Saudi Arabia Instant Food Market Size, Share, Trends and Forecast by Type, Pack Size, Packaging Material, Diet Type, Distribution Channel, and Region, 2026-2034

Saudi Arabia Instant Food Market Summary:

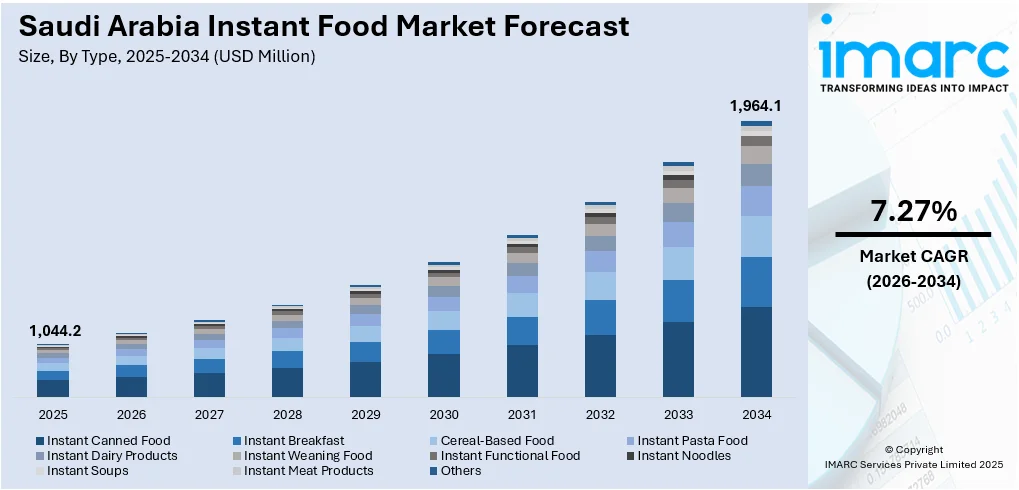

The Saudi Arabia instant food market size was valued at USD 1,044.2 Million in 2025 and is projected to reach USD 1,964.1 Million by 2034, growing at a compound annual growth rate of 7.27% from 2026-2034.

The Saudi Arabia instant food market is experiencing robust expansion driven by rapid urbanization, evolving consumer lifestyles, and the increasing preference for convenient meal solutions among busy professionals and households. The rising number of working women and young professionals who seek time-saving food options without compromising on taste is propelling market growth. Product innovation featuring localized flavors that align with cultural preferences and halal dietary requirements continues to strengthen consumer trust and adoption. The extensive development of retail infrastructure, coupled with the proliferation of e-commerce platforms, is enhancing product accessibility across urban and suburban areas, contributing to the Saudi Arabia instant food market share.

Key Takeaways and Insights:

- By Type: Instant noodles dominate the market with a share of 22% in 2025, driven by their affordability, quick preparation time, and widespread availability across retail channels. The growing preference for non-vegetarian chicken-flavored varieties among consumers continues to strengthen this segment's market position.

- By Pack Size: Single pack leads the market with a share of 48% in 2025, reflecting the rising demand for individual portion sizes among students, working professionals, and single-person households seeking convenient on-the-go meal solutions.

- By Packaging Material: Pouches exhibit a clear dominance with 44% share in 2025, owing to their lightweight nature, cost-effectiveness, extended shelf life preservation, and growing consumer preference for flexible packaging formats.

- By Diet Type: Non-veg represents the largest segment with a market share of 49% in 2025, fueled by strong consumer preference for chicken-based instant food products that align with halal dietary requirements and local taste preferences.

