Saudi Arabia Laminated Flooring Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End User, and Region, 2026-2034

Saudi Arabia Laminated Flooring Market Overview:

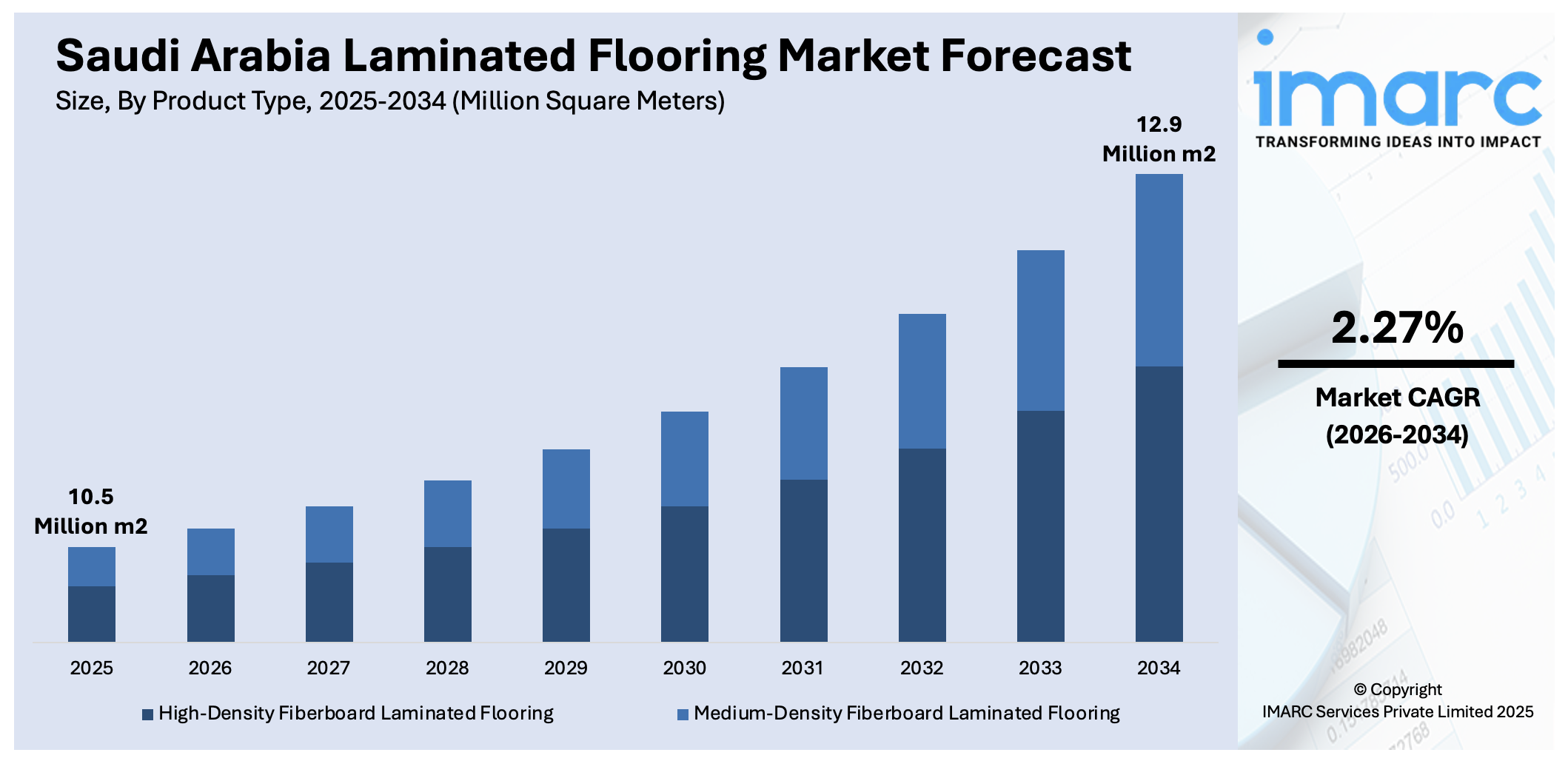

The Saudi Arabia laminated flooring market size reached 10.5 Million Sq. Metres in 2025. Looking forward, IMARC Group expects the market to reach 12.9 Million Sq. Metres by 2034, exhibiting a growth rate (CAGR) of 2.27% during 2026-2034. The market is driven by sustained residential construction under Vision 2030, expanding the use of modern, cost-effective materials in housing projects. Commercial and institutional developments favor laminates for their durability, safety, and rapid installation advantages. Rising consumer appetite for trendy, customizable interiors and a maturing retail landscape further augment the Saudi Arabia laminated flooring market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 10.5 Million Sq. Metres |

| Market Forecast in 2034 | 12.9 Million Sq. Metres |

| Market Growth Rate 2026-2034 | 2.27% |

Saudi Arabia Laminated Flooring Market Trends:

