Saudi Arabia Load Break Switch Market Size, Share, Trends and Forecast by Type, Voltage, Installation, End Use, and Region, 2026-2034

Saudi Arabia Load Break Switch Market Summary:

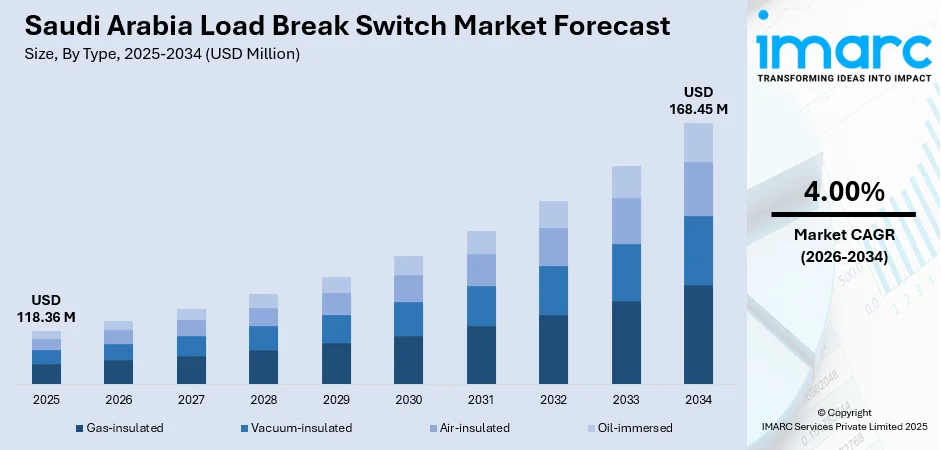

The Saudi Arabia load break switch market size was valued at USD 118.36 Million in 2025 and is projected to reach USD 168.45 Million by 2034, growing at a compound annual growth rate of 4.00% from 2026-2034.

The market expansion is primarily propelled by the Kingdom's ambitious renewable energy integration initiatives under Vision 2030, which targets 130 gigawatts of renewable capacity by 2030, necessitating substantial upgrades to electrical distribution infrastructure. The accelerating deployment of smart grid technologies is driving demand for advanced load break switches capable of supporting intelligent grid operations. Additionally, major transmission and distribution infrastructure projects are creating sustained need across utility and industrial applications, expanding the Saudi Arabia load break switch market share.

Key Takeaways and Insights:

- By Type: Gas-insulated load break switches dominate the market with a share of 36% in 2025, driven by their compact design requirements in space-constrained substations and superior performance characteristics in harsh desert environments.

- By Voltage: Below 11 kV leads the market with a share of 48% in 2025, reflecting the extensive medium-voltage distribution networks servicing residential, commercial, and light industrial facilities across the Kingdom.

- By Installation: Outdoor represent the largest segment with a market share of 65% in 2025, favored by abundant land availability, cost efficiencies in desert terrain, and well-established outdoor substation infrastructure throughout Saudi Arabia.

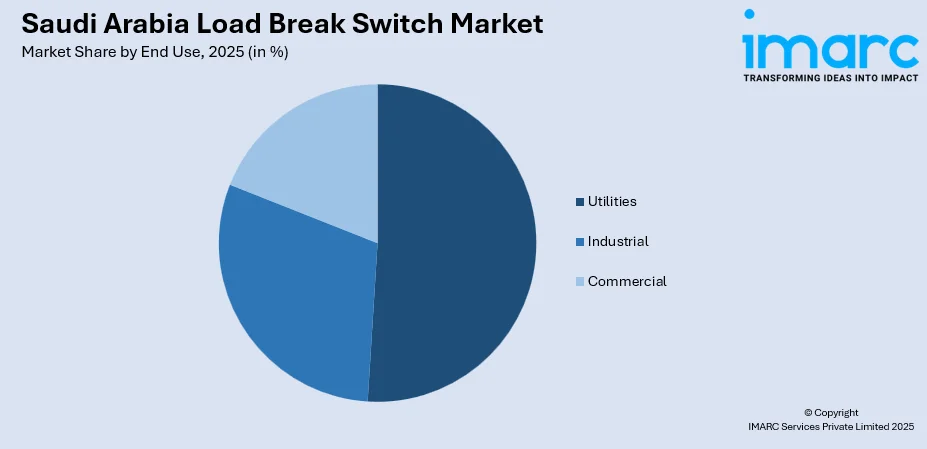

- By End Use: Utilities lead the market with a share of 51% in 2025, underpinned by massive grid modernization programs, renewable energy integration requirements, and regional interconnection projects connecting Saudi Arabia's electrical grid with neighboring nations.