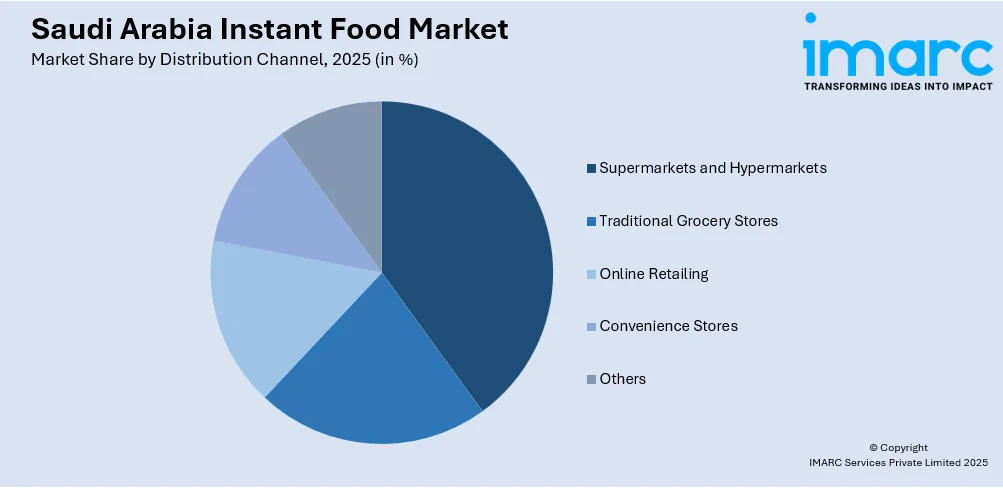

- By Distribution Channel: Supermarkets and hypermarkets hold the biggest share at 38% in 2025, driven by their extensive product assortments, competitive pricing strategies, and growing presence in urban areas across the Kingdom.

- By Region: Northern and Central region is the largest region with 34% share in 2025, attributed to the concentration of population in Riyadh, higher disposable incomes, developed retail infrastructure, and significant presence of working professionals and expatriates.

- Key Players: Key players drive the Saudi Arabia instant food market by expanding product portfolios, improving flavor profiles and nutritional content, and strengthening nationwide distribution networks. Their investments in marketing, localized product development, and partnerships with retail chains boost awareness, accelerate adoption, and ensure consistent product availability across diverse consumer segments.

To get more information on this market Request Sample

The Saudi Arabia instant food market is witnessing significant transformation as changing demographics and lifestyle patterns reshape consumption habits across the Kingdom. The government's Vision 2030 initiative continues to drive economic diversification, fostering increased female workforce participation that directly correlates with growing demand for convenient food solutions. According to the General Authority for Statistics, the labor force participation rate of Saudi women reached 36.2 percent in the third quarter of 2024, marking an increase of 0.8 percentage points from the previous quarter. This rising workforce engagement among women, combined with the expanding expatriate population in major urban centers like Riyadh, Jeddah, and Dammam, is creating sustained demand for time-saving instant food products. The market is further supported by extensive retail modernization efforts, with supermarkets and hypermarkets expanding their footprint across the Kingdom. Product manufacturers are responding to evolving preferences by introducing healthier formulations, including low-sodium variants and nutrient-fortified options, while maintaining competitive pricing to attract budget-conscious consumers across different income segments.

Saudi Arabia Instant Food Market Trends:

Rising Demand for Convenient Meal Solutions Among Working Professionals

The fast-paced urban lifestyle in major Saudi cities is significantly boosting demand for convenient instant food products. Working professionals, students, and dual-income households increasingly rely on instant meals that require minimal preparation time while delivering satisfying taste and nutrition. The government's Vision 2030 initiative has accelerated female workforce participation, driving the need for time-saving meal solutions that fit busy schedules without sacrificing quality. The growing expatriate population in urban centers further contributes to sustained demand for quick and accessible food options that accommodate diverse dietary preferences and hectic daily routines.

Expansion of E-Commerce and Digital Food Retail Platforms

The rapid growth of online grocery shopping is transforming instant food distribution channels across Saudi Arabia. Digital platforms are enhancing product accessibility through quick delivery services and expanded product selections. According to the Saudi Central Bank, electronic payments represented 79 percent of total retail payments in 2024, an increase from 70 percent in 2023, reflecting growing consumer comfort with digital commerce platforms. This digital transformation is enabling instant food manufacturers to reach broader consumer segments efficiently.

