Saudi Arabia Luxury Apparel Market Size, Share, Trends and Forecast by Type, Distribution Channel, End User, and Region, 2026-2034

Saudi Arabia Luxury Apparel Market Overview:

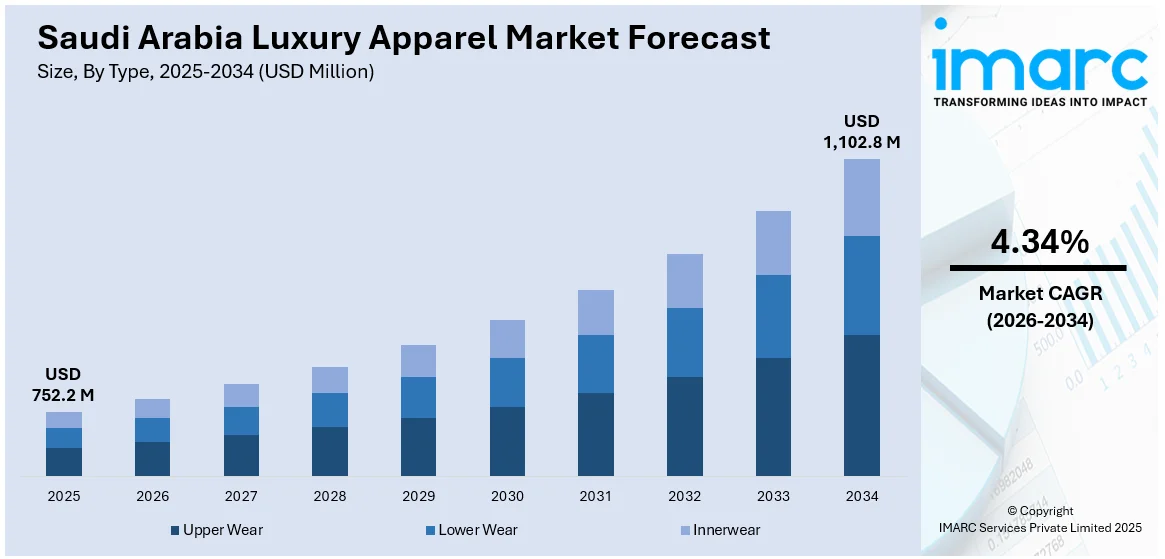

The Saudi Arabia luxury apparel market size reached USD 752.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,102.8 Million by 2034, exhibiting a growth rate (CAGR) of 4.34% during 2026-2034. At present, rising tourism activities are increasing the influx of high-spending visitors who seek premium shopping experiences. This is driving the demand for luxury apparel in the country. Besides this, the growing impact of social media platforms is contributing to the expansion of the Saudi Arabia luxury apparel market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 752.2 Million |

| Market Forecast in 2034 | USD 1,102.8 Million |

| Market Growth Rate 2026-2034 | 4.34% |

Saudi Arabia Luxury Apparel Market Trends:

Increasing tourism activities

Rising tourism activities are positively influencing the market in Saudi Arabia. The Saudi Minister of Tourism announced that the kingdom recorded 30 Million international visitors in 2024, setting a new benchmark for the nation. Tourists often view luxury apparel as a part of their travel indulgence, and this demand is fueling the growth of high-end fashion outlets, especially in popular destinations like Riyadh and Jeddah. Luxury malls and retail hubs are expanding to cater to both international tourists and affluent domestic users, creating a vibrant market for designer clothing. The presence of international tourists is encouraging international luxury brands to establish flagship stores in Saudi Arabia, enhancing product availability. Tourism-related events, such as cultural festivals and sports tournaments, are attracting stylish audiences who prefer branded and exclusive fashion. Additionally, airport retail and duty-free outlets offer luxury apparel, further increasing tourist spending. With the government promoting tourism through Vision 2030, the retail infrastructure continues to improve, motivating luxury shopping. Tourists are also influencing local preferences, encouraging residents to explore worldwide trends. This blend of tourist-oriented purchases and shifting user habits is creating a favorable environment for the luxury apparel market.

To get more information on this market Request Sample

Growing impact of social media

Increasing influence of social media is impelling the Saudi Arabia luxury apparel market growth. Social media platforms expose users to fashion trends, luxury lifestyle content, and celebrity endorsements, encouraging people to explore premium fashion choices. As per industry reports, in February 2024, Saudi Arabia had 17,254,100 Instagram users, representing 45.4% of the total population. Influencers and fashion bloggers regularly showcase luxury outfits, creating aspirational demand among followers. Luxury brands are employing social media to launch campaigns, display new collections, and engage directly with customers, making high-end fashion more accessible and desirable. The young demographic, in particular, follows style icons and celebrities who often wear designer labels, leading to a rise in brand consciousness and status-based purchases. Social media also plays a role in online shopping, where sponsored ads and product links guide users to purchase luxury apparel through brand websites or e-commerce platforms. User-generated content, fashion reviews, and unboxing videos are further shaping opinions and encouraging trial. As digital interaction is increasing, individuals are associating luxury with lifestyle and self-expression. The constant exposure to curated luxury content is driving the demand, making social media a powerful tool in expanding the market in Saudi Arabia.

