Saudi Arabia Internet of Things Market Size, Share, Trends and Forecast by Component, Application, Vertical, and Region, 2026-2034

Saudi Arabia Internet of Things Market Summary:

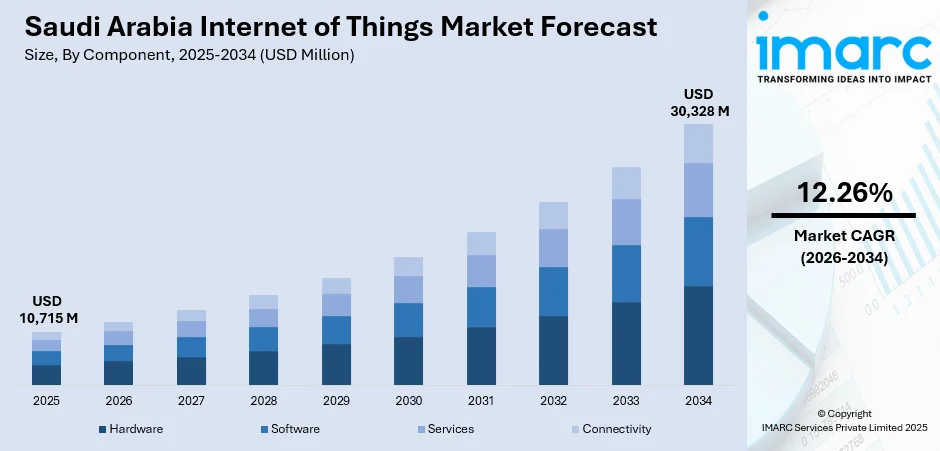

The Saudi Arabia internet of things market size was valued at USD 10,715 Million in 2025 and is projected to reach USD 30,328 Million by 2034, growing at a compound annual growth rate of 12.26% from 2026-2034.

The market is driven by the Kingdom's ambitious Vision 2030 digital transformation agenda, which prioritizes smart city development, industrial modernization, and enhanced public services through connected technologies. The rapid deployment of 5G networks across major urban centers, coupled with substantial government investments in digital infrastructure, has created a robust foundation for internet of things (IoT) adoption. Manufacturing facilities increasingly deploy connected sensors for predictive maintenance, while utilities modernize grid infrastructure with smart metering systems that enable real-time monitoring and consumption optimization, thereby expanding the Saudi Arabia internet of things market share.

Key Takeaways and Insights:

- By Component: Hardware dominates the market with a share of 42% in 2025, driven by widespread sensor deployment across smart city projects and industrial applications.

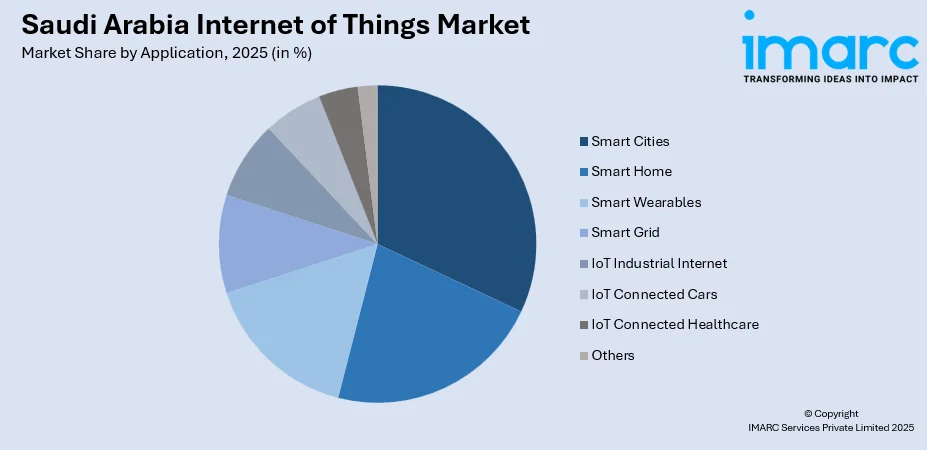

- By Application: Smart cities leads the market with a share of 24% in 2025, fueled by landmark megaprojects including NEOM and The Line that integrate IoT infrastructure.

