Saudi Arabia Home Security Systems Market Size, Share, Trends and Forecast by Product, Residence Type, and Region, 2026-2034

Saudi Arabia Home Security Systems Market Overview:

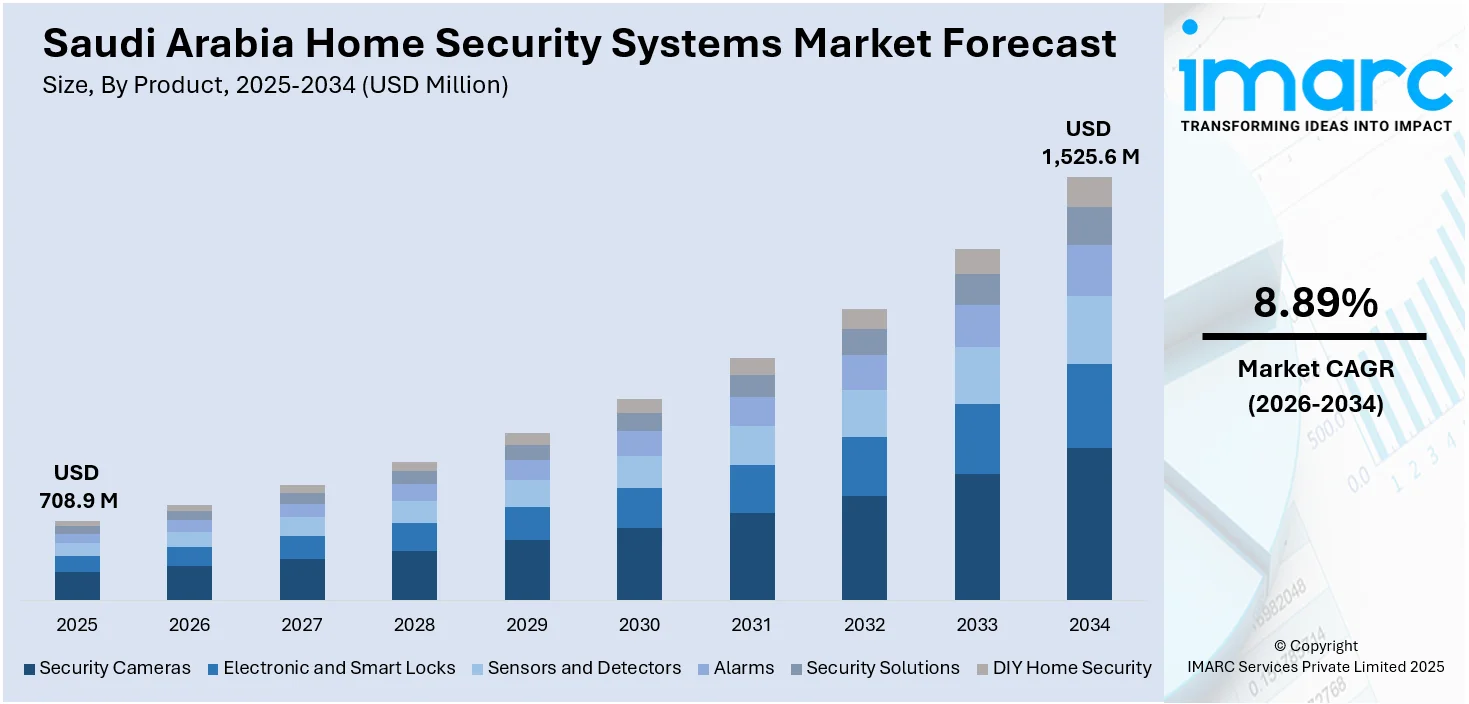

The Saudi Arabia home security systems market size reached USD 708.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,525.6 Million by 2034, exhibiting a growth rate (CAGR) of 8.89% during 2026-2034. The market is driven by large-scale urban development and residential expansion, demanding advanced home protection solutions. The widespread adoption of smart home ecosystems is pushing integration-ready, app-controlled security systems across Saudi households. In addition to this, regulatory support, insurance incentives, and growing public awareness of personal safety are some of the key factors augmenting the Saudi Arabia home security systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 708.9 Million |

| Market Forecast in 2034 | USD 1,525.6 Million |

| Market Growth Rate 2026-2034 | 8.89% |

Saudi Arabia Home Security Systems Market Trends:

Rising Population Density and Urbanization

The rapid pace of urbanization in Saudi Arabia is propelling the market expansion. With more people moving into metropolitan areas, such as Riyadh, Jeddah, and Dammam, residential neighborhoods are expanding at a significant rate. As population density is increasing, concerns about theft, break-ins, and personal safety are rising, encouraging families to invest in advanced surveillance and alarm systems. As per the Worldometer, in 2024, Saudi Arabia had a population density of 16 individuals per Km² (42 per mi²). Apartment living in high-rise towers and gated communities is also catalyzing the demand for electronic access control systems and video door entry solutions. Furthermore, property developers are integrating smart security features in new housing projects to increase the value and attractiveness of residential units.

