Saudi Arabia Kitchen Chimney Market Size, Share, Trends and Forecast by Product Type, Duct Type, Application, Distribution Channel, and Region, 2026-2034

Saudi Arabia Kitchen Chimney Market Summary:

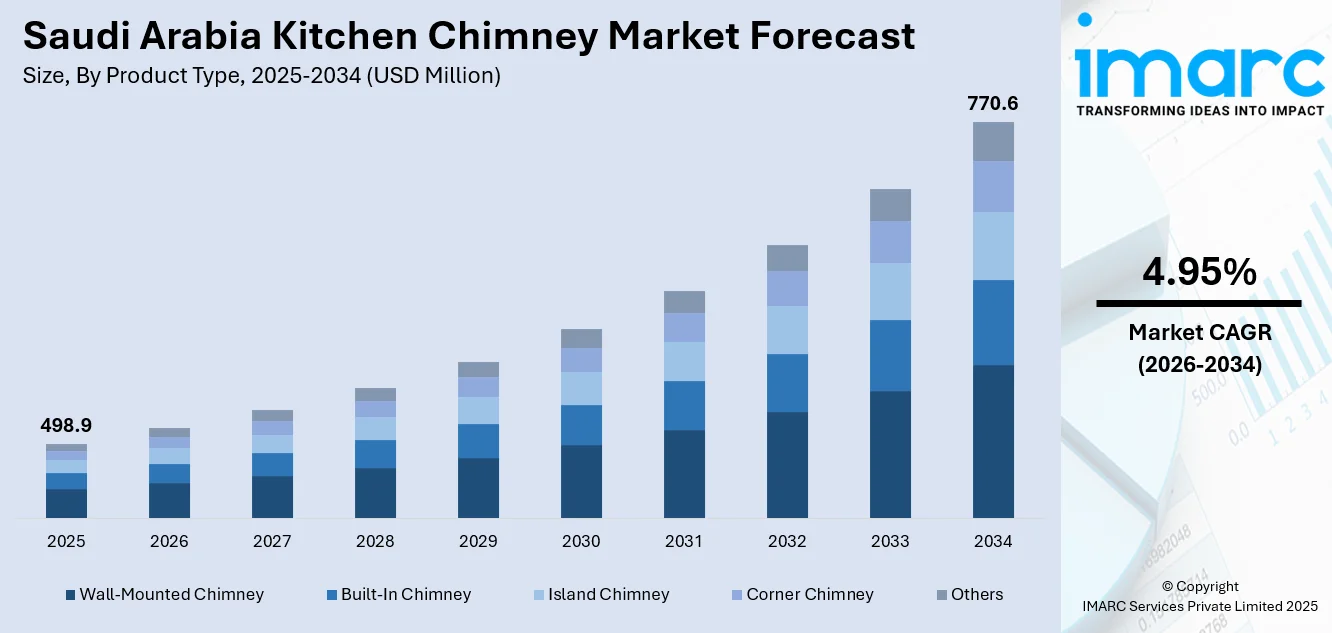

The Saudi Arabia kitchen chimney market size was valued at USD 498.9 Million in 2025 and is projected to reach USD 770.6 Million by 2034, growing at a compound annual growth rate of 4.95% from 2026-2034.

The Saudi Arabia kitchen chimney market is experiencing robust growth driven by the country's ambitious housing development programs under Vision 2030. Rising disposable incomes are enabling consumers to invest in premium kitchen appliances, including modern ventilation systems. The transformation of kitchens from functional cooking spaces into social hubs for family gatherings is accelerating demand for aesthetically pleasing and efficient exhaust solutions. Increasing urbanization rates are also driving the need for effective indoor air quality management in densely populated residential areas, further propelling the Saudi Arabia kitchen chimney market share.

Key Takeaways and Insights:

- By Product Type: Wall-mounted chimney dominates the market with a share of 43% in 2025, owing to its versatile installation capabilities, space efficiency in modern kitchen layouts, and widespread availability across various price segments. Consumer preference for sleek designs that complement contemporary kitchen aesthetics is fueling adoption.