Expansion of Residential Real Estate and Urban Projects

Saudi Arabia’s Vision 2030 housing initiatives have prioritized affordable residential development, driving significant demand for cost-efficient construction materials. Laminated flooring is increasingly used in new housing units for its low cost, easy maintenance, and adaptability to modern interior designs. The Ministry of Housing’s partnership with the private sector has accelerated urban housing projects in Riyadh, Jeddah, and Dammam, integrating laminated flooring into mid-tier and premium real estate offerings. In the first four months of 2025, Saudi banks extended SR 34.1 billion (USD 9.1 billion) in residential mortgages, marking a 24.14% increase from the previous year. The real estate sector contributed over 16% of foreign investment, with Saudi housing prices rising by 4.3% in Q1 2025, including a 10.3% increase in villa prices. Saudi Arabia aims to achieve 70% homeownership by 2030. Developers value its quick installation and compatibility with fast-paced project timelines. Additionally, middle-class homebuyers and young families are drawn to laminate options for their aesthetic versatility and resistance to scratches and stains, which suits daily use. Importantly, home design trends are shifting toward Western-inspired interiors, favoring laminate textures resembling oak, walnut, and stone. Retail chains and online platforms have also contributed to market awareness, making high-quality laminated products widely accessible. With sustained real estate development and growing homeowner demand for durable yet stylish materials, this housing momentum continues to support Saudi Arabia laminated flooring market growth.

To get more information on this market Request Sample

Shifting Consumer Preferences and Retail Expansion

Consumer expectations in Saudi Arabia have shifted toward contemporary and minimalist interior design styles, positioning laminated flooring as a favorable choice in both renovations and new constructions. Influenced by global design trends and increased exposure through social media, Saudi homeowners are choosing finishes that mimic hardwood, marble, or concrete without the associated costs or maintenance burden. Laminated flooring meets these aesthetic and functional expectations while offering practicality suited to regional climate considerations. Retailers and e-commerce platforms have scaled up their offerings, providing a range of imported and locally produced laminate solutions. The presence of in-store visualization tools, digital customization options, and flexible pricing tiers enhances consumer engagement. In 2025, over 40% of customers are more likely to buy flooring when AR/VR tools are available, and 50% of flooring purchases in developed markets will be influenced by digital tools. Smart flooring systems are expected to grow rapidly, with AI and robotics in manufacturing projected to reduce production waste by 30%. Moreover, the rise of do-it-yourself home upgrades among young professionals and newly married couples has made easy-to-install laminate flooring popular among first-time buyers. As domestic retail networks widen and consumer tastes align more with globally recognized design motifs, customized laminate products continue to appeal to a broad demographic of homeowners and tenants.

Saudi Arabia Laminated Flooring Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type, distribution channel, and end user.

Product Type Insights:

- High-Density Fiberboard Laminated Flooring

- Medium-Density Fiberboard Laminated Flooring

The report has provided a detailed breakup and analysis of the market based on the product type. This includes high-density fiberboard laminated flooring and medium-density fiberboard laminated flooring.