To get more information on this market Request Sample

Increasing Adoption of Smart Home Technology

Saudi Arabia’s growing interest in smart homes is driving the demand for home security systems. As per the IMARC Group, the Saudi Arabia smart homes market size reached USD 1.2 Billion in 2024. People are utilizing connected devices that provide convenience, efficiency, and safety through automation and real-time monitoring. Smart locks, motion detectors, and app-controlled cameras are no longer considered luxuries but essential parts of modern living for tech-savvy households. The integration of security solutions with voice assistants and mobile apps enhances user experience, allowing residents to monitor their homes remotely from anywhere. This seamless connection to daily life builds confidence and creates peace of mind, encouraging widespread adoption. Moreover, young consumers with higher disposable incomes are particularly inclined towards technology-driven solutions, catalyzing the demand for innovative home security systems.

Growth of E-commerce Channels for Security Devices

The increasing use of e-commerce platforms in Saudi Arabia has played an important role in expanding access to home security products. As per the CEIC, Saudi Arabia e-commerce and shopping statistics were recorded at 1,667.267 USD on 30 April 2025. Online marketplaces allow households to easily browse and purchase a wide variety of devices, including alarms, smart locks, and video doorbells, often at competitive prices. Consumers are attracted to the convenience of home delivery, detailed product comparisons, and customer reviews, making online channels a major driver of adoption. Furthermore, promotions, discounts, and bundled security packages available through e-commerce encourage impulse purchases and wider distribution. With the growing trust in online shopping, security device manufacturers are focusing on direct-to-consumer (D2C) strategies. This digital accessibility reduces barriers to entry, enabling even smaller households or renters to invest in basic home security devices.

Key Growth Drivers of Saudi Arabia Home Security Systems Market:

Rising Awareness About Safety and Crime Prevention

Rising awareness about the potential risks of thefts, trespassing, and property damage is catalyzing the demand for home security solutions in Saudi Arabia. Households are becoming more proactive in safeguarding their families, valuable possessions, and property, leading to a shift towards installing surveillance systems, burglar alarms, and advanced access controls. Awareness campaigns by both government and private security companies highlight the importance of preventive measures, making security systems more mainstream. Homeowners are also influenced by insurance policies that encourage or require the installation of basic security measures. As more people are prioritizing safety, this heightened awareness is directly strengthening the demand for modern, reliable home security systems in Saudi Arabia.

Increasing Expatriate Population and Rental Housing Demand

The growing expatriate population in Saudi Arabia, especially in urban centers, is catalyzing the demand for home security systems in rental properties. Expatriates, who often prioritize the safety of their families while living abroad, tend to adopt portable and easy-to-install solutions, such as smart door locks. Property owners and landlords are also motivated to enhance security infrastructure to attract long-term tenants, as safety has become a deciding factor in rental housing choices. Additionally, residential compounds designed for expatriates often incorporate central monitoring and perimeter security features, reflecting the demand for high standards of safety. This trend has also encouraged mid-range and affordable housing projects to integrate basic security systems to remain competitive in the market. With the continuous inflow of international workers, the emphasis on reliable and accessible security systems continues to strengthen in Saudi Arabia.

Technological Advancements and Artificial Intelligence (AI)-Driven Security

Advancements in security technology, particularly the use of AI, cloud storage, and Internet of Things (IoT) integration, are driving the market growth in Saudi Arabia. Smart surveillance cameras come equipped with motion detection, facial recognition, and AI-based anomaly alerts that minimize false alarms and provide real-time actionable insights. Cloud-enabled storage solutions also allow homeowners to monitor and access video footage securely from anywhere. Additionally, integration with the IoT devices ensures seamless control of multiple home features through centralized platforms, enhancing convenience and user experience. These innovations are making systems more effective, user-friendly, and adaptable to different housing needs, encouraging higher adoption rates. With technology evolving rapidly, households in Saudi Arabia are upgrading to advanced solutions that offer enhanced reliability, efficiency, and long-term value.

Saudi Arabia Home Security Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product and residence type.

Product Insights:

- Security Cameras

- Electronic and Smart Locks

- Sensors and Detectors

- Alarms

- Security Solutions

- DIY Home Security

The report has provided a detailed breakup and analysis of the market based on the product. This includes security cameras, electronic and smart locks, sensors and detectors, alarms, security solutions, and DIY home security.

