Saudi Arabia Industrial Safety Equipment Market Size, Share, Trends and Forecast by Product Type, End-Use Industry, and Region, 2026-2034

Saudi Arabia Industrial Safety Equipment Market Overview:

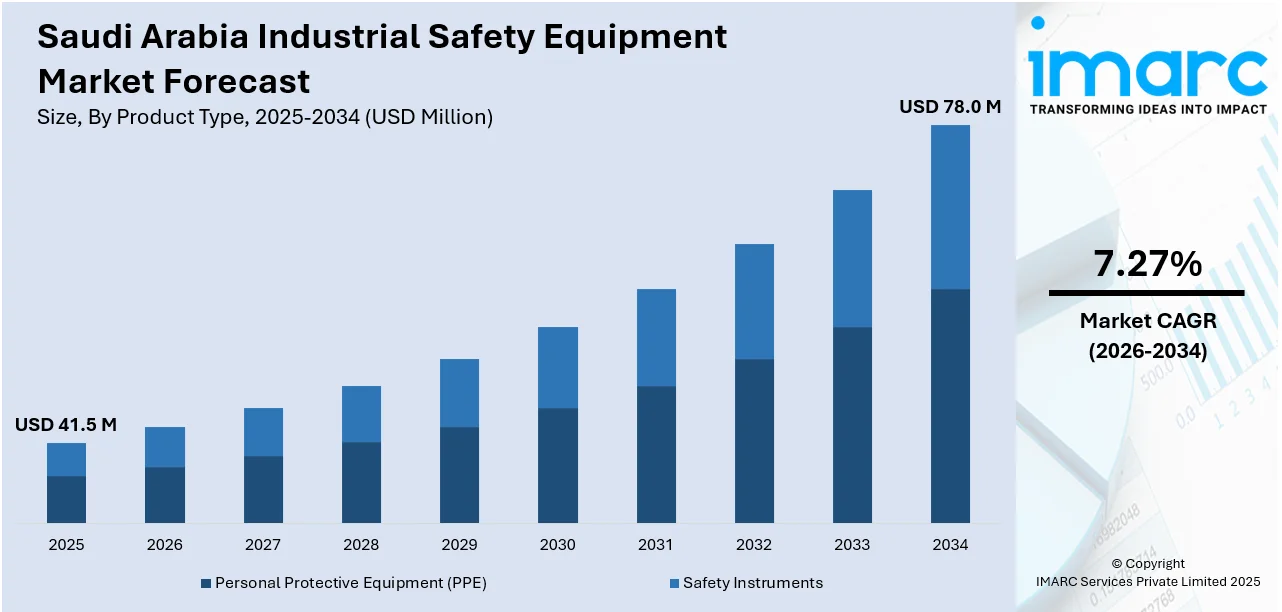

The Saudi Arabia industrial safety equipment market size reached USD 41.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 78.0 Million by 2034, exhibiting a growth rate (CAGR) of 7.27% during 2026-2034. At present, the government of Saudi Arabia is enhancing its industrial safety laws, resulting in a consistent rise in the demand for safety gear. Moreover, Saudi Arabia is aggressively diversifying its economy by investing significantly in infrastructure and construction initiatives under its Vision 2030 strategy. Besides this, the heightened need for worker safety and health is expanding the Saudi Arabia industrial safety equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 41.5 Million |

| Market Forecast in 2034 | USD 78.0 Million |

| Market Growth Rate 2026-2034 | 7.27% |

Saudi Arabia Industrial Safety Equipment Market Trends:

Rising Government Laws and Compliance Levels

The government of Saudi Arabia is enhancing its industrial safety laws, resulting in a consistent rise in the demand for safety gear. The authorities are proactively implementing tougher safety measures across numerous industries, including the oil and gas, construction, and manufacturing sectors. Organizations are now responding by integrating superior safety equipment, like helmets, gloves, and protective gear, in order to meet legal standards. In addition, there is a persistent focus on enhancing workplace safety to meet international standards, which is encouraging organizations to invest in better-quality industrial safety equipment. These initiatives are fueling the market growth as companies seek to minimize workplace accidents and prevent expensive fines. The government's ongoing efforts to improve worker safety standards are creating a strong foundation for safety equipment suppliers to grow their presence and offerings in the region. In 2024, the Intersec Saudi Arabia took place from 1st to 3rd October 2024 at the Riyadh International Convention and Exhibition Centre (RICEC). It established itself as a major center for networking and knowledge sharing in the security, safety, and fire protection industries.

To get more information on this market Request Sample

Development of Industrial Infrastructure and Construction Activities

Saudi Arabia is aggressively diversifying its economy by investing significantly in infrastructure and construction initiatives under its Vision 2030 strategy. In November 2024, the Saudi authorities endorsed a strong budget for 2025 amounting to SR1. 3tn ($342.7bn), designed to support the construction industry. Recent information from the Investment Ministry shows that 3,800 building permits were granted in 2024, highlighting a significant increase in sector activity. The continued investments in industrial infrastructure, such as the construction of new oil refineries, petrochemical facilities, and major construction projects, is driving the demand for industrial safety equipment. Businesses engaged in these projects are presently ordering safety equipment to reduce risks posed by dangerous work environments. Employees in industries like construction, manufacturing, and energy are utilizing personal protective equipment (PPE) and other safety devices to reduce risks of injury. With the industrial and construction industries innovating, the demand for quality safety equipment is becoming more crucial, thus contributing to the Saudi Arabia industrial safety equipment market growth.

