Saudi Arabia High-Pressure Pumps Market Size, Share, Trends and Forecast by Type, Pressure, End User Industry, and Region, 2026-2034

Saudi Arabia High-Pressure Pumps Market Summary:

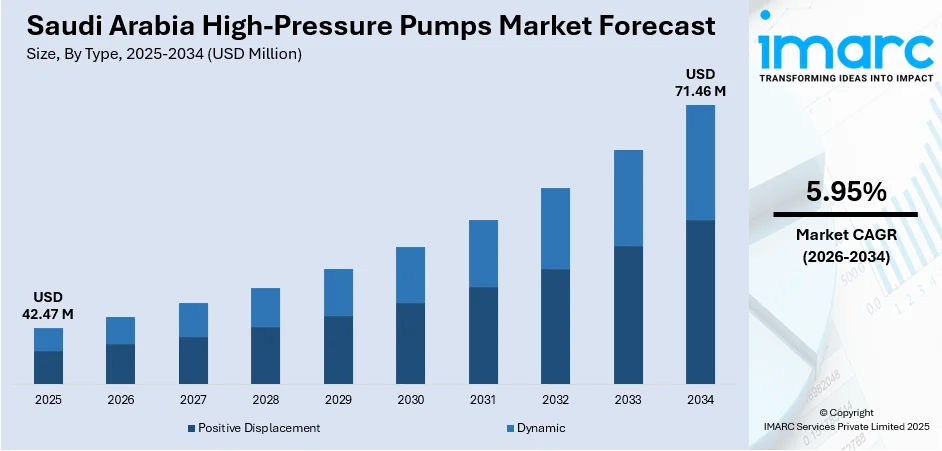

The Saudi Arabia high-pressure pumps market size was valued at USD 42.47 Million in 2025 and is projected to reach USD 71.46 Million by 2034, growing at a compound annual growth rate of 5.95% from 2026-2034.

The Saudi Arabia high-pressure pumps market is experiencing robust growth, driven by the Kingdom's massive infrastructure investments under Vision 2030 and the National Water Strategy. Rising demand from strategic sectors including oil and gas exploration, seawater desalination, power generation, and petrochemical manufacturing is propelling market expansion. Government-backed programs focused on water sustainability, industrial diversification, and energy efficiency are reinforcing the adoption of advanced high-pressure pumping technologies across critical applications, strengthening the Saudi Arabia high-pressure pumps market share.

Key Takeaways and Insights:

- By Type: Dynamic dominate the market with approximately 62% revenue share in 2025, driven by their high efficiency in handling large fluid volumes, widespread adoption in desalination plants utilizing reverse osmosis technology, and suitability for continuous-flow applications across oil refineries and power generation facilities.

- By Pressure: The 100 bar to 500 bar segment leads the market with a share of 48% in 2025, owing to its optimal pressure range for seawater reverse osmosis desalination operations, industrial water treatment applications, and enhanced oil recovery processes requiring sustained high-pressure performance.

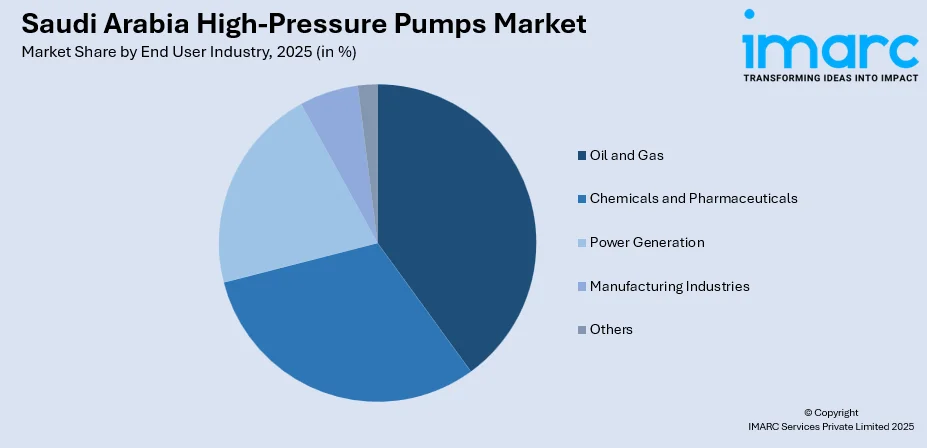

- By End User Industry: Oil and gas represent the largest segment with a market share of 38% in 2025, supported by Saudi Arabia's position as one of the world's leading hydrocarbon producers, extensive refining operations, and ongoing investments in enhanced recovery techniques and pipeline pressurization systems.

