Saudi Arabia HR Tech Market Size, Share, Trends and Forecast by Application, Type, End Use Industry, Company Size, and Region, 2026-2034

Saudi Arabia HR Tech Market Summary:

The Saudi Arabia HR tech market size was valued at USD 359.49 Million in 2025 and is projected to reach USD 710.43 Million by 2034, growing at a compound annual growth rate of 7.84% from 2026-2034.

The market is experiencing robust expansion driven by the Kingdom's Vision 2030 initiative, which emphasizes digital transformation and workforce modernization across public and private sectors. Organizations are accelerating adoption of cloud-based platforms, AI-powered recruitment systems, and mobile-first solutions to enhance operational efficiency, ensure Saudization compliance, and improve employee engagement. The government's substantial investments in digital infrastructure, combined with mandatory workforce nationalization tracking requirements, are compelling businesses to deploy sophisticated technologies that support strategic talent management, thereby expanding the Saudi Arabia HR tech market share.

Key Takeaways and Insights:

-

By Application: Talent management dominates the market with a share of 26% in 2025, driven by increasing demand for AI-powered recruitment and performance tracking solutions.

-

By Type: Inhouse leads the market with a share of 62% in 2025, as organizations prioritize data security and local labor regulation compliance.

-

By End Use Industry: Public sector represents the largest segment with a market share of 27% in 2025, propelled by the implementation of favorable government digital transformation initiatives.

-

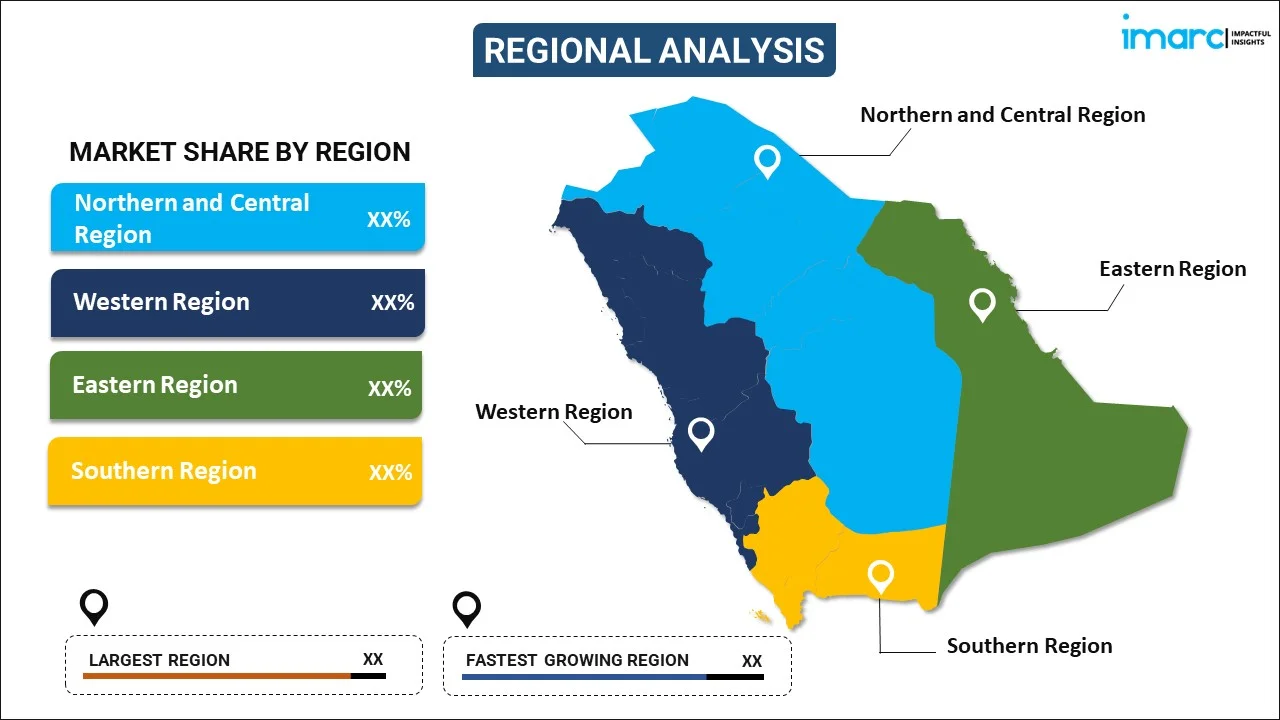

By Region: Northern and Central region represents the largest segment with a market share of 35% in 2025, owing to the presence of key market players and heightened number of companies planning to digitalize their operations.

