Saudi Arabia Luxury Interior Design Market Size, Share, Trends and Forecast by Type, Material, Style, Distribution Channel, Application, and Region, 2026-2034

Saudi Arabia Luxury Interior Design Market Overview:

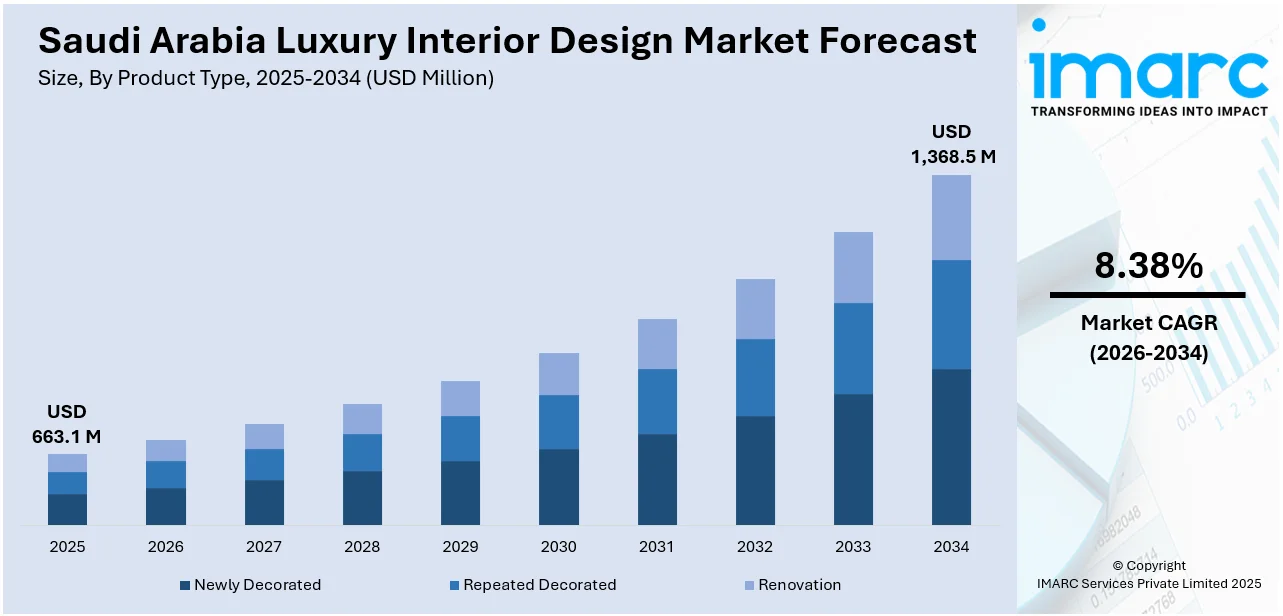

The Saudi Arabia luxury interior design market size reached USD 663.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,368.5 Million by 2034, exhibiting a growth rate (CAGR) of 8.38% during 2026-2034. Rapid urbanization, increasing disposable incomes, and cultural change toward upscale living are the primary drivers of the market. Government plans, such as Vision 2030 boost tourism and real estate growth, spurring the demand for high-end interiors in hotels, homes, and office buildings. Influx of global design companies and increasing interest in smart homes and sustainable luxury are transforming customer tastes. Bespoke furniture, craftsmanship finishes, and branded decorative features are also in demand, which further adds to the growth of Saudi Arabia luxury interior design market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 663.1 Million |

| Market Forecast in 2034 | USD 1,368.5 Million |

| Market Growth Rate 2026-2034 | 8.38% |

Saudi Arabia Luxury Interior Design Market Trends:

Rising Aesthetic Trends and Cultural Convergence

Saudi Arabia luxury interior design is undergoing a dramatic change, driven by a demand to merge modernity with heritage. High-end developers and luxury homeowners alike are increasingly opting for designs that incorporate traditional Arabian aesthetics e.g., geometric patterns of utmost intricacy, calligraphy, and intricately detailed archways blended with contemporary materials and minimalist spaces. Such cultural fusion is creating one-of-a-kind visual identities for luxury spaces and creating a sense of national pride for contemporary interiors. Design consumers are seeking to have a space which reflects their heritage but also signifies international sophistication, thereby creating demand for custom design services. Foreign designers working in the kingdom are commissioning local artisans to add Saudi authenticity to contemporary settings, and luxurious, culturally rich interiors are being crafted. The result is a market fashion in which personalization, authenticity, and cultural story have significant roles to play in shaping high-end residential and commercial interior projects.

To get more information on this market Request Sample

Technology Integration and Smart Luxury Living

One of the foremost trends redefining the Saudi luxury interior design market is the integration of new-age technology and smart home solutions. Saudi buyers are increasingly expecting interiors that go beyond visual appeal to deliver seamless functionality and ease of operation. Smart lighting, climate control, home security, and voice-operated devices are being subtly integrated into design schemes, which allow users to control their environments easily and stylishly. Interior designers have now to collaborate with technology advisors to ensure that these systems are seamlessly integrated with the overall design. Luxurious today not about rich materials anymore—it is now about the convenience and modernity of high-end technology. This is especially predominant in newly constructed urban neighborhoods and luxury villas, where homeowners appreciate both privacy and high-technology living. As a result, the market is experiencing a shift toward interiors that are good to look at along with being smart and responsive to the needs of new lifestyles, which further contributes to the Saudi Arabia luxury interior design market growth.