- Key Players: The Saudi Arabia high-pressure pumps market exhibits a moderately fragmented competitive structure, with established global pump manufacturers competing alongside regional suppliers. Market participants are focusing on energy-efficient technologies, localization strategies aligned with Vision 2030, and aftermarket service expansion to strengthen their positioning.

To get more information on this market Request Sample

The strategic focus on water security and industrial modernization is catalyzing unprecedented demand for high-pressure pumping solutions in the region. For example, Saudi Water Authority (previously Saline Water Conversion Corporation, SWCC) recently oversaw a major expansion of desalination infrastructure, ramping up desalinated water supply capacity and launching multiple new Independent Water Plants (IWPs) under a revamped public‑private partnership (PPP) framework. With desalinated water production capacity targeted to reach over twelve million cubic meters daily, coupled with extensive investments in water transmission networks and wastewater treatment infrastructure, the market presents significant opportunities for technology providers. The integration of smart monitoring systems, AI-powered predictive maintenance capabilities, and energy-optimized designs is reshaping operational paradigms across the sector. Meanwhile, the oil and gas industry's emphasis on maximizing reservoir productivity and the chemicals sector's expansion into downstream specialty products are generating sustained demand for advanced high-pressure equipment capable of operating under extreme conditions.

Saudi Arabia High-Pressure Pumps Market Trends:

Integration of Smart Technologies and IoT-Enabled Systems

The adoption of intelligent monitoring and predictive maintenance solutions is transforming high-pressure pump operations across Saudi Arabia. For example, Aqualia, a major water‑services provider operating across Saudi clusters, has implemented AI‑powered leak detection systems and smart‑metering/IoT solutions, cutting water losses by around 15 % and enabling real‑time monitoring of pipelines, reservoirs, and treatment plants. AI-powered sensors and IoT connectivity enable real-time performance tracking, facilitating proactive identification of potential equipment failures before they occur. This technological shift supports operational efficiency goals while reducing unplanned downtime in critical desalination and oil refining applications, aligning with the Kingdom's broader industrial digitalization objectives.

Transition Toward Energy-Efficient Pumping Solutions

Growing emphasis on sustainability and operational cost optimization is driving demand for energy-efficient high-pressure pumps. For instance, at GE Power Conversion’s new Yanbu 3 Power and Desalination Plant in Saudi Arabia, medium‑voltage variable frequency drives (VFDs) have been deployed to power boiler‑feed and high‑pressure pumps,

delivering higher energy savings, operational flexibility and lower maintenance costs compared with conventional pump systems. Variable frequency drives and intelligent control systems are gaining traction as industries seek to reduce energy consumption in water-intensive processes. The Kingdom's commitment to achieving significant energy demand reductions in desalination operations is accelerating the deployment of advanced pump technologies that minimize power requirements while maintaining optimal pressure levels.

Expansion of Reverse Osmosis Desalination Capacity

The strategic shift from thermal desalination methods to energy-efficient reverse osmosis technology is reshaping pump requirements across Saudi Arabia's water infrastructure. New membrane-based desalination facilities require high-pressure pumps capable of sustaining pressure levels for seawater applications. According to a recent 2025 update, the Kingdom is accelerating the transition, several major desalination plants including Saline Water Conversion Corporation (SWCC)‑managed facilities have been converted from thermal to RO systems, reflecting a core part of its sustainability agenda under Vision 2030. This technological transition is generating substantial demand for specialized pumping equipment optimized for continuous high-pressure operations in coastal and inland installations.

