Saudi Arabia Luxury Perfume Market Size, Share, Trends and Forecast by Price, Distribution Channel, End User, and Region, 2026-2034

Saudi Arabia Luxury Perfume Market Summary:

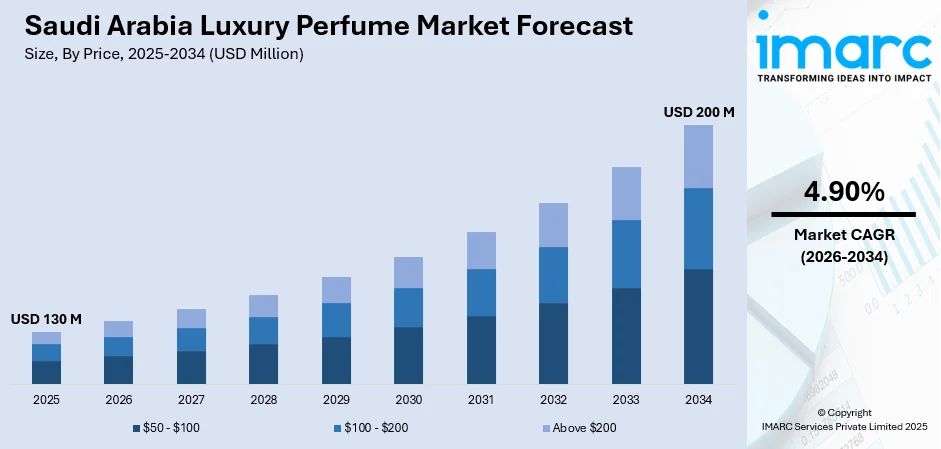

The Saudi Arabia luxury perfume market size was valued at USD 130 Million in 2025 and is projected to reach USD 200 Million by 2034, growing at a compound annual growth rate of 4.90% from 2026-2034.

The market is driven by the Kingdom's deep-rooted cultural affinity for premium fragrances, rising disposable incomes, and government initiatives under Vision 2030 promoting luxury goods manufacturing in the country. Apart from this, the rapid tourism growth, digital retail innovation, and increasing demand for bespoke and artisanal scents among affluent consumers are further expanding the Saudi Arabia luxury perfume market share.

Key Takeaways and Insights:

-

By Price: Above $200 dominates the market with a share of 54% in 2025, reflecting Saudi consumers' strong cultural preference for ultra-premium, exclusive fragrances that signify sophistication, wealth, elevated social status, and exceptional craftsmanship.

-

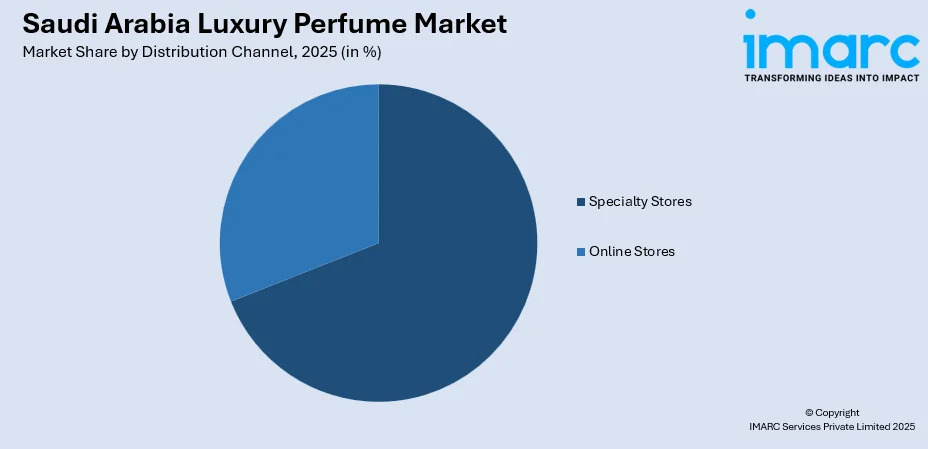

By Distribution Channel: Specialty stores lead the market with a share of 69% in 2025, providing personalized shopping experiences, expert fragrance consultations, exclusive product collections, and attentive service that aligns with Saudi luxury consumer expectations.

