Saudi Arabia Luxury Watch Market Size, Share, Trends and Forecast by Type, End User, Distribution Channel, and Region, 2026-2034

Saudi Arabia Luxury Watch Market Summary:

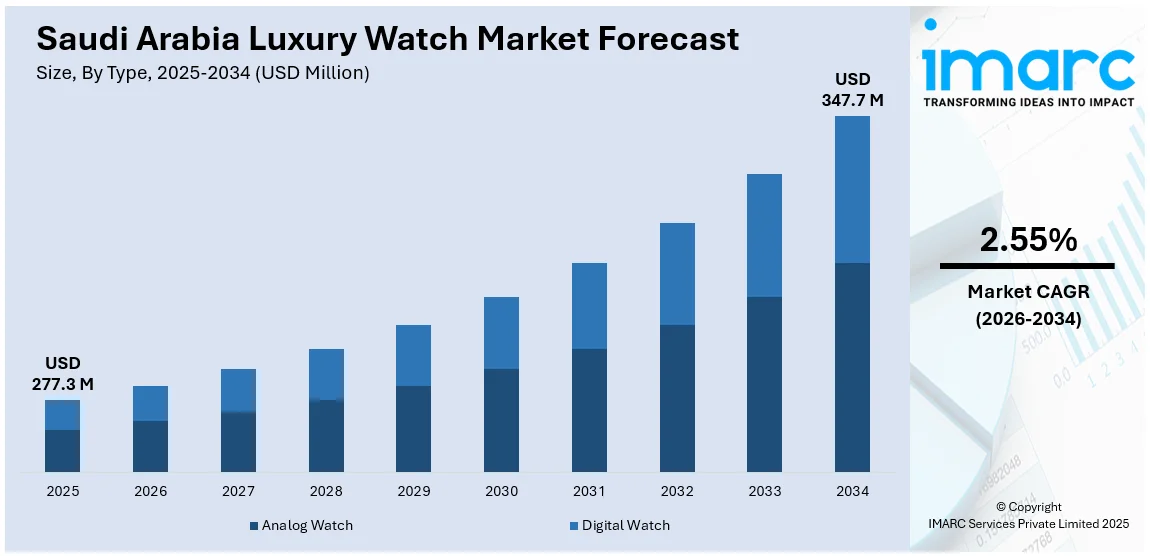

The Saudi Arabia luxury watch market size was valued at USD 277.3 Million in 2025 and is projected to reach USD 347.7 Million by 2034, growing at a compound annual growth rate of 2.55% from 2026-2034.

The market growth is driven by rising disposable incomes, a growing affluent population, and a deep-rooted cultural emphasis on prestige and status. Saudi Arabia's Vision 2030 initiatives have accelerated economic diversification, leading to substantial wealth accumulation among high-net-worth individuals who view luxury watches not merely as timepieces but as symbols of success and personal achievement. The extension of premium retail infrastructure across major cities, coupled with digital transformation in luxury retail, continues to attract both local buyers and expand the Saudi Arabia luxury watch market share.

Key Takeaways and Insights:

- By Type: Analog watch dominates the market with a share of 61% in 2025, reflecting consumer preference for traditional craftsmanship and mechanical precision.

