Saudi Arabia Low Calorie Sweeteners Market Size, Share, Trends and Forecast by Source, Type, Application, and Region, 2026-2034

Saudi Arabia Low Calorie Sweeteners Market Overview:

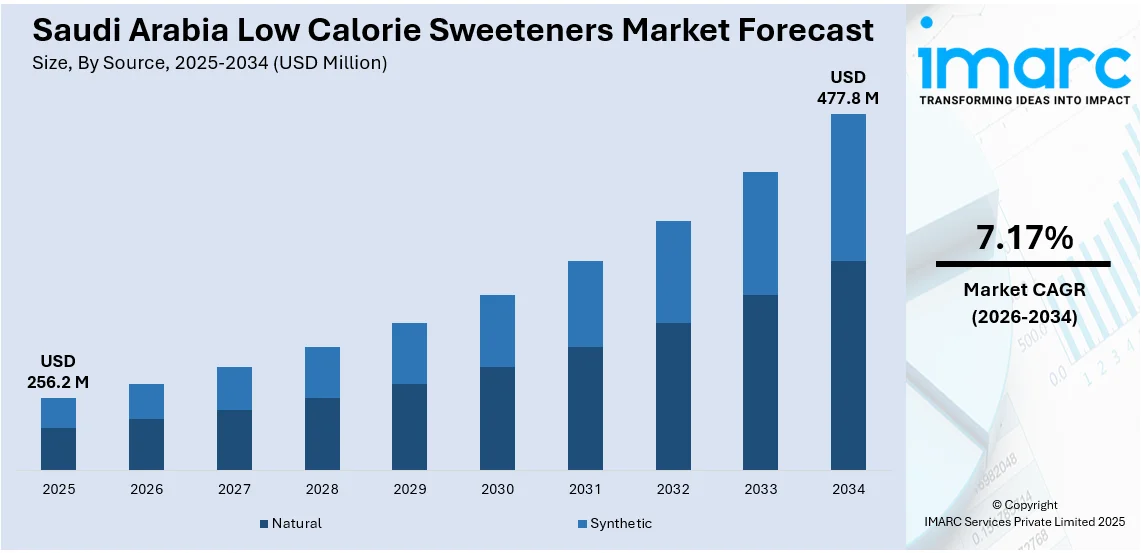

The Saudi Arabia low calorie sweeteners market size reached USD 256.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 477.8 Million by 2034, exhibiting a growth rate (CAGR) of 7.17% during 2026-2034. At present, with the rise of diabetes linked to inactivity, unhealthy eating, and genetic factors, both patients and healthcare professionals are emphasizing incorporating low-calorie sweeteners into everyday meals. Besides this, the broadening of e-commerce sites, which aid in making products more accessible to a wider audience, is contributing to the expansion of the Saudi Arabia low calorie sweeteners market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 256.2 Million |

| Market Forecast in 2034 | USD 477.8 Million |

| Market Growth Rate 2026-2034 | 7.17% |

Saudi Arabia Low Calorie Sweeteners Market Trends:

Rising diabetic population

The growing diabetic population is positively influencing the market in Saudi Arabia. As diabetes is becoming more prevalent due to sedentary lifestyles, poor dietary habits, and genetic predisposition, both patients and healthcare providers are prioritizing the use of low calorie sweeteners in daily diets. As per industry reports, diabetes emerged as a significant public health issue in Saudi Arabia, with an estimated incidence of 18.5% among adults in the country. Low calorie sweeteners offer a way to enjoy sweet-tasting food items without the harmful effects of refined sugar, making them essential in diabetic meal planning. Pharmacies and health stores are increasing their stock of such products to cater to the growing demand. Public health campaigns are further promoting awareness about managing diabetes, reinforcing the importance of reducing sugar intake. Consequently, even non-diabetic individuals are adopting low calorie sweeteners as part of a preventive health strategy. The market also benefits from ongoing product innovations, offering sweeteners with better taste profiles and natural origins like stevia and monk fruit, appealing to diabetic individuals looking for safe, effective, and pleasant-tasting alternatives. This ongoing shift in dietary habits is fueling the growth of the market across Saudi Arabia.

To get more information on this market Request Sample

Growing applications in food and beverage (F&B) industry

As people are demanding healthier food choices, manufacturers are reformulating products like soft drinks, yogurts, baked goods, and confectionery with low calorie sweeteners to reduce sugar content without compromising taste. Beverage companies increasingly rely on artificial and natural sweeteners to create low-sugar or sugar-free drinks, responding to health-conscious preferences. Similarly, the snacks segment is using sweeteners to meet the requirement for guilt-free indulgence. The versatility of low calorie sweeteners makes them ideal for diverse culinary applications, including sauces, cereals, and frozen desserts. As the foodservice sector is thriving and focusing on innovations, the incorporation of these sweeteners is becoming a key strategy, catalyzing their demand and contributing to the market growth across Saudi Arabia. As per the IMARC Group, the Saudi Arabia foodservice market size was valued at USD 28,669 Million in 2024.