- By Duct Type: Ducted leads the market with a share of 70% in 2025. This dominance is driven by superior pollutant removal capabilities, better indoor air quality maintenance, and preference among homeowners for complete smoke and odor elimination through external venting systems.

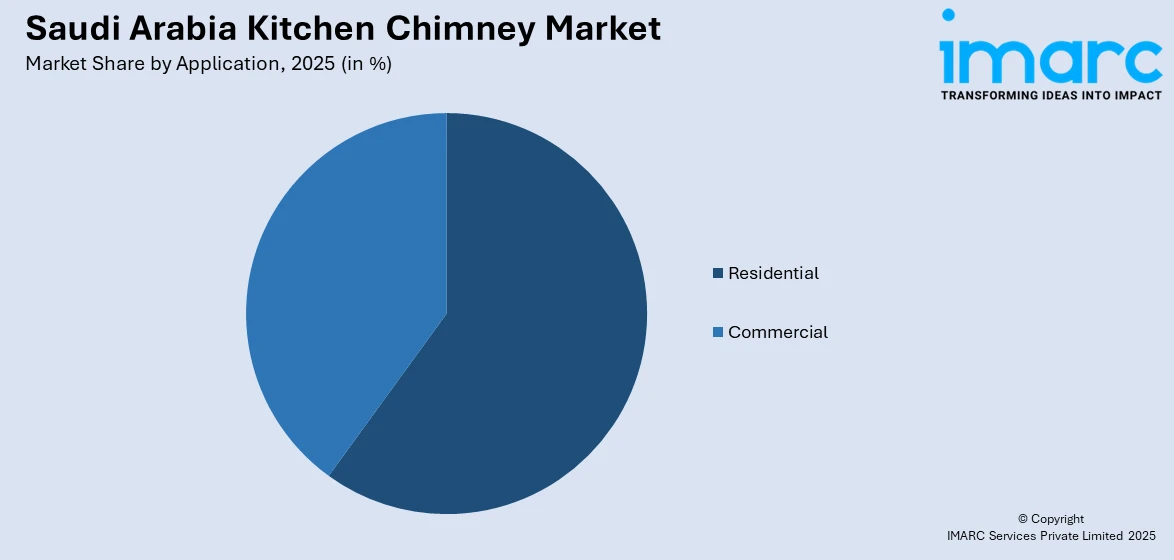

- By Application: Residential holds the largest segment with a market share of 81% in 2025, reflecting the massive residential construction boom, growing middle-class population, and increasing household formation rates across Saudi Arabia's urban centers.

- By Distribution Channel: Offline exhibits a clear dominance in the market with 68% share in 2025, driven by consumer preference for physical product inspection, professional consultation services, and immediate availability at specialty stores and hypermarkets throughout the Kingdom.

- By Region: Western Region represents the largest region with 30% share in 2025, driven by the concentration of population in Jeddah and Makkah metropolitan areas, robust tourism-driven hospitality development, and higher consumer spending on premium home appliances.

- Key Players: Key players drive the Saudi Arabia kitchen chimney market by expanding product portfolios, integrating smart technologies, and strengthening distribution networks. Their investments in energy-efficient solutions, premium designs, and partnerships with kitchen retailers boost awareness, accelerate adoption, and ensure consistent product availability across diverse consumer segments.

To get more information on this market Request Sample

Saudi Arabia Kitchen Chimney Market Trends:

Integration of Smart Technologies and IoT Connectivity

The Saudi Arabia kitchen chimney market is witnessing increasing integration of smart technologies and IoT-enabled features. Modern chimneys now incorporate touch controls, gesture-based operations, and smartphone connectivity, allowing users to monitor and adjust ventilation settings remotely. Auto-clean technology with heat-based oil collection systems is gaining popularity, significantly reducing maintenance requirements. The Kingdom's smart city initiatives, including developments in NEOM and Riyadh, are accelerating consumer adoption of connected kitchen appliances that integrate seamlessly with home automation ecosystems.

