Saudi Arabia Inland Cargo Shipping Market Size, Share, Trends and Forecast by Cargo Type, Mode of Transport, Service Type, End-Use Industry, and Region, 2026-2034

Saudi Arabia Inland Cargo Shipping Market Overview:

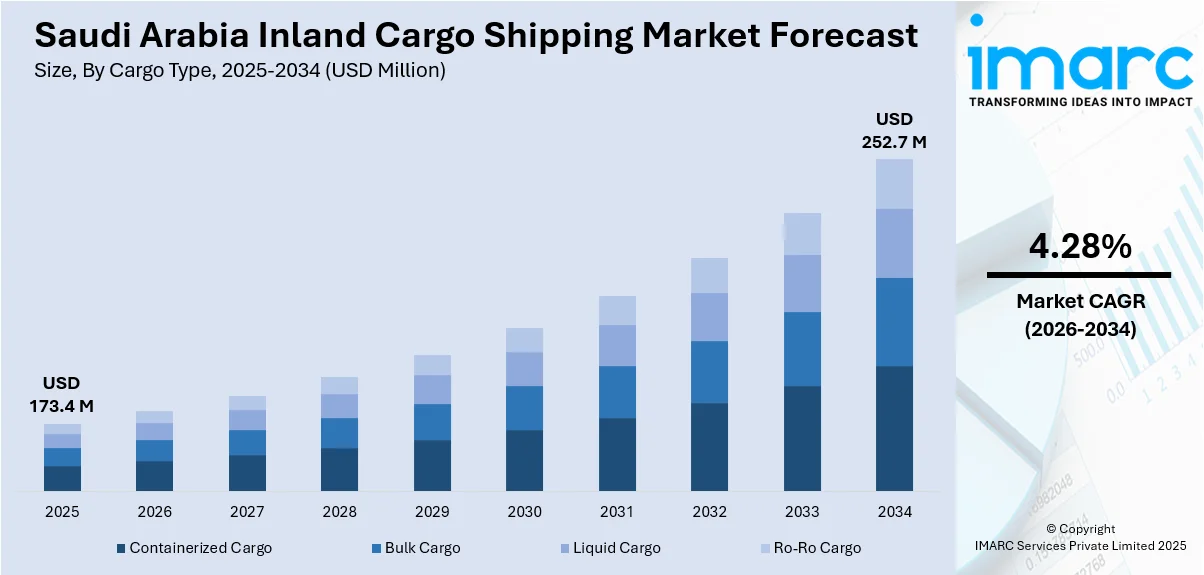

The Saudi Arabia inland cargo shipping market size reached USD 173.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 252.7 Million by 2034, exhibiting a growth rate (CAGR) of 4.28% during 2026-2034. The inland cargo shipping market in Saudi Arabia is growing because of government-backed infrastructure improvements, including enhanced transportation networks, dry ports, and logistics zones. The rise of e-commerce is driving the demand for advanced last-mile and regional distribution systems. Additionally, strategic expansions of land routes, which ensure seamless connections between ports and inland hubs, are contributing to the expansion of the Saudi Arabia inland cargo shipping market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 173.4 Million |

|

Market Forecast in 2034

|

USD 252.7 Million |

| Market Growth Rate 2026-2034 | 4.28% |

Saudi Arabia Inland Cargo Shipping Market Trends:

Government-Backed Infrastructure and Logistics Expansion

Saudi Arabia is undertaking major infrastructure investments to establish itself as a logistics hub in the region as part of its Vision 2030. This encompasses significant enhancements in transportation networks, the enlargement of dry ports, and the establishment of large logistics areas. The aim of the governing body is to enhance the logistics sector, which will contribute to the GDP and boost the logistics performance index. Major initiatives, such as the Saudi Landbridge Railway, aim to connect Jeddah with Riyadh, thereby reducing inland transportation times. As part of these initiatives, the Public Authority for Special Economic Zones and Free Zones (OPAZ) revealed a tender in 2025 for building a dry port at Al-Dhahira close to the Saudi-Omani border. This initiative will enhance bilateral trade efficiency and shorten transit durations by connecting the port with border crossings. The establishment of this essential infrastructure, along with streamlined customs procedures, enhances the domestic logistics network's efficiency, allowing private logistics companies to expand their inland cargo services.

To get more information on this market Request Sample

E-commerce Growth and Last-Mile Integration

The swift expansion of online shopping and evolving user habits is a crucial factor propelling the Saudi Arabia inland cargo shipping market growth. As more people in Saudi Arabia make online purchases, particularly in smaller towns, retailers are expanding into regional markets to meet this demand. According to International Trade Administration (ITA), the number of internet users in Saudi Arabia participating in e-commerce attained 33.6 million by 2024, accounting a 42% increase since 2019. This change is encouraging logistics firms to develop stronger last-mile and regional distribution systems. Furthermore, cargo volumes are not only rising in frequency but are also expanding over a broader geographic region. To address this, operators are employing technology, including route optimization and real-time tracking to enhance efficiency. As people anticipate quicker deliveries, freight firms are adopting integrated hub-and-spoke models to guarantee faster delivery periods and improved inventory fulfillment responsiveness. Inland cargo shipping is transforming from a basic port-to-warehouse movement to a more advanced, technology-enhanced framework.