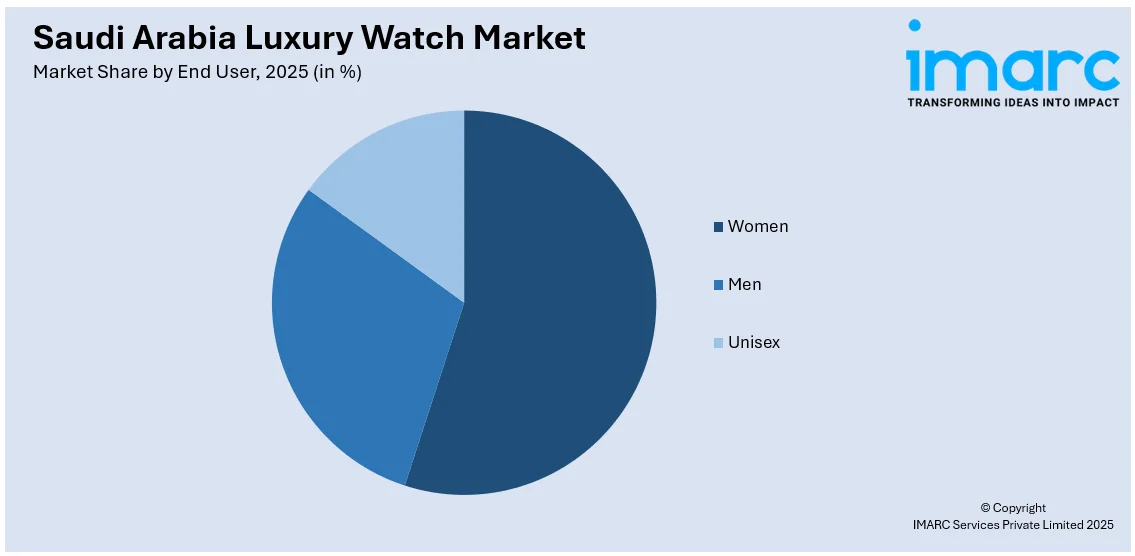

- By End User: Men lead the market with a share of 50% in 2025, driven by the longstanding perception of luxury watches as male status symbols and investment pieces.

- By Distribution Channel: Offline stores represent the largest segment with a market share of 65% in 2025, as consumers seek immersive brand experiences and personalized service in luxury boutiques.

- By Region: Northern and Central Region leads the market with a share of 28% in 2025, anchored by Riyadh's concentration of affluent consumers and premium retail infrastructure.

- Key Players: Saudi luxury watch brands are expanding boutique presence, partnering with high-end retailers, offering exclusive regional editions, and strengthening digital sales. Many are targeting affluent tourists, investing in VIP experiences, and aligning with Vision 2030 lifestyle growth.

To get more information on this market Request Sample

The Saudi Arabia luxury watch market is witnessing robust momentum fueled by the Kingdom's strategic economic transformation and expanding high-net-worth population. Riyadh experienced a 65% increase in millionaires between 2014 and 2024, now hosting over 20,000 individuals with liquid investable assets of USD 1 million or more, including 77 centi-millionaires and 11 billionaires. This wealth accumulation, combined with the cultural significance placed on luxury accessories, positions Saudi Arabia as a rapidly growing market for premium timepieces. The tourism sector's expansion, with the Kingdom welcoming 60.9 million visitors in the first half of 2025 and generating USD 43 billion in tourism spending, further amplifies demand for luxury watches. Moreover, brands are responding to Saudi preferences with exclusive Middle East collections and limited-edition releases.

Saudi Arabia Luxury Watch Market Trends:

Growing Demand for Limited-Edition and Bespoke Timepieces

In Saudi Arabia, there has been a noticeable demand from wealthy people for limited-edition and unique watches that showcase their personal style, craftsmanship and social status. Unlike standard production watches, these watches have distinctive elements designed by the watch brand or through intricate complexities and have historical significance which makes them very valuable for both collectors and those who want to make an impression. The watch brands that are currently producing watches like this include Patek Philippe, Audemars Piguet and Richard Mille and they are producing special editions of their watches for Middle Eastern consumers or special events within the Saudi Arabian market. In 2024, Laco and 10Ten Labs produced a limited-edition, Middle-East-exclusive edition of 75 pilot watches featuring pastel tones including 'Smoked Salmon', 'Fuchsia' and 'Moss Aqua'. Each 39mm watch was secured by a Miyota 821A movement priced at $620 demonstrating the Saudi Arabian market's demand for unique, localized products.

