Saudi Arabia Instant Soups Market Size, Share, Trends and Forecast by Nature, Form, Source, Distribution Channel, End Use, and Region, 2026-2034

Saudi Arabia Instant Soups Market Summary:

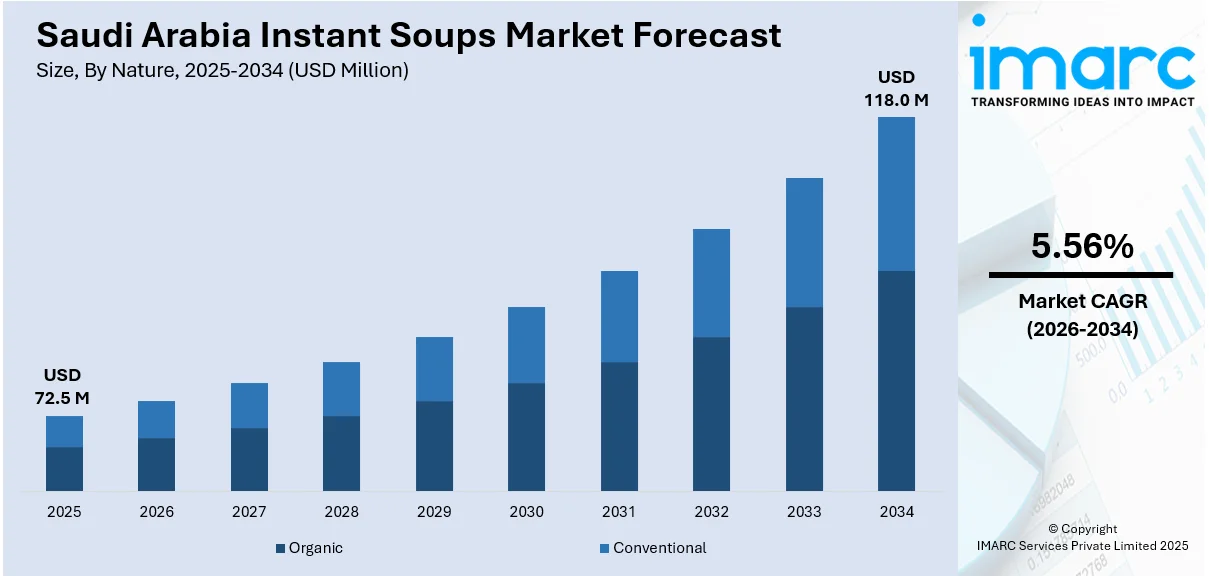

The Saudi Arabia instant soups market size was valued at USD 72.5 Million in 2025 and is projected to reach USD 118.0 Million by 2034, growing at a compound annual growth rate of 5.56% from 2026-2034.

The market for instant soups in Saudi Arabia is expanding steadily due to the country's fast urbanization, changing consumer habits, and rising demand from working professionals and households for quick lunch options. Product accessibility throughout the Kingdom is being improved by the growth of contemporary retail channels and e-commerce platforms. Rising health consciousness among consumers is also generating demand for nutritious and conveniently cooked soup variations that match with contemporary dietary habits.

Key Takeaways and Insights:

- By Nature: Conventional dominates the market with a share of 74% in 2025, owing to its widespread availability, affordability, and established consumer acceptance. The preference for familiar flavors and cost-effective meal solutions continues driving conventional instant soup adoption across retail and foodservice channels.

- By Form: Dry leads the market with a share of 65% in 2025. This dominance is driven by extended shelf life, ease of storage, transportation convenience, and lower production costs that enable competitive pricing while maintaining product quality and flavor consistency.

- By Source: Plant-based exhibits a clear dominance with 60% share in 2025, reflecting growing consumer preference for vegetable-based nutrition, health-conscious dietary choices, and sustainable food options. Traditional lentil and vegetable soup varieties remain popular across diverse consumer segments.