- Key Players: The Saudi Arabia load break switch market exhibits moderate concentration with multinational electrical equipment corporations competing alongside regional manufacturers and local distributors. Major global players maintain strong market presence through established relationships with key regional players and other key utilities, while regional suppliers leverage localization strategies and proximity advantages to secure contracts for distribution network upgrades and renewable energy projects.

To get more information on this market Request Sample

The Saudi Arabia load break switch market is experiencing transformative growth as the Kingdom pursues its Vision 2030 objectives for energy diversification and economic development. The National Renewable Energy Program's aggressive expansion plans, targeting to generate 50% of its electricity from renewables by decade’s end, require extensive grid infrastructure enhancements to accommodate variable renewable generation patterns. Smart grid initiatives have accelerated remarkably, with Saudi Electricity Company deploying approximately 11 million smart meters by 2022 and The Ministry of Energy’s advancing plans to establish nine digital control centers by 2026 for real-time monitoring and precision management of the electricity distribution network. In 2025, Siemens Energy secured a 1.6-billion-dollar contract to supply critical technologies for the Rumah 2 and Nairyah 2 gas-fired power plants, which will add 3.6 gigawatts to Saudi Arabia's national grid, demonstrating the scale of ongoing infrastructure development that continues to drive load break switch demand across voltage classes and application segments throughout the Kingdom.

Saudi Arabia Load Break Switch Market Trends:

Grid Digitalization and Smart Meter Deployment

Saudi Arabia is implementing comprehensive digitalization programs across its electrical distribution infrastructure, transforming traditional grid operations through advanced monitoring and automation technologies. The Ministry of Energy announced in December 2024 that the Kingdom had achieved 32 percent automation of its electricity distribution network, with ambitious plans to reach 40 percent by the end of 2025. This rapid digitalization requires sophisticated load break switches equipped with intelligent sensors and communication capabilities to integrate seamlessly with automated distribution management systems. These digitalization initiatives necessitate load break switches with enhanced data transmission capabilities, remote operation functionalities, and compatibility with supervisory control and data acquisition systems, fundamentally transforming equipment specifications and accelerating replacement cycles for legacy infrastructure across Saudi Arabia's expanding distribution networks.

Integration of Renewable Energy into Power Distribution Networks

The Kingdom's aggressive renewable energy expansion is reshaping electrical distribution infrastructure requirements as variable solar and wind generation sources necessitate more flexible and responsive grid management solutions. Saudi Arabia connected an additional 2,100 megawatts of renewable energy to its power grid since 2022, bringing total installed renewable capacity to 2.8 gigawatts, representing a 300% increase that demonstrates the accelerating pace of clean energy deployment. Saudi Arabia's energy transition progressed as the partnership of France’s TotalEnergies and Aljomaih Energy & Water (AEW) secured the license to develop, construct, and manage the 400-megawatt As Sufun solar photovoltaic facility in the Hail area. The Saudi Power Procurement Company (SPPC) granted the award after a competitive bidding process under the sixth phase of the National Renewable Energy Program (NREP). Load break switches play critical roles in connecting distributed renewable generation facilities to medium-voltage distribution networks, managing power flow fluctuations from intermittent sources, and enabling rapid isolation of grid sections for maintenance or fault conditions. The integration of renewable energy requires load break switches with enhanced arc-quenching capabilities, faster switching speeds to respond to voltage fluctuations, and robust construction to withstand the demanding operational requirements of renewable-connected substations across Saudi Arabia's diverse climatic conditions.

Localization of Electrical Equipment Manufacturing

Saudi Arabia is pursuing aggressive localization strategies for electrical equipment manufacturing to reduce import dependence, strengthen domestic supply chains, and create high-value employment opportunities as part of Vision 2030 economic diversification objectives. The Public Investment Fund announced joint ventures with Chinese manufacturers including Envision, Jinko Solar, and TCL Zhonghuan to establish domestic production facilities for wind turbines, solar modules, and related electrical components. The Kingdom's strategic framework aims to localize 75 percent of the renewable energy value chain by 2030, encompassing nacelle and blade assembly, tower fabrication, and grid infrastructure components including switchgear and distribution equipment. This localization trend is influencing procurement patterns as utilities and project developers increasingly prioritize suppliers with domestic manufacturing capabilities or significant local content commitments. The establishment of domestic production facilities is expected to reduce equipment lead times, lower total project costs through decreased shipping expenses and import duties, and provide more responsive technical support services for Saudi Arabia's rapidly expanding electrical infrastructure deployment programs.