Emphasis on Energy Efficiency and Sustainability

Growing environmental consciousness and rising utility costs are driving demand for energy-efficient kitchen chimneys. Consumers are increasingly prioritizing products with high-efficiency motors, LED lighting, and optimized airflow designs that minimize electricity consumption while maintaining superior extraction performance. The Saudi Standards, Metrology and Quality Organization's energy labeling programs are encouraging manufacturers to develop products meeting stringent efficiency standards, supporting the Kingdom's broader sustainability goals under Vision 2030's environmental initiatives.

Premium Design and Aesthetic Integration

Saudi Arabian consumers are increasingly viewing kitchen chimneys as design elements that complement modern kitchen aesthetics rather than purely functional appliances. The trend toward open-plan living spaces is driving demand for elegant, architecturally integrated chimney designs featuring premium materials such as tempered glass, stainless steel, and designer finishes. Mid-century modern and minimalist styles are particularly popular in luxury homes, with manufacturers offering customizable options to match diverse interior design preferences prevalent across the Kingdom's upscale residential developments.

How Vision 2030 is Transforming the Saudi Arabia Kitchen Chimney Market:

The Saudi Vision 2030 is transforming the kitchen chimney sector as it is experiencing unmatched residential projects and making Saudi Arabia a hub for those aspiring for contemporary life in general and kitchen appliances like chimneys in particular. Mega-schemes like NEOM, Roshn projects, Qiddiah, and Riyadh's historical expansion in Diriyah are increasing the demand for modern kitchen appliances like chimneys in Saudi Arabia. Changes in policies such as ownership proposals, easy home acquisition options in Sakani, and home finance options are increasing purchasing power in Saudi Arabia. Riyadh's population growth and the ambitious target of 70% Saudi homeownership by 2030 are accelerating housing supply, while integrated residential communities are creating modern kitchens requiring efficient chimney installations.

Market Outlook 2026-2034:

The Saudi Arabia kitchen chimney market outlook remains positive, underpinned by sustained residential construction activity and evolving consumer preferences for premium kitchen solutions. The expansion of retail infrastructure, including the opening of home furnishing stores across emerging cities like Tabuk, Madinah, and Abha, is improving product accessibility in underserved markets. Furthermore, the transformation of Saudi kitchens from isolated cooking spaces into social entertainment areas is creating sustained demand for aesthetically appealing, high-performance ventilation solutions that enhance both functionality and interior design throughout the forecast period. The market generated a revenue of USD 498.9 Million in 2025 and is projected to reach a revenue of USD 770.6 Million by 2034, growing at a compound annual growth rate of 4.95% from 2026-2034.

Saudi Arabia Kitchen Chimney Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Wall-Mounted Chimney |

43% |

|

Duct Type |

Ducted |

70% |

|

Application |

Residential |

81% |

|

Distribution Channel |

Offline |

68% |

|

Region |

Western Region |

30% |

Product Type Insights:

- Wall-Mounted Chimney

- Built-In Chimney

- Island Chimney

- Corner Chimney

- Others

Wall-mounted chimney dominates with a market share of 43% of the total Saudi Arabia kitchen chimney market in 2025.

Wall-mounted chimneys command the largest share of the Saudi Arabia kitchen chimney market owing to their versatile installation capabilities and compatibility with diverse kitchen configurations prevalent across the Kingdom's residential properties. These chimneys are mounted directly against the wall above cooktops, making them ideal for standard kitchen layouts found in apartments and villas throughout major urban centers including Riyadh, Jeddah, and Dammam. The growing urban consumer preference for compact and multifunctional cooking appliances reflects the increasing demand for space-efficient solutions that align with modern living requirements.