- By Vertical: Energy represents the largest segment with a market share of 28% in 2025, reflecting extensive smart grid modernization and renewable energy integration initiatives.

- By Region: Northern and central region leads the market with a share of 30% in 2025, led by Riyadh's concentration of government facilities and technology infrastructure.

- Key Players: Key market players are expanding connectivity services, launching tailored IoT platforms, forming tech partnerships, enhancing analytics and security features, entering new industry segments, investing in local talent and infrastructure, and offering flexible pricing to attract enterprise customers and accelerate digital transformation adoption.

To get more information on this market Request Sample

The Saudi Arabia IoT market is experiencing rapid growth, driven by digital transformation efforts across various sectors. The demand for connected devices, real-time analytics, and smart infrastructure is increasing, especially in areas like smart cities, healthcare, utilities, and manufacturing. Government initiatives and the expansion of 5G networks are further accelerating adoption. In December 2025, stc Group's five-year Master Frame Agreement with Ericsson exemplified this collaborative approach, encompassing 5G hardware, cloud-native solutions, and AI-driven managed services to advance national digital infrastructure. The market is projected to grow significantly, reaching billions of dollars by 2030. A notable example of IoT's impact is a smart waste management system implemented in Makkah, where sensors monitor waste bin fill levels, triggering collection only when necessary. This system reduces fuel consumption, optimizes routes, and ensures cleaner streets, particularly during high-traffic periods like Hajj. IoT applications are also expanding in industries such as predictive maintenance, logistics, and smart home technologies, reshaping both business operations and consumer lifestyles.

Saudi Arabia Internet of Things Market Trends:

Artificial Intelligence (AI) and Machine Learning (ML) Integration Enhancing IoT Capabilities

The convergence of AI with IoT technologies represents a transformative trend reshaping the Saudi Arabian digital landscape, enabling systems to process vast sensor data streams and deliver predictive insights that optimize operations across industries. Manufacturing facilities deploy AI-powered analytics for equipment health monitoring and quality control, while smart buildings utilize machine learning algorithms to optimize energy consumption patterns based on occupancy and environmental conditions. The establishment of HUMAIN in 2025, a Public Investment Fund-owned entity operating throughout the AI value chain, marked a significant milestone by providing comprehensive AI infrastructure, cloud capabilities, next-generation data centers, and one of the most potent multimodal Arabic large language models globally.

Megaproject-Driven Smart City Development Accelerating IoT Deployment

Saudi Arabia's unprecedented investment in futuristic urban developments catalyzes comprehensive IoT infrastructure implementation at scales rarely witnessed globally, with projects integrating connected systems from initial design phases rather than retrofitting existing infrastructure. NEOM, the flagship USD 500 billion megacity spanning 26,500 square kilometers in the Kingdom's northwestern region, exemplifies this approach by incorporating advanced IoT networks, cognitive computing platforms, and autonomous systems as foundational elements. The project's partnership with stc Group in 2020 for 5G network infrastructure development established connectivity capabilities supporting IoT applications, data analytics, virtual reality, augmented reality, and autonomous vehicles. King Abdullah Financial District in Riyadh partnered with Orange Business to design, build, and operate a Smart City Platform integrating existing digital technologies, while announcing plans for an electric monorail system by 2026.

Industry 4.0 Transformation Driving Industrial IoT Adoption

Manufacturing and industrial sectors embrace connected technologies to enhance operational efficiency, reduce downtime, and optimize resource utilization through comprehensive sensor networks and real-time monitoring systems that enable data-driven decision-making. Energy facilities leverage asset monitoring solutions providing visibility into equipment performance and enabling predictive maintenance strategies that minimize unplanned outages and extend asset lifecycles. The Ministry of Industry and Mineral Resources' agreement in 2025 to launch the Industrial Transformation Exhibition in December 2025 underscored governmental commitment to showcasing advancements in automation, smart manufacturing, and Industry 4.0 technologies. Nokia and Zain KSA's deployment of the region's first 4G/5G Femtocell solution in 2025 enhanced indoor connectivity for enterprise clients, facilitating seamless Industrial IoT integration across sectors including manufacturing, logistics, and utilities.

