Saudi Arabia Industrial Robotics for Assembly Lines Market Size, Share, Trends and Forecast by Robot Type, Payload Capacity, Application, End-Use Industry, and Region, 2026-2034

Saudi Arabia Industrial Robotics for Assembly Lines Market Overview:

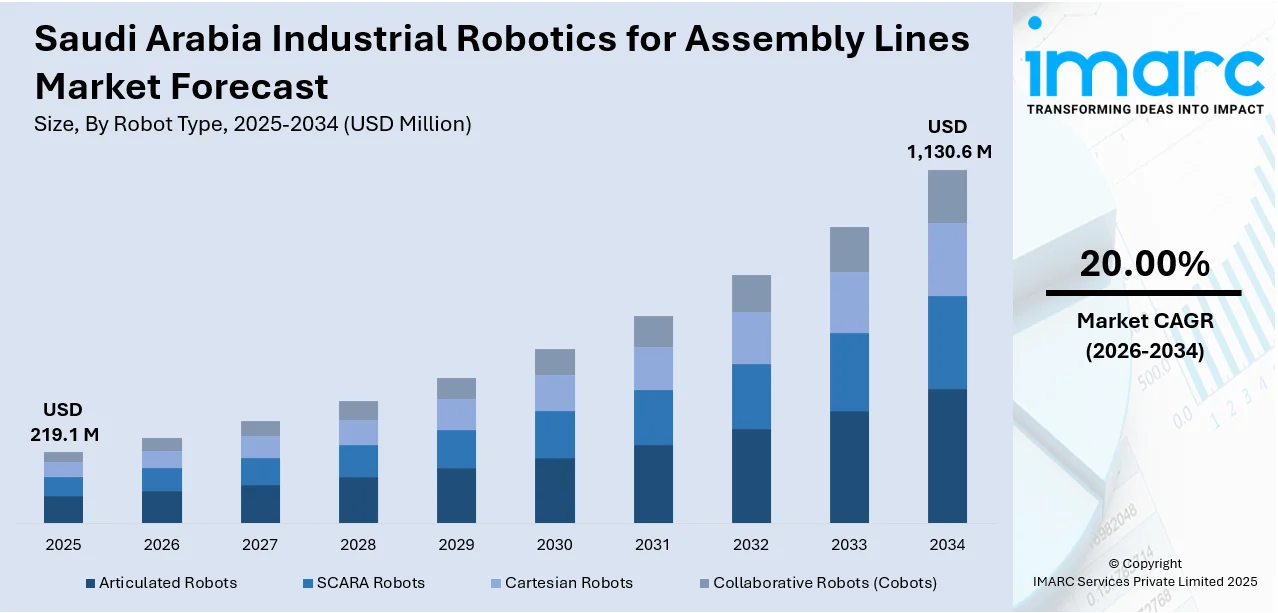

The Saudi Arabia industrial robotics for assembly lines market size reached USD 219.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,130.6 Million by 2034, exhibiting a growth rate (CAGR) of 20.00% during 2026-2034. The market is driven by increased government investments in manufacturing under Saudi Vision 2030, aiming to diversify the economy beyond oil. Demand for precision, speed, and operational efficiency in the automotive, electronics, and metal industries is accelerating the adoption of industrial robotics on assembly lines. Additionally, the shortage of skilled labor is pushing factories toward automation to maintain productivity and quality standards, which is a significant factor augmenting the Saudi Arabia industrial robotics for assembly lines market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 219.1 Million |

|

Market Forecast in 2034

|

USD 1,130.6 Million |

| Market Growth Rate 2026-2034 | 20.00% |

Saudi Arabia Industrial Robotics for Assembly Lines Market Trends:

