex located in King Abdullah Economic City, Jeddah. This development also marks the debut of the Kingdom’s first AHRI-certified performance testing laboratory for air-cooled chillers with capacities up to 600 tons, establishing Saudi Arabia as a key regional center for HVAC innovation and manufacturing excellence. The new production line will enhance local manufacturing of high-efficiency chillers, designed for optimal performance and energy savings, supporting Saudi Arabia’s Vision 2030 goals. These frameworks are particularly relevant in a climate where HVAC accounts for over 60% of electricity consumption in buildings. New installations increasingly require systems that recover thermal energy from exhaust air to reduce HVAC loads, while retrofitting initiatives in Riyadh and Jeddah target older buildings to comply with efficiency mandates. Market participants are witnessing stable demand for certified HVAC units with integrated energy recovery systems that comply with both domestic and international performance standards. These interventions are enhancing lifecycle efficiency across real estate assets in the Kingdom.

Saudi Arabia Heat Recovery Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, technology, and industry.

Type Insights:

- Preheating

- Steam and Electricity Generation

- Recuperators

- Regenerators

- Rotary Heat Exchangers

- Economizers

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes preheating, steam and electricity generation, recuperators, regenerators, rotary heat exchangers, economizers, and others.

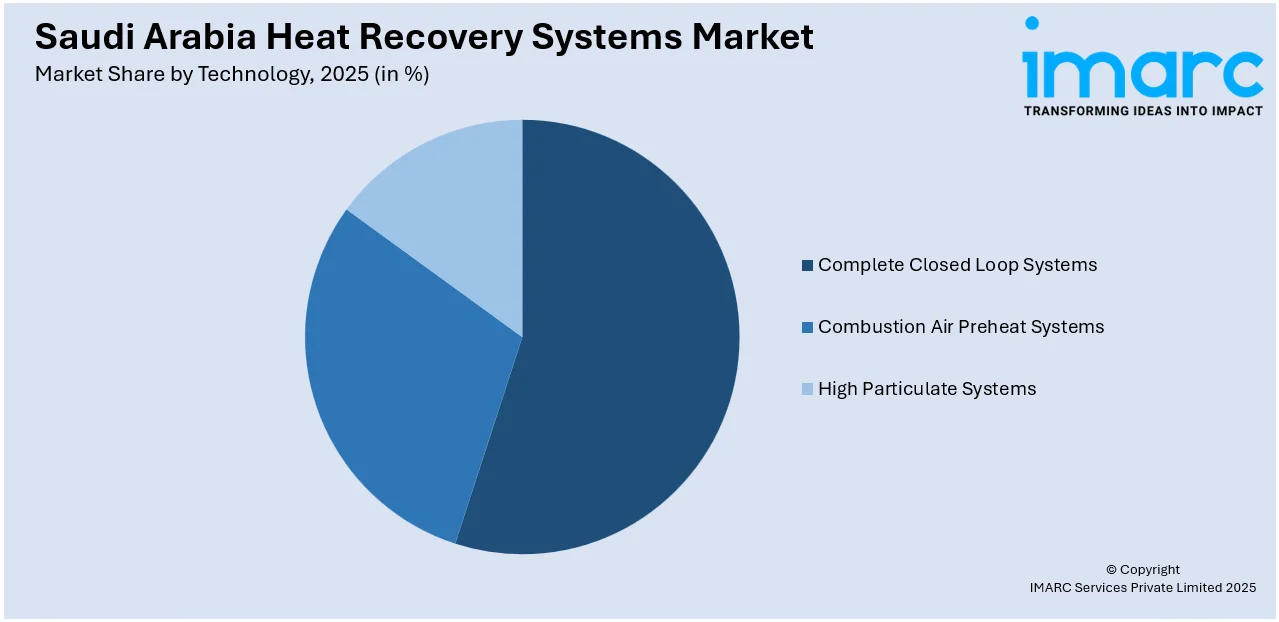

Technology Insights:

Access the comprehensive market breakdown Request Sample

- Complete Closed Loop Systems

- Combustion Air Preheat Systems

- High Particulate Systems

The report has provided a detailed breakup and analysis of the market based on the technology. This includes complete closed loop systems, combustion air preheat systems, and high particulate systems.

Industry Insights:

- Petroleum Refining

- Metal Production

- Cement

- Chemical

- Paper and Pulp

- Others

The report has provided a detailed breakup and analysis of the market based on the industry. This includes petroleum refining, metal production, cement, chemical, paper and pulp, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Heat Recovery Systems Market News:

- On November 29, 2023, Riyadh Cement Company granted a USD 34.8 million contract to Sinoma Energy Conservation for the installation of a Waste Heat Recovery (WHR) facility at its cement plant in Riyadh, with a power generation capacity of 12.6 MW. This project aims to harness waste heat from the cement production process, converting it into electricity, which will enhance the plant's energy efficiency. The installation of this WHR plant is a key step in improving sustainability at the plant, helping to reduce energy costs and minimize environmental impact by reusing waste heat.

Saudi Arabia Heat Recovery Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Preheating, Steam and Electricity Generation, Recuperators, Regenerators, Rotary Heat Exchangers, Economizers, Others |

| Technologies Covered | Complete Closed Loop Systems, Combustion Air Preheat Systems, High Particulate Systems |

| Industries Covered | Petroleum Refining, Metal Production, Cement, Chemical, Paper and Pulp, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia heat recovery systems market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia heat recovery systems market on the basis of type?

- What is the breakup of the Saudi Arabia heat recovery systems market on the basis of technology?

- What is the breakup of the Saudi Arabia heat recovery systems market on the basis of industry?

- What is the breakup of the Saudi Arabia heat recovery systems market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia heat recovery systems market?

- What are the key driving factors and challenges in the Saudi Arabia heat recovery systems market?

- What is the structure of the Saudi Arabia heat recovery systems market and who are the key players?

- What is the degree of competition in the Saudi Arabia heat recovery systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia heat recovery systems market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia heat recovery systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia heat recovery systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)