Increased Awareness About Worker Safety and Health

The heightened need for worker safety and health is increasing in Saudi Arabia, which is motivating industries to implement industrial safety equipment. Employers and workers are becoming aware about the dangers in dangerous workplaces, which is facilitating the shift towards the utilization of protective safety equipment. This increased awareness is presently manifesting itself in greater investment in protective equipment such as respiratory devices, fall devices, and fire protection devices. Organizations are constantly making their employees aware about the need for safety measures and how these devices can lower accident rates and occupational risks substantially. The growing consciousness of health and safety is also demanding the adoption of high-tech equipment in safety wearables, like smart wearables, which can continuously monitor the health conditions of workers.

Saudi Arabia Industrial Safety Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type and end-use industry.

Product Type Insights:

- Personal Protective Equipment (PPE)

- Head Protection

- Eye and Face Protection

- Hearing Protection

- Respiratory Protection

- Hand Protection

- Protective Clothing

- Foot Protection

- Safety Instruments

- Safety Sensors

- Safety Controllers/Relays

- Safety Valves

- Emergency Shutdown Systems (ESD)

- Fire and Gas Monitoring Systems

- High Integrity Pressure Protection Systems (HIPPS)

- Burner Management Systems (BMS)

The report has provided a detailed breakup and analysis of the market based on the product type. This includes personal protective equipment (PPE) (head protection, eye and face protection, hearing protection, respiratory protection, hand protection, protective clothing, and foot protection) and safety instruments (safety sensors, safety controllers/relays, safety valves, emergency shutdown systems (ESD), fire and gas monitoring systems, high integrity pressure protection systems (HIPPS), and burner management systems (BMS)).

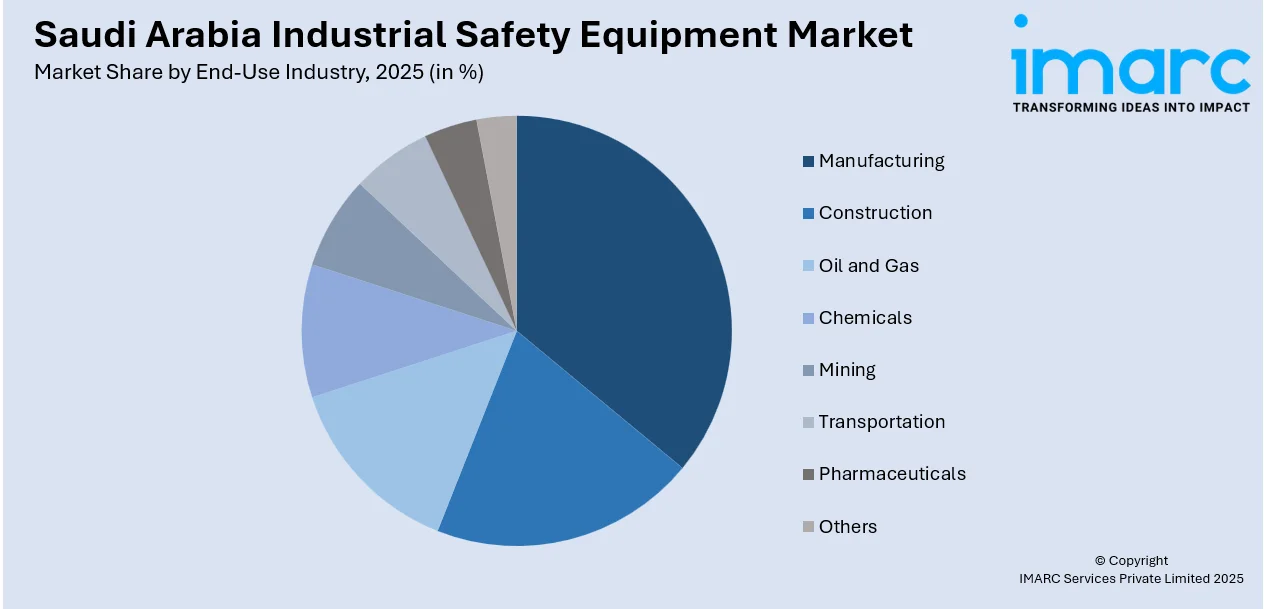

End-Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Manufacturing

- Construction

- Oil and Gas

- Chemicals

- Mining

- Transportation

- Pharmaceuticals

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes manufacturing, construction, oil and gas, chemicals, mining, transportation, pharmaceuticals, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Industrial Safety Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| End-Use Industries Covered | Manufacturing, Construction, Oil and Gas, Chemicals, Mining, Transportation, Pharmaceuticals, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia industrial safety equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia industrial safety equipment market on the basis of product type?

- What is the breakup of the Saudi Arabia industrial safety equipment market on the basis of end-use industry?

- What is the breakup of the Saudi Arabia industrial safety equipment market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia industrial safety equipment market?

- What are the key driving factors and challenges in the Saudi Arabia industrial safety equipment market?

- What is the structure of the Saudi Arabia industrial safety equipment market and who are the key players?

- What is the degree of competition in the Saudi Arabia industrial safety equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia industrial safety equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia industrial safety equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia industrial safety equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)