-

Key Players: Key players are deploying cloud-based platforms with artificial intelligence (AI)-powered recruitment automation, implementing predictive workforce analytics, enhancing regulatory compliance systems for national requirements, pursuing strategic partnerships and acquisitions, investing in mobile-first employee engagement tools, integrating chatbots for employee queries, and strengthening data security features to address privacy concerns.

The market landscape is characterized by rapid technological evolution, with organizations investing heavily in intelligent automation to streamline administrative processes and enable data-driven decision-making. The convergence of artificial intelligence (AI), machine learning (ML), and cloud computing is fundamentally reshaping human resource management practices across the Kingdom. In March 2024, Saudi Arabia witnessed significant startup investment momentum with USD 198 million raised in funding, including a notable USD 130 million round for e-commerce platform Salla, demonstrating strong investor confidence in the Kingdom's digital economy. The investment was conducted in collaboration with Sanabil Investment, a company entirely owned by Saudi Arabia’s Public Investment Fund. STV, a local venture capital investor and a current shareholder of Salla, was also involved in the deal. This investment climate is fostering innovation in HR tech solutions that address unique regional requirements while incorporating global best practices for talent acquisition, performance management, and workforce analytics.

Saudi Arabia HR Tech Market Trends:

AI-Powered Recruitment and Intelligent Talent Acquisition

AI is revolutionizing recruitment processes across Saudi organizations, with sophisticated screening algorithms and predictive analytics transforming candidate evaluation methods. By 2024, a major portion of Saudi companies implemented applicant tracking systems to optimize hiring workflows, while 54% adopted AI-powered recruitment tools for enhanced candidate matching. Leading organizations are achieving measurable efficiency gains through these technologies. Saudi Aramco reduced hiring time and improved candidate quality through advanced recruitment technologies that leverage ML for resume analysis and automated interview scheduling, enabling human resources teams to focus on strategic talent decisions rather than administrative tasks.

Cloud-Based HR Platform Migration and Remote Work Enablement

The transition to cloud-based human resources systems is accelerating as organizations recognize the scalability and flexibility benefits for distributed workforce management. A major percentage of Saudi businesses migrated to cloud platforms by 2024, driven by government initiatives and enterprise digital transformation requirements. The cloud services market in Saudi Arabia is projected to reach USD 13.1 Billion by 2033, as per IMARC Group, supporting comprehensive HR functionality delivery. The Saudi government’s SME support programs like Monsha’at and Fintech Saudi, inspire cloud adoption by offering funding and incentives. Adoption is particularly strong among organizations managing hybrid work arrangements, as Saudi workers operated remotely at least half the time by, necessitating sophisticated platforms for attendance tracking, performance monitoring, virtual onboarding, and regulatory compliance across geographically dispersed teams.

Mobile-First Solutions and Self-Service Employee Engagement

The Kingdom's predominantly young demographic is driving demand for intuitive, mobile-accessible HR applications that enable employees to manage their workplace interactions independently. Approximately 71% of Saudi Arabia's population was under 35 according to the 2024 Saudi Family Statistics Report. This population comprises a tech-savvy workforce expecting seamless digital experiences for scheduling, benefits administration, and career development access. Organizations are responding by deploying mobile-first platforms that reduce administrative overhead while improving employee satisfaction. In 2024, Saudi Arabia has officially introduced 'Jadarat,' the Unified National Employment Platform, which is set to reshape the job market dynamics in the Kingdom. Minister of Human Resources and Social Development Ahmed Al Rajhi announced that the platform now provides over 70,000 job openings in multiple sectors.

How Vision 2030 is Transforming the Saudi Arabia HR Tech Market:

Vision 2030 is fundamentally reshaping Saudi Arabia's HR Tech market through comprehensive digital transformation initiatives. The strategic framework drives economic diversification beyond oil, mandating workforce modernization and Saudization compliance that accelerates HR technology adoption. Government programs are establishing digital infrastructure for employment management. Labor law reforms enacted in 2024-2025 strengthen worker protections while requiring automated compliance tracking. The Kingdom's $100 billion AI initiative is catalyzing cloud-based HR solutions, predictive workforce analytics, and automated talent management systems. With unemployment reduction targets enhancing, organizations increasingly leverage HR technology for skills development, talent retention, and data-driven workforce planning aligned with national transformation objectives.

Market Outlook 2026-2034:

The Saudi Arabia HR tech market is positioned for sustained growth trajectory as digital transformation initiatives accelerate across government and private sector organizations. The market generated a revenue of USD 359.49 Million in 2025 and is projected to reach a revenue of USD 710.43 Million by 2034, growing at a compound annual growth rate of 7.84% from 2026-2034. The Kingdom's AI initiative is catalyzing innovation in employee engagement applications and predictive talent management solutions throughout the forecast period.

