Saudi Arabia Home Healthcare Monitoring Devices Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Saudi Arabia Home Healthcare Monitoring Devices Market Summary:

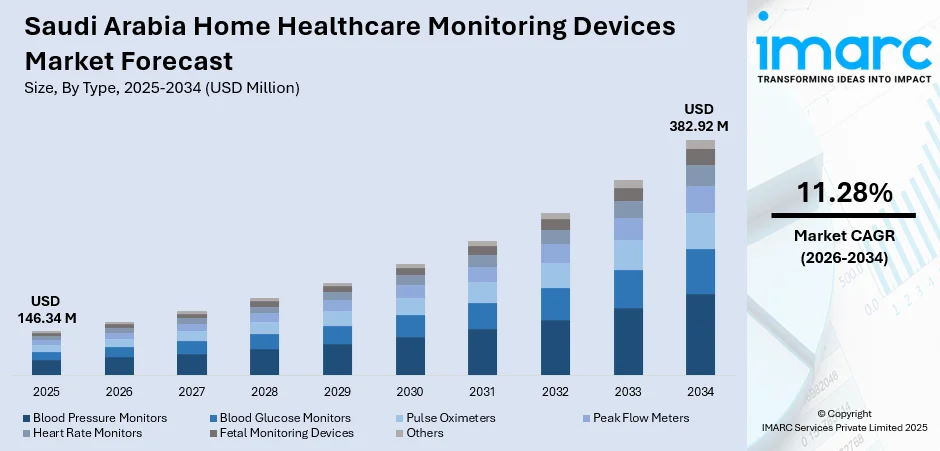

The Saudi Arabia home healthcare monitoring devices market size was valued at USD 146.34 Million in 2025 and is projected to reach USD 382.92 Million by 2034, growing at a compound annual growth rate of 11.28% from 2026-2034.

The Saudi Arabia home healthcare monitoring devices market growth is driven by the growing prevalence of chronic diseases, particularly diabetes and hypertension, alongside demographic shifts toward an aging population. The Kingdom's Vision 2030 healthcare transformation initiatives are accelerating digital health adoption, with significant government investment in telemedicine infrastructure and remote patient monitoring technologies. The convergence of technological innovation, expanding healthcare infrastructure, and evolving consumer preferences for home-based care solutions is fundamentally reshaping the Saudi Arabia home healthcare monitoring devices market share.

Key Takeaways and Insights:

- By Type: Blood pressure monitors dominate the market with a share of 32% in 2025, driven by the high prevalence of hypertension among Saudi adults and growing awareness of cardiovascular disease prevention through regular home monitoring.

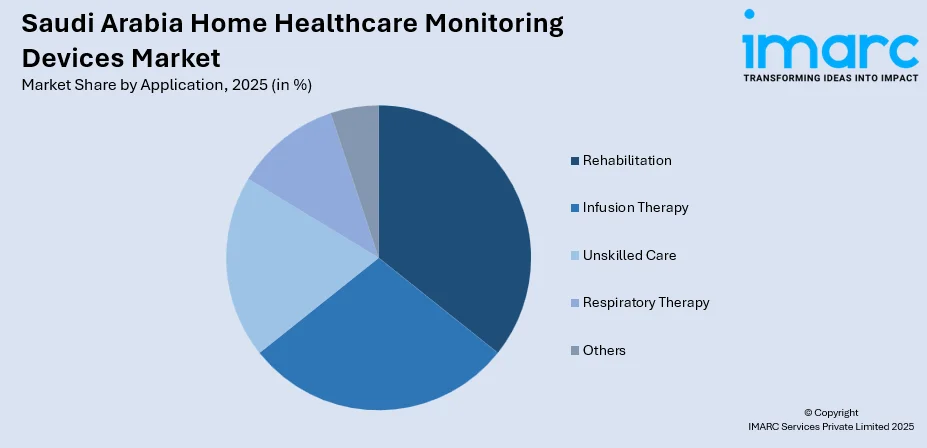

- By Application: Rehabilitation represents the largest segment with a market share of 26% in 2025, owing to the expanding elderly population requiring physiotherapy services and the growing preference for home-based recovery programs.

