Saudi Arabia IoT Sensors Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2026-2034

Saudi Arabia IoT Sensors Market Summary:

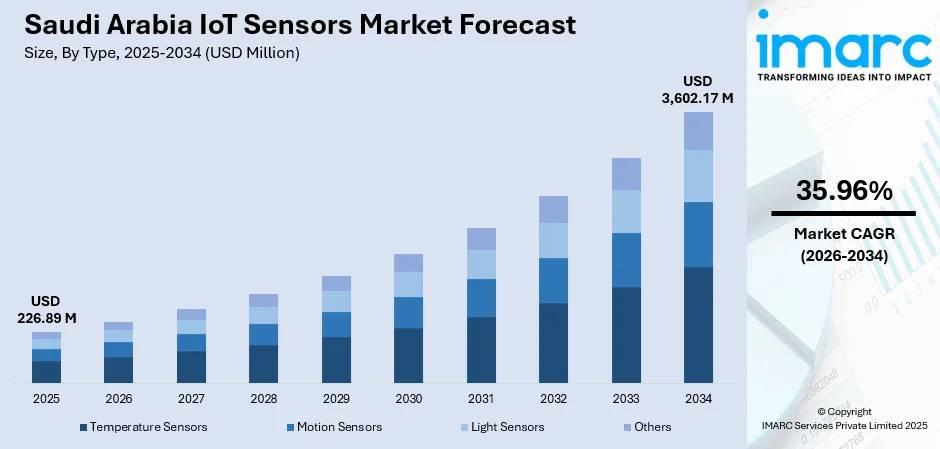

The Saudi Arabia IoT sensors market size was valued at USD 226.89 Million in 2025 and is projected to reach USD 3,602.17 Million by 2034, growing at a compound annual growth rate of 35.96% from 2026-2034.

The Saudi Arabia IoT sensors market growth is primarily driven by the Vision 2030 initiative, which is transforming the Kingdom into a global technology hub through unprecedented investments in smart city development, digital infrastructure expansion, and industrial automation. The convergence of massive infrastructure projects, rapid 5G network deployment, and increasing adoption of Industry 4.0 technologies across oil and gas, manufacturing, and consumer sectors is fundamentally reshaping the competitive landscape and creating substantial opportunities for market participants.

Key Takeaways and Insights:

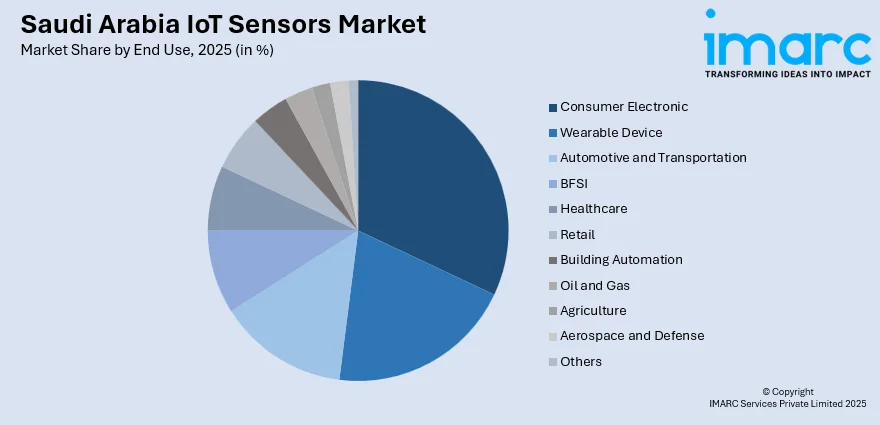

- By Type: Temperature sensors dominate the market with a share of 42% in 2025, driven by their critical applications across industrial automation, oil and gas monitoring, HVAC systems, and consumer electronics manufacturing, where precise thermal measurement ensures operational efficiency and product quality.

- By End Use: Consumer electronic leads the market with a share of 18% in 2025, owing to the Kingdom's tech-savvy population, rising smartphone penetration, the growing adoption of smart home devices, and increasing demand for wearable technology products.

- Key Players: The Saudi Arabia IoT sensors market exhibits dynamic competitive intensity, with multinational semiconductor manufacturers competing alongside regional technology providers across industrial, automotive, and consumer segments.

