Saudi Arabia Juvenile Products Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Age Group, and Region, 2026-2034

Saudi Arabia Juvenile Products Market Summary:

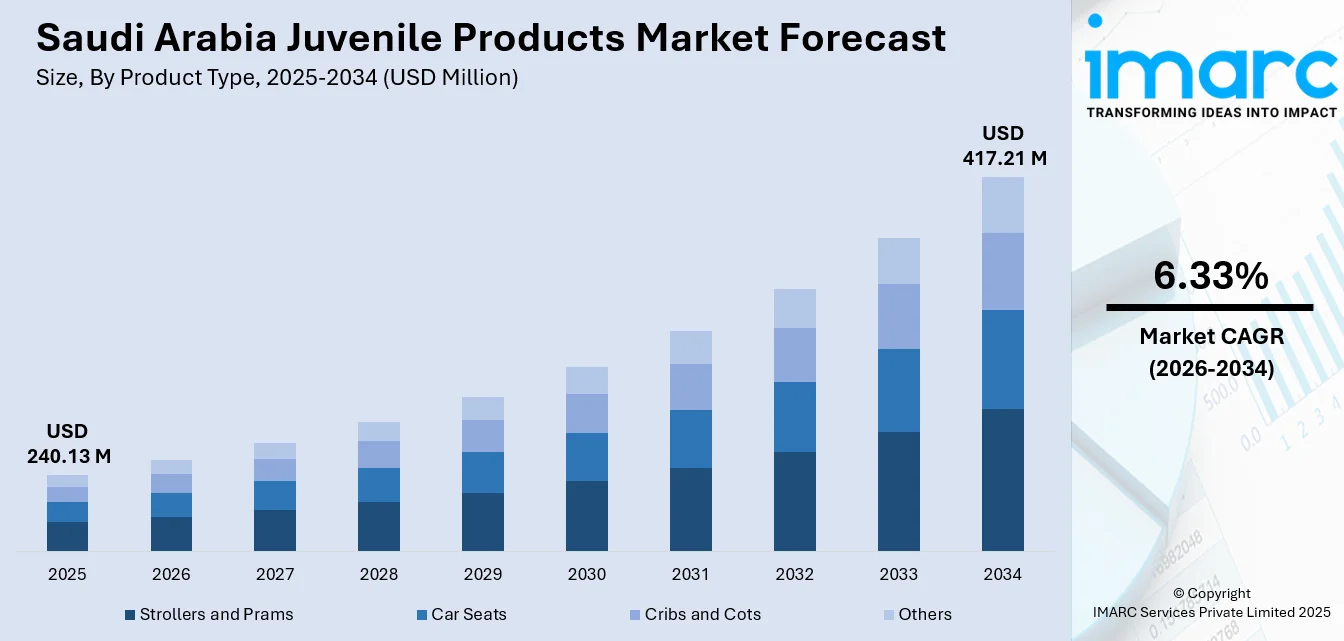

The Saudi Arabia juvenile products market size was valued at USD 240.13 Million in 2025 and is projected to reach USD 417.21 Million by 2034, growing at a compound annual growth rate of 6.33% from 2026-2034.

At present, the market is experiencing steady growth owing to the demographic shifts, evolving parenting preferences, and increasing awareness about child safety standards among parents. Apart from this, the rising disposable incomes and cultural emphasis on premium child care products are reshaping purchasing behaviors across urban and suburban communities throughout the Kingdom, thereby expanding the Saudi Arabia juvenile products market smart.

Key Takeaways and Insights:

- By Product Type: Strollers and prams dominate the market with a share of 29% in 2025, propelled by parental preference for mobility solutions combining convenience with modern safety features across varied Saudi terrains and climatic conditions.