Saudi Arabia HR Tech Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Application |

Talent Management |

26% |

|

Type |

Inhouse |

62% |

|

End Use Industry |

Public Sector |

27% |

|

Region |

Northern and Central Region |

35% |

Application Insights:

- Talent Management

- Payroll Management

- Performance Management

- Workforce Management

- Recruitment

- Others

Talent management dominates with a market share of 26% of the total Saudi Arabia HR tech market in 2025.

Talent management has emerged as the dominant application segment, propelled by the Kingdom's Vision 2030 initiative emphasizing human capital development and economic diversification. Organizations are deploying sophisticated platforms that integrate recruitment, onboarding, performance tracking, learning management, and succession planning functionalities. According to recent surveys, a major number of Saudi companies plan to increase their investments in HR technology over the next three years, with HR professionals identifying technology adoption as crucial for achieving organizational objectives. The demand intensified as the Saudi ICT Strategy aims to create over 25,000 technology sector jobs, significantly boosting emerging technologies adoption, requiring comprehensive talent management systems to attract, develop, and retain qualified professionals in competitive labor markets.

Companies are leveraging cloud-based talent management solutions to facilitate real-time performance feedback, personalized learning pathways, and data-driven succession planning. These systems enable organizations to align individual employee development with broader business strategy while ensuring compliance with Saudization requirements. The integration of artificial intelligence and machine learning enhances predictive capabilities, allowing HR departments to identify high-potential employees, forecast skill gaps, and implement proactive retention strategies that reduce turnover costs while building sustainable competitive advantage through superior human capital management practices.

Type Insights:

- Inhouse

- Outsourced

Inhouse leads with a share of 62% of the total Saudi Arabia HR tech market in 2025.

Inhouse HR technology implementations are preferred by Saudi organizations seeking to maintain direct oversight of human resources operations while ensuring strict adherence to evolving data protection regulations and local labor laws. This approach enables companies to customize systems according to specific operational requirements, integrate seamlessly with existing enterprise resource planning infrastructure, and maintain complete control over sensitive employee information. The preference is particularly strong among large enterprises and government entities that require tailored functionality aligned with complex organizational structures and stringent security protocols mandated by the Saudi Data and Artificial Intelligence Authority, which enforces penalties for data breaches and non-compliance incidents.

Organizations deploying inhouse solutions benefit from enhanced flexibility in system configuration, faster implementation of policy changes, and reduced long-term operational costs compared to recurring subscription models. This model supports organizations in meeting Nitaqat program requirements by enabling precise tracking of Saudi national employment ratios, facilitating compliance reporting, and ensuring alignment with workforce nationalization objectives. The approach also provides greater capability for integrating Arabic language interfaces, accommodating cultural considerations in human resources practices, and addressing data residency concerns that are increasingly important in the Kingdom's regulatory environment.

End Use Industry Insights:

- TTH (Travel, Transportation, Hospitality)

- Public Sector

- Health Care

- Information Technology

- BFSI (Banking, Financial services, and Insurance)

- Others

Public sector exhibits a clear dominance with a 27% share of the total Saudi Arabia HR tech market in 2025.

The public sector is driving significant HR technology adoption as government entities implement comprehensive digital transformation programs aligned with Vision 2030 objectives. The Digital Transformation Measurement for government operations increased from 69.39% in 2021 to 87.14% in 2024, reflecting accelerated technology integration across ministries, regulatory bodies, and public service organizations. Government agencies are deploying advanced HR systems to modernize workforce management, enhance service delivery efficiency, and support the Kingdom's goal of achieving top-five ranking in global digital government performance. These initiatives encompass cloud-based platforms, AI-powered analytics, and mobile-first applications that streamline employee administration while enabling data-driven workforce planning decisions.

Public sector organizations face unique requirements including complex organizational hierarchies, extensive compliance obligations, and the need to support both national development objectives and operational efficiency targets. HR technology implementations enable government entities to manage large-scale talent acquisition campaigns, track progress toward Saudization targets, coordinate training and development programs, and ensure transparent performance management across diverse departments. The sector's leadership in technology adoption is creating demonstration effects that influence private sector practices while establishing standards for digital government services that benefit citizens and employees through improved accessibility, transparency, and responsiveness throughout the public workforce ecosystem.

Company Size Insights:

- Less Than 1k Employees

- 1k -5k Employees

- Greater Than 5k Employees

Small organizations with fewer than 1,000 employees typically adopt cloud-based HR solutions offering cost-effective scalability without extensive IT infrastructure investments. These companies prioritize user-friendly interfaces and essential functionalities including payroll processing, attendance tracking, and basic compliance management to streamline operations efficiently.