How Vision 2030 is Transforming the Saudi Arabia Internet of Things Market:

Saudi Arabia's Vision 2030 is significantly shaping the country's IoT market, driving a shift towards technological innovation and economic diversification. The initiative aims to modernize infrastructure, enhance public services, and establish the kingdom as a hub for digital transformation. IoT plays a central role in this vision, enabling smart cities, industrial automation, and advanced healthcare systems. Key projects like NEOM, a futuristic city under development, are leveraging IoT technologies to optimize energy usage, transportation, and urban management. The government’s focus on 5G expansion is also propelling IoT adoption, as faster, more reliable connectivity supports the growing number of connected devices. Moreover, Vision 2030’s push for sustainability aligns with IoT’s role in energy management, smart grids, and waste management systems. With strategic investments in digital infrastructure and innovation, the Saudi IoT market is set to grow, driving efficiencies, enhancing quality of life, and opening new avenues for business and technology.

Market Outlook 2026-2034:

Saudi Arabia's Internet of Things market trajectory through 2033 reflects sustained momentum driven by continued megaproject development, expanding 5G coverage, and evolving regulatory frameworks that create favorable conditions for accelerated technology adoption across public and private sectors. Large-scale infrastructure initiatives, including The Line, Red Sea Project, and Qiddiya, will generate sustained demand for connected devices, platforms, and integration services as these developments progress through construction and operational phases. The market generated a revenue of USD 10,715 Million in 2025 and is projected to reach a revenue of USD 30,328 Million by 2034, growing at a compound annual growth rate of 12.26% from 2026-2034. Consumer markets will witness proliferation of connected services creating ecosystems of devices, platforms, and applications that reinforce adoption patterns and drive network effects.

Saudi Arabia Internet of Things Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Component |

Hardware |

42% |

|

Application |

Smart Cities |

24% |

|

Vertical |

Energy |

28% |

|

Region |

Northern and Central Region |

30% |

Component Insights:

- Hardware

- Software

- Services

- Connectivity

Hardware dominates with a market share of 42% of the total Saudi Arabia internet of things market in 2025.

The hardware segment commands the largest share due to extensive deployment of sensors, actuators, processors, and edge devices across smart city projects, industrial facilities, and infrastructure systems throughout the Kingdom. IoT devices market analysis reveals sensors represented a major part of the segment, reflecting widespread implementation in applications ranging from environmental monitoring to asset tracking. Manufacturing operations require comprehensive sensor networks for equipment monitoring, quality control, and predictive maintenance, while smart city initiatives deploy thousands of connected devices for traffic management, waste monitoring, and public safety applications. Edge devices segment exhibits particularly strong expansion as organizations increasingly process data closer to sources to reduce latency, enhance security, and optimize bandwidth utilization, supporting applications requiring real-time responsiveness such as autonomous systems and industrial control processes.

The proliferation of connected hardware benefits from declining component costs, improved power efficiency enabling extended battery life for remote sensors, and enhanced processing capabilities allowing sophisticated edge computing applications that reduce dependency on centralized cloud infrastructure. NEOM's ambitious development plans incorporate millions of IoT devices supporting cognitive city functions, autonomous transportation, and intelligent building management systems, creating substantial hardware demand. Smart meter deployments by utility providers, represent significant hardware volume driving segment growth. Industrial facilities increasingly adopt specialized sensors for environmental monitoring, equipment vibration analysis, and product quality verification, while agricultural applications utilize soil moisture sensors, weather stations, and irrigation controllers to optimize resource utilization in the Kingdom's challenging climate conditions.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Smart Home

- Smart Wearables

- Smart Cities

- Smart Grid

- IoT Industrial Internet

- IoT Connected Cars

- IoT Connected Healthcare

- Others

Smart cities lead with a share of 24% of the total Saudi Arabia internet of things market in 2025.

The Smart Cities application segment captures the largest share driven by the Kingdom's unprecedented investments in next-generation urban developments that integrate IoT infrastructure as foundational elements rather than supplementary features. Vision 2030's emphasis on economic diversification and improved quality of life positions smart city projects as central pillars of national transformation, with flagship initiatives like NEOM allocated USD 500 billion for development encompassing advanced IoT networks, cognitive computing platforms, and autonomous systems. Riyadh, Jeddah, and Dammam undergo comprehensive smart city transformations leveraging IoT technology to enhance urban services, improve transportation systems, reduce energy consumption, and ensure sustainable living conditions through integrated sensor networks and data analytics platforms.