-

By End User: Female represents the largest segment with a market share of 45% in 2025, driven by cultural norms emphasizing fragrances as essential personal grooming components, strong beauty habits, substantial spending capacity, and sophisticated preferences.

-

By Region: Northern and central region leads the market with a share of 34% in 2025, anchored by Riyadh's position as luxury retail hub, concentration of high-net-worth individuals, sophisticated infrastructure, and Vision 2030 investment.

-

Key Players: Key players are expanding flagship stores, boosting ecommerce, partnering with influencers, offering exclusive and bespoke scents, enhancing instore experiences, introducing loyalty programs, tailoring products to local tastes, and leveraging tourismdriven retail to attract affluent shoppers.

To get more information on this market Request Sample

The luxury perfume market in Saudi Arabia is among the most advanced markets in the Middle East, exhibiting strong growth dynamics and dynamic consumer behavior. The market is characterized by a distinct amalgamation of rich perfume traditions, which have deep-rooted origins in the country’s rich culture, and contemporary luxury trends. Perfumes featuring the rich aroma of oud have continued to retain their importance within consumer preferences, symbolizing tradition and class. However, designer brands from the West have continued to make significant inroads, taking over a larger market share, especially among young consumers with strong affinity and association with fashion. The Vision 2030 economic diversification strategy launched by the Kingdom has strategically identified the luxury perfume sector as a foundation pillar within the exportation of the country’s rich culture, stressing the importance of the perfume sector within the country’s strategy to move past dependence on oil. The government has set aside a contribution of $50 million in the year 2024 to help develop local cosmetic and perfume brands, presenting a new dawn for local players and international luxury perfume brands that wish to take solid roots within the ME market.

Saudi Arabia Luxury Perfume Market Trends:

Rise of Personalization and Bespoke Fragrance Services

The Saudi luxury perfume market is witnessing a transformative shift toward personalized scent experiences, driven by affluent consumers seeking distinctive fragrances that reflect individual identity and exclusivity. Brands are investing in advanced fragrance consultation services and custom creation capabilities to meet this growing demand. Similarly, premium retailers like Jo Malone stores provide dedicated fragrance consultations to shoppers, offering customized product recommendations based on individual preferences and lifestyle patterns, establishing new standards for luxury service delivery in the Kingdom's perfume retail landscape. In 2025, the Perfume Expo at Jeddah Superdome has attracted significant audiences since its debut during Jeddah Season, uniting creativity and the deep heritage of perfumery for fragrance enthusiasts and industry experts. The 11-day occasion showcases over 90 local, regional, and global brands, presenting new launches, exclusive deals, and engaging experiences aimed at emphasizing the craftsmanship and tradition of perfumery.

Acceleration of Digital Transformation and AI-Driven Shopping Experiences

The integration of artificial intelligence and digital technologies is revolutionizing the luxury perfume shopping experience in Saudi Arabia, enabling brands to offer sophisticated online personalization and virtual consultation services. Major fragrance creation houses are significantly expanding their regional presence to capitalize on this digital transformation. These advanced platforms utilize AI-powered recommendation systems to analyze individual preferences, skin chemistry, and lifestyle patterns, creating bespoke scent profiles through digital channels while reducing traditional barriers to luxury perfume discovery and enabling brands to reach wider consumer bases across the Kingdom. IMARC Group predicts that the audi Arabia artificial intelligence market is projected to reach USD 4,374.5 Million by 2034.