How Vision 2030 is Transforming the Saudi Arabia load break switch market:

Saudi Arabia’s Vision 2030 is reshaping the load break switch market by accelerating grid expansion, urban development, and industrial growth. Large investments in renewable energy, smart cities, and infrastructure projects are increasing demand for reliable medium-voltage switching equipment. Power utilities are upgrading distribution networks to reduce outages and support rising electricity consumption from new residential, commercial, and industrial zones. Localization policies under Vision 2030 are also encouraging domestic manufacturing and partnerships with global electrical equipment firms, improving supply chains and technical capabilities. Together, these shifts are driving steady demand for advanced, durable, and compliant load break switches across the Kingdom.

Market Outlook 2026-2034:

The Saudi Arabia load break switch market is positioned for sustained expansion throughout the forecast period as the Kingdom advances its Vision 2030 infrastructure modernization agenda and renewable energy deployment targets. The market generated a revenue of USD 118.36 Million in 2025 and is projected to reach a revenue of USD 168.45 Million by 2034, growing at a compound annual growth rate of 4.00% from 2026-2034. Industrial and commercial segments will experience robust growth as mega-projects require substantial electrical infrastructure investments. Outdoor installations will maintain dominance given the Kingdom's abundant land availability and favorable economics for open-air substations, while gas-insulated technologies will gain market share in urban and space-constrained applications as cities expand and land values appreciate in metropolitan areas across Saudi Arabia.

Saudi Arabia Load Break Switch Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Gas-insulated |

36% |

|

Voltage |

Below 11 kV |

48% |

|

Installation |

Outdoor |

65% |

|

End Use |

Utilities |

51% |

Type Insights:

- Gas-insulated

- Vacuum-insulated

- Air-insulated

- Oil-immersed

Gas-insulated dominates with a market share of 36% of the total Saudi Arabia load break switch market in 2025.

Gas-insulated load break switches have established strong market presence in Saudi Arabia due to their compact footprint requirements, which prove advantageous in space-constrained urban substations and facilities where land availability presents constraints despite the Kingdom's generally abundant desert terrain. These switches utilize sulfur hexafluoride or alternative insulating gases to achieve superior dielectric strength in sealed enclosures, enabling significantly reduced equipment dimensions compared to air-insulated alternatives while maintaining equivalent voltage ratings and interrupting capacities.

The harsh desert environment of Saudi Arabia, characterized by extreme temperatures, abrasive sand particles, and occasional dust storms, favors gas-insulated technologies that protect critical switching components from environmental contamination and degradation. Gas-insulated switches require minimal maintenance interventions due to their sealed construction, reducing operational expenditures and improving system reliability in remote or difficult-to-access locations throughout the Kingdom's expansive geography.

Voltage Insights:

- Below 11 kV

- 11-33 kV

- 33-60 kV

Below 11 kV leads with a share of 48% of the total Saudi Arabia load break switch market in 2025.

The Below 11 kV voltage class encompasses the vast majority of electrical distribution infrastructure serving residential neighborhoods, commercial districts, and light industrial facilities throughout Saudi Arabia's urban centers and rural communities. This voltage level forms the backbone of secondary distribution networks that deliver electricity from primary distribution substations to end consumers, requiring extensive networks of load break switches for sectionalizing, protection, and maintenance isolation across thousands of kilometers of overhead lines and underground cables. Key market players operate massive Below 11 kV distribution infrastructure across all regions of the Kingdom, with particularly dense networks in population centers like Riyadh, Jeddah, Dammam, and Medina where customer concentrations necessitate intricate distribution arrangements with numerous switching points for operational flexibility and reliability enhancement.

The ongoing urban development trends in Saudi Arabia, with population growth driving expansion of residential communities and commercial developments, continuously increase the length and complexity of Below 11 kV distribution networks requiring additional load break switch installations. The segment benefits from standardized product specifications, mature manufacturing processes, and competitive pricing that enable utilities to procure equipment in volume for systematic network upgrade programs across Saudi Arabia's extensive territory. Government infrastructure investments supporting Vision 2030 development initiatives, including industrial cities, economic zones, and mega-projects, necessitate greenfield Below 11 kV distribution networks requiring comprehensive load break switch installations that reinforce the segment's dominant market position throughout the forecast period.