Strategic Land Routes and Maritime Connectivity

The inland cargo shipping market is benefiting from the resilience and flexibility shown by logistics providers in adapting to disruptions in maritime shipping. In 2024, Hapag-Lloyd launched new land routes connecting Jebel Ali, Dammam, and Jubail to Jeddah, providing an alternative for cargo flow when Red Sea shipping faced disruptions. This initiative helped mitigate delays and maintain seamless cargo movement, especially amid vessel rerouting caused by security concerns. The new land routes not only supported inland transport within Saudi Arabia but also enhanced regional connectivity, linking Jeddah to Jordan and facilitating access to Hapag-Lloyd’s ocean services. This development underscores the growing importance of reliable inland transport solutions to ensure continuity in supply chains. By providing alternative routes and improving connectivity between key Saudi ports, leading companies are strengthening the resilience of Saudi Arabia’s logistics infrastructure, ensuring consistent cargo movement even in the face of external disruptions. This adaptability contributes significantly to the growth of inland cargo shipping in the region.

Saudi Arabia Inland Cargo Shipping Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on cargo type, mode of transport, service type, and end-use industry.

Cargo Type Insights:

- Containerized Cargo

- Bulk Cargo

- Liquid Cargo

- Ro-Ro Cargo

The report has provided a detailed breakup and analysis of the market based on the cargo type. This includes containerized cargo, bulk cargo, liquid cargo, and ro-ro cargo.

Mode of Transport Insights:

- Inland Waterways

- Coastal Shipping

- Transoceanic Shipping

A detailed breakup and analysis of the market based on the mode of transport have also been provided in the report. This includes inland waterways, coastal shipping, and transoceanic shipping.

Service Type Insights:

- Freight Forwarding

- Warehousing and Distribution

- Customs Brokerage

The report has provided a detailed breakup and analysis of the market based on the service type. This includes freight forwarding, warehousing and distribution, and customs brokerage.

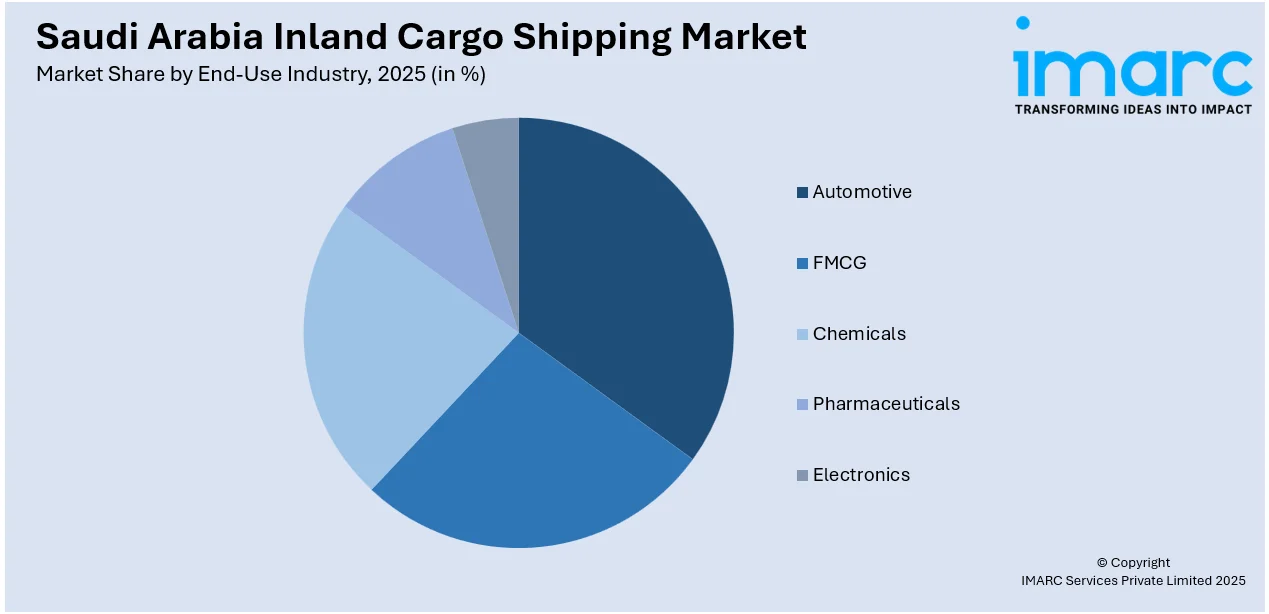

End-Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- FMCG

- Chemicals

- Pharmaceuticals

- Electronics

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes automotive, FMCG, chemicals, pharmaceuticals, and electronics.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Inland Cargo Shipping Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Cargo Types Covered | Containerized Cargo, Bulk Cargo, Liquid Cargo, Ro-Ro Cargo |

| Mode of Transports Covered | Inland Waterways, Coastal Shipping, Transoceanic Shipping |

| Service Types Covered | Freight Forwarding, Warehousing and Distribution, Customs Brokerage |

| End-Use Industries Covered | Automotive, FMCG, Chemicals, Pharmaceuticals, Electronics |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia inland cargo shipping market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia inland cargo shipping market on the basis of cargo type?

- What is the breakup of the Saudi Arabia inland cargo shipping market on the basis of mode of transport?

- What is the breakup of the Saudi Arabia inland cargo shipping market on the basis of service type?

- What is the breakup of the Saudi Arabia inland cargo shipping market on the basis of end-use industry?

- What is the breakup of the Saudi Arabia inland cargo shipping market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia inland cargo shipping market?

- What are the key driving factors and challenges in the Saudi Arabia inland cargo shipping market?

- What is the structure of the Saudi Arabia inland cargo shipping market and who are the key players?

- What is the degree of competition in the Saudi Arabia inland cargo shipping market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia inland cargo shipping market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia inland cargo shipping market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia inland cargo shipping industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)