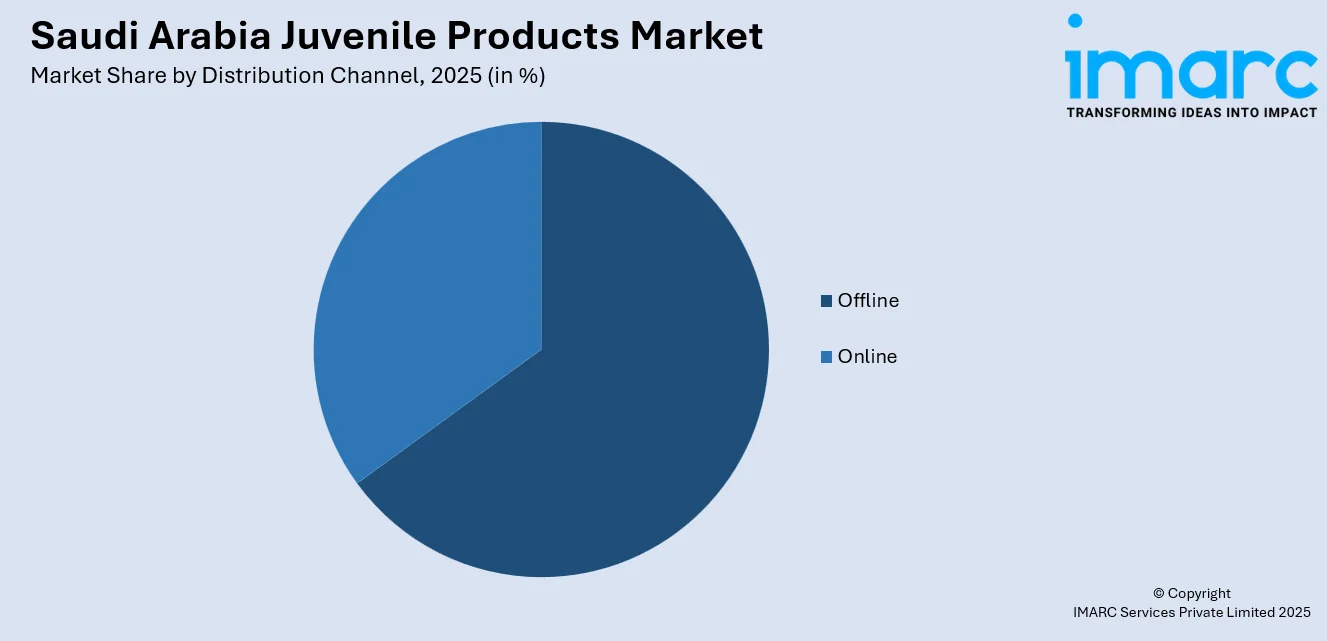

- By Distribution Channel: Offline leads the market with a share of 65% in 2025, reflecting consumer trust in physical retail environments where tactile product evaluation and personalized consultations influence purchasing decisions for infants and toddler essentials.

- By Age Group: 0-1 year segment represents the largest segment with a market share of 38% in 2025, driven by the rising parental investment during critical early development stages when product safety and quality requirements reach their peak importance.

- By Region: Northern and central region dominates with a market share of 36% in 2025, benefiting from concentrated urban populations, higher household spending capacity, and superior retail infrastructure connecting major metropolitan centers throughout this economically vibrant corridor.

- Key Players: The competitive landscape exhibits a balanced mix of international brands leveraging global reputations for safety innovation and regional distributors capitalizing on localized customer service networks, creating diverse price-point accessibility across premium and value-oriented consumer segments.

To get more information on this market Request Sample

The Saudi juvenile products sector reflects broader economic transformation and demographic evolution within the Kingdom. Urban expansion projects, rising female workforce participation, and nuclear family structures are fundamentally altering how parents approach child-rearing investments. Modern Saudi parents increasingly prioritize products meeting international safety certifications while incorporating features suited to local climate conditions and cultural preferences. Shopping malls and specialized baby stores remain cultural gathering points where purchasing decisions blend practical evaluation with community recommendations, though digital channels are gradually gaining traction among tech-savvy younger parents seeking convenience and product variety. International brands hold a strong position, though regional distributors play a key role in pricing, after-sales service, and retail reach. E-commerce has become an important sales channel, particularly for premium and imported products. A notable market signal was the enforcement of Saudi technical regulations for child restraint systems, which led major retailers to discontinue non-certified car seats and strollers and realign assortments toward approved models. This regulatory shift has strengthened trust in branded products and raised entry barriers, shaping a more structured and quality-focused competitive environment. In 2025, Bridgestone MEA has initiated a campaign in the UAE, Saudi Arabia, Egypt, and Morocco aimed at changing the way parents consider child safety in vehicles. In line with the campaign's broader goals, the mobility firm is providing essential information on safety measures and useful tips to foster a safer and better-informed community.