Localization and Smart Manufacturing Initiatives under Vision 2030

Saudi Arabia’s Vision 2030 has prioritized the development of a local industrial base, with advanced automation and robotics playing a central role. The government has introduced multiple programs, including the National Industrial Development and Logistics Program (NIDLP), to stimulate domestic manufacturing capabilities. Notably, in the automotive sector specifically, Vision 2030 targets the establishment of 3 to 4 original equipment manufacturers (OEMs) manufacturing nearly 400,000 passenger vehicles annually within the Kingdom by the end of the decade. These initiatives are prompting manufacturers to embrace robotics to meet objectives about operational efficiency and diminished reliance on overseas labor. In addition, robotics in manufacturing lines enables higher consistency, lower waste, and increased output, all facilitating competitive local manufacturing. Public-private partnerships and foreign direct investment in the robotics industry have also gained momentum, especially in industrial areas such as NEOM and King Abdullah Economic City. Such regions are built with infrastructure appropriate for intelligent factories based on robotics-integrated production systems. As robotics is integrated into the overall strategy for economic change, companies that do not implement automation risk losing ground on cost-effectiveness and quality levels established by new domestic and international standards.

To get more information on this market Request Sample

Integration of AI and IoT with Robotic Assembly Lines

Saudi industrial robotics is progressing from simple automation to integrated systems propelled by artificial intelligence (AI) and the Internet of Things (IoT). The Kingdom is strategically using these technologies to boost its manufacturing capacity and lessen dependence on human labor. One notable development is the USD 100 Billion Project Transcendence, which seeks to make Saudi Arabia a world capital for AI, data analytics, and cutting-edge technology. This is not exclusively for research purposes but also has direct implementation in industrial automation, such as robotics deployed on production lines. AI-powered robots are now becoming more able to manage variable inputs, detect defects in real-time, and streamline workflows without human intervention. These functions are particularly applicable in industries such as the automotive and electronics sectors, which require accuracy and efficiency. This, consequently, is favorably contributing to the Saudi Arabia industrial robotics for assembly lines market growth. Apart from this, IoT devices facilitate real-time data sharing among robots and other equipment, making predictive maintenance, workflow enhancement, and remote monitoring possible. These technologies facilitate improved decision-making at the plant level and assist in reducing unplanned downtime, which is paramount for industries that have thin margins and high throughput. Apart from this, training programs and technical partnerships are also expanding to build the necessary local talent pool for managing and maintaining these advanced systems. Over time, the integration of AI and IoT is expected to become standard practice rather than a high-end option for Saudi manufacturers.

Saudi Arabia Industrial Robotics for Assembly Lines Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on robot type, payload capacity, application, and end-use industry.

Robot Type Insights:

- Articulated Robots

- SCARA Robots

- Cartesian Robots

- Collaborative Robots (Cobots)

The report has provided a detailed breakup and analysis of the market based on the robot type. This includes articulated robots, SCARA robots, cartesian robots, and collaborative robots (cobots).

Payload Capacity Insights:

- Up to 5 Kg

- 5 to 10 Kg

- 10 to 20 Kg

- Above 20 Kg

A detailed breakup and analysis of the market based on the payload capacity have also been provided in the report. This includes up to 5Kg, 5 to10 Kg, 10 to 20 Kg, and above 20 Kg.