The segment benefits from extensive product availability across multiple price points, from budget-friendly models to premium designer variants featuring advanced filtration systems and smart controls. Wall-mounted chimneys offer strong suction power capabilities, with leading models like Glen Auto Clean Glass Filterless Chimney with Motion Sensor achieving airflow rates exceeding 1,200 cubic meters per hour, ensuring effective removal of cooking fumes, smoke, and grease particles. Their aesthetic versatility allows homeowners to select from curved glass, straight glass, and traditional canopy designs, enabling seamless integration with contemporary Saudi kitchen interiors that increasingly serve as social gathering spaces for extended families.

Duct Type Insights:

- Ducted

- Ductless

Ducted leads with a share of 70% of the total Saudi Arabia kitchen chimney market in 2025.

Ducted kitchen chimneys maintain dominant market position owing to their superior performance in extracting and expelling cooking pollutants, smoke, and odors directly outside the building through dedicated ventilation channels. Range hoods exhausting air outdoors remove harmful gases and particles from cooking more effectively than recirculating alternatives, capturing pollutants with greater efficiency. Saudi Arabian homeowners, particularly those engaging in traditional cooking methods involving high-temperature frying and spice preparation, prefer ducted systems for maintaining optimal indoor air quality throughout expansive residential properties.

The residential construction practices in Saudi Arabia, characterized by purpose-built ventilation infrastructure in new developments, facilitate ducted chimney installations across the housing market. The National Housing Company's delivery of new homes under Vision 2030 initiatives incorporates modern kitchen designs with pre-installed ductwork, streamlining chimney installation processes for homeowners. Professional installation services ensure proper duct routing to exterior walls, maximizing extraction efficiency while meeting local building codes and regulations governing residential ventilation systems throughout the Kingdom's diverse climate zones.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

Residential holds the largest segment with an 81% share of the total Saudi Arabia kitchen chimney market in 2025.

The residential segment's commanding market position reflects Saudi Arabia's unprecedented housing development momentum, driven by Vision 2030's ambitious homeownership targets. The Real Estate Development Fund continues depositing substantial funds into Sakani beneficiary accounts, with numerous families benefiting from housing support services, directly stimulating demand for home appliances including kitchen ventilation systems. This government-backed financial support enables middle-income Saudi families to purchase and furnish new homes with modern kitchen equipment, establishing sustained demand for residential kitchen chimneys across price segments.

Growing health consciousness among Saudi consumers regarding indoor air quality is accelerating residential chimney adoption, as homeowners recognize the importance of effective ventilation in managing cooking-generated pollutants including particulate matter, carbon monoxide, and volatile organic compounds. The transformation of Saudi residential kitchens from enclosed cooking spaces to open-plan social areas connected with living rooms necessitates efficient, quiet ventilation solutions that maintain air quality without disrupting family interactions. Extended families commonly gathering for meals in Saudi culture require larger kitchens with robust ventilation capabilities, driving preference for high-capacity residential chimneys.

Distribution Channel Insights:

- Online

- Offline

Offline represents the leading segment with a 68% share of the total Saudi Arabia kitchen chimney market in 2025.

Offline distribution channels maintain market leadership owing to Saudi consumers' preference for physical product examination before purchasing major kitchen appliances. As per the industry reports, home furnishing retailers continue expanding their footprint across the Kingdom, with major players opening new stores in cities including Madinah, where a recently inaugurated 18,000 square meter store provides comprehensive kitchen solutions. Specialty appliance stores, hypermarkets, and electronics retailers offer hands-on product demonstrations, enabling customers to evaluate suction power, noise levels, and design aesthetics before committing to purchases.

Professional consultation services available through offline channels provide significant value to consumers navigating kitchen chimney selection, with trained staff advising on appropriate chimney sizes, duct requirements, and installation considerations based on individual kitchen configurations. The complexity of installation requirements, including ductwork routing, electrical connections, and proper mounting, reinforces consumer preference for purchasing through established retailers offering bundled installation services. Rising mall rents across Riyadh alongside strong occupancy rates indicate robust offline retail activity supporting appliance sales throughout the Kingdom.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Western Region exhibits a clear dominance with a 30% share of the total Saudi Arabia kitchen chimney market in 2025.