Mid-sized organizations employing 1,000 to 5,000 individuals implement integrated HR platforms combining workforce management, performance tracking, and talent acquisition modules. These enterprises require sophisticated analytics capabilities and customization options to support growing operational complexity while maintaining cost-effectiveness through cloud deployment models.

Large enterprises exceeding 5,000 employees lead market adoption, deploying comprehensive AI-powered HR ecosystems with advanced workforce analytics, predictive modeling, and end-to-end automation. These organizations possess substantial technology budgets enabling sophisticated implementations that optimize talent management, ensure regulatory compliance, and deliver strategic competitive advantages through data-driven insights.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region exhibits a clear dominance with a 35% share of the total Saudi Arabia HR tech market in 2025.

The Northern and Central Region, centered on Riyadh, serves as the epicenter of HR technology adoption due to its concentration of government institutions, multinational corporations, financial services firms, and large enterprises. Riyadh functions as the administrative and economic capital, hosting the headquarters of major Saudi companies, international businesses operating regional offices, and government ministries driving digital transformation initiatives. This geographic concentration creates density of technology buyers, skilled workforce availability, and ecosystem infrastructure that accelerates HR platform deployment and innovation adoption. The region's dominance reflects its strategic importance in implementing Vision 2030 programs and leading the Kingdom's economic diversification efforts.

Organizations based in the Northern and Central Region typically possess larger technology budgets, more sophisticated IT infrastructure, and greater access to specialized implementation partners compared to other areas. The presence of technology providers, consulting firms, and talent pools with digital expertise facilitates complex HR system deployments while enabling organizations to leverage best practices and share implementation experiences. Government initiatives promoting smart city development, digital government services, and innovation clusters further reinforce the region's leadership position in HR technology adoption, establishing Riyadh as the primary market for advanced solutions serving large-scale enterprise requirements.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia HR Tech Market Growing?

Vision 2030 and Comprehensive Digital Transformation Initiatives

The Kingdom's ambitious Vision 2030 strategic framework is fundamentally reshaping the business environment and accelerating HR technology adoption across all economic sectors. Saudi Arabia's digital economy reached approximately SAR 495 billion in 2024, contributing 15% to national GDP and demonstrating the substantial economic impact of digitalization efforts. The government's commitment to modernization is evidenced by the Kingdom's USD 100 billion AI initiative launched in 2025, which includes significant investments in HR tech infrastructure and adaptation of advanced language models for workforce analytics and employee engagement applications, creating comprehensive ecosystem support for technological innovation throughout the forecast period.

Saudization Requirements and Nitaqat Program Compliance

Workforce nationalization mandates are compelling organizations to deploy sophisticated HR technologies for tracking, reporting, and managing Saudi national employment ratios required under the Nitaqat classification system. Over 1.8 million Saudis were employed in the private sector under Saudization programs in 2023, with regulatory frameworks requiring continuous compliance monitoring and strategic workforce planning. A large number of firms reported investing in HR tech tools specifically to meet these regulatory requirements, particularly in construction, retail, and other sectors with substantial compliance obligations. The complexity of maintaining appropriate Saudi-to-expatriate ratios while managing business operations necessitates automated systems capable of real-time workforce composition analysis and proactive compliance management.

Youth Demographics and Tech-Savvy Workforce Expectations

Saudi Arabia's predominantly young population is creating unprecedented demand for modern, intuitive HR technologies that align with digital-native expectations and preferences. Approximately 71% of the population was under 35 according to the 2024 Saudi Family Statistics Report 2024, representing a demographic cohort with fundamentally different technology engagement patterns compared to previous generations. These young professionals expect mobile-first experiences, self-service functionality, instant access to information, and seamless digital interactions for all workplace activities including job applications, schedule management, benefits administration, and career development planning, making traditional HR approaches inadequate for attracting and retaining talented individuals.

Market Restraints:

What Challenges the Saudi Arabia HR Tech Market is Facing?

High Implementation and Maintenance Costs

The substantial financial investments required for deploying comprehensive HR technology platforms present significant barriers, particularly for small and medium-sized enterprises operating with constrained budgets. Implementation expenses encompass software licensing, hardware infrastructure, system customization, data migration, employee training, and ongoing maintenance costs that can accumulate to millions of riyals for large-scale deployments. Despite SMEs representing 99.5% of total enterprises, only 45% had implemented any form of HR tech by 2023 according to Ministry of Commerce data, reflecting cost constraints that limit technology adoption among smaller organizations without dedicated IT budgets or specialized technical resources.