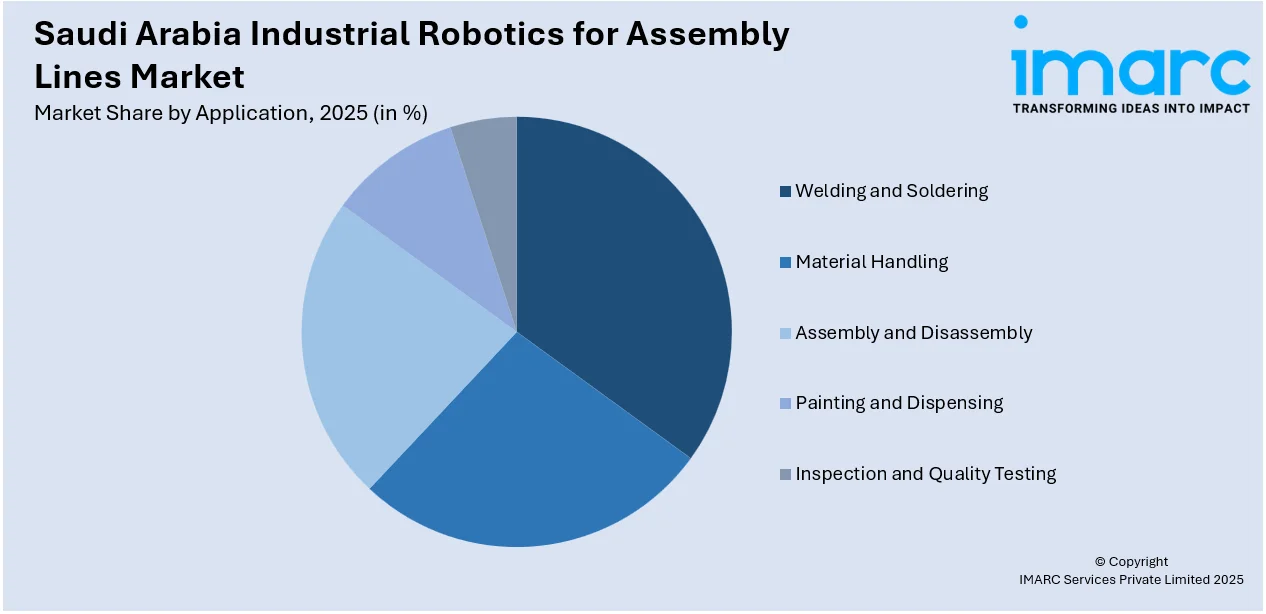

Application Insights:

Access the comprehensive market breakdown Request Sample

- Welding and Soldering

- Material Handling

- Assembly and Disassembly

- Painting and Dispensing

- Inspection and Quality Testing

The report has provided a detailed breakup and analysis of the market based on the application. This includes welding and soldering, material handling, assembly and disassembly, painting and dispensing, and inspection and quality testing.

End-Use Industry Insights:

- Automotive

- Electronics and Semiconductor

- Metal and Machinery

- Plastics and Chemicals

- Food and Beverage

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes automotive, electronics and semiconductor, metal and machinery, plastics and chemicals, food and beverage, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern & Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Industrial Robotics for Assembly Lines Market News:

- On February 20, 2024, Alat, a Public Investment Fund (PIF) company, and SoftBank Group Corp. announced a strategic partnership to establish a next-generation industrial automation business in Saudi Arabia. The joint venture will invest up to USD 150 Million to build a fully automated manufacturing and engineering hub in Riyadh. This initiative aims to produce advanced industrial robots for various manufacturing and assembly processes, supporting the Kingdom's Vision 2030 goals for advancements in technology and economic diversification.

Saudi Arabia Industrial Robotics for Assembly Lines Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Robot Types Covered | Articulated Robots, SCARA Robots, Cartesian Robots, Collaborative Robots (Cobots) |

| Payload Capacities Covered | Up to 5 Kg, 5 to 10Kg, 10 to 20 Kg, Above 20 Kg |

| Applications Covered | Welding and Soldering, Material Handling, Assembly and Disassembly, Painting and Dispensing, Inspection and Quality Testing |

| End-Use Industries Covered | Automotive, Electronics and Semiconductor, Metal and Machinery, Plastics and Chemicals, Food and Beverage, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia industrial robotics for assembly lines market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia industrial robotics for assembly lines market on the basis of robot type?

- What is the breakup of the Saudi Arabia industrial robotics for assembly lines market on the basis of payload capacity?

- What is the breakup of the Saudi Arabia industrial robotics for assembly lines market on the basis of application?

- What is the breakup of the Saudi Arabia industrial robotics for assembly lines market on the basis of end-use industry?

- What is the breakup of the Saudi Arabia industrial robotics for assembly lines market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia industrial robotics for assembly lines market?

- What are the key driving factors and challenges in the Saudi Arabia industrial robotics for assembly lines market?

- What is the structure of the Saudi Arabia industrial robotics for assembly lines market and who are the key players?

- What is the degree of competition in the Saudi Arabia industrial robotics for assembly lines market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia industrial robotics for assembly lines market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia industrial robotics for assembly lines market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia industrial robotics for assembly lines industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)