Saudi Arabia Industrial Gas Market Size, Share, Trends and Forecast by Type, Application, Supply Mode, and Region, 2026-2034

Saudi Arabia Industrial Gas Market Overview:

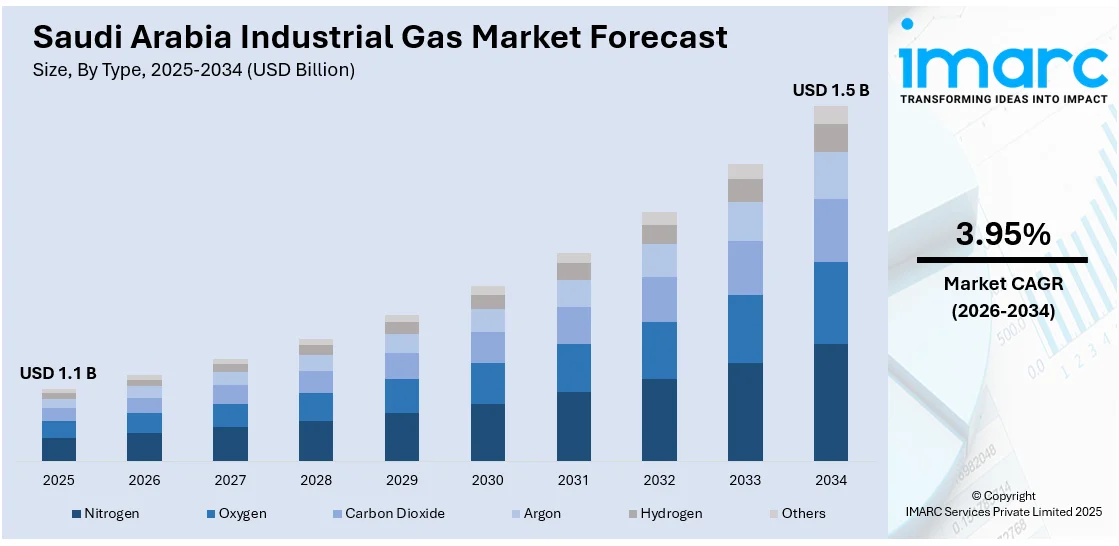

The Saudi Arabia industrial gas market size reached USD 1.1 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 1.5 Billion by 2034, exhibiting a growth rate (CAGR) of 3.95% during 2026-2034. Increased demand from sectors like manufacturing, chemicals, and oil and gas is one of the factors contributing to Saudi Arabia industrial gas market share. Investments in infrastructure, growing industrial activities, and the push towards energy efficiency and sustainable practices further fuel market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.1 Billion |

| Market Forecast in 2034 | USD 1.5 Billion |

| Market Growth Rate 2026-2034 | 3.95% |

Saudi Arabia Industrial Gas Market Trends:

Expansion of Petrochemical Industry

Saudi Arabia’s rapidly thriving petrochemical industry is a major driver of the market growth. As per the IMARC Group, the Saudi Arabia petrochemicals market size reached USD 6.0 Billion in 2024. Industrial gases, such as hydrogen, oxygen, and nitrogen, are essential in refining, cracking, and polymer production processes. Vision 2030 supports diversification into high-value petrochemicals, leading to rising demand for industrial gases in Jubail and Yanbu complexes. Global joint ventures with multinational chemical players ensure consistent utilization of industrial gases across refining and downstream processes. With petrochemical projects becoming more advanced, there is an increasing need for gases that improve efficiency and environmental compliance. Additionally, industrial gases are vital in enhancing product quality and reducing energy consumption.