Saudi Arabia Juvenile Products Market Trends:

Premium Product Positioning Gains Momentum

Saudi families are demonstrating stronger willingness to invest in higher-priced juvenile products that promise superior durability, advanced safety mechanisms, and aesthetic appeal. This shift reflects changing perceptions where child care purchases are viewed as long-term investments rather than temporary necessities. Parents increasingly seek brands offering extended warranties, eco-friendly materials, and innovative features that simplify daily routines while ensuring child wellbeing across different developmental stages. In 2025, the biggest maternity, baby, and toddler event in the Middle East took place at The Arena Riyadh Venue on October 30th and 31st, uniting over 10,000 parents to discover leading brands, thrilling giveaways, the newest products, and gain insights from top experts. In partnership with QiDZ Saudi, the premier app for family leisure, entertainment, and activities in KSA and UAE, the Baby Expo Riyadh is scheduled for October 30th to 31st at The Arena Riyadh Venue. To kick off the event, The Baby Expo Riyadh presented NextGen Talks, a vibrant platform uniting global and regional industry leaders to discuss trends, challenges, and innovations impacting the mother, baby, and toddler market.

Gender-Specific Product Differentiation Influences Design

Manufacturers are developing distinct product lines tailored to cultural preferences regarding color schemes, styling elements, and functional features that align with traditional gender expectations. This trend extends beyond simple color variations to encompass comprehensive design philosophies addressing perceived differences in activity levels, aesthetic preferences, and usage scenarios that resonate with Saudi family structures and values. In 2025, Kids & Toys Expo Saudi Arabia 2025 took place in Riyadh, bringing together over 150 exhibitors and more than 200 brands from around the world to showcase latest toys, baby care, educational products, and children’s entertainment.

Multi-Functional Versatility Drives Product Innovation

Space-conscious urban living environments are encouraging demand for juvenile products that serve multiple purposes throughout different growth phases. Convertible furniture, adjustable strollers, and modular systems that adapt from infancy through early childhood offer economic value while addressing storage limitations in modern Saudi apartments and villas, appealing particularly to families planning multiple children. Various international companies offering high-quality baby products are also expanding to the kingdom to fulfill the need of parents. In 2024, Brainbees Solutions, the parent entity of the childcare brand Firstcry, announced its plans to grow its presence in Saudi Arabia. This action is prompted by the significantly higher average spending on childcare items in the Kingdom, which is almost eight times that of India. The company supported by Softbank, which filed its draft red herring prospectus (DRHP) in December, plans to use Rs 155 crore from its initial public offering (IPO) funds to strengthen its position in the Gulf nation. Already a key competitor in the Saudi market, this investment will enhance its standing further.

How Vision 2030 is Transforming the Saudi Arabia Juvenile Products Market:

Vision 2030 is reshaping the Saudi Arabia juvenile products market by linking family wellbeing, safety standards, and retail modernization with broader social reform goals. Policies encouraging higher female workforce participation and improved childcare infrastructure are increasing demand for dependable strollers, car seats, feeding products, and nursery furniture. Investments in organized retail, logistics, and digital commerce have improved access to global brands while supporting faster product launches and wider geographic reach. Regulatory upgrades have tightened compliance for child safety products, raising quality benchmarks and reducing the presence of low-grade imports. A practical example is the stricter enforcement of child restraint regulations, which prompted large retailers to overhaul their assortments and prioritize certified models, directly influencing purchasing behavior. Local manufacturing incentives and SME support under Vision 2030 are also opening space for domestic assembly and distribution partnerships. Together, these shifts are moving the market toward higher safety awareness, brand trust, and long-term structural growth aligned with national development goals.