- Key Players: The Saudi Arabia home healthcare monitoring devices market exhibits moderate competitive intensity, with multinational medical technology corporations competing alongside regional distributors across product segments and price tiers.

To get more information on this market Request Sample

The growing demand for home-based care in Saudi Arabia is shaped by shifting demographics, rising chronic illness, and the government’s strong focus on expanding digital health services. An ageing population and rising cases of diabetes, cardiovascular conditions, and respiratory disorders are driving the need for continuous monitoring outside hospitals. This direction became more visible in 2025 with the launch of the world’s first digital diabetes command center, which allows real-time tracking of patients’ vital signs across the Kingdom and supports preventive and patient-centered care. National reforms under Vision 2030 reinforce the adoption of connected medical technology to reduce pressure on clinical facilities and strengthen follow-up care. Higher household incomes, wider insurance coverage, and greater awareness of preventive health encourage the uptake of home monitoring tools, while the growth of telemedicine and reliable digital infrastructure makes remote oversight more practical for long-term care management.

Saudi Arabia Home Healthcare Monitoring Devices Market Trends:

Rising Burden of Chronic Illness

The use of home healthcare monitoring devices is increasing as more residents manage long-term conditions that require steady oversight outside clinical settings. The growing cases of hypertension, diabetes, cardiovascular concerns, and respiratory disorders are driving the need for dependable home-based monitoring. According to the data from the 2024 National Health Survey and the Woman and Child Health Survey, 18.95% of adults have at least one chronic illness, comprising (diabetes 9.1%, high cholesterol 3.6%, heart and vascular diseases 1.5%, and cancer 0.6%). Families rely on accurate home devices to reduce clinic visits, while physicians promote structured monitoring to support timely intervention and maintain stable care routines.

Growing Geriatric Population

The steady increase in the elderly population is catalyzing the demand for home monitoring devices, as older adults often need frequent checks for blood pressure, glucose levels, oxygen saturation, and general wellbeing within the comfort of their own homes. The Elderly Survey 2025 reported that around 1.7 million people in Saudi Arabia were aged 60 years and above, representing 4.8% of the total population. People are prioritizing safety and preventive oversight for ageing family members, making home-based equipment a key element of long-term care planning. User-friendly devices that simplify routine tracking have encouraged broader adoption, supporting consistent, home-centered management of age-related conditions.

Greater Awareness and Preventive Health Behavior

The growing access to health information and targeted awareness efforts is encouraging individuals to adopt preventive routines and monitor their wellbeing more consistently. In 2025, Saudi Arabia’s Food and Drug Authority launched a digital campaign promoting the safe use of home medical devices, highlighting the need to buy from licensed suppliers, verify certifications, seek professional guidance, follow maintenance steps, and report incidents. With clearer guidance and stronger public messaging, people are paying closer attention to their vital signs and aiming to maintain stable readings. This proactive approach is increasing household use of reliable monitoring tools and supported steadier long-term health management at home.

Market Outlook 2026-2034:

The Saudi Arabia home healthcare monitoring devices market shows strong long-term growth prospects, supported by structural demographic changes and sustained government investment in healthcare modernization. Rising demand for convenient, home-based monitoring solutions aligns with national priorities to enhance preventive care and reduce the burden on clinical facilities. The market generated a revenue of USD 146.34 Million in 2025 and is projected to reach a revenue of USD 382.92 Million by 2034, growing at a compound annual growth rate of 11.28% from 2026-2034.

Saudi Arabia Home Healthcare Monitoring Devices Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Blood Pressure Monitors | 32% |

| Application | Rehabilitation | 26% |

Type Insights:

- Blood Pressure Monitors

- Blood Glucose Monitors

- Pulse Oximeters

- Peak Flow Meters

- Heart Rate Monitors

- Fetal Monitoring Devices

- Others

Blood pressure monitors dominate with a market share of 32% of the total Saudi Arabia home healthcare monitoring devices market in 2025.

