Saudi Arabia Leak Detection Market Size, Share, Trends and Forecast by Technology, End User, and Region, 2026-2034

Saudi Arabia Leak Detection Market Overview:

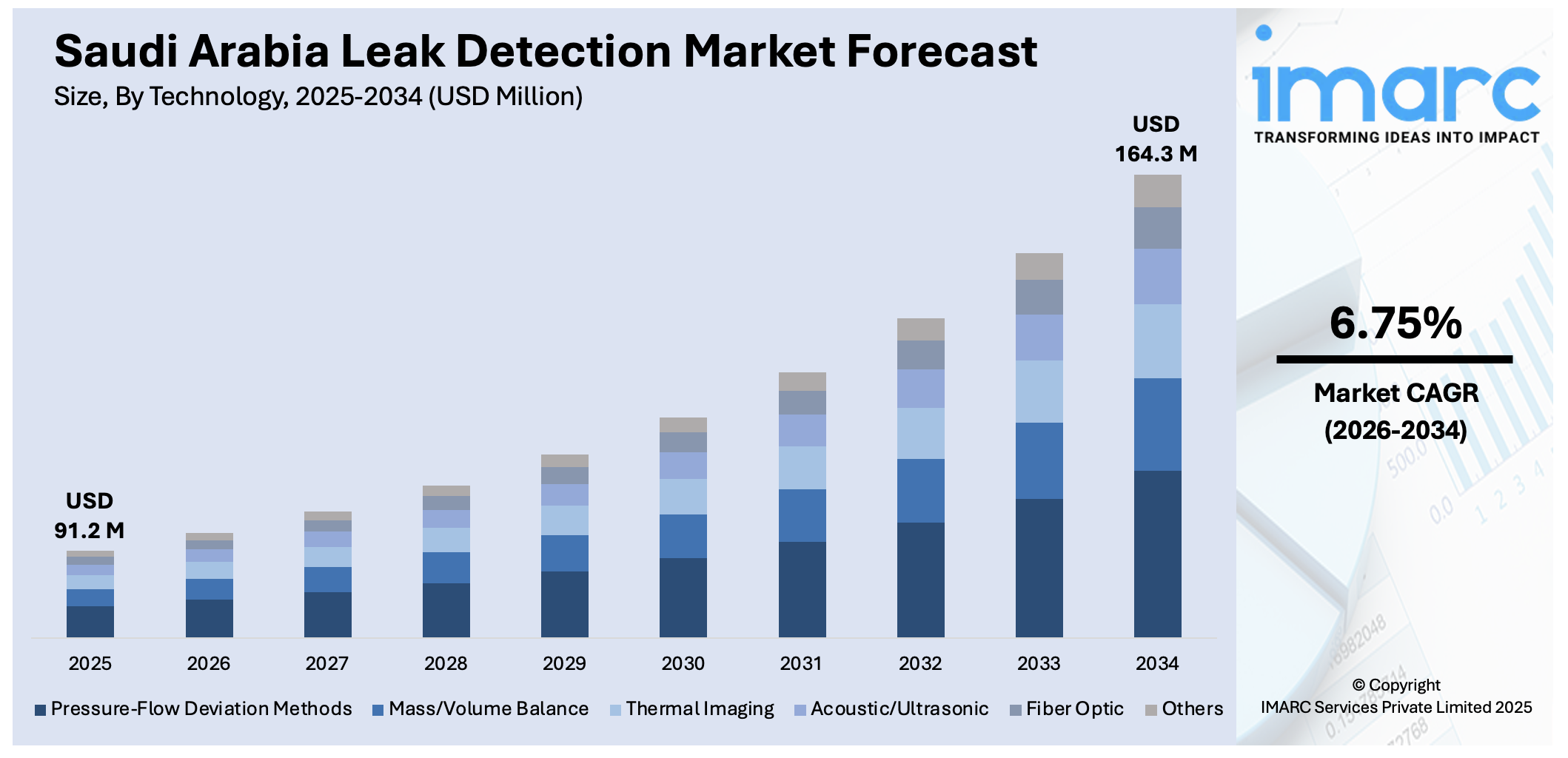

The Saudi Arabia leak detection market size reached USD 91.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 164.3 Million by 2034, exhibiting a growth rate (CAGR) of 6.75% during 2026-2034. The market is driven by the rapid adoption of advanced technologies, such as IoT-enabled monitoring and AI-driven analytics, enhancing real-time leak detection and predictive maintenance. Government mandates on efficient water management and infrastructure modernization under Vision 2030 are accelerating investments in smart leak detection solutions. Additionally, the expanding oil and gas sector and rising water scarcity concerns are escalating demand for robust detection systems, further augmenting the Saudi Arabia leak detection market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 91.2 Million |

| Market Forecast in 2034 | USD 164.3 Million |

| Market Growth Rate 2026-2034 | 6.75% |

Saudi Arabia Leak Detection Market Trends:

Increasing Adoption of Advanced Leak Detection Technologies

The market is witnessing a significant shift toward advanced technologies including acoustic sensors, IoT-enabled monitoring systems, and AI-driven analytics. With the government’s focus on reducing water loss and improving infrastructure efficiency, utilities and industrial sectors are investing in smart leak detection solutions. These technologies enable real-time monitoring, early leak identification, and predictive maintenance, minimizing resource wastage and operational downtime. In 2023, Saudi Vision 2030 efforts introduced a great shift in its water management policy: desalination of seawater production rose by 31%, now representing 50% of the total supply distributed, up from 44% in 2022. At the same time, non-renewable groundwater consumption for agriculture decreased by 7%, reaching 9,356 million cubic meters. Even with this reduction, non-renewable groundwater continues to account for 62% of the natural supply, down from 68%. Water reuse also increased by 12% to 555 million cubic meters, while per capita household water consumption decreased to 102.1 liters per day. This increasing reliance on costly desalinated and treated water, which is piped through elaborate networks, underscores the immediate need for Saudi Arabia's leak detection industry to manage water loss, thereby maintaining the sustainability and efficiency of these critical, newly dominant resources. Additionally, stringent regulations mandating the use of efficient water management systems are accelerating adoption. Companies are also integrating drone-based inspections and satellite imaging for large-scale pipeline networks, particularly in oil and gas sectors. As Saudi Arabia continues to modernize its infrastructure under Vision 2030, the demand for automated, high-precision leak detection systems is expected to grow, creating opportunities for global and local technology providers.

To get more information on this market Request Sample

Rising Demand in Oil and Gas and Water Management Sectors

The expanding oil and gas industry and increasing water scarcity concerns are also propelling the Saudi Arabia leak detection market growth. The country’s extensive pipeline networks and desalination plants require robust leak detection systems to prevent costly spills and ensure a sustainable water supply. In the oil sector, stringent safety standards and the need to minimize environmental risks are pushing companies to adopt advanced detection methods such as fiber-optic sensing and pressure monitoring. Meanwhile, municipal water authorities are deploying smart metering and acoustic leak detectors to combat high non-revenue water losses. With Vision 2030 emphasizing infrastructure development and environmental sustainability, both public and private sectors are prioritizing investments in leak prevention technologies, fueling market expansion. Gas Arabian Services Company (GAS) signed two major contracts with Saudi Power Procurement Company (SPPC) worth SAR 830.64 Million (approximately USD 221.46 Million) for the development of gas pipeline networks for the Nairyah and Rumah Independent Power Projects (IPPs). The two contracts, each worth SAR 504.32 million (approximately USD 134.45 Million) and SAR 326.32 Million (approximately USD 86.99 Million), involve design, procurement, and installation within 24 months. With the expansion of pipeline infrastructure, the application of sophisticated leak detection systems will be necessary to ensure safety and improve operational efficiency.

Saudi Arabia Leak Detection Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on technology and end user.

Technology Insights:

- Pressure-Flow Deviation Methods

- Mass/Volume Balance

- Thermal Imaging

- Acoustic/Ultrasonic

- Fiber Optic

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes pressure-flow deviation methods, mass/volume balance, thermal imaging, acoustic/ultrasonic, fiber optic, and others.