Market Outlook 2026-2034:

The Saudi Arabia juvenile products market is positioned for sustained growth as Vision transformation initiatives stimulate economic diversification and household income expansion across demographic segments. Government emphasis on family welfare programs, coupled with evolving retail landscapes integrating omnichannel shopping experiences, will continue reshaping how parents discover and purchase child care essentials. The market generated a revenue of USD 240.13 Million in 2025 and is projected to reach a revenue of USD 417.21 Million by 2034, growing at a compound annual growth rate of 6.33% from 2026-2034. Urban development patterns concentrating populations in smart city developments will drive demand for innovative products addressing contemporary lifestyle requirements while respecting cultural foundations.

Saudi Arabia Juvenile Products Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Strollers and Prams |

29% |

|

Distribution Channel |

Offline |

65% |

|

Age Group |

0-1 Year |

38% |

|

Region |

Northern and Central Region |

36% |

Product Type Insights:

- Strollers and Prams

- Car Seats

- Cribs and Cots

- Others

Strollers and prams dominate with a market share of 29% of the total Saudi Arabia juvenile products market in 2025.

Strollers and prams represent the most visible and frequently purchased juvenile product category, serving as essential mobility solutions for Saudi families navigating diverse environments from air-conditioned shopping complexes to outdoor recreational spaces. The segment's leadership reflects the Kingdom's car-dependent culture where transportation versatility becomes paramount, requiring products that seamlessly transition between vehicle storage and active use. Parents prioritize models offering superior suspension systems to handle varied pavement conditions, expansive sun canopies protecting against intense solar exposure, and lightweight aluminum frames facilitating single-handed operation when managing multiple children or shopping packages.

Product differentiation within this segment increasingly addresses specific Saudi lifestyle patterns, with manufacturers developing variants optimized for desert climate resilience through enhanced dust protection mechanisms and heat-resistant fabrics. Premium offerings incorporating smartphone connectivity for tracking infant sleep patterns, adjustable seating configurations accommodating cultural preferences for infant positioning, and luxury materials reflecting status aspirations are gaining traction among affluent urban demographics. The segment benefits from high replacement frequency as families upgrade to accommodate growing children or acquire specialized models for different usage scenarios, creating sustained purchasing cycles throughout early childhood development phases.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Offline

- Online

Offline leads with a share of 65% of the total Saudi Arabia juvenile products market in 2025.

Physical retail environments maintain dominant market positioning through their ability to address deeply ingrained consumer preferences for tangible product interaction before committing to purchases involving infant safety and comfort. Saudi parents particularly value the opportunity to physically test stroller maneuverability, assess fabric quality, and verify safety mechanism functionality through hands-on examination that online platforms cannot replicate. Specialized baby stores and department store sections staffed with knowledgeable sales personnel provide consultative experiences where cultural norms around gift-giving, product recommendations from trusted sources, and immediate gratification merge to create compelling shopping journeys.

The offline channel's strength also derives from its social dimension, where shopping for juvenile products becomes a family activity involving multiple generations contributing opinions and preferences. Grandparents, aunts, and extended family members often participate in purchasing decisions, making the physical store a neutral meeting ground for consensus-building. Established retailers leverage this dynamic by creating immersive showroom experiences displaying complete nursery setups, offering complementary services like gift registries and product assembly assistance, and hosting community events that build brand loyalty while addressing the isolation some new mothers experience in nuclear family structures increasingly common across Saudi urban centers.

Age Group Insights:

- 0-1 Year

- 2-4 Years

- 5-7 Years

- >8 Years

0-1 year exhibits a clear dominance with a 38% share of the total Saudi Arabia juvenile products market in 2025.

The infant age category commands the largest market share reflecting the concentration of essential product purchases occurring during the first year of life when safety concerns, developmental needs, and parental anxiety converge to drive maximum spending intensity. New parents entering this phase typically invest in comprehensive product suites spanning mobility, sleep, feeding, and safety categories, with many items requiring immediate purchase upon birth or shortly thereafter. Cultural traditions surrounding newborn celebrations and gift-giving further amplify purchasing activity as extended family members and social networks contribute to equipping new parents with necessary juvenile products.