Growing Emphasis on Niche and Artisanal Fragrance Categories

Saudi Arabia's luxury perfume consumers are increasingly gravitating toward niche and artisanal fragrances that offer unique compositions and limited availability, departing from mainstream designer brands. This trend reflects sophisticated consumer tastes and desire for exclusivity within the Kingdom's affluent demographics. Private collections and niche brands drove substantial growth in Saudi Arabia during 2024, reaching 40 percent of the total fragrance weight across the luxury segment, demonstrating remarkable consumer appetite for distinctive scent experiences. This evolution is supported by expanding retail presence of prestigious niche houses, with high-end Omani brand Amouage reporting retail sales surpassing USD 200 million in the first half of 2025, representing 60 percent growth compared to the same period in 2024, confirming strong regional demand for artisanal luxury fragrances.

How Vision 2030 is Transforming the Saudi Arabia Luxury Perfume Market:

Saudi Arabia's Vision 2030 is playing a significant role in transforming its luxury perfume market, driving growth through economic diversification, increased consumer spending, and cultural shifts. As the country aims to reduce its reliance on oil, it is fostering a dynamic retail environment, enhancing opportunities for high-end brands to thrive. The rising middle class, along with a youthful and fashion-forward population, is driving demand for premium fragrances, while tourism growth contributes to the influx of international shoppers. Vision 2030's focus on modernizing infrastructure and attracting foreign investments is bolstering retail developments, including luxury malls and e-commerce platforms. Moreover, the growing emphasis on culture and heritage is also influencing fragrance preferences, as traditional Arabian perfumes merge with global luxury trends. The market is expected to continue expanding, with a greater range of high-end and niche brands entering, as well as a shift towards personalized, exclusive, and sustainable fragrance experiences.

Market Outlook 2026-2034:

The Saudi Arabia luxury perfume market is poised for robust expansion throughout the forecast period, supported by favorable macroeconomic conditions, government-led economic diversification initiatives, and evolving consumer preferences toward premium and artisanal fragrances. The market generated a revenue of USD 130 Million in 2025 and is projected to reach a revenue of USD 200 Million by 2034, growing at a compound annual growth rate of 4.90% from 2026-2034. Vision 2030's emphasis on cultural heritage preservation combined with retail modernization will continue driving investment in luxury perfumery zones within major shopping destinations across Riyadh, Jeddah, and Dammam.

Saudi Arabia Luxury Perfume Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Price | Above $200 | 54% |

| Distribution Channel | Specialty Stores | 69% |

| End Users | Female | 45% |

| Regions | Northern and Central Region | 34% |

Price Insights:

- $50 - $100

- $100 - $200

- Above $200

Above $200 dominates with a market share of 54% of the total Saudi Arabia luxury perfume market in 2025.

The Above $200 price segment dominates the Saudi Arabia luxury perfume market, driven by the Kingdom's robust economic position with GDP reaching USD 1.11 trillion as of 2024 and substantial affluent population constituting a major percent of total consumers. Saudi consumers in this premium segment demonstrate strong preference for original, long-lasting fragrances with distinctive character, frequently selecting niche brands that convey exclusivity and tailor-made craftsmanship, supported by intrinsic cultural appreciation for high-end products where expensive perfumes serve both as personal indulgence and social status expression. The segment benefits from strategic partnerships enhancing distribution capabilities, exemplified by the collaboration between Chalhoub Group and Inter Parfums for exclusive distribution of Roberto Cavalli perfumes across United Arab Emirates, Bahrain, Kuwait, Saudi Arabia, and Egypt, expanding consumer access to prestigious international luxury fragrances through sophisticated retail and digital channels.

The segment serves as an important entry point for luxury perfume consumption, particularly among younger affluent consumers and gift purchasers seeking premium quality at accessible price points. This category includes established designer fragrances and premium Arabic perfume brands offering concentrated formulations with quality ingredients at competitive pricing, appealing to people building fragrance wardrobes and those purchasing gifts for social and religious occasions. The segment benefits from expanding retail infrastructure and e-commerce platforms providing convenient access to diverse luxury fragrance selections, though it represents smaller market share compared to ultra-premium offerings favored by traditional Saudi luxury consumers.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Specialty Stores

- Online Stores

Specialty stores lead with a share of 69% of the total Saudi Arabia luxury perfume market in 2025.