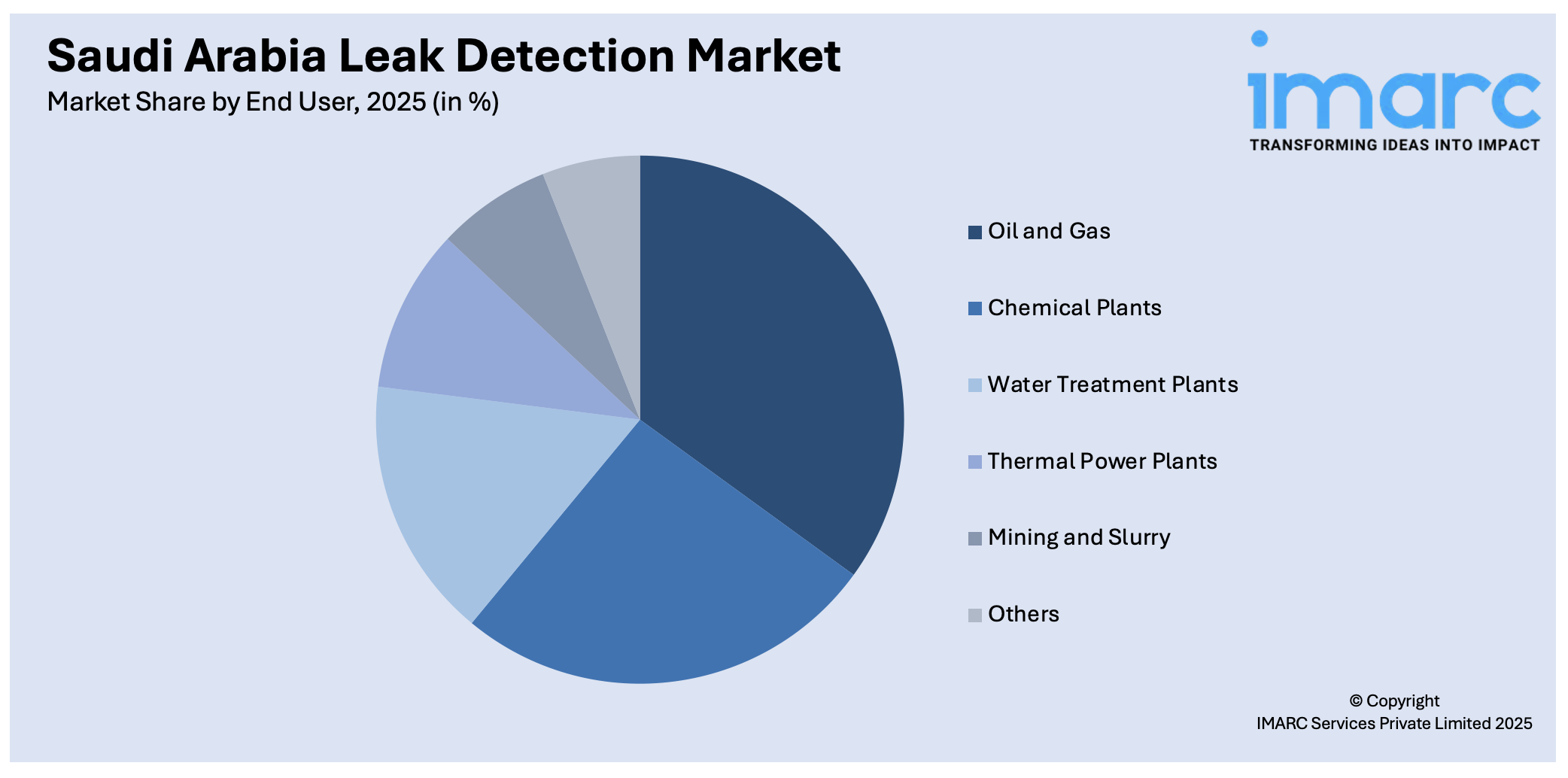

End User Insights:

Access the comprehensive market breakdown Request Sample

- Oil and Gas

- Chemical Plants

- Water Treatment Plants

- Thermal Power Plants

- Mining and Slurry

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes oil and gas, chemical plants, water treatment plants, thermal power plants, mining and slurry, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Leak Detection Market News:

- March 21, 2025: Aramco, in collaboration with Siemens Energy, commissioned Saudi Arabia's first Direct Air Capture (DAC) pilot unit, designed to remove 12 tons of CO2 annually as part of the country's net-zero goals. The initiative reflects the growing importance of advanced leak detection technologies in tracking carbon emissions and optimizing the capture process. As Saudi Arabia enhances its carbon capture and storage (CCS) capabilities, the need for reliable leak detection systems to ensure operational efficiency and sustainability will become increasingly crucial in achieving long-term climate goals.

Saudi Arabia Leak Detection Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Pressure-Flow Deviation Methods, Mass/Volume Balance, Thermal Imaging, Acoustic/Ultrasonic, Fiber Optic, Others |

| End Users Covered | Oil and Gas, Chemical Plants, Water Treatment Plants, Thermal Power Plants, Mining and Slurry, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia leak detection market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia leak detection market on the basis of technology?

- What is the breakup of the Saudi Arabia leak detection market on the basis of end user?

- What is the breakup of the Saudi Arabia leak detection market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia leak detection market?

- What are the key driving factors and challenges in the Saudi Arabia leak detection market?

- What is the structure of the Saudi Arabia leak detection market and who are the key players?

- What is the degree of competition in the Saudi Arabia leak detection market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia leak detection market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia leak detection market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia leak detection industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)