Product Innovation with Localized Flavors and Healthier Formulations

Manufacturers are increasingly developing instant food products tailored to Saudi taste preferences and cultural requirements. Traditional dishes inspired by local culinary heritage are being introduced in ready-to-cook formats, bridging convenience with cultural authenticity. Simultaneously, health-conscious innovations including low-sodium products, gluten-free instant meals, and nutrient-fortified options are gaining traction among educated urban consumers seeking both convenience and wellness benefits from their food choices. This dual focus on cultural relevance and nutritional improvement enables brands to capture broader consumer segments while building long-term loyalty through product differentiation.

How Vision 2030 is Transforming the Saudi Arabia Instant Food Market:

Saudi Arabia's Vision 2030 initiative is fundamentally reshaping the instant food market landscape through comprehensive economic diversification and social transformation programs. The initiative's focus on increasing female workforce participation has created a growing demographic of time-constrained consumers who prioritize convenient meal solutions. Urban development projects across major cities are expanding modern retail infrastructure, enhancing product accessibility through new commercial districts and mixed-use developments. The emphasis on localizing manufacturing capabilities encourages domestic production of instant food products, reducing import dependency while creating employment opportunities. Additionally, Vision 2030's tourism expansion goals are driving demand for diverse food offerings that cater to international visitors alongside local consumers. The initiative's digital transformation agenda supports e-commerce growth, enabling instant food brands to reach consumers through innovative online platforms and quick commerce delivery services that align with evolving lifestyle preferences.

Market Outlook 2026-2034:

The Saudi Arabia instant food market is positioned for sustained growth as the Kingdom undergoes significant socioeconomic transformation under Vision 2030. Urbanization continues to accelerate, creating favorable conditions for convenient food product consumption. The market generated a revenue of USD 1,044.2 Million in 2025 and is projected to reach a revenue of USD 1,964.1 Million by 2034, growing at a compound annual growth rate of 7.27% from 2026-2034. The expansion of modern retail formats, including supermarkets and hypermarkets, combined with the growth of online grocery platforms, is enhancing product accessibility across diverse geographic and demographic segments. Investments in local manufacturing capabilities, exemplified by major food companies establishing production facilities within the Kingdom, are strengthening supply chain resilience while reducing import dependency. Rising disposable incomes and evolving consumer preferences toward convenience-oriented lifestyles continue to support the positive market trajectory.

Saudi Arabia Instant Food Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Instant Noodles |

22% |

|

Pack Size |

Single Pack |

48% |

|

Packaging Material |

Pouches |

44% |

|

Diet Type |

Non-Veg |

49% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

38% |

|

Region |

Northern and Central Region |

34% |

Type Insights:

- Instant Canned Food

- Instant Breakfast

- Cereal-Based Food

- Instant Pasta Food

- Instant Dairy Products

- Instant Weaning Food

- Instant Functional Food

- Instant Noodles

- Instant Soups

- Instant Meat Products

- Others

Instant noodles dominate with a market share of 22% of the total Saudi Arabia instant food market in 2025.

The instant noodles segment has established itself as the leading product category within the Saudi Arabia instant food market, driven by their exceptional affordability, quick preparation time, and widespread availability across diverse retail channels. The segment benefits from strong consumer loyalty, particularly among young professionals, students, and expatriate communities who value the combination of convenience and satisfying taste. Pinehill Arabia Food Limited, the manufacturer of Indomie noodles, operates production facilities in Jeddah and Dammam, demonstrating the scale of domestic manufacturing supporting this segment's dominance.

The sustained growth of instant noodles is further supported by continuous product innovation, with manufacturers introducing diverse flavor variants that cater to local taste preferences while maintaining halal certification standards essential for the Saudi market. Non-vegetarian options, particularly chicken-flavored varieties, have gained significant popularity among Saudi consumers, aligning with established dietary preferences. The expansion of modern retail formats and the growth of online grocery platforms have enhanced product accessibility, enabling consumers to conveniently purchase their preferred instant noodle products through multiple distribution channels across urban and suburban areas.