Market Outlook 2026-2034:

The Saudi Arabia high-pressure pumps market is positioned for sustained expansion throughout the forecast period, underpinned by transformative investments in water infrastructure, industrial diversification initiatives, and energy sector modernization. The ambitious plans to develop additional desalination capacity, upgrade existing thermal facilities to reverse osmosis technology, and expand water transmission networks will drive consistent equipment procurement. Concurrently, ongoing mega-projects in petrochemicals, power generation, and manufacturing sectors will sustain demand across industrial applications. The market generated a revenue of USD 42.47 Million in 2025 and is projected to reach a revenue of USD 71.46 Million by 2034, growing at a compound annual growth rate of 5.95% from 2026-2034.

Saudi Arabia High-Pressure Pumps Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Dynamic | 62% |

| Pressure | 100 Bar to 500 Bar | 48% |

| End User Industry | Oil and Gas | 38% |

Type Insights:

- Positive Displacement

- Dynamic

The dynamic dominates with a market share of 62% of the total Saudi Arabia high-pressure pumps market in 2025.

Dynamic high-pressure pumps, particularly centrifugal variants, are extensively deployed across Saudi Arabia's water infrastructure and industrial processing facilities. Their superior efficiency in managing continuous high-volume fluid transfers makes them indispensable for seawater desalination plants operating reverse osmosis membranes, where consistent pressure maintenance is critical for optimal water production rates and membrane longevity.

The segment's dominance is further reinforced by widespread adoption in oil refineries, petrochemical complexes, and power generation stations across the Kingdom. These pumps offer favorable lifecycle economics through lower maintenance requirements and energy-efficient operation, aligning with industrial operators' focus on reducing operational expenditures while meeting demanding performance specifications in extreme temperature and pressure environments.

Pressure Insights:

- 30 Bar to 100 Bar

- 100 Bar to 500 Bar

- Above 500 Bar

The 100 bar to 500 bar leads with a share of 48% of the total Saudi Arabia high-pressure pumps market in 2025.

This pressure range represents the operational sweet spot for Saudi Arabia's critical infrastructure applications, particularly seawater reverse osmosis desalination where sustained pressures between fifty-four and eighty bar are essential for effective membrane-based water purification. In fact, typical seawater RO (SWRO) plants worldwide, including those used in the Arab region that operate in the 55–80 bar (≈ 5.5–8.0 MPa) feed‑pressure range to overcome seawater osmotic pressure and achieve efficient salt rejection. The segment's prominence reflects the Kingdom's strategic investments in expanding desalination capacity and upgrading existing facilities to modern reverse osmosis technology.

Industrial water treatment systems, enhanced oil recovery operations, and chemical processing applications further drive demand within this pressure category. Equipment designed for these pressure specifications must balance performance capabilities with energy efficiency considerations, as operators increasingly prioritize solutions that minimize power consumption while maintaining reliable pressure output across extended operational cycles.

End User Industry Insights:

Access the Comprehensive Market Breakdown Request Sample

- Oil and Gas

- Chemicals and Pharmaceuticals

- Power Generation

- Manufacturing Industries

- Others

The oil and gas dominates with a market share of 38% of the total Saudi Arabia high-pressure pumps market in 2025.

Saudi Arabia's position as one of the world's leading hydrocarbon producers ensures sustained demand for high-pressure pumping equipment across upstream, midstream, and downstream operations. These pumps are essential for enhanced oil recovery processes, pipeline pressurization systems, and refinery operations where maintaining precise pressure levels is critical for operational efficiency and safety compliance. According to the national water‑infrastructure programme, the Saudi Water Partnership Company (SWPC) recently secured financing for the Jubail–Buraidah Independent Water Transmission Pipeline Project, underscoring the scale of public‑sector investment in water delivery and pumping infrastructure.

Major refining complexes and petrochemical facilities throughout the Eastern Province rely extensively on high-pressure pumps for fluid handling across multiple process stages. Ongoing investments in capacity expansion, facility modernization, and integration of cleaner production technologies are generating consistent procurement requirements for advanced pumping solutions capable of operating under demanding temperature and pressure conditions characteristic of hydrocarbon processing environments.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Northern and Central Region serves as Saudi Arabia's administrative and economic nucleus, with Riyadh driving significant demand for high-pressure pumps across municipal water systems, industrial facilities, and construction projects. The region's expanding urban infrastructure requires advanced pumping solutions for water transmission networks connecting desalination plants to metropolitan distribution systems. Sudair Industrial and Business City is emerging as a specialized hub attracting pharmaceutical, food processing, and light manufacturing investments that generate steady demand for reliable high-pressure equipment supporting various production processes.