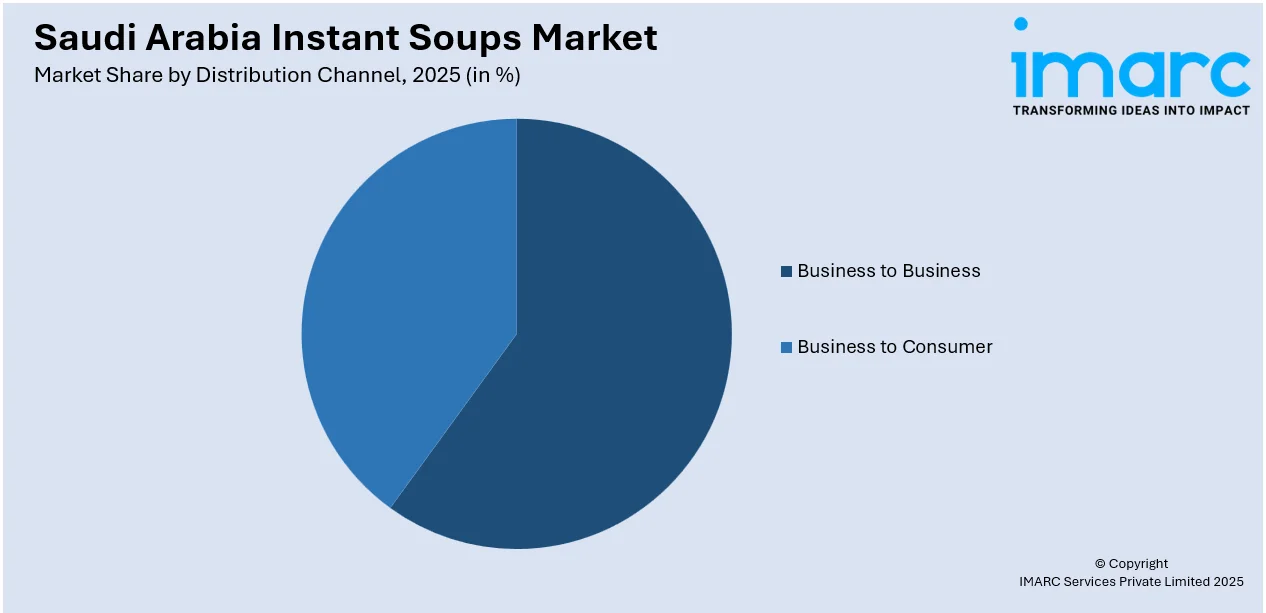

- By Distribution Channel: Business to consumer represents the biggest segment with a market share of 69% in 2025, reflecting the strong retail infrastructure and expanding e-commerce platforms that enable direct consumer access to diverse instant soup products throughout the Kingdom.

- By End Use: Retail/household dominates the market with a share of 74% in 2025, owing to increasing at-home consumption trends, busy household lifestyles, and growing preference for quick meal preparation options among families and working professionals.

- By Region: Northern and Central Region is the largest region with 30% share in 2025, driven by the concentration of population in Riyadh and surrounding urban centers, higher disposable incomes, and extensive retail infrastructure supporting convenient food product distribution.

- Key Players: Key players drive the Saudi Arabia instant soups market by expanding product portfolios, introducing innovative flavor profiles, and strengthening distribution networks. Their investments in marketing, product reformulation for healthier options, and partnerships with retailers boost consumer awareness, accelerate adoption, and ensure consistent product availability across diverse consumer segments throughout the Kingdom.

To get more information on this market Request Sample

The Saudi Arabia instant soups market is witnessing transformative growth fueled by fundamental shifts in consumer behavior, demographic changes, and retail landscape evolution. The Kingdom's rapidly urbanizing population, with urban residents comprising over ninety-two percent of the total population, is increasingly gravitating toward convenient meal solutions that accommodate demanding work schedules and modern lifestyles. The labor force participation rate of Saudi women reached 36.2 percent in the third quarter of 2024, according to the General Authority for Statistics, highlighting the expanding influence of women in the workforce and consequent demand for time-saving food solutions. This demographic shift is complemented by the growing expatriate community seeking affordable and familiar food options. Modern retail formats including supermarkets and hypermarkets are steadily expanding their presence, with major retailers assigning increasing shelf space to instant food categories. The convergence of e-commerce growth, health-conscious consumption patterns, and product innovation is creating substantial opportunities for market participants to capture evolving consumer preferences and expand their footprint across the Saudi instant soups landscape.

