Saudi Arabia Insulation Materials Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Saudi Arabia Insulation Materials Market Overview:

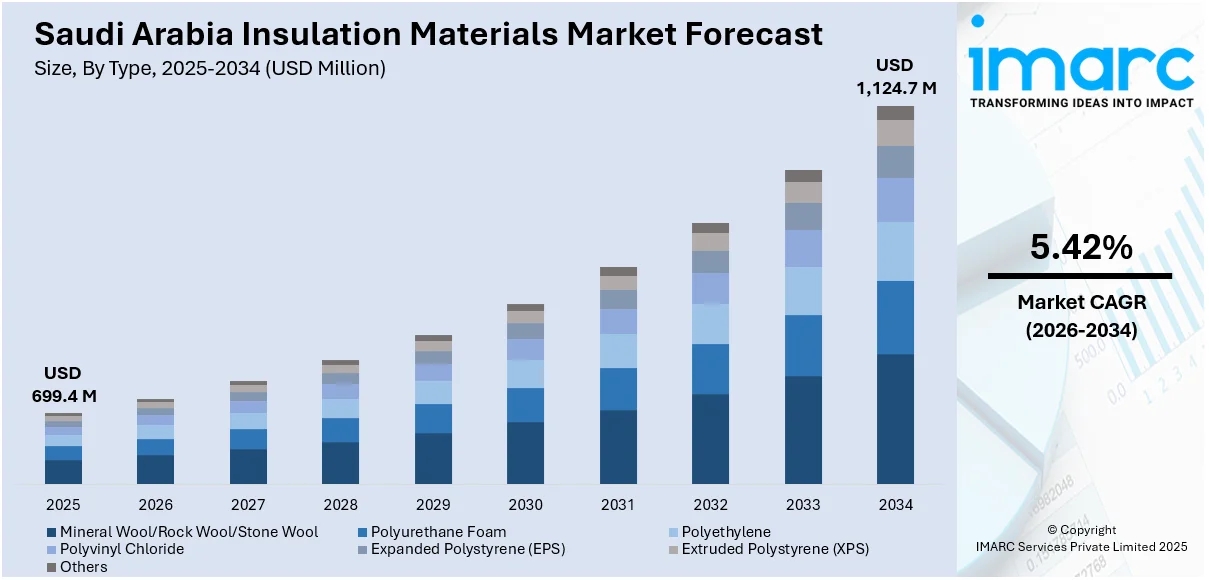

The Saudi Arabia insulation materials market size reached USD 699.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,124.7 Million by 2034, exhibiting a growth rate (CAGR) of 5.42% during 2026-2034. The market is driven by national energy efficiency regulations requiring insulation in buildings and real estate megaprojects aligned with Vision 2030 goals. Rapid industrial growth across petrochemicals and logistics is fueling demand for thermal containment materials. Smart city construction and sustainable development initiatives are integrating advanced insulation for long-term energy savings, further augmenting the Saudi Arabia insulation materials market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 699.4 Million |

| Market Forecast in 2034 | USD 1,124.7 Million |

| Market Growth Rate 2026-2034 | 5.42% |

Saudi Arabia Insulation Materials Market Trends:

Regulatory Push for Energy Efficiency in Buildings

Saudi Arabia’s Vision 2030 prioritizes reduced energy consumption, leading to the implementation of stringent building codes that emphasize insulation performance. The Saudi Building Code requires thermal insulation in residential and commercial structures to reduce electricity usage for cooling. As HVAC systems account for a significant portion of energy demand, proper insulation helps stabilize indoor temperatures and minimizes power strain. Government initiatives through the Saudi Energy Efficiency Center (SEEC) are actively auditing buildings and enforcing compliance, prompting developers to adopt mineral wool, polyurethane foam, and reflective insulation panels. With real estate megaprojects—such as NEOM, Qiddiya, and Red Sea Global—integrating sustainability targets from the design phase, insulation materials are being embedded into green building strategies. Moreover, municipalities in Riyadh and the Eastern Province are prioritizing heat-resistant, flame-retardant materials due to extreme weather conditions and fire safety considerations. On April 3, 2025, Arabian Fiberglass Insulation Company (AFICO), a subsidiary of Gulf Insulation Group and Zamil Industrial, adopted Nanoprecise Sci Corp’s AI-powered Energy-Centered Predictive Maintenance solution at its Dammam facility in Saudi Arabia. The system uses 6-in-1 IoT sensors and analytics to reduce unplanned downtime and energy waste, aligning with Saudi Arabia’s drive for industrial efficiency and smart manufacturing. This move positions AFICO among the first insulation manufacturers in the Kingdom to implement advanced machine health monitoring, reinforcing its leadership in operational sustainability. These systemic changes are creating a regulatory-led pathway for thermal insulation to become standard practice across all new developments. In the context of urban expansion and climate challenges, efficiency-centered policies are central to Saudi Arabia insulation materials market growth.

