Saudi Arabia Luxury Footwear Market Size, Share, Trends and Forecast by Product, Distribution Channel, End User, and Region, 2026-2034

Saudi Arabia Luxury Footwear Market Overview:

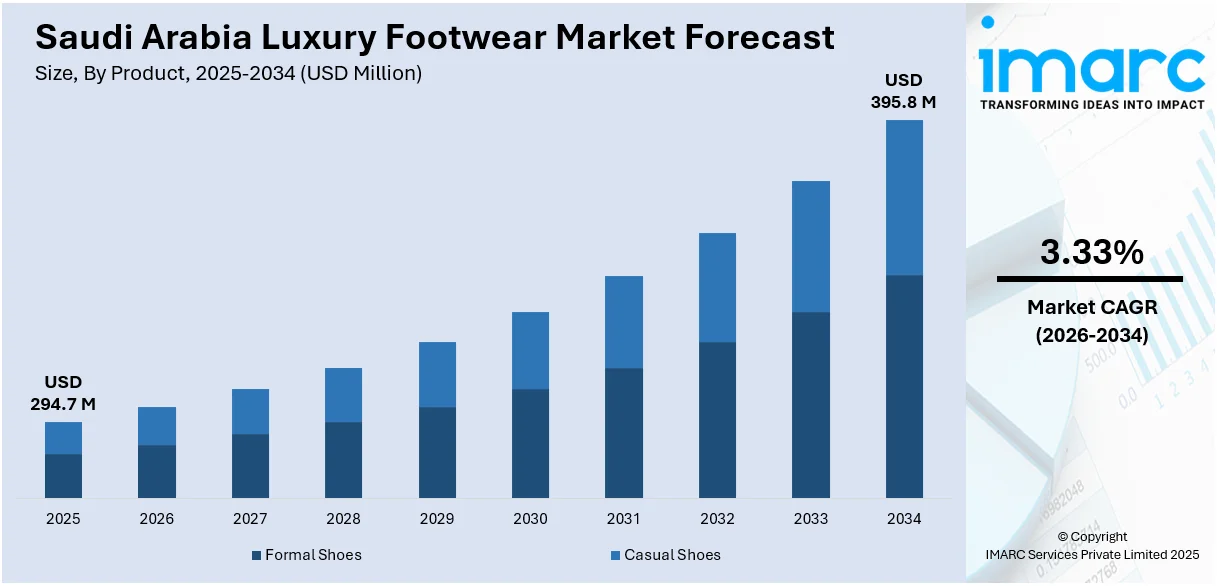

The Saudi Arabia luxury footwear market size reached USD 294.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 395.8 Million by 2034, exhibiting a growth rate (CAGR) of 3.33% during 2026-2034. The rising disposable incomes, a growing youth population with high fashion awareness, increasing tourism, expanding luxury retail infrastructure, and greater influence of social media trends are driving demand for luxury footwear in Saudi Arabia, especially among affluent consumers seeking premium, international brands and exclusive product offerings in both offline and online channels.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 294.7 Million |

| Market Forecast in 2034 | USD 395.8 Million |

| Market Growth Rate 2026-2034 | 3.33% |

Saudi Arabia Luxury Footwear Market Trends:

Growing Influence of Western Fashion and Global Luxury Brands

The market is witnessing a significant transformation driven by the increasing influence of Western fashion sensibilities, which is enhancing Saudi Arabia luxury footwear market outlook. As the Kingdom continues to diversify its economy and open to global markets under Vision 2030, the presence and accessibility of international luxury brands are expanding. Consumers, especially affluent youth and working professionals in major cities like Riyadh and Jeddah, are increasingly gravitating toward renowned global names. These brands symbolize status, exclusivity, and social distinction, aligning with the lifestyle aspirations of a segment that actively consumes global fashion content via digital platforms. Moreover, international luxury houses are tailoring collections to better suit regional tastes, including modest yet premium styles and limited editions available through select boutiques and flagship stores. In addition to this, strategic collaborations between Western designers and Middle Eastern influencers further bridge style preferences and enhance brand resonance. This growing cross-cultural fashion integration continues to shape consumer demand and elevate expectations around design, craftsmanship, and brand storytelling.

To get more information on this market Request Sample

Rise in E-Commerce and Digital Luxury Retail

The shift toward digital retail channels is a significant trend supporting the growth of Saudi Arabia luxury footwear market growth. This development is propelled by widespread internet accessibility, with penetration in the Kingdom reaching nearly 99% by the end of 2023, up from 98.6% in 2022, according to an industry report. The high level of digital connectivity, coupled with a predominantly young and tech-savvy population, is accelerating the shift in shopping behavior toward online platforms. Luxury consumers in Saudi Arabia are increasingly turning to digital channels to explore, evaluate, and purchase high-end footwear. These platforms offer extensive product selections, virtual styling consultations, exclusive online collections, and seamless delivery services. Additionally, global luxury brands are investing in localized digital strategies, offering Arabic-language interfaces, region-specific payment options, and tailored advertising that enhances customer experience. Social media platforms, particularly Instagram and Snapchat, serve as key discovery tools where influencers and celebrities showcase luxury footwear, driving direct-to-platform purchases.