Saudi Arabia Instant Soups Market Trends:

Rising Demand for Convenient and Ready-to-Eat Meal Solutions

Rapid urbanization and changing consumer lifestyles are driving strong demand for instant soups in Saudi Arabia. Young consumers, dual-income households, and busy professionals are looking for quick meal preparation solutions that fit their busy schedules without sacrificing flavor or nutrition. Convenient meal options have become necessary everyday necessities due to the growth of contemporary workplaces, retail establishments, and entertainment venues. In response, retailers are increasing the variety of instant soups they sell and enhancing product positioning to encourage impulsive sales.

Growing Preference for Healthier and Nutritious Soup Varieties

Health consciousness is altering product development methods within the Saudi instant soups market. Customers are looking for products with lower sodium content, natural ingredients, and improved nutritional profiles, and they are closely examining nutritional labels. Manufacturers have responded to this change by reformulating current products and launching new ones with low-fat formulas, organic ingredients, and additional functional advantages. The movement toward clean-label products stressing openness in ingredient origin is gaining steam across urban consumer categories seeking healthful meal choices.

Digital Commerce and Online Grocery Platform Expansion

The rapid rise of e-commerce and online grocery delivery services is redefining how consumers access instant soup products in Saudi Arabia. Convenient home delivery, more extensive product discovery, and subscription-based buying models that increase customer loyalty are all made possible by digital platforms. To facilitate quick delivery of groceries, especially instant soups, quick-commerce companies are setting up micro-fulfillment centers and dark storefronts. Younger groups, who want seamless purchasing experiences through mobile applications and online marketplaces, are especially receptive to this digital shift.

How Vision 2030 is Transforming the Saudi Arabia Instant Soup Market:

Through strategic investments in local food manufacturing facilities and supply chain modernization, Saudi Arabia's Vision 2030 plan is radically changing the instant soup market landscape. The national economic transformation program places a high priority on improving food security and reducing reliance on imports, which fosters the growth of domestic instant soup production. Government-backed industrial clusters dedicated to food processing are luring industry investments while optimizing logistics networks across the Kingdom. Regulatory frameworks encouraging quality standards and consumer protection are increasing product credibility and market integrity. The initiative's focus on workforce development, notably expanding female labor participation, is simultaneously generating demand for convenient meal options among time-constrained households. These integrated policy actions are developing sustainable foundations for long-term market growth and competitive domestic manufacturing capabilities.

Market Outlook 2026-2034:

The Saudi Arabia instant soups market outlook remains highly positive, underpinned by sustained urbanization, demographic shifts, and evolving consumer preferences toward convenient meal solutions. The market is poised for continued expansion as modern retail formats proliferate across secondary cities and digital commerce penetration deepens among diverse consumer segments. The market generated a revenue of USD 72.5 Million in 2025 and is projected to reach a revenue of USD 118.0 Million by 2034, growing at a compound annual growth rate of 5.56% from 2026-2034. Government initiatives under Vision 2030 aimed at boosting local food manufacturing and enhancing food security are creating favorable conditions for market participants. The Jeddah Food Industry Cluster, established with investments of SAR 20 Billion, is expected to strengthen domestic production capabilities. Product innovation focusing on healthier formulations, localized flavors, and premium offerings will drive differentiation strategies as competition intensifies across the market landscape.

Saudi Arabia Instant Soups Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Nature |

Conventional |

74% |

|

Form |

Dry |

65% |

|

Source |

Plant-based |

60% |

|

Distribution Channel |

Business to Consumer |

69% |

|

End Use |

Retail/Household |

74% |

|

Region |

Northern and Central Region |

30% |

Nature Insights:

- Organic

- Conventional

Conventional dominates with a market share of 74% of the total Saudi Arabia instant soups market in 2025.

The typical instant soups segment maintains its leading position through widespread product availability, established brand awareness, and competitive pricing strategies that appeal to price-sensitive customers across diverse demographic groups. The Kingdom's urban, semi-urban, and growing retail settings are all covered by mass-market distribution via supermarkets, hypermarkets, and conventional grocery stores. While economies of scale in manufacturing operations allow producers to maintain attractive price points that consistently drive volume sales and market penetration, consumer familiarity with traditional soup flavors and preparation formats fosters strong purchase loyalty and repeat buying behaviors.