Expansion of Premium Retail Infrastructure

Saudi Arabia's Vision 2030 initiatives are driving significant expansion of luxury shopping infrastructure across major cities. High-end boutiques and luxury shopping malls in Riyadh, Jeddah, and Khobar are proliferating, creating sophisticated retail environments that enhance the luxury watch shopping experience. Hublot opened a 2,650-square-foot store in Saudi Arabia featuring the region's first Experiential Room, showcasing the brand's innovative materials and watchmaking techniques. This expansion of premium retail spaces enables brands to offer immersive experiences with personalized service, complete product ranges, and exclusive access to limited editions, solidifying Saudi Arabia as a key growth market for luxury Swiss watches and strengthening the connection between international luxury brands and Saudi consumers.

Digital Transformation and E-Commerce Growth

Digital platforms are fundamentally transforming how Saudi consumers discover, research, and purchase luxury goods, with e-commerce sales projected to grow by 12% annually. Brands are leveraging digital marketing strategies, social media campaigns, and influencer collaborations to enhance visibility and consumer engagement. Retailers are offering secure delivery with authentic luxury goods, along with additional services in personalization and financing options. In 2024, FeatureMind, a provider of digital retail solutions, expanded e-commerce capabilities for the international luxury jewelry and watchmaking brand Mouawad in Saudi Arabia, strengthening the brand's online presence in the Kingdom. This digital evolution allows retailers to reach younger, tech-savvy consumers while maintaining the exclusivity and premium positioning that characterizes the luxury watch segment.

How Vision 2030 is Transforming the Saudi Arabia Luxury Watch Market:

Saudi Arabia’s Vision 2030 is reshaping the country’s luxury watch market by driving both economic diversification and lifestyle changes. With rising disposable incomes and a growing affluent population, demand for high-end timepieces has increased as these watches are increasingly seen as symbols of status and personal style. The development of modern shopping districts and luxury malls has encouraged global watch brands to establish flagship stores in major cities like Riyadh and Jeddah, making premium watches more accessible. Vision 2030’s emphasis on boosting tourism also attracts international visitors whose luxury spending includes watches, further expanding the market. In addition, the growth of e-commerce and digital platforms allows brands to reach younger, tech-savvy consumers more effectively, transforming purchasing habits. By promoting a culture of luxury consumption and improving retail infrastructure, Vision 2030 is turning Saudi Arabia into a thriving hub for premium watch sales, blending tradition with modern consumer trends.

Market Outlook 2026-2034:

The Saudi Arabia luxury watch market is poised for sustained growth over the forecast period, driven by continued wealth accumulation, expanding tourism, and evolving consumer preferences. The market generated a revenue of USD 277.3 Million in 2025 and is projected to reach a revenue of USD 347.7 Million by 2034, growing at a compound annual growth rate of 2.55% from 2026-2034. Vision 2030 initiatives boosting tourism, entertainment, and retail development are also creating new opportunities for luxury brands. Leading players are likely to increase boutique investments, exclusive product launches, and digital engagement. Demand is expected to remain strong among high-net-worth individuals and younger consumers seeking status-driven purchases.

Saudi Arabia Luxury Watch Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Analog Watch |

61% |

|

End User |

Men |

50% |

|

Distribution Channel |

Offline Stores |

65% |

Type Insights:

- Analog Watch

- Digital Watch

Analog watch dominates with a market share of 61% of the total Saudi Arabia luxury watch market in 2025.

Analog watches dominate the Saudi Arabia luxury watch market due to their timeless design, mechanical sophistication, and rich heritage that appeals to affluent collectors and status-conscious buyers. These timepieces represent the pinnacle of Swiss craftsmanship, with high-end brands commanding premium prices through their analog-based collections. Apart from this, globally, analog watches held a major portion of the traditional watch market revenue share in 2024, demonstrating their overwhelming preference among luxury consumers.

The enduring appeal of analog watches stems from Saudi users viewing these timepieces as both wearable art and valuable investment assets that appreciate over time. Mechanical watches account for a significant portion of high-end watch production globally in 2024, with collectors particularly drawn to complications like tourbillons, perpetual calendars, and minute repeaters that showcase watchmaking mastery. Saudi Arabia's growing collector community, supported by events like Sotheby's first international auction in the Kingdom in January 2025 featuring rare pieces, reinforces the analog segment's dominance.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Women

- Men

- Unisex

Men lead with a share of 50% of the total Saudi Arabia luxury watch market in 2025.