Specialty Stores command the largest distribution channel, providing differentiated value through personalized shopping experiences that align with Saudi luxury consumer expectations for attentive service and expert guidance. These dedicated perfume boutiques offer comprehensive brand representation, exclusive limited-edition collections, and knowledgeable staff capable of providing sophisticated fragrance consultations, creating immersive retail environments that resonate with Saudi Arabia's high-touch service culture. The channel excels in delivering experiential shopping journeys where consumers can test multiple fragrances, receive professional recommendations based on individual preferences and occasions, and access premium products unavailable through mass retail channels. Specialty stores also serve as brand ambassadors, hosting exclusive launch events, master perfumer visits, and VIP customer experiences that strengthen brand loyalty and community engagement among luxury perfume enthusiasts.

The channel's dominance is reinforced by continued investment in premium retail infrastructure, demonstrated by Ghawali's launch of its revamped flagship store at Riyadh's Nakheel Mall in 2023, blending contemporary design with regional cultural elements to serve the Kingdom's evolving luxury fragrance market. These sophisticated retail spaces feature climate-controlled environments optimal for fragrance preservation, elegant display systems showcasing products as art pieces, and private consultation rooms for personalized service experiences. Additionally, specialty stores maintain strong relationships with luxury perfume houses enabling access to exclusive distribution rights, rare collections, and first access to new launches, creating competitive advantages that mass retailers cannot replicate. The format particularly appeals to Saudi consumers' preference for relationship-based shopping where staff recognize repeat customers and maintain detailed preference profiles informing personalized recommendations and service delivery excellence.

End User Insights:

- Male

- Female

- Unisex

Female exhibits a clear dominance with a 45% share of the total Saudi Arabia luxury perfume market in 2025.

Female consumers represent the leading end-user segment, reflecting strong cultural emphasis on fragrance as essential component of personal grooming, social etiquette, and self-expression within Saudi society. Saudi women demonstrate sophisticated fragrance preferences embracing both traditional Arabic perfume oils featuring rose, oud, and amber notes alongside contemporary global luxury brands offering floral, fruity, and gourmand compositions, creating diverse purchasing patterns across price points and occasions. The segment exhibits particularly strong engagement with premium and luxury fragrance categories, viewing perfumes as accessible luxury items for self-purchase and meaningful gifts during social and religious celebrations. Female consumers typically maintain extensive fragrance wardrobes with multiple bottles for different occasions, seasons, and moods, contributing to higher per capita spending compared to other demographic segments.

The segment benefits from increasing female workforce participation and rising disposable incomes, with luxury perfume serving as important category for personal reward and professional image enhancement. Social media influence and beauty content creators significantly shape purchasing decisions particularly among younger female consumers aged between 20 to 35 who actively engage with international fragrance trends through social media platforms. Additionally, the expansion of women-focused retail experiences including female-only shopping hours in specialty stores and dedicated beauty sections in major malls creates comfortable environments for extended browsing and consultation. International luxury brands increasingly recognize Saudi female consumers' sophisticated preferences, launching regional exclusive collections and collaborating with local influencers to create culturally resonant marketing campaigns that blend traditional values with contemporary luxury aesthetics.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and central region leads with a share of 34% of the total Saudi Arabia luxury perfume market in 2025.

The Northern and Central Region dominates the Saudi Arabia luxury perfume market with 34 percent share, driven primarily by Riyadh's status as the nation's capital and premier luxury retail destination accounting for a major portion of national perfume sales. The region benefits from exceptional concentration of high-net-worth individuals, sophisticated retail infrastructure including premium shopping malls with dedicated luxury perfumery zones, and strong cultural affinity for premium fragrances among Riyadh's cosmopolitan population. Major shopping destinations including Riyadh Park, Kingdom Centre, and Granada Center house flagship stores of international luxury brands alongside prestigious local perfume houses, creating competitive retail landscape offering extensive product selection across all luxury fragrance categories. The capital's role as administrative and business center generates sustained demand from both resident population and visiting business travelers, diplomats, and government officials seeking premium fragrances for personal use and corporate gifting purposes.