The Western Region's market leadership stems from the concentration of Saudi Arabia's second-largest metropolitan area, Jeddah, along with the holy cities of Makkah and Madinah, which collectively drive substantial residential and hospitality construction activity. The region's retail market continues delivering significant new commercial space, indicating robust consumer market infrastructure supporting appliance distribution. Major shopping centers and specialty stores throughout the region provide extensive product availability and professional consultation services for kitchen chimney purchases.

The region benefits from significant religious tourism flows, stimulating hospitality sector kitchen equipment demand alongside residential consumption driven by an affluent, cosmopolitan population seeking premium home solutions. Ongoing urban development projects and luxury residential communities throughout Jeddah and surrounding areas create sustained demand for modern kitchen ventilation systems. The Western Region's strategic position as a commercial gateway and tourism hub ensures continued market expansion as new housing developments incorporate contemporary kitchen designs requiring efficient chimney installations.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Kitchen Chimney Market Growing?

Accelerating Residential Construction and Housing Program Initiatives

Saudi Arabia's ambitious housing development programs under Vision 2030 are fundamentally transforming the residential real estate landscape and creating sustained demand for home appliances including kitchen chimneys. Real estate investments have surged substantially, reflecting growing investor confidence and accelerating project execution across the Kingdom's housing sector, directly benefiting kitchen appliance demand. The National Housing Company continues delivering integrated residential communities across multiple cities, incorporating modern kitchen infrastructure. These developments are creating a substantial pipeline of new kitchens requiring ventilation solutions, establishing durable demand fundamentals for the kitchen chimney market throughout the forecast period.

Rising Disposable Incomes and Consumer Preference for Premium Kitchen Solutions

Growing household incomes across Saudi Arabia are enabling consumers to invest in higher-quality kitchen appliances featuring advanced technologies and premium aesthetics. Rising income levels are driving a notable shift toward premium and customized kitchen appliances, with affluent consumers increasingly prioritizing innovative features, stylish designs, and durable construction over basic functionality. The expanding middle class, supported by private-sector job creation under Vision 2030's economic diversification agenda, demonstrates strong readiness to upgrade kitchen equipment including ventilation systems that enhance cooking comfort and interior aesthetics. This premiumization trend is encouraging manufacturers to introduce higher-specification products with advanced filtration systems, smart connectivity, and designer finishes tailored to Saudi consumer preferences.

Growing Health Consciousness and Indoor Air Quality Awareness

Increasing awareness among Saudi consumers regarding the health implications of cooking-generated pollutants is driving adoption of effective kitchen ventilation solutions. Scientific research has established that cooking activities produce various harmful substances including particulate matter, nitrogen dioxide, carbon monoxide, and volatile organic compounds that can adversely affect respiratory health when inadequate ventilation allows accumulation indoors. Studies have demonstrated associations between exposure to cooking fumes without proper exhaust ventilation and elevated health risks, prompting health-conscious consumers to prioritize effective kitchen chimneys. The Kingdom's healthcare sector development and widespread access to health information are educating consumers about the importance of indoor air quality management. Growing families with young children are particularly attentive to maintaining healthy home environments, recognizing that properly functioning kitchen ventilation systems protect household members from prolonged exposure to cooking pollutants during meal preparation activities.

Market Restraints:

What Challenges the Saudi Arabia Kitchen Chimney Market is Facing?

High Initial Investment and Installation Complexity

The substantial upfront costs associated with quality kitchen chimneys and professional installation services present barriers to market expansion, particularly among price-sensitive consumer segments. Premium chimneys featuring advanced filtration systems, auto-clean technology, and smart connectivity command higher price points that may exceed budget allocations for middle-income households. Installation complexity requiring skilled technicians to properly route ductwork, ensure adequate electrical connections, and mount equipment securely adds to total ownership costs. These financial considerations can delay purchase decisions or prompt consumers to select lower-specification alternatives with reduced functionality.