Men represent the dominant consumer segment in the Saudi Arabia luxury watch market, reflecting the longstanding cultural perception of watches as masculine accessories and status symbols. High-net-worth Saudi men view luxury watches as essential elements of their personal brand, representing achievement, wealth, and refined taste. The market for men's watches encompasses a wide range from sports chronographs to dress watches, with brands commanding particular prestige. In the country, men held a significant share of the watches market in 2024, demonstrating the segment's overwhelming dominance across both luxury and mainstream categories. In Saudi Arabia, this preference is amplified by cultural norms that position watches as primary luxury accessories for men.

Mechanical complications, precious metal cases, and limited-edition releases particularly appeal to male collectors who appreciate both the craftsmanship and investment potential of luxury timepieces. Average spending on luxury watches among male high-net-worth individuals reached new heights in 2025, according to surveys, underlining the significance of this segment in driving market revenue. The prevalence of business and professional contexts where luxury watches serve as subtle yet powerful status markers further reinforces male demand.

Distribution Channel Insights:

- Online Stores

- Offline Stores

Offline stores exhibit a clear dominance with a 65% share of the total Saudi Arabia luxury watch market in 2025.

Offline stores command the largest share of the Saudi Arabia luxury watch market as affluent consumers prioritize immersive brand experiences, personalized service, and the ability to physically examine luxury timepieces before making significant purchases. Single-brand boutiques strategically located in high-end shopping districts and luxury malls across Riyadh, Jeddah, and Makkah offer complete product ranges with exclusive customer service, private viewing appointments, and preferential access to limited editions. Various key market players are opening flagship store in Saudi Arabia, featuring the experiential room showcasing innovative materials and watchmaking techniques, exemplifies the sophisticated retail environments luxury brands are creating to engage Saudi consumers beyond mere transactions.

These premium boutiques provide comprehensive brand experiences that extend to after-sales service, watch authentication certificates, maintenance programs, and membership in exclusive collector communities that enhance ownership value. The physical retail environment enables skilled sales consultants to educate customers about complex mechanical movements, demonstrate complications, and facilitate trying multiple models to ensure perfect fit and satisfaction. Saudi Arabia's expanding luxury mall infrastructure, with developments in major cities creating world-class shopping destinations, supports offline retail dominance by concentrating multiple luxury watch brands in prestigious locations that attract affluent shoppers.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region leads with a share of 28% of the total Saudi Arabia luxury watch market in 2025.

The Northern and Central Region dominates the Saudi Arabia luxury watch market due to Riyadh's status as the Kingdom's capital and primary economic hub. The region hosts the highest concentration of high-net-worth individuals, with Riyadh experiencing an increase in millionaires, now hosting a significant number of individuals with liquid investable assets of USD 1 million or more. This exceptional wealth concentration is creating a robust consumer base with substantial purchasing power for luxury timepieces. The region's sophisticated urban lifestyle, characterized by high-profile business districts, exclusive residential compounds, and international corporate presence, drives consistent demand for prestigious watches as essential professional and social accessories.

The Northern and Central Region's market leadership is further reinforced by its superior retail infrastructure and strong brand presence. The region features premium shopping destinations, including luxury malls with international brand boutiques such as Hublot's 2,650-square-foot flagship store with the region's first Experiential Room, exclusive watch retailers, and authorized dealers for prestigious Swiss brands like Rolex, Patek Philippe, and Audemars Piguet. Riyadh's role as a business and government center ensures consistent foot traffic of affluent professionals, senior executives, and decision-makers who view luxury watches as essential career accessories and status symbols. The city's position as a hub for major corporate headquarters, government ministries, and diplomatic missions creates a concentration of high-income professionals who regularly purchase luxury watches, solidifying the Northern and Central Region's dominant market position.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Luxury Watch Market Growing?