Government initiatives under Vision 2030 promoting retail sector development and cultural tourism have accelerated investment in luxury retail experiences, evidenced by numerous flagship store openings and exclusive brand partnerships throughout Riyadh and surrounding cities. The region particularly benefits from Diriyah development project transforming historic district into premier cultural and luxury destination, while Qiddiya entertainment city development promises additional luxury retail opportunities attracting affluent consumers. Additionally, the Northern and Central Region's young, affluent population demonstrates strong engagement with global luxury trends while maintaining appreciation for traditional Arabic fragrances, creating balanced demand supporting both heritage perfume houses and contemporary international brands. The convergence of wealth concentration, retail infrastructure investment, and evolving consumer sophistication positions the region for continued market leadership throughout the forecast period.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Luxury Perfume Market Growing?

Rapid E-Commerce Expansion and Digital Retail Infrastructure Development

The explosive growth of e-commerce platforms has fundamentally transformed luxury perfume distribution in Saudi Arabia, creating unprecedented market accessibility and consumer reach beyond traditional retail limitations. By the end of 2024, Saudi Arabia reached 33.6 million internet users engaged in e-commerce activities, representing a remarkable 42 percent increase from 2019 levels. This digital infrastructure expansion enables luxury perfume brands to implement direct-to-consumer strategies, personalized marketing campaigns, and comprehensive product information delivery that were previously impossible through physical retail alone. Major international platforms have entered the Saudi market, intensifying competition and driving service quality improvements across the e-commerce ecosystem. Additionally, people increasingly value the convenience of browsing extensive fragrance collections, comparing prices, reading authentic customer reviews, and accessing niche international brands unavailable in physical stores, fundamentally reshaping purchasing behavior particularly among younger demographics comfortable with digital transactions.

Strategic Brand Partnerships and Premium Positioning Initiatives

The Saudi Arabia luxury perfume market benefits significantly from strategic collaborations between international luxury houses and regional distribution powerhouses, creating sophisticated retail ecosystems that elevate brand accessibility and consumer experiences. These strategic alliances enable international brands to navigate complex regulatory environments, understand nuanced cultural preferences, and establish premium positioning within competitive market landscape. Such collaborations and retail innovations create exclusive product offerings, limited-edition collections, and culturally relevant marketing campaigns that resonate deeply with Saudi consumers' sophisticated luxury preferences, driving sustained market growth across premium fragrance categories. In 2025, Cupid Limited finalized a Term Sheet to obtain a significant share in the fragrance brand Mansam, a luxury fragrance label from Saudi Arabia. The investment is executed via a fund structure overseen by GII Investment Management Limited.

Rising Influence of Younger Demographics and Social Media Marketing

Saudi Arabia's luxury perfume market experiences substantial growth momentum driven by younger consumer demographics demonstrating heightened engagement with global luxury trends and sophisticated purchasing power. The Kingdom boasts a large number of active social media users across platforms in within the Middle East region, creating powerful digital marketing channels for luxury perfume brands. The GoDaddy survey indicates that almost 94 percent of entrepreneurs in the Kingdom view social media platforms as crucial to their sales strategy, with a significant majority of 68 percent stating that these tools are very important for achieving their business objectives. Beauty influencers and fragrance content creators significantly shape purchasing decisions through detailed product reviews, application tutorials, and lifestyle content that seamlessly integrates luxury perfumes into aspirational narratives. among affluent younger consumers seeking status-signaling luxury products.

Market Restraints:

What Challenges the Saudi Arabia Luxury Perfume Market is Facing?