To get more information on this market Request Sample

Infrastructure Development and Construction Growth

Saudi Arabia’s massive construction projects are significantly driving the demand for industrial gases. In 2024, Saudi Arabia’s construction industry experienced notable expansion, adding 3,800 new licenses in one year, resulting in a total of 8,900, according to government data. Large-scale projects, such as NEOM City, require welding, cutting, and steel fabrication processes where gases like acetylene, argon, and oxygen are extensively used. Industrial gases are crucial in cement production, metalworking, and advanced building materials, making them essential in the construction boom. With billions of dollars allocated to housing, smart cities, and industrial parks, the scale of demand is unprecedented. Contractors and fabricators rely on gas cylinders and bulk supply systems for onsite operations. Additionally, the shift towards sustainable and smart construction techniques is enhancing the use of specialized gases in modern materials and energy-efficient processes.

Growth of the Energy and Power Generation Sector

The energy sector in Saudi Arabia is undergoing transformation, and industrial gases are central to both traditional and renewable power generation. As per the General Authority for Statistics, by the end of 2024, the overall count of active renewable energy projects stood at ten, including nine solar energy projects with a total capacity of 6,151 megawatts, alongside one wind energy project with a capacity of 400 megawatts. Oxygen and hydrogen are critical in refining fuels, while gases like nitrogen are used in turbines, cooling, and maintenance processes. As the country is expanding its natural gas power plants and renewable energy facilities, industrial gases play a vital role in maintaining efficiency and reliability. Hydrogen, in particular, is gaining importance in clean energy initiatives, with Saudi Arabia investing in green hydrogen projects. Power plant operators rely on industrial gases for cooling systems, insulation, and welding of high-strength materials.

Key Growth Drivers of Saudi Arabia Industrial Gas Market:

Growing Healthcare and Medical Applications

The healthcare sector in Saudi Arabia is becoming an important growth avenue for industrial gases, particularly oxygen, nitrogen, and medical-grade carbon dioxide. With investments in hospital infrastructure and specialized care centers, the demand for medical gases in surgeries, intensive care, and respiratory treatments is growing significantly. Rising cases of chronic illnesses, surgical procedures, and emergency care are further boosting the adoption. In addition, gases like nitrous oxide are widely used in anesthesia, while oxygen cylinders are indispensable in both hospitals and homecare. The Saudi government’s emphasis on improving healthcare access, coupled with private sector involvement, ensures long-term demand stability. Medical gas delivery systems, cylinder refilling, and on-site generation technologies are being expanded across hospitals in Riyadh, Jeddah, and Dammam.

Rising Demand from Food and Beverage (F&B) Industry

The F&B industry in Saudi Arabia is burgeoning, and industrial gases play a critical role in packaging, preservation, and processing. Carbon dioxide is widely used in carbonated beverages, while nitrogen helps in food packaging to extend shelf life and prevent spoilage. Cold chain logistics and frozen food demand also rely heavily on liquid nitrogen and dry ice. With increasing urbanization, changing dietary patterns, and the growing popularity of packaged food items, the consumption of gases in this sector continues to rise. International fast-food chains and local food processors are also adopting advanced packaging technologies that rely on gas-based solutions. The government’s encouragement of food self-sufficiency and local production is further catalyzing the demand.

Technological Advancements and Automation

Technological innovations in gas production, storage, and distribution are driving the market expansion in Saudi Arabia. Companies are investing in advanced air separation units, on-site gas generation plants, and automated cylinder filling systems to meet rising demand efficiently. Automation in gas handling ensures higher safety, reduced costs, and faster supply to end users across petrochemicals, healthcare, and manufacturing industries. With the adoption of Industry 4.0 and smart plant solutions, real-time monitoring of gas usage and digital logistics is becoming a standard practice. This not only improves reliability but also reduces waste and downtime. Furthermore, research and development (R&D) in high-purity and specialty gases is supporting applications in electronics, renewable energy, and precision manufacturing.

Saudi Arabia Industrial Gas Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, application, and supply mode.

Type Insights:

- Nitrogen

- Oxygen

- Carbon Dioxide

- Argon

- Hydrogen

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes nitrogen, oxygen, carbon dioxide, argon, hydrogen, and others.