Strong supply chain architecture and extended shelf-life features that lessen distribution difficulties, lower inventory losses, and make stock management easier for merchants of all sizes greatly benefit this market. Modern retail locations are progressively devoting more shelf space to handy food categories as consumer demand continues strengthening throughout market channels. With established retail channels, recognizable packaging formats, and affordability-focused positioning strategies, product innovation in the conventional segment increasingly concentrates on introducing regional flavor profiles and culturally relevant recipes that complement local culinary preferences while maintaining widespread accessibility.

Form Insights:

- Dry

- Liquid

Dry leads with a share of 65% of the total Saudi Arabia instant soups market in 2025.

The dry instant soups category commands market leadership through intrinsic benefits in storage stability, transportation efficiency, and prolonged shelf life that appeal to both merchants and consumers seeking reliable pantry options. Lightweight packaging allows households looking for dependable meal staples that stay fresh for extended periods of time to conveniently stockpile while drastically lowering logistics costs throughout the distribution chain. The ease of preparation of adding hot water is ideal for meeting consumer demands for quick meal solutions that don't require a lot of kitchen equipment, a lot of cooking experience, or a significant amount of time for preparation and cleanup.

Manufacturing efficiency in dry soup production enables competitive pricing while supporting diverse product formulations across flavor categories. The Saudi Arabia instant food market size reached USD 1,044.2 Million in 2025, with dry formats representing a significant portion of overall instant food consumption. Innovations in seasoning technology, dehydration techniques, and packaging designs continue enhancing product quality and consumer experience within the dry soup category, strengthening its market position against liquid alternatives.

Source Insights:

- Animal-based

- Plant-based

The plant-based exhibits a clear dominance with 60% share of the total Saudi Arabia instant soups market in 2025.

Plant-based quick soups maintain market leadership by strong congruence with traditional culinary tastes favoring lentil, vegetable, and grain-based soup variants profoundly anchored in Middle Eastern cuisine and regional cuisines. Plant-based choices are becoming more popular among health-conscious customers since they are seen to be lighter, easier to digest, and more nutritious for sustaining balanced eating habits. The market gains from increased consumer acceptability across a range of dietary needs, such as vegetarian households, health-conscious people, and those actively looking to cut back on meat intake as part of lifestyle changes.

Urban consumer demographics and younger population cohorts are seeing faster sector growth due to increased knowledge of plant-based diets and the health benefits they offer. Plant-based instant soup development with creative ingredient combinations, superior nutritional profiles, and better taste sensations is encouraged by the growing interest in plant-derived food items. In response to changing consumer needs for convenience and healthful nutrition, manufacturers are producing a variety of vegetable blends, ancient grain formulations, and plant-based versions enhanced with protein. The sector strength is further reinforced by the cultural resonance of classic plant-based soup recipes, which link contemporary convenience forms with well-known flavors that are loved by all generations in the Kingdom.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Business to Business

- Business to Consumer

Business to consumer represents the leading segment with 69% share of the total Saudi Arabia instant soups market in 2025.

The business-to-consumer distribution channel dominates the market through extensive retail infrastructure comprising supermarkets, hypermarkets, convenience stores, and traditional grocery outlets strategically positioned across the Kingdom. Modern retail formats continue expanding their geographic presence, establishing outlets in emerging residential communities, commercial districts, and suburban developments to capture growing consumer demand. The proliferation of organized retail provides consumers with convenient access to diverse instant soup brands, product variants, and packaging options under comprehensive single-roof shopping experiences that simplify purchasing decisions.

E-commerce and online grocery platforms are emerging as significant contributors to the business-to-consumer segment growth trajectory, fundamentally transforming how consumers discover and purchase instant soup products. Quick-commerce services and home delivery applications are enabling consumers to acquire instant soup products with unprecedented convenience, speed, and reliability, particularly resonating with residents of major urban centers where digital adoption rates remain exceptionally elevated. Mobile shopping applications, subscription services, and personalized recommendation algorithms are enhancing consumer engagement while expanding market reach beyond traditional retail boundaries. This digital transformation complements physical retail channels, creating integrated omnichannel experiences that maximize consumer convenience and accessibility throughout the purchasing journey.