Smart city implementations encompass diverse IoT applications including intelligent traffic management systems that optimize signal timing based on real-time congestion data, waste management solutions utilizing fill-level sensors to optimize collection routes, and energy-efficient buildings employing occupancy detection and environmental controls to minimize consumption. Public safety initiatives deploy connected surveillance cameras with AI-powered analytics, emergency response systems with automated incident detection, and environmental monitoring networks tracking air quality and noise levels across urban areas.

Vertical Insights:

- Healthcare

- Energy

- Public and Services

- Transportation

- Retail

- Individuals

- Others

Energy exhibits a clear dominance with a 28% share of the total Saudi Arabia internet of things market in 2025.

The Energy vertical leads market adoption as utilities and energy companies implement comprehensive IoT systems to modernize grid infrastructure, integrate renewable energy sources, and enhance operational efficiency across generation, transmission, and distribution networks. The Saudi Electricity Company's automation of the electricity distribution network, with plans to increase to 40 percent by end of 2025, demonstrates tangible progress in implementing IoT-enabled infrastructure that reduces outages, enhances reliability, and streamlines operations through real-time monitoring and automated response capabilities.

Smart meter deployments represent substantial IoT infrastructure, enabling real-time consumption monitoring, accurate billing, theft detection, and demand response programs that optimize grid loading. The smart meters market is driven by government support through Vision 2030 initiatives and nationwide deployment programs requiring installation in all new residential and commercial buildings. Renewable energy integration necessitates sophisticated grid management as solar installations, including projects create variable generation profiles requiring predictive analytics and automated balancing to maintain grid stability. IoT sensors monitor equipment health across substations, transmission lines, and generation facilities, enabling predictive maintenance that minimizes downtime and extends asset lifecycles while reducing operational costs through optimized inspection schedules and targeted interventions.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and central region leads with a share of 30% of the total Saudi Arabia internet of things market in 2025.

The Northern and Central Region commands the largest market share owing to Riyadh's role as the Kingdom's capital and primary hub for government facilities, technology infrastructure, and economic activity that concentrates IoT deployment across multiple sectors. The region hosts extensive government digitalization initiatives implementing IoT solutions for public services, with the Ministry of Health's introduction of Digital Twin features on the Sehhaty app in October 2024 exemplifying citizen-facing applications that reached 31 million users. Healthcare facilities throughout Riyadh implement IoT-enabled patient monitoring systems, asset tracking solutions, and telemedicine platforms.

King Abdullah Financial District represents a concentrated smart city implementation within the region, with Orange Business partnership delivering integrated smart city platform connecting digital technologies and services for the Kingdom's premier business district. Industrial facilities across the region deploy Industrial IoT solutions for manufacturing automation, supply chain optimization, and quality control, while logistics operations utilize asset tracking and fleet management systems. NEOM's development in the northwestern portion of the region, spanning 26,500 square kilometers with planned IoT infrastructure supporting cognitive city functions, will substantially increase regional IoT deployment through the forecast period. Research institutions and universities concentrated in Riyadh foster innovation ecosystems that develop localized IoT solutions tailored to regional requirements, while government backing through Vision 2030 prioritizes the region for pilot programs and large-scale technology implementations that subsequently expand to other areas of the Kingdom.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Internet of Things Market Growing?

Government Vision 2030 Digital Transformation Initiatives

Saudi Arabia's Vision 2030 framework establishes digital transformation as a central pillar of economic diversification and modernization efforts, with specific programs and substantial financial commitments creating favorable conditions for IoT deployment across public and private sectors. The National Transformation Program outlines concrete objectives for technology integration across healthcare, education, transportation, and public services, while regulatory reforms streamline approval processes and establish standards facilitating interoperability and security. Government agencies lead by example through extensive digital infrastructure projects, with the Saudi Electricity Company's deployment of 11 million smart meters demonstrating scale and commitment to modernization. By 2024, the Saudi government allocated over USD 500 billion to megacity and smart infrastructure projects including NEOM and The Line, providing unprecedented opportunities for IoT solution providers and system integrators. Healthcare sector initiatives, including the Health Sector Transformation Program, emphasize telemedicine and remote monitoring solutions, with the Sehhaty app's Digital Twin feature launched in October 2024 serving 31 million users. Smart city programs across Riyadh, Jeddah, and Dammam receive substantial funding for intelligent traffic management, waste optimization, and environmental monitoring systems that improve urban living conditions while generating valuable operational data.