Integration Complexity with Legacy Systems

Many Saudi organizations continue operating legacy HR systems that create substantial challenges when implementing modern cloud-based platforms and AI-powered solutions. According to 2024 industry reports, over 40% of companies struggle with integrating contemporary HR technologies into existing IT infrastructure, resulting in deployment delays, increased costs, and temporary operational disruptions during transition periods. The compatibility issues require extensive customization, middleware development, and phased implementation approaches that extend project timelines while consuming significant technical resources and management attention.

Data Security and Privacy Compliance Concerns

Evolving data protection regulations and stringent security requirements create ongoing challenges for HR technology providers and implementing organizations. In 2024, over 60% of companies expressed concerns about data breaches and privacy issues that could hinder cloud-based HR solution adoption. The Saudi Data and Artificial Intelligence Authority mandates strict compliance for companies processing sensitive employee information, with penalties reaching up to USD 7 million for serious breaches depending on severity and impact. Organizations must balance technology adoption benefits against security risks, regulatory compliance obligations, and employee privacy protection requirements that demand continuous monitoring, system updates, and security infrastructure investments throughout the technology lifecycle.

Competitive Landscape:

The Saudi Arabia HR tech market features intense competition among global technology leaders and regional solution providers delivering comprehensive platforms, specialized applications, and managed services. Established multinational corporations leverage extensive product portfolios, implementation experience, and global resources to serve large enterprise clients requiring sophisticated functionality, seamless integration capabilities, and proven reliability. These international vendors compete alongside emerging regional players that offer localized solutions optimized for Arabic language requirements, Saudi regulatory frameworks, and cultural considerations specific to the Kingdom's business environment. Market participants are pursuing diverse strategies including strategic partnerships, technology acquisitions, product innovation investments, and service expansion initiatives to strengthen competitive positions and capture growing demand across government, financial services, healthcare, manufacturing, and other sectors undergoing digital workforce management transformation.

Recent Developments:

-

In December 2025, Pakistani fintech firm ABHI revealed on Monday a collaboration with Saudi Arabia’s HR technology company KABi to offer employees in the Kingdom Earned Wage Access (EWA), enabling workers to access a portion of their earned salary ahead of payday. The agreement signifies the most recent growth by the Karachi-based startup in the Gulf region due to the rising demand for digital payments, payroll solutions, and worker-focused financial products as part of Saudi Vision 2030, the Kingdom’s strategic initiative to diversify its economy and update labor markets.

-

In October 2025, In a notable move to aid the digital evolution of Saudi Arabia’s workforce, SBR, a rapidly expanding Saudi startup focusing on AI-driven HR technologies, has entered into a Memorandum of Understanding with Jisr, a prominent platform in the Kingdom for human resources and financial management. This strategic alliance seeks to transform hiring methodologies by creating innovative solutions that allow organizations to utilize precise data and identify exceptional talent more effectively. The partnership aims to decrease recruitment duration and expenses, simplify processes, and achieve more effective results.

Saudi Arabia HR Tech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Applications Covered | Talent Management, Payroll Management, Performance Management, Workforce Management, Recruitment, Others |

| Types Covered | Inhouse, Outsourced |

| End Use Industries Covered | TTH (Travel, Transportation, Hospitality), Public Sector, Health Care, Information Technology, BFSI (Banking, Financial services, and Insurance), Others |

| Company Sizes Covered | Less Than 1k Employees, 1k -5k Employees, Greater Than 5k Employees |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia HR tech market size was valued at USD 359.49 Million in 2025.

The Saudi Arabia HR tech market is expected to grow at a compound annual growth rate of 7.84% from 2026-2034 to reach USD 710.43 Million by 2034.

Talent management leads the market with 26% share, driven by organizational focus on strategic workforce planning, AI-powered recruitment systems, and comprehensive employee development platforms that align individual capabilities with business objectives while ensuring compliance with workforce nationalization requirements.

Primary growth drivers include the Kingdom's Vision 2030 digital transformation initiatives contributing to national GDP through technology adoption, mandatory Saudization compliance requirements with millions of Saudis employed in private sector, and youth demographics with 71% of population under 35 demanding mobile-first HR solutions, creating sustained demand for sophisticated platforms supporting modern workforce management practices aligned with strategic economic diversification objectives.

Major challenges include high implementation costs limiting SME adoption, with a limited number of firms implementing HR tech, legacy system integration difficulties affecting over several companies, and data security concerns with potential fines increasing for compliance breaches under stringent Saudi regulations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)