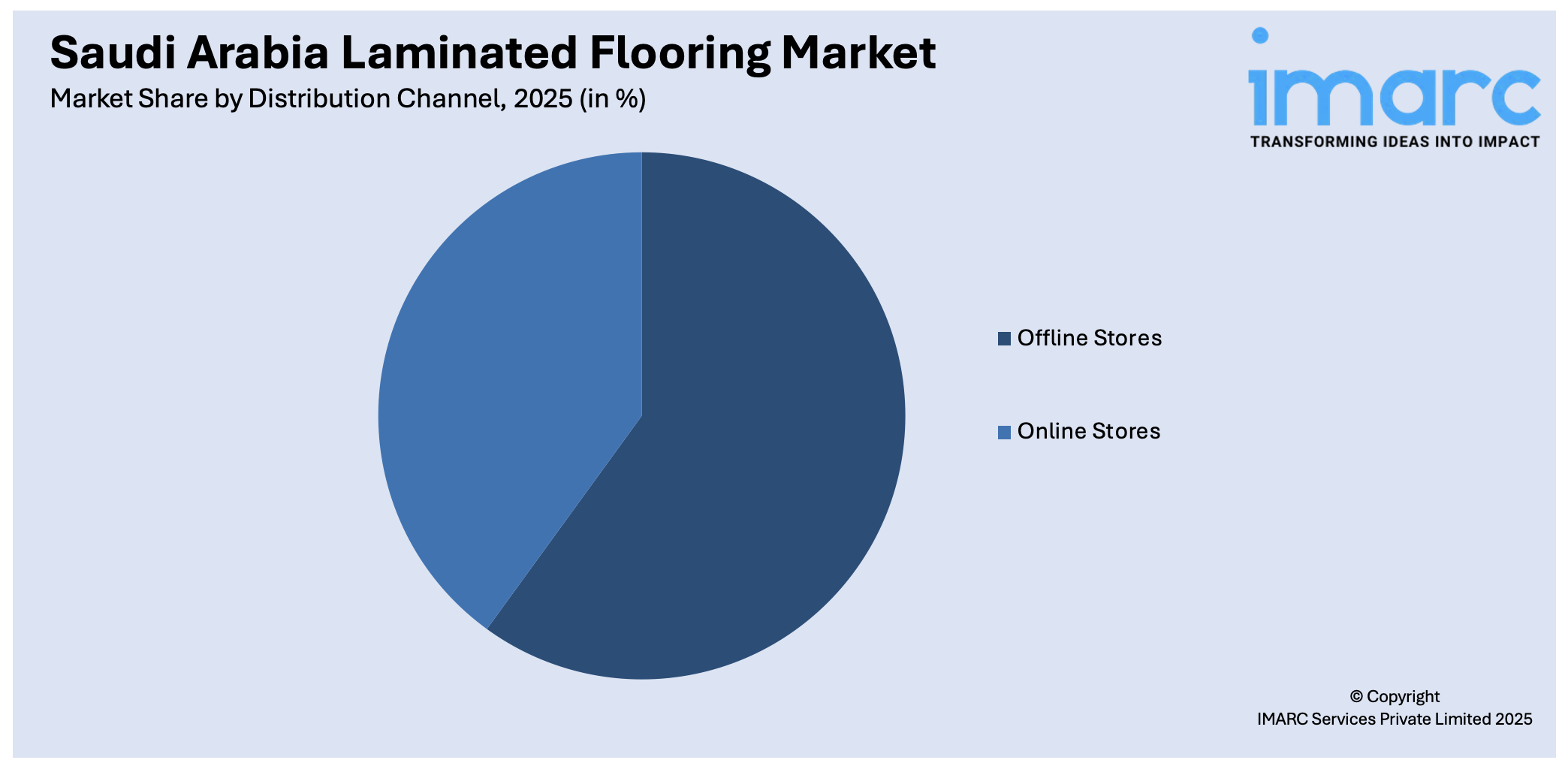

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Offline Stores

- Online Stores

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes offline stores and online stores.

End User Insights:

- Residential

- Commercial

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential and commercial.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Laminated Flooring Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Sq. Metres |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | High-Density Fiberboard Laminated Flooring, Medium-Density Fiberboard Laminated Flooring |

| Distribution Channels Covered | Offline Stores, Online Stores |

| End Users Covered | Residential, Commercial |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia laminated flooring market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia laminated flooring market on the basis of product type?

- What is the breakup of the Saudi Arabia laminated flooring market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia laminated flooring market on the basis of end user?

- What is the breakup of the Saudi Arabia laminated flooring market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia laminated flooring market?

- What are the key driving factors and challenges in the Saudi Arabia laminated flooring market?

- What is the structure of the Saudi Arabia laminated flooring market and who are the key players?

- What is the degree of competition in the Saudi Arabia laminated flooring market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia laminated flooring market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia laminated flooring market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia laminated flooring industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)