Expansion of e-commerce portals

The expansion of e-commerce sites is impelling the Saudi Arabia low calorie sweeteners market growth. Online platforms offer convenience and variety, allowing people to easily find and purchase low calorie sweeteners from different brands. E-commerce also enables manufacturers to reach customers in remote areas where physical stores may be limited. This increases product awareness and adoption among health-conscious consumers. Additionally, online reviews and social media influence buyers to try low calorie sweeteners, driving the demand. Subscription services and discounts on e-commerce sites are encouraging repeat purchases, supporting steady market growth. As more people are shopping online for health and wellness products, the availability and visibility of low calorie sweeteners continue to improve, accelerating their acceptance and usage in Saudi Arabia. As per industry reports, the Saudi Arabia e-commerce market, which was worth USD 24.67 Billion in 2024, is expected to grow at a CAGR of 12.10% during the period from 2025 to 2033 and attain USD 68.94 Billion by 2033.

Saudi Arabia Low Calorie Sweeteners Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on source, type, and application.

Source Insights:

- Natural

- Synthetic

The report has provided a detailed breakup and analysis of the market based on the source. This includes natural and synthetic.

Type Insights:

- Sucralose

- Saccharin

- Aspartame

- Neotame

- Advantame

- Acesulfame Potassium

- Stevia

- Others

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes sucralose, saccharin, aspartame, neotame, advantame, acesulfame potassium, stevia, and others.

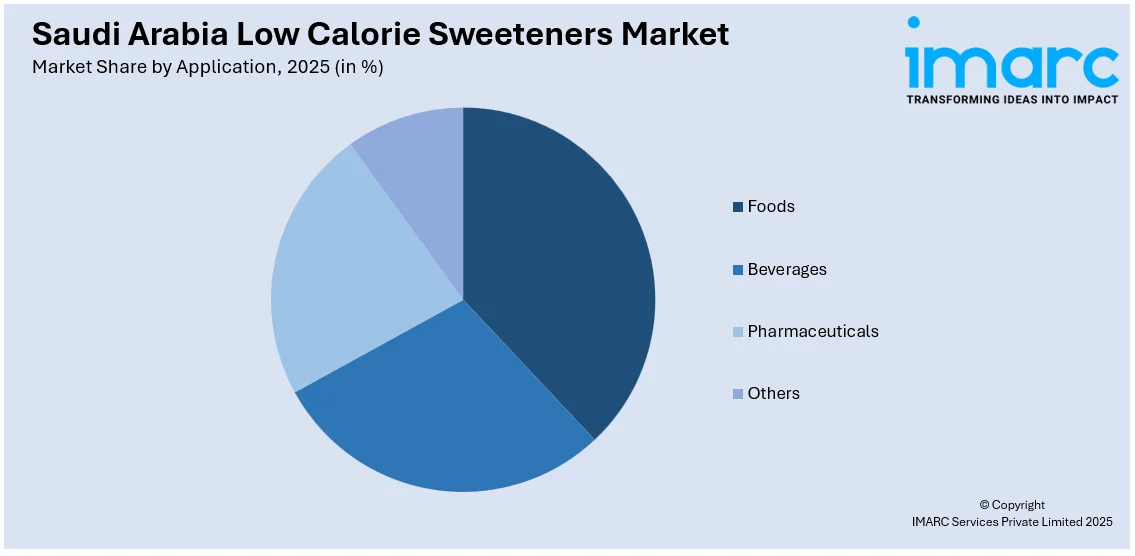

Application Insights:

Access the comprehensive market breakdown Request Sample

- Foods

- Bakery

- Frozen Food and Dairy

- Confectionery

- Others

- Beverages

- Pharmaceuticals

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes foods (bakery, frozen food and dairy, confectionery, and others), beverages, pharmaceuticals, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Low Calorie Sweeteners Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Natural, Synthetic |

| Types Covered | Sucralose, Saccharin, Aspartame, Neotame, Advantame, Acesulfame Potassium, Stevia, Others |

| Applications Covered |

|

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia low calorie sweeteners market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia low calorie sweeteners market on the basis of source?

- What is the breakup of the Saudi Arabia low calorie sweeteners market on the basis of type?

- What is the breakup of the Saudi Arabia low calorie sweeteners market on the basis of application?

- What is the breakup of the Saudi Arabia low calorie sweeteners market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia low calorie sweeteners market?

- What are the key driving factors and challenges in the Saudi Arabia low calorie sweeteners market?

- What is the structure of the Saudi Arabia low calorie sweeteners market and who are the key players?

- What is the degree of competition in the Saudi Arabia low calorie sweeteners market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia low calorie sweeteners market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia low calorie sweeteners market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia low calorie sweeteners industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)