5G Network Expansion and Advanced Connectivity Infrastructure

The rapid deployment of 5G networks across Saudi Arabia's major population centers provides the high-bandwidth, ultra-low latency, and massive device connectivity capabilities essential for advanced IoT applications ranging from autonomous mobility to remote surgery and industrial automation. Investment from government and private sector strengthens IT infrastructure with industrial data centers and edge computing capabilities accelerating data processing while enhancing security, critical for industrial functions requiring real-time responsiveness and data sovereignty. In 2025, ZTE Corporation, a prominent global supplier of integrated information and communication technology solutions, along with GO Telecom of Saudi Arabia, have reached an important milestone by successfully conducting extensive outdoor trials of 5G-A millimeter-wave (mmWave) technology in the 26 GHz frequency band over considerable distances. This groundbreaking project signifies Saudi Arabia's initial long-range 5G-A mmWave experiment, heralding the start of a new phase in high-capacity final-mile access communication.

Healthcare Digitalization and Chronic Disease Management

Rising prevalence of chronic conditions including diabetes, cardiovascular disease, and hypertension drives demand for IoT-enabled remote patient monitoring solutions that enable continuous tracking of vital signs and health metrics, facilitating early intervention and reducing hospital readmissions. Connected medical devices including smart glucose meters, wearable heart monitors, and blood pressure cuffs transmit real-time data to healthcare providers, enabling timely adjustments to treatment plans and reducing need for frequent facility visits particularly valuable in the Kingdom's vast and remote regions where access to healthcare centers can be limited. Telemedicine platforms integrated with IoT devices expanded significantly following lessons learned during health crises, with healthcare facilities recognizing benefits of remote monitoring for managing patient populations while optimizing facility capacity and reducing exposure risks for vulnerable individuals. IMARC Group predicts that the Saudi Arabia internet of things (IoT) in healthcare market is projected to attain USD 24.8 Billion by 2034.

Market Restraints:

What Challenges the Saudi Arabia Internet of Things Market is Facing?

Cybersecurity Vulnerabilities and Data Privacy Concerns Limiting Adoption

The proliferation of connected devices exponentially increases attack surfaces, with each IoT endpoint representing a potential entry point for malicious actors seeking to compromise networks, steal sensitive data, or disrupt critical infrastructure operations. Smart city implementations collecting vast amounts of data about citizens' movements, behaviors, and preferences raise significant privacy concerns that must be addressed through robust governance frameworks, encryption protocols, and access controls. Organizations hesitate to deploy IoT solutions without confidence in security measures, particularly in sectors handling sensitive information like healthcare and financial services where breaches carry severe regulatory and reputational consequences. Limited cybersecurity expertise within many organizations creates vulnerabilities as systems are deployed without proper security configurations, regular patching, or monitoring capabilities. The Communications and Information Technology Commission establishes security requirements, yet enforcement and compliance verification remain ongoing challenges requiring continued investment in security infrastructure and skilled personnel.

High Initial Investment Costs and Infrastructure Requirements Creating Financial Barriers

Comprehensive IoT implementations require substantial upfront capital for hardware procurement, network infrastructure, software platforms, system integration, and ongoing operational expenses that can strain budgets particularly for small and medium enterprises. Legacy systems integration adds complexity and cost as organizations must bridge new IoT platforms with existing IT infrastructure, often requiring custom development work and middleware solutions. Return on investment timelines extend over multiple years as benefits accrue gradually through operational efficiency improvements, predictive maintenance savings, and enhanced service delivery rather than immediate revenue generation. Limited availability of financing options tailored to IoT projects, combined with uncertainty about technology evolution and standards, makes organizations cautious about committing to large-scale deployments. Organizations must also account for ongoing costs including cloud services, data storage, connectivity fees, software licensing, security updates, and skilled personnel for system management and analytics.