End Use Insights:

- Foodservice

- Retail/Household

Retail/household dominates with a market share of 74% of the total Saudi Arabia instant soups market in 2025.

The retail and household segment maintains overwhelming market dominance driven by strong at-home consumption patterns among Saudi families and working professionals seeking convenient meal solutions that accommodate demanding daily schedules. Dual-income households with limited cooking time increasingly rely on instant soups as quick appetizers, light meals, nutritious snacks, or complementary accompaniments to main dishes during family gatherings. The segment benefits substantially from growing product availability across multiple retail formats and the continuous expansion of home delivery services that significantly enhance consumer convenience and accessibility.

Consumer preferences for home-prepared meals continue supporting retail channel strength, with instant soups offering affordable and practical options that align with household budget considerations and meal planning requirements. The expanding retail landscape creates favorable conditions for instant soup sales growth through improved product visibility and distribution reach. Promotional activities, strategic shelf placement initiatives, attractive bundling offers, and retailer loyalty programs further strengthen the retail and household segment's competitive market position. Additionally, the cultural emphasis on family dining and home-centered meal occasions reinforces sustained demand for household-oriented instant soup products that deliver quality, convenience, and value across diverse consumer segments.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region leads with a share of 30% of the total Saudi Arabia instant soups market in 2025.

The Northern and Central Region commands market leadership through the substantial concentration of population, economic activity, and retail infrastructure centered around Riyadh, the capital city, and its surrounding metropolitan areas. Higher disposable incomes among residents support premium product purchases and willingness to explore diverse instant soup varieties, while extensive supermarket and hypermarket presence ensures comprehensive product availability across neighborhood and destination shopping formats. The region benefits from advanced logistics networks enabling efficient distribution operations and rapid e-commerce fulfillment services that meet evolving consumer expectations for convenience and speed.

The concentration of corporate offices, government institutions, and commercial enterprises creates substantial demand for convenient meal solutions among working professionals navigating demanding schedules. Modern residential developments and expanding suburban communities continue driving retail infrastructure investments that enhance instant soup accessibility throughout the region. Additionally, the presence of major distribution centers and warehousing facilities strengthens supply chain efficiency, ensuring consistent product availability and freshness across retail channels. The region's sophisticated consumer base demonstrates receptiveness to product innovations, healthier formulations, and premium offerings, making it a strategically important market for manufacturers seeking to establish brand presence and test new product concepts before broader national rollouts.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Instant Soups Market Growing?

Rapid Urbanization and Evolving Consumer Lifestyles

The Saudi Arabia instant soups market is experiencing substantial growth driven by accelerating urbanization and fundamental shifts in consumer lifestyles across the Kingdom. The concentration of population in major metropolitan areas including Riyadh, Jeddah, and Dammam is creating environments where convenience-oriented food solutions become essential components of daily life. Urban residents face demanding work schedules, lengthy commutes, and time constraints that limit traditional cooking practices, driving preference for ready-to-prepare meal options that deliver satisfying nutrition without extensive preparation requirements. The demographic composition of urban centers, characterized by young professionals, expatriate workers, and dual-income households, creates receptive consumer segments for instant soup products offering affordability and convenience. Modern housing developments with compact kitchen spaces further reinforce demand for easy-to-prepare food items that minimize cooking complexity while addressing nutritional needs.

Expansion of Modern Retail Infrastructure and E-Commerce Platforms

The proliferation of modern retail formats and digital commerce channels is significantly enhancing instant soup product accessibility throughout Saudi Arabia. Supermarkets and hypermarkets operated by leading retailers are expanding their geographic footprint, bringing organized retail experiences to previously underserved areas and increasing product touchpoints for consumers. These modern retail environments provide optimal conditions for instant soup merchandising through dedicated shelf space, promotional displays, and category management strategies that drive consumer awareness and trial purchases. Simultaneously, e-commerce platforms and quick-commerce services are revolutionizing grocery purchasing behaviors by enabling convenient online ordering and rapid home delivery. Digital platforms facilitate product discovery across extensive assortments while subscription models and personalized recommendations enhance customer engagement. The convergence of physical and digital retail channels creates omnichannel experiences that maximize consumer convenience and support market expansion.