Saudi Arabia Luxury Apparel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, distribution channel, and end user.

Type Insights:

- Upper Wear

- Lower Wear

- Innerwear

The report has provided a detailed breakup and analysis of the market based on the type. This includes upper wear, lower wear, and innerwear.

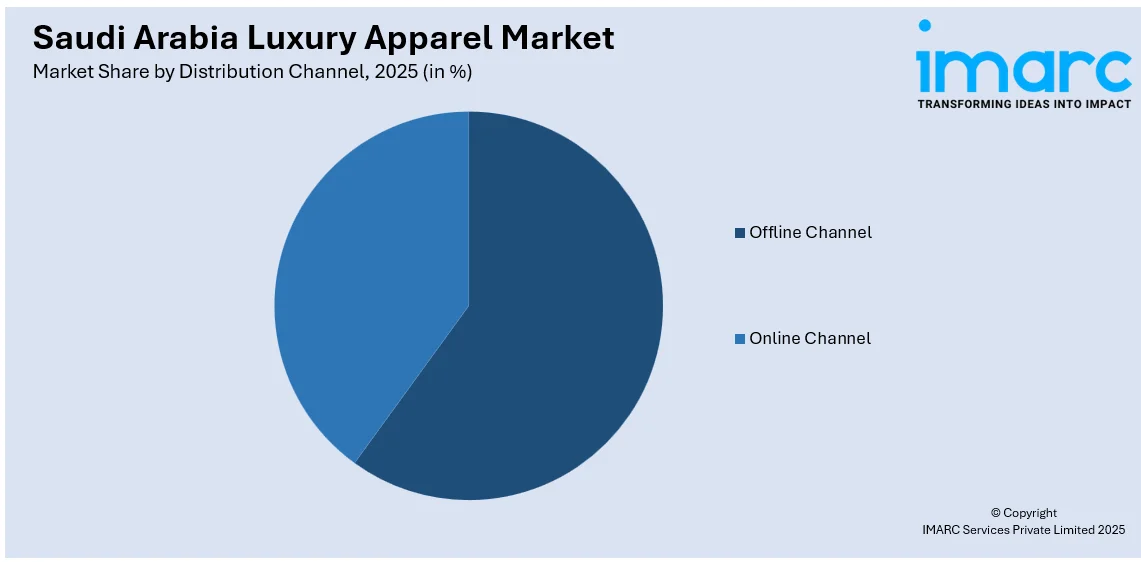

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Offline Channel

- Online Channel

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline channel and online channel.

End User Insights:

- Men

- Women

- Children

The report has provided a detailed breakup and analysis of the market based on the end user. This includes men, women, and children.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Luxury Apparel Market News:

- In January 2025, the Cultural Development Fund of Saudi Arabia, together with the Fashion Commission, welcomed luxury fashion designer and Italian clothing entrepreneur Brunello Cucinelli to AlUla. The event bolstered the fund's aim to aid creatives and entrepreneurs in the cultural industry by encouraging knowledge sharing and promoting sustainability.

- In June 2024, Marina Rinaldi, the prominent luxury fashion label, revealed the highly awaited launch of its store in Riyadh, Saudi Arabia. The spacious boutique in Riyadh displayed the brand's new collections, featuring ready-to-wear clothing and the Spring Summer 2024 capsule collection designed by Mary Katrantzou. The assortment presented an ideal combination of summer items, spanning from cotton daytime clothing to semi-sheer cocktail dresses and classic evening attire, along with accessories and shoes, appealing to the varied preferences of its customers.

Saudi Arabia Luxury Apparel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Upper Wear, Lower Wear, Innerwear |

| Distribution Channels Covered | Offline Channel, Online Channel |

| End Users Covered | Men, Women, Children |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia luxury apparel market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia luxury apparel market on the basis of type?

- What is the breakup of the Saudi Arabia luxury apparel market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia luxury apparel market on the basis of end user?

- What is the breakup of the Saudi Arabia luxury apparel market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia luxury apparel market?

- What are the key driving factors and challenges in the Saudi Arabia luxury apparel market?

- What is the structure of the Saudi Arabia luxury apparel market and who are the key players?

- What is the degree of competition in the Saudi Arabia luxury apparel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia luxury apparel market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia luxury apparel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia luxury apparel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)