Limited Technical Workforce and Skills Gap Hindering Implementation

Shortage of professionals with expertise spanning IoT architecture, data analytics, cybersecurity, and domain-specific knowledge creates bottlenecks in project planning, deployment, and ongoing management of connected systems. Educational institutions have not yet fully adapted curricula to address emerging skill requirements in IoT, edge computing, and AI integration, resulting in supply-demand mismatches in the labor market. International talent recruitment faces challenges including work authorization processes, compensation expectations, and cultural adaptation, while organizations compete intensely for limited pool of experienced IoT specialists. Training existing workforce requires time and resources, with employees needing to develop competencies beyond traditional IT skills including understanding of operational technology, wireless protocols, sensor technologies, and industry-specific applications. Rapid pace of technological change necessitates continuous learning as new platforms, protocols, and best practices emerge, placing additional burden on organizations to maintain current knowledge among technical staff.

Competitive Landscape:

The Saudi Arabia IoT market features diverse competitive dynamics with international technology corporations establishing partnerships alongside domestic entities to address market requirements across infrastructure, platform, and application layers. Major multinational players leverage global expertise and comprehensive product portfolios to serve enterprise and government clients deploying large-scale IoT implementations. Regional telecommunications operators hold advantageous positions through ownership of network infrastructure and existing customer relationships enabling bundled connectivity and IoT services. System integrators and solution providers compete on vertical expertise, with specialized firms focusing on healthcare, industrial, energy, or smart city applications offering tailored implementations addressing sector-specific requirements. The market exhibits moderate barriers to entry for niche applications where innovative startups develop specialized sensors or analytics platforms, yet comprehensive infrastructure projects favor established players with proven track records and financial resources to execute complex, multi-year deployments serving government megaproject initiatives.

Recent Developments:

- In October 2025, The Global Internet of Things Congress 2025 (GIoTC 2025) is poised to be held in Riyadh, Saudi Arabia on 21st October 2025. The three-day event will put Riyadh in the spotlight as a regional powerhouse of emerging IoT technologies and is the largest dedicated IoT event in Saudi Arabia and the wider MENA region.

- In February 2025, Myriota, the worldwide supplier of secure, affordable, and long-lasting battery satellite IoT connectivity, has announced their completion of the Kingdom’s Communications, Space and Technology Commission (CST) Emerging Technologies Regulatory Sandbox program. The initiative aligns with CST’s goal to enhance regulatory maturity, fast-track digital transformation, and promote innovative solutions in partnership with global and national organizations.

Saudi Arabia Internet of Things Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services, Connectivity |

| Applications Covered | Smart Home, Smart Wearables, Smart Cities, Smart Grid, IoT Industrial Internet, IoT Connected Cars, IoT Connected Healthcare, Others |

| Verticals Covered | Healthcare, Energy, Public and Services, Transportation, Retail, Individuals, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia internet of things market size was valued at USD 10,715 Million in 2025.

The Saudi Arabia internet of things market is expected to grow at a compound annual growth rate of 12.26% from 2026-2034 to reach USD 30,328 Million by 2034.

Hardware dominated the segment with a 42% market share in 2025, driven by extensive deployment of sensors, actuators, processors, and edge devices across smart city projects, industrial facilities, and infrastructure systems. The segment benefits from declining component costs, improved power efficiency, and enhanced processing capabilities enabling sophisticated edge computing applications, with particular strength in sensor deployments for manufacturing operations, smart city initiatives, and utility infrastructure supporting applications ranging from environmental monitoring to predictive maintenance.

Key factors driving the market include government Vision 2030 digital transformation initiatives allocating over USD 500 billion to megacity and smart infrastructure projects, rapid 5G network expansion providing high-bandwidth and ultra-low latency connectivity essential for advanced applications, healthcare digitalization expanding connected medical device adoption for chronic disease management, and industrial sector modernization embracing Industry 4.0 technologies for operational efficiency enhancement through comprehensive sensor networks and real-time monitoring systems.

Major challenges include cybersecurity vulnerabilities and data privacy concerns as proliferation of connected devices exponentially increases attack surfaces requiring robust security measures, high initial investment costs and infrastructure requirements creating financial barriers particularly for small and medium enterprises with return on investment timelines extending over multiple years, and limited technical workforce with skills gap hindering implementation as shortage of professionals with expertise spanning IoT architecture, data analytics, and cybersecurity creates bottlenecks in project planning and deployment.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)