Pack Size Insights:

- Single Pack

- Four Pack

- Six Pack

- Others

Single pack leads with a share of 48% of the total Saudi Arabia instant food market in 2025.

The single pack segment has emerged as the dominant pack size category, accounting for nearly half of the total market share, driven by the growing preference for individual portion sizes among students, working professionals, and single-person households. This format aligns perfectly with the fast-paced lifestyle of urban consumers who seek convenient, ready-to-prepare meals that can be consumed quickly during work breaks or study sessions. The affordability of single pack options makes them particularly attractive to price-conscious consumers, including the significant expatriate population residing in major Saudi cities who represent a substantial consumer base for instant food products.

The rising trend of on-the-go consumption patterns among Saudi Arabia's predominantly young population continues to strengthen single pack segment performance. According to demographic data, approximately 71 percent of Saudi Arabia's population is below the age of 35, representing a consumer demographic highly inclined toward convenient food formats. Single pack products are strategically placed in convenience stores, supermarket checkout areas, and vending machines, ensuring maximum visibility and accessibility. The compact nature of single pack products also makes them ideal for online grocery orders and quick commerce delivery services that have gained significant traction across the Kingdom.

Packaging Material Insights:

- Cardboard Boxes

- Pouches

- Plastic Cups

- Others

Pouches exhibit a clear dominance with 44% share of the total Saudi Arabia instant food market in 2025.

The pouch packaging segment has secured the largest share of the market, driven by its superior barrier properties that extend product shelf life, lightweight characteristics that reduce transportation costs, and cost-effectiveness compared to rigid packaging alternatives. Flexible pouch packaging offers excellent protection against moisture and oxygen, ensuring that instant food products maintain their quality and freshness throughout the supply chain. The Saudi Arabia pouches market is valued at approximately USD 531.1 Million in 2025 and is projected to grow at a compound annual growth rate of 4.38 percent through 2033, reflecting strong industry confidence in this packaging format.

The growing consumer preference for convenient packaging formats that are easy to open, reseal, and dispose of continues to drive pouch adoption across instant food categories. Manufacturers are increasingly investing in innovative pouch designs, including stand-up pouches and retort pouches that offer enhanced functionality and visual appeal on retail shelves. The sustainability trend is also influencing the segment, with companies exploring recyclable and biodegradable pouch materials to address environmental concerns while maintaining product integrity. The versatility of pouch packaging makes it suitable for diverse instant food products ranging from noodles and soups to breakfast cereals and functional foods.

Diet Type Insights:

- Vegetarian

- Non-Veg

- Vegan

Non-veg represents the leading segment with 49% share of the total Saudi Arabia instant food market in 2025.

The non-vegetarian segment holds the dominant position in the Saudi Arabia instant food market, reflecting the strong cultural preference for meat-based products among Saudi consumers and the large Muslim population's dietary habits. Chicken-flavored instant food products, particularly instant noodles, have achieved remarkable popularity since their introduction to the Saudi market, becoming a staple in many households. The segment benefits from robust halal certification processes that ensure compliance with Islamic dietary requirements, building strong consumer trust and encouraging repeat purchases across diverse demographic groups.

The growth of non-vegetarian instant food products is further supported by the significant expatriate population from countries like Indonesia, Philippines, and South Asian nations who brought their preference for meat-based instant meals to the Kingdom. Saudi Arabia ranks among the world's highest per capita meat consumers, creating a natural alignment between consumer preferences and non-vegetarian instant food offerings. Manufacturers continue to expand their non-vegetarian product portfolios with new flavor variants including beef, mutton, and seafood options, catering to diverse taste preferences while maintaining strict halal standards essential for market acceptance.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Traditional Grocery Stores

- Online Retailing

- Convenience Stores

- Others

Supermarkets and hypermarkets hold the largest share at 38% of the total Saudi Arabia instant food market in 2025.