Installation Insights:

- Outdoor

- Indoor

Outdoor exhibits a clear dominance with a 65% share of the total Saudi Arabia load break switch market in 2025.

Outdoor load break switch installations dominate the Saudi Arabia market due to the Kingdom's abundant land availability, favorable climatic conditions for outdoor electrical equipment during most seasons, and well-established engineering practices for open-air substation design throughout the region. The vast majority of Saudi Arabia's electrical substations utilize outdoor configurations where equipment is mounted on concrete pads or steel structures exposed to ambient environmental conditions, taking advantage of natural air cooling and eliminating the need for building enclosures that would increase project capital costs substantially.

Outdoor installations prove particularly economical in desert regions where land acquisition costs remain relatively modest compared to urban centers, enabling utilities to construct spacious substation layouts with generous equipment spacing that simplifies maintenance access and enhances worker safety during operational activities. The technical specifications for outdoor load break switches incorporate robust weatherproofing features including UV-resistant polymer housings, sealed mechanisms protecting internal components from dust and sand ingress, and corrosion-resistant materials withstanding the Kingdom's occasionally harsh environmental conditions including coastal humidity near Red Sea and Arabian Gulf littorals.

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Utilities

- Industrial

- Commercial

Utilities lead with a share of 51% of the total Saudi Arabia load break switch market in 2025.

The utilities segment encompasses Saudi Electricity Company and regional distribution companies that operate the Kingdom's extensive electrical transmission and distribution infrastructure serving millions of residential, commercial, and industrial customers across all 13 administrative regions. Utilities represent the single largest purchaser category for load break switches in Saudi Arabia, driven by continuous network expansion programs, systematic equipment replacement initiatives, and major infrastructure modernization projects aligned with Vision 2030 objectives. Saudi Electricity Company, as the dominant utility operator owning approximately 87 percent of the Kingdom's installed generation capacity and operating the majority of transmission and distribution assets, conducts large-scale procurement programs for standardized load break switches deployed throughout its service territory.

Regional distribution companies servicing specific provinces and municipalities likewise maintain active equipment procurement activities to expand network coverage, enhance service reliability, and integrate renewable energy sources into local distribution grids. Grid modernization programs are expanding rapidly as utilities implement advanced distribution management systems, automated fault detection algorithms, and real-time network optimization protocols that necessitate compatible load break switches throughout medium-voltage networks. Renewable energy integration mandates under the National Renewable Energy Program are driving substantial utility investments in distribution infrastructure upgrades to accommodate variable generation patterns, manage bidirectional power flows, and maintain voltage regulation as solar and wind penetration increases across the Kingdom's electrical grid.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Northern and Central Region, anchored by the capital city Riyadh, dominates the Saudi Arabia load break switch market due to its status as the Kingdom's administrative, financial, and commercial hub hosting the largest concentration of government institutions, corporate headquarters, and major infrastructure developments. The region benefits from aggressive infrastructure spending supporting Vision 2030 mega-projects and numerous commercial real estate developments that require comprehensive electrical distribution networks with multiple voltage levels and extensive load break switch installations. Government facilities, ministerial complexes, and diplomatic quarters throughout Riyadh maintain stringent reliability requirements driving demand for redundant electrical systems incorporating sophisticated switching arrangements.

The Western Region stands as a critical hub for load break switch deployment, encompassing the economic powerhouses. This territory exhibits accelerated electricity demand patterns, with consumption peaks increasing during summer months. The concentration of specialized industrial zones alongside transformative infrastructure initiatives creates persistent requirements for dependable electrical isolation equipment. Religious tourism infrastructure supporting millions of annual visitors necessitates flexible power distribution systems capable of managing seasonal consumption fluctuations. The regional energy portfolio integrating conventional thermal generation, emerging solar installations, and water desalination facilities mandate Usophisticated load break switches to ensure network stability, facilitate maintenance procedures, and support operational continuity across diverse end-user segments including hospitality, industrial manufacturing, and public utilities.