To get more information on this market Request Sample

The growth of Saudi Arabia IoT sensors market is supported by sustained investment in smart infrastructure, rapid industrial automation, and steady progress under national modernization initiatives. Demand is rising across utilities, transport, and manufacturing as digital upgrades require accurate sensing systems that strengthen monitoring, safety, and resource management. In 2024, Tilal Real Estates announced a $1.6 billion smart city project in Khobar covering 268,000 square meters, featuring residential, commercial, and hospitality zones designed around connected technologies, which reinforces the Kingdom’s shift toward smart infrastructure development. Furthermore, industrial and energy operators are adopting advanced monitoring tools to improve efficiency and reduce downtime, while expanding telecom networks and cloud usage allow real-time data transfer across facilities. Market growth is also driven by the rising private investment, broader commercial adoption, and ongoing integration efforts across connected systems within key industries.

Saudi Arabia IoT Sensors Market Trends:

Advancement of Smart City Development Across the Kingdom

Smart city development across Saudi Arabia is driving the demand for IoT sensors as municipalities adopt connected technologies to enhance urban management and public services. Sensors support real-time monitoring of traffic, air quality, energy systems, and safety operations, enabling automated controls and efficient resource use. This momentum strengthened further in 2025 when the King Abdullah Financial District Development and Management Company signed an MoU with Samsung Electronics to integrate advanced smart city technologies at KAFD in Riyadh, introducing real-time asset management and modern access systems. As cities modernize, IoT sensors become essential infrastructure, supporting long-term growth across transport, utilities, and public services.

Growing Use of Automation Across Industrial Operations

Industrial sectors across Saudi Arabia are increasingly integrating IoT sensors to enhance productivity, strengthen asset reliability, and support data-driven operational control. These sensors play a vital role in tracking machine health, monitoring pressure, vibration, temperature, and flow, and enabling predictive maintenance to prevent costly downtime. This transition toward smarter industrial practices gained further momentum in 2025 when Rockwell Automation participated in the Industrial Transformation Saudi Arabia event, showcasing its cloud-native Plex Smart Manufacturing Platform designed to improve efficiency and decision-making. As industries adopt more advanced production technologies, IoT sensors become indispensable for maintaining precision, safety, and consistent performance across facilities.

Rising Digitalization in Healthcare Services

Digital health adoption in Saudi Arabia is catalyzing the demand for medical-grade IoT sensors that support continuous monitoring, diagnostics, and efficient management of healthcare equipment. These sensors enable real-time tracking of patient vitals, enhance the accuracy of clinical devices, and strengthen remote care models that rely on timely data for effective decision-making. This momentum is further expanded in 2025 when IQVIA partnered with Six Phases to deploy cloud-based health systems across Healthcare Alliance facilities, improving workflow efficiency and patient care coordination. As healthcare providers embrace technology-enabled services, IoT sensors become essential for improving care quality, safety, and long-term clinical oversight.

Market Outlook 2026-2034:

The Saudi Arabia IoT sensors market is positioned for notable growth, supported by Vision 2030’s emphasis on digital transformation and ongoing investment in advanced infrastructure. Increasing adoption of smart systems across industrial, commercial, and public sectors further strengthens demand. The market generated a revenue of USD 226.89 Million in 2025 and is projected to reach a revenue of USD 3,602.17 Million by 2034, growing at a compound annual growth rate of 35.96% from 2026-2034. Steady technological integration and national modernization efforts continue to drive widespread deployment of IoT sensor solutions.

Saudi Arabia IoT Sensors Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Temperature Sensors | 42% |

| End Use | Consumer Electronic | 18% |

Type Insights:

- Temperature Sensors

- Motion Sensors

- Light Sensors

- Others

Temperature sensors dominate with a market share of 42% of the total Saudi Arabia IoT sensors market in 2025.

Temperature sensors lead the market because they are essential across industries that require precise thermal monitoring, including manufacturing, logistics, healthcare, and smart buildings. Their importance was further highlighted in 2024 when amplifAI Health partnered with USATherm to advance thermal imaging in healthcare, combining AI-driven diagnostics with advanced imaging technology to enhance early disease detection and patient care.

Their dominance is further reinforced by the growing adoption of smart infrastructure and climate-controlled systems across the Kingdom. Integration with IoT platforms enables real-time tracking, predictive maintenance, and energy optimization, making temperature sensors a core component of digital transformation efforts in both industrial and commercial settings.