The Western Region encompasses critical industrial infrastructure along the Red Sea coast, including Yanbu Industrial City and major desalination installations serving the Makkah and Madinah metropolitan areas. Jeddah hosts the Kingdom's primary food manufacturing cluster and aerospace industrial zone, creating diverse applications for high-pressure pumping technologies. The region's desalination facilities, including plants at Shuaibah and Rabigh, require continuous procurement of specialized high-pressure pumps for reverse osmosis operations, while the expanding manufacturing sector generates demand for fluid handling equipment across chemical processing and food production facilities.

The Eastern Region dominates Saudi Arabia's high-pressure pumps market, accounting for the largest share of industrial demand driven by concentrated oil and gas operations, petrochemical complexes, and desalination infrastructure. Jubail Industrial City houses the world's largest petrochemical manufacturing hub, generating substantial requirements for high-pressure pumping solutions across refining, chemical processing, and water treatment applications. The region's major desalination facilities at Ras Al-Khair and Jubail serve water transmission networks extending to Riyadh, necessitating continuous investments in high-performance pumping equipment capable of operating under demanding conditions.

The Southern Region is positioned for accelerated growth through the development of Jazan City for Basic and Transformative Industries, a strategic economic zone attracting investments in heavy industries, petrochemicals, and energy-intensive manufacturing. The region's industrial expansion, supported by port infrastructure facilitating exports to African markets, is generating emerging demand for high-pressure pumps across diverse applications. Jazan's oil refinery operations and planned downstream processing facilities are expected to drive procurement of specialized pumping equipment, while agricultural and food processing investments create additional market opportunities for fluid handling technologies.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia High-Pressure Pumps Market Growing?

Massive Investments in Water Infrastructure and Desalination Expansion

The ambitious water infrastructure development program is a primary catalyst for high-pressure pump demand. Saudi Arabia has committed substantial investments to water distribution, transmission systems, and desalination capacity expansion to meet growing population and industrial requirements. The strategic focus on converting thermal desalination plants to energy-efficient reverse osmosis technology necessitates specialized high-pressure pumping equipment capable of maintaining consistent pressure levels across membrane systems. Notably, under Vision 2030 driven by government‑backed initiatives, such as the country has rolled out a $533 million water and sewerage project portfolio as part of efforts to expand service coverage, build new transmission pipelines and pumping stations, and improve overall water‑service networks. Government-backed initiatives under Vision 2030 are accelerating the construction of new desalination facilities along both Red Sea and Arabian Gulf coastlines, while existing infrastructure undergoes modernization to enhance water production capacity and operational efficiency.

Robust Oil and Gas Sector Driving Industrial Equipment Demand

Saudi Arabia's position as one of the world's largest hydrocarbon producers ensures sustained demand for high-pressure pumps across exploration, production, refining, and distribution operations. The extensive network of refineries and petrochemical complexes requires reliable pumping equipment for critical processes including crude oil transfer, enhanced recovery operations, and chemical processing applications. According to sources, in 2025, Saudi Aramco and Sinopec have signed a framework agreement to expand the Yasref petrochemical complex, underscoring continued investment in downstream integration and refining‑to‑chemicals capacity. Ongoing investments in downstream integration, facility expansions, and adoption of advanced recovery techniques are generating consistent procurement requirements for high-performance pumping solutions designed to operate under extreme pressure and temperature conditions characteristic of petroleum industry applications.

Industrial Diversification and Manufacturing Sector Expansion

The Kingdom's strategic vision for economic diversification is driving substantial investments in manufacturing infrastructure across specialized industrial clusters. Development of petrochemical, automotive, aerospace, food processing, and pharmaceutical manufacturing facilities is creating diverse applications for high-pressure pumping technologies. Industrial cities including Jubail, Yanbu, and the emerging Jazan economic zone are attracting domestic and foreign investments that generate equipment procurement across multiple sectors. The expansion of power generation capacity to support industrial growth further reinforces demand for high-pressure pumps utilized in thermal and combined-cycle power plants throughout the Kingdom.