The Eastern Region functions as a premier industrial corridor, distinguished by its concentration of hydrocarbon processing and heavy manufacturing operations centered around Dammam, Jubail, and Al-Khobar. This territory hosts the nation's most extensive petrochemical complexes, which account for substantial portions of global chemical production and require mission-critical electrical distribution infrastructure. The proliferation of oil refineries, gas processing plants, and integrated industrial cities generates continuous demand for high-capacity load break switches capable of handling elevated voltage levels and harsh operating environments. Ongoing industrial expansion projects, coupled with the region's role as the primary energy production zone, position it as a strategic market for specialized switchgear solutions.

The Southern Region exhibits progressive market characteristics, encompassing Asir, Jizan, and Najran provinces where balanced economic development drives electrical infrastructure expansion. This territory experiences steady urbanization trends alongside agricultural modernization initiatives, creating diversified demand for power distribution equipment. Strategic transportation corridor developments and connectivity enhancement projects require dependable load break switches for substation applications and distribution network expansion. The regional focus on establishing technology-oriented industrial clusters and educational institutions contributes to rising electricity consumption patterns.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Load Break Switch Market Growing?

Renewable Energy Expansion Under Vision 2030

Saudi Arabia's transformative shift toward renewable energy generation under its Vision 2030 economic diversification program stands as the most significant driver propelling load break switch market expansion throughout the forecast period. This massive renewable deployment requires comprehensive upgrades to electrical distribution infrastructure as variable generation sources introduce new operational challenges including power flow fluctuations, voltage regulation complexities, and bidirectional energy movements that traditional grid architectures were not designed to accommodate. Load break switches play indispensable roles in renewable energy integration by enabling rapid isolation of grid sections for maintenance activities. The scale of Saudi Arabia's renewable energy ambitions is evidenced by major project commitments including the state-funded Saudi Power Procurement Company’s (SPCC) two power purchase agreements (PPA) with a consortium headed by Japan's Marubeni Corporation to obtain power from the 600-megawatt (MW) AlGhat and 500-MW Wa’ad Alshamal wind initiatives in 2024. Each large-scale renewable project requires dozens to hundreds of load break switches depending on project configuration, collection system voltage levels, and redundancy requirements specified by utility interconnection agreements.

Infrastructure Modernization and Grid Upgrades

The comprehensive modernization of Saudi Arabia's electrical infrastructure represents a fundamental driver propelling sustained load break switch demand as utilities systematically upgrade aging equipment, implement smart grid technologies, and enhance network reliability to support the Kingdom's economic development objectives. This automation drive encompasses thousands of switching points across Saudi Arabia's vast distribution networks spanning all 13 administrative regions, creating massive near-term replacement demand independent of network expansion requirements. The Saudi Arabia’s Ministry of Industry and Mineral Resources signed agreements for 9 projects, presenting the first group of beneficiaries of the standard incentives for the industrial division, with a total investment of nearly SR2 billion ($523 million). These initiatives require cutting-edge technologies for real-time network monitoring and precision management, along with compatible field equipment including load break switches with data transmission capabilities enabling centralized operational oversight and automated response protocols.

Growing Utility and Industrial Electricity Demand

The relentless expansion of electricity consumption across Saudi Arabia's utility, industrial, and commercial sectors constitutes a fundamental growth driver necessitating continuous distribution infrastructure expansion and load break switch procurement to maintain reliable power delivery as demand scales upward throughout the forecast period. IMARC Group stated that the Saudi Arabia's power market was valued at 84.0 GW in 2024, with projections indicating growth to 106.0 GW by 2026-2034, driven by population expansion, industrial development, and rising per-capita consumption patterns across all customer segments. The industrial sector is experiencing particularly robust electricity demand growth as Vision 2030 manufacturing and processing initiatives advance, with new industrial facilities including petrochemical complexes, minerals processing plants, automotive manufacturing operations, and various value-added industries requiring substantial electrical infrastructure investments incorporating numerous load break switches across distribution voltage levels.

Market Restraints:

What Challenges the Saudi Arabia Load Break Switch Market is Facing?

Supply Chain Disruptions and Equipment Lead Times

The Saudi Arabia load break switch market faces persistent challenges from global supply chain disruptions and extended equipment lead times that complicate project scheduling, increase costs, and potentially delay critical infrastructure deployments across the Kingdom's ambitious development programs. The electrical equipment manufacturing industry globally has experienced significant supply chain stress stemming from semiconductor shortages affecting intelligent switchgear components, raw material price volatility impacting copper conductors and steel enclosures, and logistics bottlenecks disrupting international shipping routes particularly through the Suez Canal corridor connecting Asian manufacturing centers with Middle Eastern markets.