End Use Insights:

Access the Comprehensive Market Breakdown Request Sample

- Consumer Electronic

- Wearable Device

- Automotive and Transportation

- BFSI

- Healthcare

- Retail

- Building Automation

- Oil and Gas

- Agriculture

- Aerospace and Defense

- Others

Consumer electronic leads with a market share of 18% of the total Saudi Arabia IoT sensors market in 2025.

Consumer electronic dominates the market because connected devices, such as smartphones, wearables, home automation systems, and smart appliances, depend heavily on integrated sensors for performance, safety, and user interaction. This reliance of connected devices on integrated sensors, is demonstrated by Saudi Arabia's 2025 launch of a smart medical wristband by the Ministry of Interior, which uses AI and IoT technology to monitor the vital signs of security officers during Hajj. The increasing adoption of smart lifestyles across households in Saudi Arabia is driving the demand for compact, accurate, and energy-efficient IoT sensors.

Dominance is reinforced by rising digital engagement, higher device replacement cycles, and expanding interest in health monitoring, entertainment, and home management technologies. Manufacturers integrate advanced sensing capabilities to enhance functionality, driving wider sensor usage and keeping consumer electronics at the forefront of overall IoT sensor demand in the Kingdom.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region is a crucial segment in the market due to its dense urban centers, strong industrial bases, and advanced digital infrastructure. High investment in smart city projects and government services supports extensive IoT sensor deployment across public, commercial, and residential applications.

Western Region shows strong uptake driven by major tourism hubs, healthcare facilities, and expanding commercial zones. The growing demand for smart buildings and transport systems encourages wider use of IoT sensors, supported by continuous infrastructure modernization across key metropolitan areas.

Eastern Region benefits from its industrial concentration, particularly in energy and manufacturing, where IoT sensors enhance operational efficiency and safety. Strong corporate investments and ongoing digital transformation efforts make this region a significant contributor to overall market growth.

Southern Region is gradually expanding IoT sensor adoption as infrastructure improves and awareness increases. Emerging smart city initiatives, growing commercial activity, and enhanced connectivity contribute to steady integration of sensors across diverse applications.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia IoT Sensors Market Growing?

Rapid 5G Network Deployment Enabling Advanced IoT Applications

Saudi Arabia’s rapid expansion of 5G networks is establishing the high-performance connectivity needed for advanced IoT sensor applications. In 2024, Zain KSA reported 94% 4G and 65% 5G population coverage across 64 cities, alongside aimed to extend 5G to 122 cities through a SAR 1.6 billion investment. This improved bandwidth and reduced latency support real-time sensor communication for industrial automation, mobility solutions, and remote healthcare. Significant telecommunications investment is extending coverage beyond major cities, enabling IoT adoption in industrial zones, agricultural regions, and transport networks. Enhanced connectivity allows sensor systems to operate with greater accuracy, responsiveness, and reliability.

Growing Prioritization of Energy Efficiency and Sustainability

The increasing emphasis on reducing energy usage and strengthening environmental performance is accelerating the adoption of IoT sensors across buildings, industrial facilities, and public infrastructure in Saudi Arabia. These sensors support real-time monitoring of energy use, identify inefficiencies, and automate systems, such as HVAC, lighting, and machinery, to optimize overall resource utilization. In 2024, ROSHN Group partnered with Cisco to integrate IoT technologies into smart buildings to enhance energy efficiency and building management, reinforcing the importance of sustainability-oriented digital solutions. As sustainability becomes a strategic priority for organizations seeking regulatory compliance, cost efficiency, and environmental responsibility, demand for energy-focused IoT sensors continues to grow across multiple sectors.

Expansion of Digital Transformation

Saudi Arabia’s push toward broad digital modernization is strengthening demand for IoT sensors as new policies expand connectivity, competition, and technology adoption. National initiatives are accelerating the use of connected systems across utilities, transportation, and enterprise operations, creating stronger foundations for sensor-driven services. During LEAP 2025 in Riyadh, the Communications, Space, and Technology Commission granted telecom licenses to Water Transmission and Technologies Co., Saudi Railways, and Raqeem Smart Solutions to support advanced smart infrastructure and attract investment. As the Kingdom deepens its commitment to digital transformation, organizations increasingly rely on IoT sensors to improve performance and operational oversight.