To get more information on this market Request Sample

Demand from Sustainable Construction and Smart Cities

Sustainability benchmarks, integrated into Saudi Arabia’s smart city planning and public sector developments, are increasing the uptake of environmentally responsible building materials, including advanced insulation. Projects such as NEOM are positioned as models for energy efficiency, where every material used must support low-carbon objectives and future-ready construction. Insulation materials made from recycled content or offering high R-value per inch are being favored for schools, healthcare facilities, and government offices. The rise of modular and prefabricated buildings in these projects demands insulation that is not only thermally effective but also lightweight and installation-friendly. Roofs, columns, and slabs contribute up to 93.6% of the cooling load in Saudi homes, yet 95% of buildings lack roof insulation. Using a single wall with cement–polyurethane brick (W6) reduces wall cooling load from 18.2 kW to 2.2 kW, and an optimized roof system (R3) lowers roof load from 15.5 kW to 1.76 kW—a ~9× improvement. Across 1120 configurations, smarter material choices outperformed the most expensive options in both thermal resistance and cost efficiency. Additionally, LEED and local energy certification programs encourage the use of insulation that contributes to indoor comfort and reduced HVAC loads. Saudi Arabia’s commitment to smart grids and net-zero developments further elevates the role of building envelope optimization. Developers are collaborating with material science companies to test next-generation insulation products for both thermal and acoustic control. The interplay of innovation, sustainability mandates, and smart urban planning is placing insulation at the forefront of future-oriented construction projects in the Kingdom.

Saudi Arabia Insulation Materials Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

- Mineral Wool/Rock Wool/Stone Wool

- Polyurethane Foam

- Polyethylene

- Polyvinyl Chloride

- Expanded Polystyrene (EPS)

- Extruded Polystyrene (XPS)

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes mineral wool/rock wool/stone wool, polyurethane foam, polyethylene, polyvinyl chloride, expanded polystyrene (EPS), extruded polystyrene (XPS), and others.

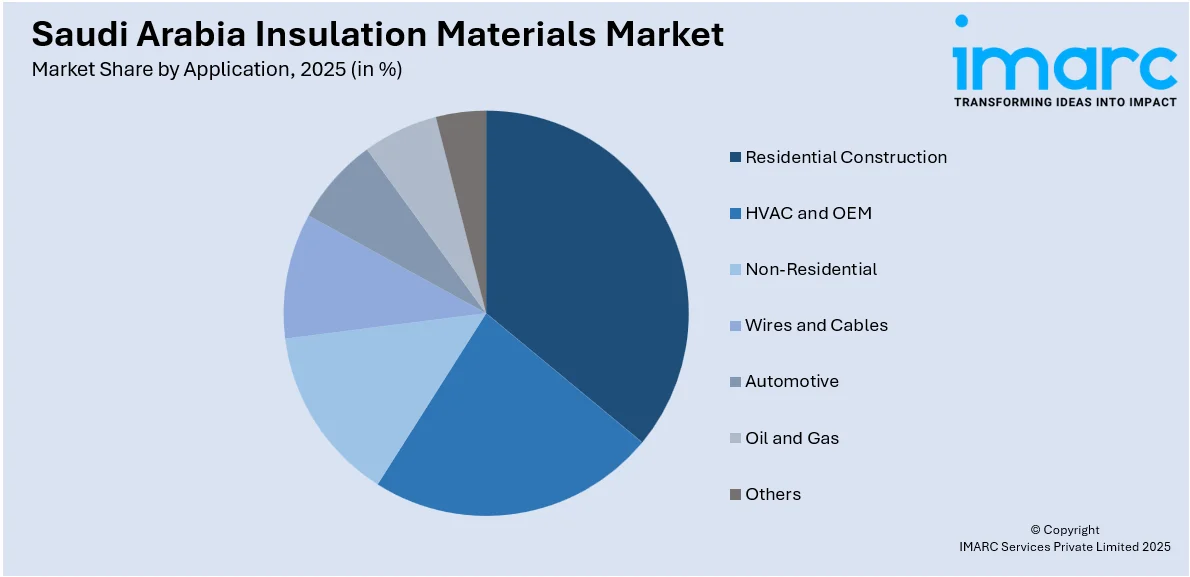

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential Construction

- HVAC and OEM

- Non-Residential

- Wires and Cables

- Automotive

- Oil and Gas

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential construction, HVAC and OEM, non-residential, wires and cables, automotive, oil and gas, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Insulation Materials Market News:

- On May 21, 2025, Gulf-O-Flex inaugurated Saudi Arabia’s first fully localized thermal insulation manufacturing facility, marking a strategic advancement in the Kingdom’s push for industrial self-reliance and energy efficiency under Vision 2030. The new plant is designed to serve the country’s expanding construction, HVAC, and infrastructure sectors, with local production expected to significantly reduce lead times and support domestic job creation. Engineered to global sustainability and safety standards, the facility enhances Saudi Arabia’s insulation materials market by offering tailored, high-performance solutions for regional climate conditions.

Saudi Arabia Insulation Materials Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Mineral Wool/Rock Wool/Stone Wool, Polyurethane Foam, Polyethylene, Polyvinyl Chloride, Expanded Polystyrene (EPS), Extruded Polystyrene (XPS), Others |

| Applications Covered | Residential Construction, HVAC and OEM, Non-Residential, Wires and Cables, Automotive, Oil and Gas, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia insulation materials market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia insulation materials market on the basis of type?

- • What is the breakup of the Saudi Arabia insulation materials market on the basis of application?

- What is the breakup of the Saudi Arabia insulation materials market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia insulation materials market?

- What are the key driving factors and challenges in the Saudi Arabia insulation materials market?

- What is the structure of the Saudi Arabia insulation materials market and who are the key players?

- What is the degree of competition in the Saudi Arabia insulation materials market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia insulation materials market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia insulation materials market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia insulation materials industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)