Government Initiatives Supporting Local Food Manufacturing

Saudi Arabia's Vision 2030 economic transformation program is creating favorable conditions for instant soup market development through strategic initiatives supporting local food manufacturing and enhanced food security. Government investments in industrial infrastructure including specialized food production clusters are enabling manufacturers to establish domestic production facilities that reduce import dependence and improve supply chain resilience. These initiatives encompass regulatory frameworks encouraging food industry investment, financing programs supporting manufacturing capacity expansion, and incentives promoting technology adoption in food processing operations. The focus on localizing food production aligns with broader economic diversification objectives while creating opportunities for market participants to develop products tailored to regional taste preferences. Supporting policies addressing quality standards, labeling requirements, and consumer protection enhance market integrity and build consumer confidence in locally manufactured instant soup products.

Market Restraints:

What Challenges the Saudi Arabia Instant Soups Market is Facing?

Growing Health Consciousness and Nutritional Concerns

Increasing consumer awareness regarding health and nutrition presents challenges for the Saudi Arabia instant soups market as consumers scrutinize product ingredients and nutritional profiles. Concerns about high sodium content, artificial additives, and preservatives commonly associated with instant food products are influencing purchasing decisions among health-conscious demographics. This trend is compelling manufacturers to reformulate products with healthier ingredient compositions, potentially increasing production costs and affecting price competitiveness.

Competition from Alternative Convenient Meal Options

The Saudi Arabia instant soups market faces intensifying competition from expanding categories of convenient meal alternatives including ready-to-eat meals, food delivery services, and fresh prepared foods available at retail outlets. The rapid growth of restaurant delivery applications and cloud kitchens provides consumers with diverse quick-service options that compete directly with home-prepared instant meals. This competitive pressure requires instant soup manufacturers to continuously innovate and enhance value propositions to maintain consumer relevance.

Stringent Regulatory Requirements and Compliance Costs

The implementation of comprehensive food safety regulations and labeling requirements by the Saudi Food and Drug Authority creates compliance challenges for instant soup market participants. Mandatory nutritional labeling, halal certification requirements, and product registration procedures involve administrative complexity and associated costs that impact market entry and operational efficiency. Smaller manufacturers may face particular challenges meeting evolving regulatory standards while maintaining competitive pricing structures.

Competitive Landscape:

The Saudi Arabia instant soups market exhibits a moderately competitive landscape characterized by the presence of established international manufacturers alongside regional and local players serving diverse consumer segments. Market participants compete through product innovation, pricing strategies, distribution network expansion, and brand building initiatives aimed at capturing consumer loyalty. International brands leverage global research and development capabilities, manufacturing expertise, and established brand recognition to maintain market positions, while local manufacturers emphasize cultural relevance, regional flavor profiles, and competitive pricing to attract price-conscious consumers. The competitive environment is intensifying as retailers expand private label offerings and new entrants seek market opportunities through differentiated product propositions. Strategic partnerships between manufacturers and distributors, investments in marketing communications, and e-commerce channel development represent key competitive strategies being deployed across the market landscape.

Saudi Arabia Instant Soups Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Natures Covered | Organic, Conventional |

| Forms Covered | Dry, Liquid |

| Sources Covered | Animal-based, Plant-based |

| Distribution Channels Covered | Business to Business, Business to Consumer |

| End Uses Covered | Foodservice, Retail/Household |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia instant soups market size was valued at USD 72.5 Million in 2025.

The Saudi Arabia instant soups market is expected to grow at a compound annual growth rate of 5.56% from 2026-2034 to reach USD 118.0 Million by 2034.

Conventional dominated the market with a share of 74%, driven by widespread availability, established consumer acceptance, and competitive pricing that appeals to diverse consumer segments across retail channels.

Key factors driving the Saudi Arabia instant soups market include rapid urbanization, evolving consumer lifestyles demanding convenient meal solutions, expansion of modern retail infrastructure, growth of e-commerce platforms, and government initiatives supporting local food manufacturing.

Major challenges include growing health consciousness among consumers regarding sodium and additive content, intensifying competition from alternative convenient meal options, stringent regulatory requirements, and compliance costs associated with food safety and labeling standards.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)