Market Restraints:

What Challenges the Saudi Arabia IoT Sensors Market is Facing?

High Implementation Costs and Infrastructure Investment Requirements

The significant capital required for large-scale IoT sensor deployment continues to limit adoption among smaller enterprises and cost-conscious industries. Advanced sensors integrated with AI analytics, edge computing, and secure communication networks demand considerable upfront spending on hardware, software, and system integration. Additional expenses related to maintenance, upgrades, and interoperability further increase financial pressure, slowing adoption across organizations that lack adequate investment capacity.

Cybersecurity Vulnerabilities and Data Protection Concerns

The rapid expansion of connected sensor networks increases exposure to cyber risks, leading to higher concern over data breaches, unauthorized access, and system manipulation. Ensuring encryption, strong authentication frameworks, and continuous threat monitoring becomes essential for safeguarding operations. Compliance with evolving data protection regulations adds complexity and operational cost, particularly in critical sectors like energy, transportation, and government, where security standards are stringent.

Skills Gap and Technical Workforce Limitations

The limited availability of trained professionals in IoT architectures, sensor engineering, cybersecurity, and advanced analytics poses operational constraints for many organizations. Insufficient local expertise slows project execution, complicates maintenance, and affects the long-term performance of deployed systems. Companies frequently report challenges in finding qualified talent capable of managing complex IoT ecosystems, highlighting the need for expanded technical training and workforce development initiatives.

Competitive Landscape:

The Saudi Arabia IoT sensors market exhibits dynamic competitive intensity characterized by multinational semiconductor manufacturers competing alongside regional technology providers and emerging local enterprises. Market dynamics reflect strategic positioning ranging from advanced sensor solutions emphasizing AI integration and miniaturization to cost-effective options targeting industrial automation applications. The competitive landscape is increasingly shaped by localization initiatives, strategic partnerships with government entities, and technology transfer arrangements that enhance local manufacturing capabilities. Major international players are establishing local facilities and forming joint ventures to serve the growing demand while meeting local content requirements mandated by Vision 2030 objectives.

Recent Developments:

- In December 2025, Nozomi Networks announced its participation at Black Hat MEA 2025 in Riyadh, where it will showcase its AI-powered Guardian Air and Nozomi Arc sensors for securing OT/IoT environments. These sensors enhance visibility, threat detection, and risk management, particularly for critical infrastructure sectors like energy and transportation. The company's solutions align with Saudi Arabia's cybersecurity initiatives, supporting resilience and compliance across the nation's industrial systems.

- In May 2025, Qualcomm, Aramco, and Saudi Arabia’s RDIA launched the "Design in Saudi Arabia with AI" (DISAI) accelerator to support AI and IoT innovation. Six startups were selected to participate, focusing on areas like predictive maintenance, carbon sequestration, and healthcare diagnostics using edge AI and IoT sensors. The program runs from April to November 2025, offering mentorship, intellectual property training, and opportunities for commercialization.

Saudi Arabia IoT Sensors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Temperature Sensors, Motion Sensors, Light Sensors, Others |

| End Uses Covered | Consumer Electronic, Wearable Device, Automotive and Transportation, BFSI, Healthcare, Retail, Building Automation, Oil and Gas, Agriculture, Aerospace and Defense, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia IoT sensors market size was valued at USD 226.89 Million in 2025.

The Saudi Arabia IoT sensors market is expected to grow at a compound annual growth rate of 35.96% from 2026-2034 to reach USD 3,602.17 Million by 2034.

Temperature sensors dominate the Saudi Arabia IoT sensors market with 42% revenue share in 2025, driven by extensive applications across oil and gas operations, industrial automation, HVAC systems, and consumer electronics.

Key factors driving the Saudi Arabia IoT sensors market include digital health expansion, which requires IoT sensors for real-time monitoring and diagnostics. This trend strengthened in 2025 when IQVIA partnered with Six Phases to deploy cloud-based systems across Healthcare Alliance facilities, enhancing efficiency, patient oversight, and connected care delivery.

Major challenges include high implementation costs and infrastructure investment requirements, cybersecurity vulnerabilities and data protection concerns, technical workforce limitations and skills gaps, and integration complexity with legacy industrial systems.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)