This segment benefits from heightened emotional investment characteristic of early parenthood, where quality concerns override price sensitivity for many households. Parents demonstrate willingness to invest in premium car seats meeting international safety standards, ergonomic cribs supporting healthy sleep development, and certified strollers offering maximum protection against environmental elements. The rapid developmental changes occurring during the first year also drive repeat purchases as infants quickly outgrow initial equipment or require specialized products addressing emerging mobility capabilities. First-time parents, who represent a significant portion of buyers in this category, often rely heavily on retailer guidance and peer recommendations, creating opportunities for upselling and category expansion beyond initially intended purchases.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and central region leads with a share of 36% of the total Saudi Arabia juvenile products market in 2025.

The Northern and Central Region's market leadership stems from its concentration of the Kingdom's most populous and economically prosperous urban centers, including Riyadh, the capital city that serves as both administrative headquarters and commercial hub. This geographical corridor benefits from the highest density of modern retail infrastructure, with expansive shopping malls, specialized baby stores, and international brand flagship outlets creating unparalleled product accessibility for buyers. The region's demographics skew toward younger, educated professionals employed in government ministries, corporate headquarters, and emerging technology sectors, resulting in household income profiles that support premium juvenile product purchasing behaviors and brand consciousness.

Riyadh's ongoing urban transformation projects and smart city development initiatives are reshaping residential patterns, with new suburban communities designed around nuclear family living attracting young Saudi couples establishing independent households. These developments incorporate family-friendly amenities, parks, and recreational facilities that encourage outdoor mobility products like advanced stroller systems. The region's concentration of private hospitals, specialized pediatric clinics, and maternal health centers creates ecosystems where healthcare professionals influence product recommendations, often steering parents toward internationally certified safety equipment. Additionally, the Northern and Central Region serves as the primary entry point for imported juvenile products, with distribution networks radiating outward to other regions, giving local consumers first access to new product launches and seasonal collections. Cultural events, baby expos, and parenting workshops occur with greater frequency in this region, building consumer awareness around product innovations and safety standards that drive purchasing decisions across all juvenile product categories.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Juvenile Products Market Growing?

Demographic Transformation and Birth Rate Patterns

The Kingdom's sustained population growth combined with government initiatives encouraging family formation creates consistent demand for juvenile products across urban and rural communities. By the end of 2024, Saudi Arabia's population reached 35.3 million, reflecting a 4.7% increase from 2023. Young Saudi families represent an expanding consumer segment with evolving expectations regarding child care quality and safety standards. Household formation patterns show increasing numbers of nuclear families establishing independent residences away from extended family compounds, necessitating complete juvenile product suites rather than shared equipment across generations. Cultural values emphasizing child-centered parenting approaches merge with modern consumer aspirations, where purchasing decisions reflect both traditional family priorities and contemporary lifestyle preferences influenced by global trends accessible through digital media and international travel experiences.

Rising Household Income and Spending Capacity

Economic diversification efforts under national transformation initiatives are generating employment opportunities across non-oil sectors, expanding the middle and upper-middle class segments with disposable income allocated toward quality child care products. In 2024, Saudi Arabia’s actual household consumption increased by 2.7 percent and is projected to climb to 3.8 percent by 2026. Professional dual-income households demonstrate particularly strong spending power, viewing juvenile product investments as expressions of successful lifestyle achievement and parental responsibility. Consumer financing options and installment payment plans offered by major retailers have democratized access to premium product tiers, enabling aspiration-driven purchasing behaviors among households aspiring toward higher living standards. The growing wealth concentration in urban centers translates into market premiumization where imported brands and innovative product features command price premiums accepted by parents prioritizing perceived quality and safety credentials.

Retail Infrastructure Expansion and Shopping Experience Enhancement

Modern shopping mall proliferation throughout Saudi cities has transformed juvenile product accessibility by concentrating specialized retailers within climate-controlled environments that encourage browsing and comparison shopping. Retail developers increasingly incorporate dedicated mother-and-child facilities, nursing rooms, and family-friendly amenities that extend shopping duration and create positive associations with purchasing environments. The emergence of standalone baby superstore formats offering comprehensive product ranges, educational workshops for new parents, and post-purchase support services elevates the consumer experience beyond transactional exchanges. International retailer entries into the Saudi market introduce global best practices in merchandising, customer service, and loyalty programs while domestic chains adapt by enhancing their value propositions through localized product curation and culturally resonant marketing approaches. IMARC Group predicts that the Saudi Arabia retail market reached USD 411.7 Billion by 2034.