Sustainability and Ethical Luxury Design

Sustainability is emerging as a trend-defining feature of the Saudi Arabia luxury interior design market, reacting to global expectations for environmental stewardship and resource conservation. Sophisticated consumers are becoming more conscious of where the goods used in their houses and offices come from and their impacts. This has bred an increasing demand for natural, ethically sourced, and energy-efficient materials while not compromising luxury and sophistication. Designers are turning towards organic materials such as reclaimed wood, stone, and natural textiles while incorporating energy-efficient lighting and water-saving technologies. Locally produced goods and handicraft workmanship are also demanded more, supporting local economies and reducing carbon signatures. The shift is part of a broader shift among luxury consumers that true sophistication also means being a responsible person. For instance, MIA Design Studio, recognized for its smooth integration of contemporary architecture with natural balance, has gained worldwide recognition for its dedication to sustainability and creative design. MIA Design Studio is set to grow its presence in Saudi Arabia, aiming to support the Kingdom’s ambitious development objectives. Hence, in choosing sustainable interiors, Saudi Arabia's upper class is creating new models of responsible luxury integrating environmental responsibility into the design ideology.

Saudi Arabia Luxury Interior Design Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, material, style, distribution channel, and application.

Type Insights:

- Newly Decorated

- Repeated Decorated

- Renovation

The report has provided a detailed breakup and analysis of the market based on the type. This includes newly decorated, repeated decorated, and renovation.

Material Insights:

- Textiles

- Wood

- Metals

- Glass

- Ceramics

- Plastics

- Others

A detailed breakup and analysis of the market based on the material has also been provided in the report. This includes textiles, wood, metals, glass, ceramics, plastics, and others.

Style Insights:

- Modern

- Traditional

- Rustic

- Vintage

- Classical

- Others

A detailed breakup and analysis of the market based on the style has also been provided in the report. This includes modern, traditional, rustic, vintage, classical, and others.

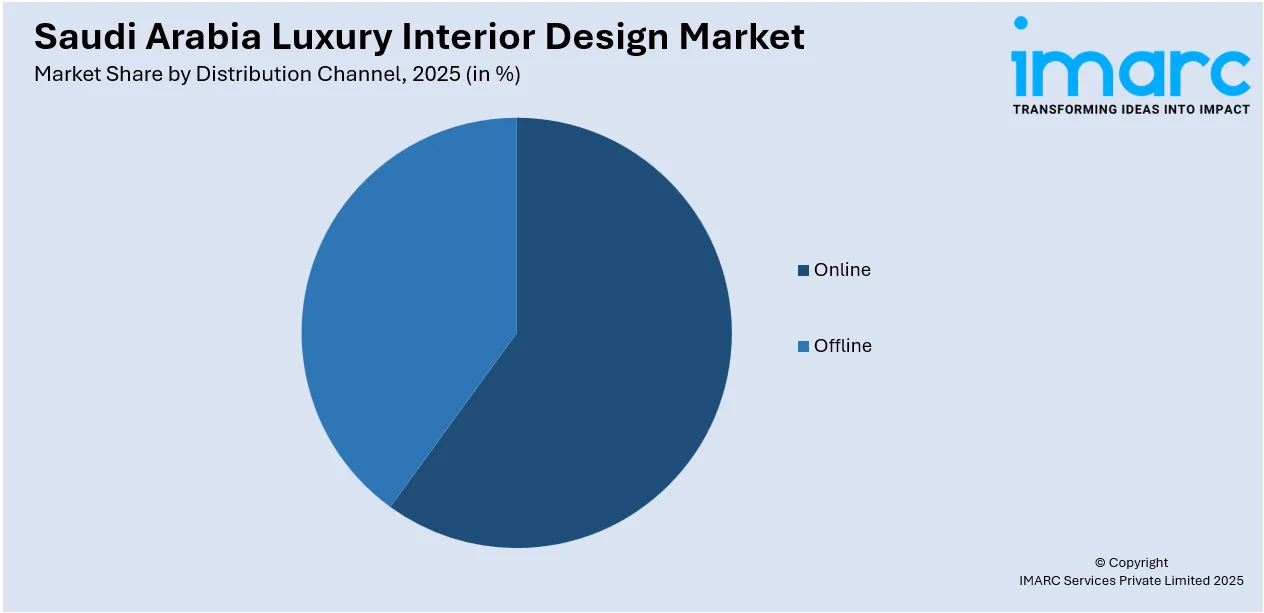

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online and offline.

Application Insights:

- Residential

- Commercial

- Hospitality

- Retail

- Others

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes residential, commercial, hospitality, retail, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Luxury Interior Design Market News:

- In December 2024, following the recent launch in Dubai, Bentley Home revealed plans for expansion with two new stores set to open in Riyadh and Jeddah. The new shops will display the newest collections alongside timeless pieces that honor the design and utility of the luxury car brand. These new openings increase the total count of Bentley Home flagship stores globally to five, strengthening its position as a leader in high-end home decor.

Saudi Arabia Luxury Interior Design Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Newly Decorated, Repeated Decorated, Renovation |

| Materials Covered | Textiles, Wood, Metals, Glass, Ceramics, Plastics, Others |

| Styles Covered | Modern, Traditional, Rustic, Vintage, Classical, Others |

| Distribution Channels Covered | Online, Offline |

| Applications Covered | Residential, Commercial, Hospitality, Retail, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia luxury interior design market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia luxury interior design market on the basis of type?

- What is the breakup of the Saudi Arabia luxury interior design market on the basis of material?

- What is the breakup of the Saudi Arabia luxury interior design market on the basis of style?

- What is the breakup of the Saudi Arabia luxury interior design market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia luxury interior design market on the basis of application?

- What is the breakup of the Saudi Arabia luxury interior design market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia luxury interior design market?

- What are the key driving factors and challenges in the Saudi Arabia luxury interior design market?

- What is the structure of the Saudi Arabia luxury interior design market and who are the key players?

- What is the degree of competition in the Saudi Arabia luxury interior design market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia luxury interior design market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia luxury interior design market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia luxury interior design industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)