Rapid E-Commerce Expansion and Digital Retail Infrastructure Development

The explosive growth of e-commerce platforms has fundamentally transformed luxury perfume distribution in Saudi Arabia, creating unprecedented market accessibility and consumer reach beyond traditional retail limitations. This digital infrastructure expansion enables luxury perfume brands to implement direct-to-consumer strategies, personalized marketing campaigns, and comprehensive product information delivery that were previously impossible through physical retail alone. Major international platforms have entered the Saudi market, intensifying competition and driving service quality improvements across the e-commerce ecosystem. Additionally, people increasingly value the convenience of browsing extensive fragrance collections, comparing prices, reading authentic customer reviews, and accessing niche international brands unavailable in physical stores, fundamentally reshaping purchasing behavior particularly among younger demographics comfortable with digital transactions.

Strategic Brand Partnerships and Premium Positioning Initiatives

The Saudi Arabia luxury perfume market benefits significantly from strategic collaborations between international luxury houses and regional distribution powerhouses, creating sophisticated retail ecosystems that elevate brand accessibility and consumer experiences. These strategic alliances enable international brands to navigate complex regulatory environments, understand nuanced cultural preferences, and establish premium positioning within competitive market landscape. Such collaborations and retail innovations create exclusive product offerings, limited-edition collections, and culturally relevant marketing campaigns that resonate deeply with Saudi consumers' sophisticated luxury preferences, driving sustained market growth across premium fragrance categories.

Rising Influence of Younger Demographics and Social Media Marketing

Saudi Arabia's luxury perfume market experiences substantial growth momentum driven by younger consumer demographics demonstrating heightened engagement with global luxury trends and sophisticated purchasing power. The Kingdom boasts a large number of active social media users across platforms in within the Middle East region, creating powerful digital marketing channels for luxury perfume brands. Beauty influencers and fragrance content creators significantly shape purchasing decisions through detailed product reviews, application tutorials, and lifestyle content that seamlessly integrates luxury perfumes into aspirational narratives. among affluent younger consumers seeking status-signaling luxury products.

Competitive Landscape:

The Saudi Arabia luxury perfume market features sophisticated competitive dynamics characterized by strong presence of established regional players alongside prestigious international luxury houses, creating diverse ecosystem serving varied consumer preferences across traditional and contemporary fragrance categories. Leading regional companies maintain exceptional brand equity built through generations of traditional perfumery expertise and cultural authenticity, while Arabian Oud operates extensive retail network of stores worldwide specializing in oriental and oil-based compositions. International luxury brands leverage global prestige and marketing capabilities, with premium distribution partnerships’ exclusive arrangements with luxury houses expanding accessibility to discerning Saudi customers through sophisticated retail environments and digital platforms, while emerging niche players including Amouage capture growing demand for artisanal and bespoke fragrances among ultra-affluent consumer segments.

Recent Developments:

-

In September 2025, Healthcare products maker Cupid Ltd announced on Thursday that it has finalized a term sheet to obtain a strategic stake in the fragrance brand Mansam based in Saudi Arabia. The investment is made via a fund model overseen by GII Investment Management Limited, as noted in a company statement that withheld financial specifics.

Saudi Arabia Luxury Perfume Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Prices Covered | $50 - $100, $100 - $200, Above $200 |

| Distribution Channels Covered | Specialty Stores, Online Stores |

| End Users Covered | Male, Female, Unisex |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia luxury perfume market size was valued at USD 130 Million in 2025.

The Saudi Arabia luxury perfume market is expected to grow at a compound annual growth rate of 4.90% from 2026-2034 to reach USD 200 Million by 2034.

Above $200 commands 54% market share, driven by Saudi consumers' cultural preference for ultra-premium fragrances featuring rare ingredients like pure oud extracts, premium rose absolutes, and exotic amber formulations that signify sophistication, wealth, and elevated social status.

Key factors driving the Saudi Arabia luxury perfume market include rapid e-commerce expansion with 33.6 million users, strategic brand partnerships enhancing premium positioning, rising influence of younger demographics with a large number of social media users, and government Vision 2030 initiatives supporting luxury sector development.

Major challenges include intense competition from diverse brands creating market saturation, high import costs from tariffs and shipping expenses inflating retail pricing, complex Saudi FDA regulatory requirements causing compliance delays, and counterfeit products compromising brand reputation and consumer safety.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)