Limited Consumer Awareness in Emerging Markets

Despite growing urbanization across Saudi Arabia, consumer awareness regarding the importance and benefits of kitchen chimneys remains limited in certain market segments and geographic regions outside major metropolitan areas. Traditional cooking practices and reliance on natural ventilation through windows persist in some households, particularly in smaller cities and rural communities where modern kitchen infrastructure may be less prevalent. The absence of comprehensive consumer education regarding indoor air quality benefits and proper chimney selection criteria hampers market penetration among first-time buyers unfamiliar with ventilation product categories.

Maintenance Requirements and After-Sales Service Accessibility

Regular maintenance requirements for optimal chimney performance, including filter cleaning, oil collector emptying, and periodic motor servicing, create ongoing ownership responsibilities that some consumers find inconvenient. Limited availability of authorized service centers and trained technicians in smaller cities can complicate maintenance and repair procedures, particularly for premium brands with specialized components. Concerns regarding long-term serviceability and spare parts availability may influence purchase decisions, with some consumers preferring simpler, traditional ventilation solutions requiring minimal ongoing maintenance despite reduced performance capabilities.

Competitive Landscape:

The Saudi Arabia kitchen chimney market features a dynamic competitive landscape characterized by the presence of international appliance manufacturers alongside regional distributors and local retailers. Global players leverage brand recognition, technological innovation, and established distribution networks to maintain market positions, while regional competitors differentiate through localized service offerings and competitive pricing strategies. Market participants are investing in product diversification, expanding from basic wall-mounted models to premium designer variants incorporating smart technologies and energy-efficient features. Strategic partnerships between manufacturers and major kitchen retailers are strengthening distribution capabilities, ensuring product availability across diverse retail formats from hypermarkets to specialty showrooms. Companies are emphasizing after-sales service networks to build customer loyalty, recognizing the importance of installation support and maintenance services in driving repeat purchases and brand recommendations.

Recent Developments:

- In September 2025, Panasonic Marketing Middle East and Africa announced a partnership with Alessa Industries Co., appointing the company as the official distributor of Panasonic's premium large home appliances in Saudi Arabia. This strategic distribution agreement enhances product availability across the Kingdom's retail channels, expanding consumer access to international appliance brands and supporting market growth.

- In May 2024, Saudi-based Basic Electronics Company collaborated with leading Chinese electric appliances group Gree to launch a new smart factory in Dammam. The facility is dedicated to manufacturing heating, ventilation, and air-conditioning products, demonstrating growing local production capabilities for home appliances and supporting the Kingdom's industrial diversification objectives under Vision 2030.

Saudi Arabia Kitchen Chimney Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Wall-Mounted Chimney, Built-In Chimney, Island Chimney, Corner Chimney, Others |

| Duct Types Covered | Ducted, Ductless |

| Applications Covered | Residential, Commercial |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia kitchen chimney market size was valued at USD 498.9 Million in 2025.

The Saudi Arabia kitchen chimney market is expected to grow at a compound annual growth rate of 4.95% from 2026-2034 to reach USD 770.6 Million by 2034.

Wall-mounted chimney dominated the market with a share of 43%, driven by its versatile installation capabilities, space efficiency in modern kitchen layouts, and extensive availability across multiple price segments catering to diverse consumer preferences.

Key factors driving the Saudi Arabia kitchen chimney market include accelerating residential construction under Vision 2030 housing programs, rising disposable incomes enabling premium appliance purchases, and growing consumer awareness regarding indoor air quality and health benefits of effective kitchen ventilation.

Major challenges include high initial investment costs for quality chimneys and professional installation, limited consumer awareness in emerging markets outside major metropolitan areas, maintenance requirements necessitating regular filter cleaning and servicing, and accessibility of after-sales support in smaller cities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)