The supermarkets and hypermarkets segment commands the largest distribution channel share, driven by their extensive product assortments, competitive pricing strategies, and strategic locations in high-traffic urban areas across the Kingdom. These modern retail formats offer consumers a convenient one-stop shopping experience where they can browse and compare various instant food products across multiple brands and categories. Major retail chains including Panda Retail Company, which has earmarked 20 new stores for 2025 alone with emphasis on Riyadh and remote areas, continue to expand their footprint, enhancing instant food product accessibility.

The dominance of supermarkets and hypermarkets is reinforced by their integration of digital technologies including click-and-collect services, in-aisle QR codes, and mobile applications that enhance the shopping experience and promote cross-selling opportunities. The organized retail sector in Saudi Arabia continues on a steady growth trajectory, supported by the addition of approximately one million square meters of new mall gross leasable area. Instant food manufacturers actively collaborate with these retail channels for promotional activities, end-cap displays, and seasonal campaigns that drive consumer awareness and trial purchases, contributing to sustained segment growth.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central region is the largest region with 34% share of the total Saudi Arabia instant food market in 2025.

The Northern and Central region, anchored by the capital city Riyadh, commands the largest regional share in the Saudi Arabia instant food market, driven by the concentration of population, economic activities, and developed retail infrastructure in this area. Riyadh Province leads the Kingdom with over 33,399 restaurants, cafes, and bakeries, demonstrating the region's vibrant food service ecosystem that complements retail instant food consumption. The capital serves as a central hub for commerce and trade, attracting significant working professional and expatriate populations who represent key consumer segments for convenient instant food products.

The regional dominance is further supported by higher disposable incomes, greater workforce participation, and the presence of major retail chains and hypermarkets concentrated in the Northern and Central region. The capital city serves as a leading hub for food production and consumption, reflecting the region's significance in shaping national dietary patterns and market trends. The ongoing urban development initiatives under Vision 2030, including new commercial districts and mixed-use developments, continue to create favorable conditions for instant food market expansion in this strategically important region.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Instant Food Market Growing?

Rising Female Workforce Participation and Changing Household Dynamics

The significant increase in female workforce participation under Saudi Arabia's Vision 2030 initiative is fundamentally reshaping household consumption patterns and driving demand for convenient instant food solutions. The labor force participation rate of Saudi women has demonstrated sustained progress in women's economic empowerment, reflecting the Kingdom's commitment to workforce diversification. Dual-income households, with limited time available for traditional meal preparation, are increasingly relying on instant food products that offer quick preparation without compromising nutritional value or taste preferences. This demographic shift is creating sustained demand growth across instant noodles, ready-to-eat meals, and breakfast cereals that cater to busy modern lifestyles. The government's continued commitment to workforce diversification ensures this driver will remain influential throughout the forecast period, supporting market expansion across product categories.

Expansion of Modern Retail Infrastructure and E-Commerce Platforms

The rapid development of modern retail formats and digital commerce platforms is significantly enhancing instant food product accessibility across Saudi Arabia's diverse geographic regions. Supermarkets and hypermarkets continue expanding their footprint in urban centers and emerging residential areas, with major retailers investing heavily in new store openings and facility upgrades. The online grocery market is experiencing substantial growth, supported by rising consumer adoption of digital payment methods across the Kingdom. Quick commerce platforms offering rapid delivery within urban areas have gained significant consumer adoption, particularly among younger demographics who value convenience. The integration of physical retail with digital ordering capabilities through omnichannel strategies enables instant food manufacturers to reach broader consumer segments efficiently while maintaining competitive pricing through optimized supply chain operations.

Product Innovation and Localization Aligned with Cultural Preferences

The continuous innovation in instant food product development, with particular emphasis on localized flavors and halal certification, is strengthening consumer acceptance and driving market penetration across diverse demographic segments. Manufacturers are introducing traditional Saudi and Middle Eastern flavors in convenient instant formats, effectively bridging the gap between cultural food preferences and modern convenience requirements. Health-focused innovation including low-sodium formulations, gluten-free options, and nutrient-fortified products addresses the growing health consciousness among urban consumers. The strict adherence to halal standards throughout manufacturing processes builds essential consumer trust in a market where Islamic dietary requirements are paramount. Companies are also investing in sustainable packaging solutions that appeal to environmentally conscious consumers while maintaining product freshness and shelf life, creating differentiation opportunities in an increasingly competitive marketplace.

