Saudi Arabia Industrial Gas Cylinders Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Saudi Arabia Industrial Gas Cylinders Market Overview:

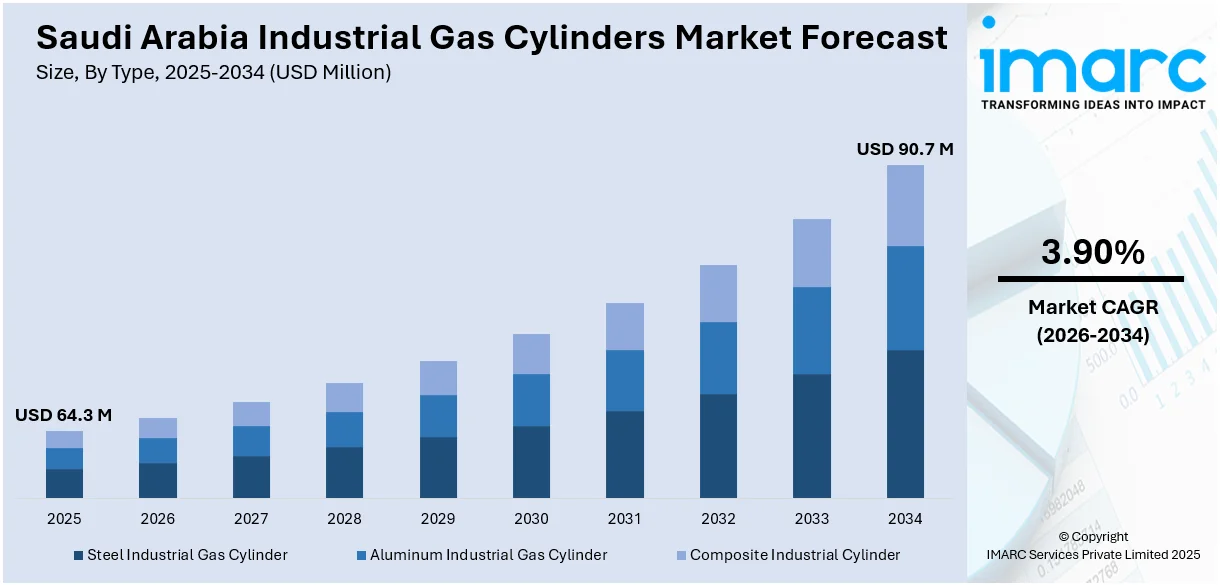

The Saudi Arabia industrial gas cylinders market size reached USD 64.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 90.7 Million by 2034, exhibiting a growth rate (CAGR) of 3.90% during 2026-2034. The market is driven by robust demand from Saudi Arabia’s oil and gas sector, where industrial gases, including oxygen, nitrogen, and argon are essential for drilling, refining, and petrochemical operations. Government-led Vision 2030 investments in energy projects and gas-based power expansion further propel the need for high-pressure cylinders, while the shift toward composite alternatives enhances safety and efficiency. The rising industrial diversification is further augmenting the Saudi Arabia industrial gas cylinders market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 64.3 Million |

| Market Forecast in 2034 | USD 90.7 Million |

| Market Growth Rate 2026-2034 | 3.90% |

Saudi Arabia Industrial Gas Cylinders Market Trends:

Increasing Demand for Industrial Gas Cylinders in Oil and Gas Sector

The market is experiencing significant growth due to rising demand from the oil and gas sector. In 2023, Saudi Arabia's oil production decreased by 9% to 9.5 million barrels per day (b/d), while crude oil exports declined by 5% to 7.0 million b/d. Saudi Arabia has 17% of the world's proven oil reserves. Additionally, it plans to expand its natural gas production by 2025 by opening the Jafurah field, targeting 2 billion cubic feet per day (Bcf/d) of natural gas by 2030. Due to some continuous upgrades to infrastructure and domestic gas processing, Saudi Arabia is making significant developments in its energy sector, which is significantly influencing the industrial gas cylinder market. Saudi Arabia is the largest oil producer in the world and, as such, uses oxygen, nitrogen, and argon as industrial gases for drilling, refining, and petrochemical products. The Government's ongoing vision of Vision 2030 will encourage investments in energy projects, thus resulting in high-pressure gas cylinders to transport and store added-value gases. Moreover, the greater application of power generation based on gas, along with the application of enhanced oil recovery (EOR) technology, is anticipated to increase industrial gas consumption. Industrial gas cylinder demand, linked to industrial gas-related cylinders, is expected to expand with further industrial diversification and infrastructure growth. With domestic consumption supported by, as well as export opportunities within the Middle East, industrial gas-related cylinder demand is likely to expand.