High Initial Infrastructure Investment Costs

The substantial capital requirements for comprehensive electrical infrastructure development present ongoing financial challenges for utility operators and industrial customers pursuing network expansion and modernization programs throughout Saudi Arabia. Load break switches, while individually representing relatively modest equipment costs compared to larger assets like transformers and circuit breakers, aggregate to significant expenditures when deployed across extensive distribution networks requiring hundreds or thousands of units for complete coverage. The transition to intelligent switchgear incorporating remote operation capabilities, integrated sensors, and communication systems commands premium pricing compared to conventional manually-operated alternatives, increasing project budgets for utilities implementing smart grid initiatives across their service territories.

Skilled Labor Shortage in Technical Sectors

The availability of qualified technical personnel for load break switch installation, commissioning, and maintenance activities represents a persistent constraint affecting project execution timelines and operational efficiency across Saudi Arabia's electrical infrastructure sector. The rapid pace of infrastructure development under Vision 2030, with numerous concurrent mega-projects demanding specialized technical expertise simultaneously, creates acute competition for skilled workers driving labor costs upward and potentially compromising quality standards as contractors struggle to staff projects adequately. Load break switch installation and commissioning require specialized training in medium-voltage electrical systems, safety protocols for energized equipment, testing procedures verifying proper operation, and integration with protective relaying and control systems, yet workforce development initiatives have struggled to produce sufficient qualified personnel meeting industry demand. The transition to intelligent switchgear incorporating sophisticated communication systems and integration with distribution management platforms requires additional specialized skills in networking protocols, cybersecurity implementation, and software configuration that further constrain the available labor pool.

Competitive Landscape:

The Saudi Arabia load break switch market exhibits moderate competitive intensity with established multinational electrical equipment manufacturers competing alongside regional suppliers and local distributors across diverse application segments and voltage classes. Major global corporations maintain strong market positions through long-standing relationships with Saudi Electricity Company and regional distribution utilities, extensive product portfolios spanning all voltage ratings and insulation technologies, and well-developed after-sales support infrastructure including spare parts inventories, field service teams, and technical assistance capabilities. Regional manufacturers leverage proximity advantages, competitive pricing strategies, and localization commitments aligned with Vision 2030 objectives to secure contracts particularly for standardized equipment specifications in distribution network expansion projects. The competitive landscape is characterized by established procurement relationships between utilities and preferred suppliers, technical prequalification requirements favoring manufacturers with proven track records in harsh Middle Eastern environments, and increasing emphasis on local content requirements driving manufacturing localization initiatives. Market participants compete across multiple dimensions including product reliability and performance characteristics, pricing competitiveness particularly for large-scale procurement programs, delivery timelines accommodating project schedules, technical support capabilities, and compliance with evolving smart grid and digitalization requirements.

Saudi Arabia Load Break Switch Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Gas-insulated, Vacuum-insulated, Air-insulated, Oil-immersed |

| Voltages Covered | Below 11 kV, 11-33 kV, 33-60 kV |

| Installations Covered | Outdoor, Indoor |

| End Uses Covered | Utilities, Industrial, Commercial |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia load break switch market size was valued at USD 118.36 Million in 2025.

The Saudi Arabia load break switch market is expected to grow at a compound annual growth rate of 4.00% from 2026-2034 to reach USD 168.45 Million by 2034.

Gas-insulated load break switches dominate the market with a 36% share, driven by their compact design advantages, superior performance in harsh environments, and minimal maintenance requirements that prove particularly advantageous in Saudi Arabia's desert climate and space-constrained urban substations.

Key factors driving the Saudi Arabia load break switch market include the National Renewable Energy Program targeting 130 gigawatts of renewable capacity by 2030 requiring extensive distribution infrastructure upgrades, comprehensive grid modernization initiatives with distribution network automation, major transmission projects, growing utility and industrial electricity demand driven by Vision 2030 economic development programs, and smart grid deployments necessitating intelligent switchgear with remote operation and monitoring capabilities throughout the Kingdom's electrical distribution networks.

Major challenges include supply chain disruptions and extended equipment lead times affecting project schedules and costs, high initial infrastructure investment requirements for comprehensive network upgrades and smart grid implementations, skilled labor shortages constraining installation and commissioning activities as multiple concurrent projects compete for qualified technical personnel, and cybersecurity concerns associated with increasingly connected and digitalized electrical distribution infrastructure requiring robust protective measures and ongoing security management protocols.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)