Rise of Fashion-Conscious Youth and Premium Streetwear Culture

The growing demand from younger consumers, particularly Gen Z, is playing a significant role in expanding Saudi Arabia luxury footwear market share. According to industry reports, Gen Z accounts for approximately 22.1% of the Kingdom's population. This demographic prioritizes individual expression, brand authenticity, and exclusivity over traditional luxury norms. These consumers are drawn to limited-edition drops, sneaker collaborations, and hype-driven releases that foster community and social validation. The popularity of street-style fashion is reinforced by regional fashion influencers and stylists on TikTok, Instagram, and YouTube, whose content frequently features luxury sneakers and designer footwear. Additionally, fashion events, pop-up shops, and urban retail spaces are curating more experiential engagements targeting the youth segment. With the government's increasing support for cultural and creative industries, youth-driven fashion movements are gaining legitimacy and visibility, contributing to the expansion of premium casual footwear sales across the Kingdom.

Saudi Arabia Luxury Footwear Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product, distribution channel, and end user.

Product Insights:

- Formal Shoes

- Casual Shoes

The report has provided a detailed breakup and analysis of the market based on the product. This includes formal shoes and casual shoes.

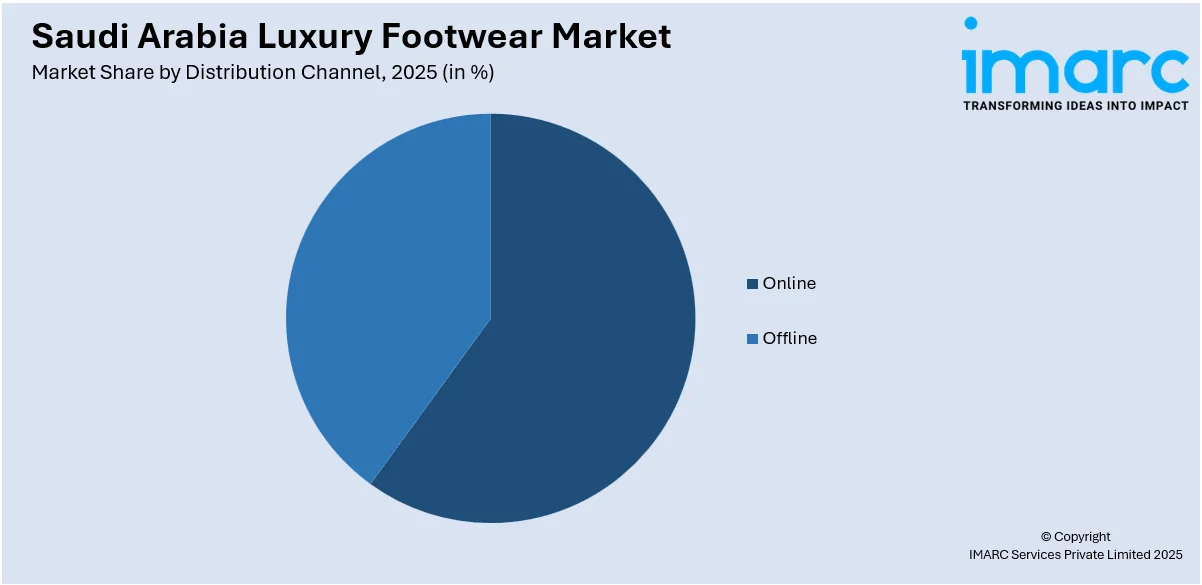

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

End User Insights:

- Men

- Women

- Children

The report has provided a detailed breakup and analysis of the market based on the end user. This includes men, women, and children.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Luxury Footwear Market News:

- On February 8, 2025, Sneaker Con commenced its inaugural event in Riyadh, Saudi Arabia, as part of the Riyadh Season festivities. Hosted at ANB Arena until February 19, the convention features over 150 brands showcasing rare sneakers, fashion items, and accessories, providing a platform for enthusiasts to buy, sell, and trade limited-edition products. The event also facilitates networking opportunities with industry experts and influencers, highlighting the growing sneaker culture within the Kingdom.

Saudi Arabia Luxury Footwear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Formal Shoes, Casual Shoes |

| Distribution Channels Covered | Online, Offline |

| End Users Covered | Men, Women, Children |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia luxury footwear market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia luxury footwear market on the basis of product?

- What is the breakup of the Saudi Arabia luxury footwear market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia luxury footwear market on the basis of end user?

- What is the breakup of the Saudi Arabia luxury footwear market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia luxury footwear market?

- What are the key driving factors and challenges in the Saudi Arabia luxury footwear market?

- What is the structure of the Saudi Arabia luxury footwear market and who are the key players?

- What is the degree of competition in the Saudi Arabia luxury footwear market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia luxury footwear market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia luxury footwear market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia luxury footwear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)