Market Restraints:

What Challenges the Saudi Arabia Juvenile Products Market is Facing?

Price Sensitivity Amid Economic Fluctuations

Despite growing affluence, significant consumer segments remain highly price-conscious, viewing juvenile products as necessary expenses requiring careful budget allocation. Economic uncertainties and fluctuating oil revenues create household spending volatility that impacts discretionary purchasing decisions. Many families prioritize essential safety items while delaying or foregoing non-critical accessories and premium upgrades, particularly during economic downturns or periods of employment uncertainty affecting household financial stability.

Cultural Preferences for Secondhand Sharing and Gift Exchanges

Traditional practices of passing down juvenile products between family members and close social networks reduce new product demand as items circulate through extended family systems. Gift-giving customs surrounding births often result in households receiving multiple similar products, creating inventory redundancy that delays future purchases. Cultural norms discouraging waste and emphasizing frugality influence some demographics to maximize existing product lifespans rather than pursuing replacement purchases driven by style preferences or minor feature enhancements.

Import Dependency and Supply Chain Complexities

Heavy reliance on international manufacturers creates vulnerability to global supply disruptions, shipping delays, and currency exchange rate fluctuations affecting final retail prices. Customs clearance processes, regulatory compliance requirements, and distribution logistics add complexity and costs that manufacturers and retailers must navigate while maintaining competitive pricing. Limited domestic manufacturing capacity prevents the development of locally-adapted products at price points accessible to broader market segments, constraining overall market expansion potential.

Competitive Landscape:

The Saudi Arabia juvenile products market features a competitive environment where established international brands leverage global reputation and safety certification credibility to command premium positioning across product categories. These multinational players benefit from extensive research and development capabilities, enabling continuous innovation in materials, safety mechanisms, and design aesthetics that resonate with quality-conscious Saudi parents. Regional distributors and specialized retailers play crucial intermediary roles, providing localized customer service, warranty administration, and after-sales support that international brands cannot deliver independently. The competitive dynamic increasingly centers on omnichannel presence, where leading players integrate physical showrooms with digital platforms to capture consumers across different purchasing journey stages. Market entry barriers remain moderate, with success depending on establishing trusted retail partnerships, navigating regulatory compliance for safety standards, and developing marketing approaches that balance modern parenting values with cultural sensitivities around family structures and child-rearing philosophies.

Saudi Arabia Juvenile Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Strollers and Prams, Car Seats, Cribs and Cots, Others |

| Distribution Channels Covered | Offline, Online |

| Age Groups Covered | 0-1 Year, 2-4 Years, 5-7 Years, >8 Years |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia juvenile products market size was valued at USD 240.13 Million in 2025.

The Saudi Arabia juvenile products market is expected to grow at a compound annual growth rate of 6.33% from 2026-2034 to reach USD 417.21 Million by 2034.

Strollers and prams dominated the product type segment with a market share of 29% in 2025, driven by their essential role in Saudi family mobility patterns, climate-adapted designs addressing intense heat conditions, and continuous innovation in safety features that resonate with quality-conscious parents prioritizing infant protection and convenience.

Key factors driving the Saudi Arabia juvenile products market include demographic expansion with sustained birth rates, rising household incomes enabling premium product purchases, retail infrastructure modernization creating enhanced shopping experiences, and evolving parenting philosophies emphasizing safety standards and quality investments.

Major challenges include price sensitivity during economic fluctuations limiting premium product adoption, cultural practices favoring product sharing and secondhand exchanges reducing new purchase frequency, import dependency creating supply chain vulnerabilities, regulatory compliance complexities, and limited domestic manufacturing constraining market-specific product development.

Major challenges include price sensitivity during economic fluctuations limiting premium product adoption, cultural practices favoring product sharing and secondhand exchanges reducing new purchase frequency, import dependency creating supply chain vulnerabilities, regulatory compliance complexities, and limited domestic manufacturing constraining market-specific product development.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)