Blood pressure monitors hold the largest market share, as hypertension is widespread and requires frequent, reliable measurement at home. According to the data from the 2024 National Health Survey and the Woman and Child Health Survey, 18.95% of adults have at least one chronic illness, with hypertension accounting for 7.9%. Users prefer devices that offer quick readings, simple operation, and consistent tracking, making them a routine part of daily health management for many households.

Their leading position is further supported by physicians encouraging regular monitoring to maintain treatment stability. The availability of validated, affordable, and easy-to-use models is increasing adoption across age groups, reinforcing their status as the most commonly used home health monitoring tools in the Kingdom.

Application Insights:

Access the Comprehensive Market Breakdown Request Sample

- Rehabilitation

- Infusion Therapy

- Unskilled Care

- Respiratory Therapy

- Others

Rehabilitation leads with a share of 26% of the total Saudi Arabia home healthcare monitoring devices market in 2025.

Rehabilitation leads the market because patients recovering from surgeries, injuries, and chronic conditions increasingly rely on home-based tools to support mobility, strength, and long-term functional improvement. These devices help maintain progress between clinical sessions and reduce dependence on frequent facility visits.

Demand is reinforced by rising musculoskeletal disorders and the growing emphasis on restoring independence in daily activities. The demand for rehabilitation and assistive devices, reinforced by rising musculoskeletal disorders and the need for independence, is substantiated by recent studies, such as the one published in Cureus on April 21, 2025, which found that 54.3% of medical students at King Saud University, Riyadh, reported musculoskeletal pain (MSP).

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region holds a strong share due to dense urban populations, advanced medical infrastructure, and higher adoption of digital health tools, supporting broader use of home monitoring devices across households and chronic care patients.

The Western Region benefits from large metropolitan centers and a high concentration of healthcare facilities, encouraging greater awareness and use of home-based monitoring solutions among residents seeking convenient and continuous care.

The Eastern Region shows steady growth driven by rising lifestyle-related illnesses, strong insurance uptake, and expanding access to modern healthcare services that promote routine home monitoring for long-term condition management.

The Southern Region is gradually increasing its adoption of home monitoring devices as awareness improves and access to healthcare services expands, supporting wider use of basic and advanced tools for ongoing health tracking.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Home Healthcare Monitoring Devices Market Growing?

Shift Toward Home-Based Care and Remote Patient Monitoring

Individual preferences are shifting toward home-based healthcare options that provide convenience, privacy, and reliable round-the-clock monitoring, especially in major cities like Riyadh and Jeddah, where many patients prefer maintaining continuity of care outside hospitals. The growing access to intuitive monitoring devices and stronger digital connectivity is making it easier for people to manage chronic conditions at home. This shift is further supported by advancements in national telecom networks. In 2025, Zain KSA began deploying 5G Standalone technology on the 600 MHz band in Riyadh and Jeddah, strengthening nationwide coverage and improving the performance of connected home healthcare solutions.

Higher Healthcare Spending

This growing readiness to allocate spending toward wellbeing and home healthcare devices is supported by robust economic performance, as the Mid-Year Economic and Fiscal Performance Report FY 2024 indicated that private consumption expenditures grew by 2.4% in real terms during the first half of FY2024 compared to the same period a year earlier. Individuals are more aware about the consequences of unmanaged chronic conditions and seek tools that allow consistent tracking. Broader health insurance coverage and wellness programs are reinforcing regular monitoring habits, while familiarity with digital health tools is driving adoption. Wider availability across clinics, pharmacies, and retail outlets are further contributing to the demand.

Expansion of Remote Patient Monitoring Ecosystems

The growing integration between healthcare providers and technology firms is strengthening the remote patient monitoring ecosystem, encouraging wider adoption of connected home-based devices. Hospitals and clinicians are increasingly using digital platforms to oversee patients with chronic or post-acute conditions, easing facility workloads and improving follow-up efficiency. The shift toward technology-enabled care aligns with national goals to modernize healthcare delivery, creating a supportive environment for solutions that enhance continuity of care, reduce hospital dependency, and promote structured at-home monitoring. In line with this trend, in 2024, HoopoeView Ltd became the first Saudi Arabian company to join the Clinitouch Partner Program, bringing remote monitoring technology to the Middle East. This partnership supported Saudi Arabia’s Vision 2030 and Healthcare Sector Transformation by enabling remote patient monitoring, reducing hospital strain.