To get more information on this market Request Sample

Rising Adoption of Automation and Smart Cylinder Technologies

Automation and smart technologies will play a pivotal role in supporting Saudi Arabia industrial gas cylinders market growth. The increased adoption of IoT-enabled cylinders offers real-time monitoring and safety management in industries such as oil and gas, manufacturing, and healthcare. Using smart cylinders with sensors that track gas levels, pressure, and leakage can also provide operational efficiencies and minimize risks. Saudi Vision 2030 aligns Saudi Arabia's transformation towards Industry 4.0, with over USD 20 Billion committed to artificial intelligence by 2030. The Kingdom's National Industrial Strategy aims at modernizing 4,000 factories, focusing on automation, energy efficiency, and smart technologies, through initiatives such as "Future Factories" that improve production efficiency. Industry specialists point to the need for industrial gas cylinders to support various sectors. Companies are supplementing RFID and GPS tracking with enhanced cylinder logistics and inventory management. The transition towards "Industry 4.0" and smart production is under Vision 2030 and is accelerating ahead of schedule, as companies need to streamline their supply chains and reduce downtime. Digital solutions are also helping with predictive maintenance, which reduces costs and enhances cylinder life. With the Industry's emphasis on creating more automated and data-informed decision-making and operations, there is expected to be a growing need for smart gas cylinders, which will change the competitive landscape.

Saudi Arabia Industrial Gas Cylinders Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

- Steel Industrial Gas Cylinder

- Aluminum Industrial Gas Cylinder

- Composite Industrial Cylinder

The report has provided a detailed breakup and analysis of the market based on the type. This includes steel industrial gas cylinder, aluminum industrial gas cylinder, and composite industrial cylinder.

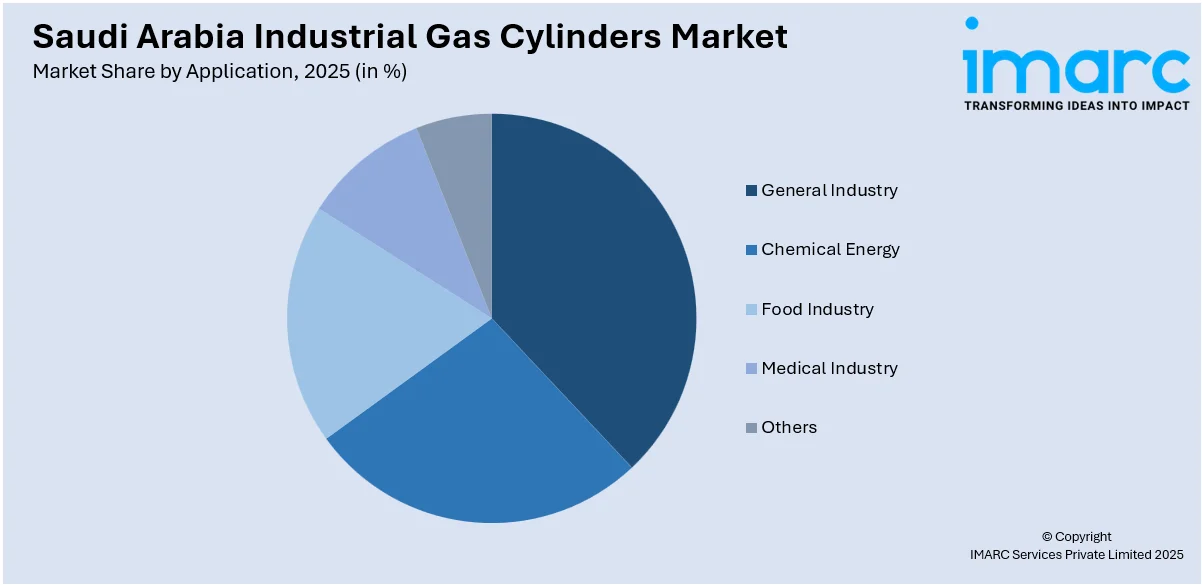

Application Insights:

Access the comprehensive market breakdown Request Sample

- General Industry

- Chemical Energy

- Food Industry

- Medical Industry

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes general industry, chemical energy, food industry, medical industry, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Industrial Gas Cylinders Market News:

- March 21, 2025: Aramco, in collaboration with Siemens Energy, kicked off Saudi Arabia's first DAC pilot project. This pilot project captures 12 tonnes of CO₂ per year and aims to test new capture materials in dry climates. The project is likely to increase demand for high-pressure composite gas cylinders, a vital technology for storing and transporting CO₂. If this scenario arises, we may see increased local manufacturing opportunities in Saudi Arabia's industrial gas cylinder sector, given the rise in carbon capture activity.

Saudi Arabia Industrial Gas Cylinders Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Steel Industrial Gas Cylinder, Aluminum Industrial Gas Cylinder, Composite Industrial Cylinder |

| Applications Covered | General Industry, Chemical Energy, Food Industry, Medical Industry, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia industrial gas cylinders market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia industrial gas cylinders market on the basis of type?

- What is the breakup of the Saudi Arabia industrial gas cylinders market on the basis of application?

- What is the breakup of the Saudi Arabia industrial gas cylinders market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia industrial gas cylinders market?

- What are the key driving factors and challenges in the Saudi Arabia industrial gas cylinders market?

- What is the structure of the Saudi Arabia industrial gas cylinders market and who are the key players?

- What is the degree of competition in the Saudi Arabia industrial gas cylinders market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia industrial gas cylinders market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia industrial gas cylinders market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia industrial gas cylinders industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)