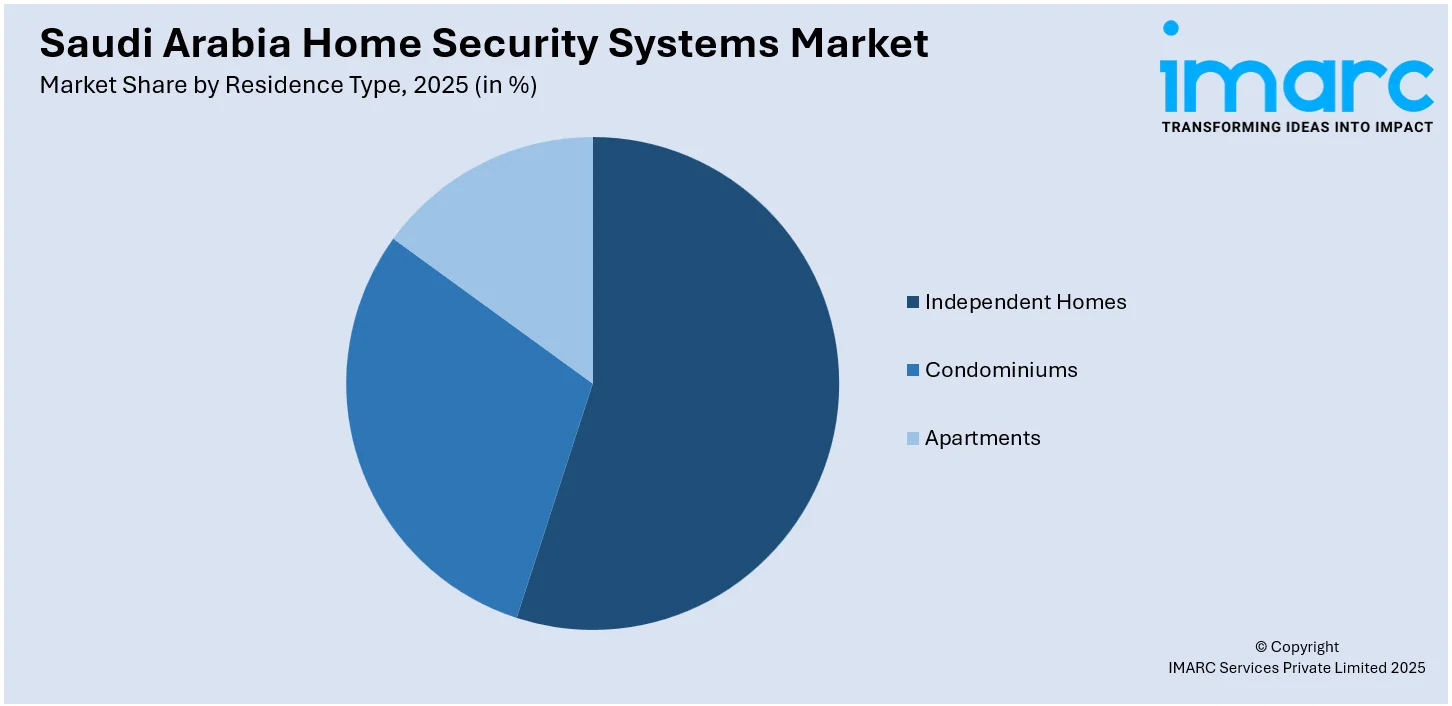

Residence Type Insights:

Access the comprehensive market breakdown Request Sample

- Independent Homes

- Condominiums

- Apartments

The report has provided a detailed breakup and analysis of the market based on the residence type. This includes independent homes, condominiums, and apartments.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Home Security Systems Market News:

- October 2024: Elock security was set to take part in Intersec Saudi Arabia at the Riyadh International Convention Centre. The event presented a great chance for the firm to display its advanced security solutions and creative products, such as smart locks for homes.

Saudi Arabia Home Security Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Security Cameras, Electronic and Smart locks, Sensors and Detectors, Alarms, Security Solutions, DIY Home Security |

| Residence Types Covered | Independent Homes, Condominiums, Apartments |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia home security systems market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia home security systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia home security systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The home security systems market in Saudi Arabia was valued at USD 708.9 Million in 2025.

The Saudi Arabia home security systems market is projected to exhibit a CAGR of 8.89% during 2026-2034, reaching a value of USD 1,525.6 Million by 2034.

Higher disposable incomes and increasing usage of smart home technologies are driving the demand for modern surveillance, alarm, and access control systems. Government initiatives promoting smart cities and safer communities are further accelerating the integration of advanced security solutions. In addition, the popularity of connected devices and mobile-based monitoring systems is appealing to tech-savvy households seeking convenience and control.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)