Market Restraints:

What Challenges the Saudi Arabia High-Pressure Pumps Market is Facing?

High Initial Capital Investment Requirements

The substantial upfront costs associated with procuring advanced high-pressure pumping systems can constrain adoption among smaller industrial operators and service providers. Premium pricing for energy-efficient models incorporating smart monitoring capabilities and specialized materials for corrosive environments presents budgetary challenges that may delay equipment upgrades or limit technology adoption across certain market segments.

Technical Expertise and Maintenance Challenges

Operating sophisticated high-pressure pumping equipment requires specialized technical knowledge and maintenance capabilities that remain limited in some regional markets. The complexity of maintaining optimal performance across extreme operating conditions, combined with requirements for genuine spare parts and qualified service technicians, can impact equipment availability and lifecycle costs for end users operating in remote or less industrialized areas.

Energy Consumption and Operational Cost Considerations

High-pressure pumping operations, particularly in desalination and heavy industrial applications, are inherently energy-intensive processes. Rising energy costs and sustainability mandates are placing pressure on operators to balance performance requirements with energy efficiency objectives, potentially limiting the deployment of certain conventional pump technologies while accelerating the transition toward more efficient alternatives that may carry higher acquisition costs.

Competitive Landscape:

The Saudi Arabia high-pressure pumps market features a moderately fragmented competitive environment characterized by the presence of established global manufacturers alongside regional suppliers and distributors. International equipment providers leverage technological expertise, extensive product portfolios, and global service networks to serve major infrastructure projects and industrial facilities. Market participants are increasingly focusing on localization strategies aligned with Vision 2030 requirements, establishing regional manufacturing facilities, service centers, and technical partnerships to enhance market positioning. Competition centers on technological differentiation through energy-efficient designs, smart monitoring integration, and extended service offerings. Aftermarket services, including maintenance contracts, spare parts supply, and technical support, represent significant revenue streams as operators prioritize equipment reliability and operational continuity across critical applications.

Recent Developments:

- In Nov 2025, ITT completed Phase 2 of its US$25 million expansion of the Industrial Process (IP) facility in Dammam, Saudi Arabia, doubling capacity to ~30,000 m². The upgraded plant, with enhanced testing capabilities, aims to handle complex pump packages, support large regional projects, and increase annual orders from US$160 million (2024) to over US$300 million by 2030.

- In Mar 2025, Larsen & Toubro secured an EPC contract for a large-scale seawater reverse osmosis (SWRO) desalination plant in Saudi Arabia. The project involves high-pressure pumps for membrane-based purification, highlighting rising demand for advanced water-treatment technologies. The plant underscores investment in high-performance pumping systems capable of handling high salinity and pressure loads.

Saudi Arabia High-Pressure Pumps Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Positive Displacement, Dynamic |

| Pressures Covered | 30 Bar to 100 Bar, 100 Bar to 500 Bar, Above 500 bar |

| End-User Industries Covered | Oil and Gas, Chemicals and Pharmaceuticals, Power Generation, Manufacturing Industries, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia high-pressure pumps market size was valued at USD 42.47 Million in 2025.

The Saudi Arabia high-pressure pumps market is expected to grow at a compound annual growth rate of 5.95% from 2026-2034 to reach USD 71.46 Million by 2034.

Dynamic pumps dominated the market with approximately 62% share, driven by their high efficiency in handling large fluid volumes across desalination plants, oil refineries, and power generation facilities.

Key factors driving the Saudi Arabia high-pressure pumps market include massive investments in water infrastructure and desalination expansion under Vision 2030, robust oil and gas sector demand, industrial diversification initiatives, adoption of energy-efficient technologies, and growth in power generation and manufacturing sectors.

Major challenges include high initial capital investment requirements for advanced pumping systems, technical expertise and maintenance capability constraints in certain regions, energy consumption concerns in intensive applications, and supply chain considerations for specialized components and spare parts.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)