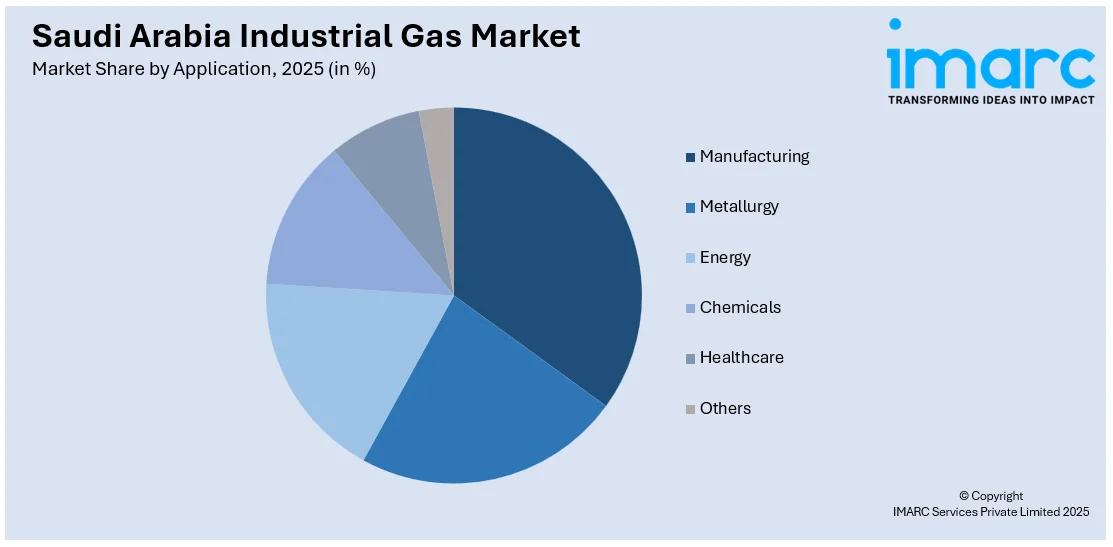

Application Insights:

Access the comprehensive market breakdown Request Sample

- Manufacturing

- Metallurgy

- Energy

- Chemicals

- Healthcare

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes manufacturing, metallurgy, energy, chemicals, healthcare, and others.

Supply Mode Insights:

- Packaged

- Bulk

- On-Site

A detailed breakup and analysis of the market based on the supply mode have also been provided in the report. This includes packaged, bulk, and on-site.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Industrial Gas Market News:

- July 2025: Saudi industrial gas firm AHG Group announced intentions to invest USD 20 Million in an industrial gas manufacturing plant in Damman, Saudi Arabia. The initiative was a component of AHG’s plan to grow in local and regional markets, boost industrial gas production, and enhance its supply chain.

- April 2025: Axens augmented its Catalyst Arabia Limited facility in Saudi Arabia, emerging as the premier manufacturer of Tail Gas Treatment Catalysts in the area. The plant facilitated sulfur recovery rates of up to 99.9%, assisting local oil and gas sectors in complying with emissions standards. Engineered for operation at lower temperatures, the catalysts minimized energy consumption and capital expenses, bolstering Saudi Arabia's industrial gas abilities and efforts for environmental compliance.

Saudi Arabia Industrial Gas Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Nitrogen, Oxygen, Carbon Dioxide, Argon, Hydrogen, Others |

| Applications Covered | Manufacturing, Metallurgy, Energy, Chemicals, Healthcare, Others |

| Supply Modes Covered | Packaged, Bulk, On-Site |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia industrial gas market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia industrial gas market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia industrial gas industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The industrial gas market in Saudi Arabia was valued at USD 1.1 Billion in 2025.

The Saudi Arabia industrial gas market is projected to exhibit a CAGR of 3.95% during 2026-2034, reaching a value of USD 1.5 Billion by 2034.

Rising construction activities and infrastructure projects are driving the demand for welding and cutting gases. Additionally, the growth of healthcare facilities in Saudi Arabia is increasing the need for medical gases. Technological advancements and international partnerships are also supporting the development of efficient gas production and distribution systems.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)