Market Restraints:

What Challenges the Saudi Arabia Home Healthcare Monitoring Devices Market is Facing?

High Cost of Advanced Monitoring Devices Limiting Adoption

Cost barriers represent a fundamental challenge constraining broader adoption of advanced home healthcare monitoring devices, particularly among price-sensitive user segments. The high development costs of innovative devices incorporating AI-based technologies, expensive raw materials, and substantial R&D investments pose challenges for market penetration across lower and middle-income households.

Data Accuracy and Reliability Concerns

Healthcare providers often express concern about the accuracy of readings generated in unsupervised environments. Variations in device quality, maintenance, and user practice can influence results, affecting clinical decision-making and long-term tracking. Providers may hesitate to rely on inconsistent measurements when monitoring chronic conditions or adjusting treatment plans. These concerns also make some patients uncertain about the reliability of their own devices, reducing motivation to use them routinely.

Limited Integration with Clinical Systems

Many home monitoring devices operate independently from hospital and clinic information systems, creating fragmented data flows. When readings cannot be easily transferred, stored, or reviewed in organized clinical records, healthcare providers face difficulty maintaining complete oversight of a patient’s status. This disconnect weakens continuity of care and limits the practical usefulness of home-based tools. The lack of seamless integration across platforms continues to slow market development and highlights the need for interoperable solutions that support coordinated follow-up.

Competitive Landscape:

The Saudi Arabia home healthcare monitoring devices market exhibits moderate competitive intensity characterized by the presence of multinational medical technology corporations alongside regional distributors competing across product segments and price tiers. Market dynamics reflect strategic positioning ranging from premium, innovation-driven offerings emphasizing advanced connectivity and AI integration to value-oriented products targeting cost-conscious consumers. The competitive landscape is increasingly shaped by digital health integration capabilities, partnerships with local healthcare providers, and alignment with Vision 2030 healthcare transformation objectives. Key players are strengthening market positions through investments in research and development (R&D), collaboration with regional healthcare institutions, and establishment of direct operations to enhance user experience and service delivery.

Recent Developments:

- In May 2025, Aktiia, now rebranded as "Hilo," raised $42 million in Series B funding to expand its cuffless blood pressure monitoring technology. The company, which has received approval in Saudi Arabia, aims to improve blood pressure management with AI-powered optical sensors.

- In February 2025, at LEAP 2025 in Riyadh, XPANCEO unveiled smart contact lenses that not only enhance vision but also feature health-monitoring capabilities. The lenses can track stress levels, blood sugar, body temperature, and detect dry eyes, with future versions set to display augmented reality content. These advancements represent a leap in both vision enhancement and personal health tracking.

Saudi Arabia Home Healthcare Monitoring Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Blood Pressure Monitors, Blood Glucose Monitors, Pulse Oximeters, Peak Flow Meters, Heart Rate Monitors, Fetal Monitoring Devices, Others |

| Applications Covered | Rehabilitation, Infusion Therapy, Unskilled Care, Respiratory Therapy, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia home healthcare monitoring devices market size was valued at USD 146.34 Million in 2025.

The Saudi Arabia home healthcare monitoring devices market is expected to grow at a compound annual growth rate of 11.28% from 2026-2034 to reach USD 382.92 Million by 2034.

Blood pressure monitors dominate the market with 32% revenue share in 2025, driven by the high prevalence of hypertension among Saudi adults and growing awareness about cardiovascular disease prevention.

Key factors driving market growth include the growing ageing population, reaching 1.7 million people aged 60+ in 2025 (4.8% of residents). This geriatric population is driving the demand for home monitoring devices, as families seek safer, preventive oversight. Easy-to-use tools for blood pressure, glucose, and oxygen checks support consistent home-based care.

Major challenges include high device costs, doubts about measurement reliability, and weak links between home tools and clinical systems. Price sensitivity, inconsistent readings, and fragmented data transfer reduce user confidence and limit the practical value of home monitoring across households.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)