Market Restraints:

What Challenges the Saudi Arabia Instant Food Market is Facing?

Health Concerns Regarding Preservatives and Nutritional Content

Growing consumer awareness about health and nutrition presents significant challenges for the instant food market, as many products contain elevated levels of preservatives, sodium, and processed ingredients. Health-conscious consumers are increasingly scrutinizing nutritional labels before purchase, with concerns about the long-term health implications of regular instant food consumption. The rising prevalence of obesity and diabetes in Saudi Arabia has heightened regulatory attention toward food labeling requirements, potentially leading to stricter nutritional guidelines that could increase reformulation costs for manufacturers.

Competition from Fresh and Traditional Food Alternatives

The deeply rooted cultural preference for fresh, home-cooked traditional meals among Saudi consumers poses a challenge to instant food market expansion, particularly in family-oriented consumption occasions. Traditional grocery stores and local food markets continue serving consumers who prioritize fresh ingredients over packaged convenience products. The growing availability of restaurant delivery services and cloud kitchen operations offers alternative convenience solutions that may be perceived as healthier or more satisfying than instant food products, intensifying competition for consumer food expenditure.

Supply Chain Vulnerabilities and Import Dependency

The reliance on imported raw materials and finished instant food products creates supply chain vulnerabilities that can affect product availability and pricing stability. Global price fluctuations, geopolitical tensions, and logistical disruptions can impact import costs and delivery timelines, particularly for specialty ingredients and packaging materials. The geographic diversity of Saudi Arabia complicates domestic distribution logistics, especially in reaching remote and rural areas where retail infrastructure remains less developed compared to major urban centers.

Competitive Landscape:

The Saudi Arabia instant food market exhibits a moderately competitive landscape characterized by the presence of both established multinational corporations and strong regional manufacturers. Market players differentiate themselves through product quality, flavor innovation, pricing strategies, and distribution network expansion. Companies are increasingly investing in local manufacturing capabilities to reduce import dependency, strengthen supply chain resilience, and align with Vision 2030 localization objectives. Strategic partnerships between international brands and local distributors enable efficient market penetration while maintaining compliance with regulatory requirements. Competition intensifies around promotional activities, shelf space positioning, and digital marketing initiatives that target younger consumer demographics through social media and influencer collaborations. The emphasis on halal certification and cultural authenticity remains a critical competitive factor for market success.

Saudi Arabia Instant Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Instant Canned Food, Instant Breakfast, Cereal-Based Food, Instant Pasta Food, Instant Dairy Products, Instant Weaning Food, Instant Functional Food, Instant Noodles, Instant Soups, Instant Meat Products, Others |

| Pack Sizes Covered | Single Pack, Four Pack, Six Pack, Others |

| Packaging Materials Covered | Cardboard Boxes, Pouches, Plastic Cups, Others |

| Diet Types Covered | Vegetarian, Non-Veg, Vegan |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Traditional Grocery Stores, Online Retailing, Convenience Stores, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia instant food market size was valued at USD 1,044.2 Million in 2025.

The Saudi Arabia instant food market is expected to grow at a compound annual growth rate of 7.27% from 2026-2034 to reach USD 1,964.1 Million by 2034.

Instant noodles dominated the market with a share of 22%, driven by their affordability, quick preparation time, widespread retail availability, and strong consumer preference for chicken-flavored varieties that align with local taste preferences.

Key factors driving the Saudi Arabia instant food market include rising female workforce participation under Vision 2030, expanding retail infrastructure, growing urbanization, increasing disposable incomes, product innovation with localized flavors, and enhanced e-commerce accessibility.

Major challenges include health concerns regarding preservatives and sodium content, competition from fresh and traditional food alternatives, supply chain vulnerabilities, import dependency for raw materials, and the need to balance convenience with nutritional quality expectations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)