Rising Disposable Income and Wealth Accumulation

The steady increase in disposable income and wealth among Saudi Arabia's affluent population serves as a primary driver of luxury watch market growth. Over the past decade, the Kingdom has experienced significant economic expansion, largely due to oil wealth and ongoing economic diversification efforts under Vision 2030. In 2024, the Kingdom's GDP was expected to increase by 3.7% annually, consumer expenditure was forecasted to grow by 4.5%, and consumer price inflation is anticipated to hit 2%. This prosperity created a growing class of high-net-worth individuals with substantial purchasing power who are willing to invest in premium timepieces from renowned global brands, viewing these watches as both functional accessories and valuable assets.

Cultural Emphasis on Status and Prestige

Saudi Arabian society places significant cultural emphasis on luxury goods as symbols of success, achievement, and social standing, particularly driving demand for prestigious timepieces. Luxury watches serve as visible markers of wealth and refinement in both personal and professional contexts, making them highly desirable among the Kingdom's affluent population. Saudi Arabia is projected to attract 2,400 high-net-worth individuals in 2025, marking an eightfold increase from 300 millionaires in 2024, positioning the Kingdom as the fastest climber in global wealth migration trends according to recent reports. The country currently hosts 58,300 millionaires, including 195 centi-millionaires and 22 billionaires, representing a 32% increase since 2013. For many Saudis, owning an exclusive luxury watch from heritage brands reflects personal success and reinforces social status, making premium timepieces essential lifestyle investments. This cultural appreciation for luxury extends across generations, with both established professionals and younger affluent consumers viewing high-end watches as markers of achievement and sophisticated taste.

Tourism Expansion and International Exposure

Saudi Arabia's expanding tourism sector significantly boosts luxury watch demand as the Kingdom attracts affluent international visitors seeking premium goods. The Ministry of Tourism reported that Saudi Arabia welcomed 60.9 million visitors in the first half of 2025. With aspirations to attract 120 million visitors in the future, the luxury watch market stands to capitalize on this influx of tourists who often seek luxury items as souvenirs and status purchases. The growth in international tourism exposes Saudi consumers to global luxury trends while simultaneously bringing affluent foreign visitors into the Kingdom's premium retail environments. Major retail destinations like King Abdulaziz International Airport feature luxury shopping experiences showcasing luxury brands, providing international travelers convenient access to prestigious timepieces, thereby expanding the customer base beyond resident Saudis and contributing to overall market growth. IMARC Group predicts that the Saudi Arabia luxury travel market is expected to reach USD 22.6 Billion by 2034.

Market Restraints:

What Challenges the Saudi Arabia Luxury Watch Market is Facing?

Heavy Reliance on Imports and Supply Chain Vulnerabilities

The Saudi luxury watch market faces significant challenges from its almost complete dependence on imported timepieces, as nearly all high-end watches come from established international manufacturers based primarily in Switzerland, Germany, and other global hubs. This reliance exposes the market to various supply chain vulnerabilities including geopolitical tensions, customs regulations, port congestions, and pandemic-related disruptions. Any interruption in global trade routes can delay the delivery of new models and limited editions, frustrating collectors and enthusiasts who prioritize exclusivity and timely access to latest products. The market's import dependence means retailers have limited control over availability and must carefully manage inventory.

Counterfeiting and Authenticity Concerns

The proliferation of counterfeit luxury watches poses a substantial threat to market integrity and consumer confidence. Analysts estimate that approximately 30% of luxury watches sold online are counterfeit, representing significant challenges for legitimate manufacturers and authorized retailers. These fake products not only tarnish brand reputation and diminish consumer trust but also inflict substantial financial damages on the industry. Sophisticated counterfeits can be difficult to distinguish from authentic pieces for untrained eyes, creating risks for buyers in secondary markets and unauthorized channels. This challenge necessitates increased investment in authentication technologies, consumer education, and regulatory enforcement.

Currency Exchange Rate Fluctuations

Fluctuating currency exchange rates significantly impact the final retail price of imported luxury watches, creating pricing uncertainties and competitive challenges. As nearly all luxury watches are imported and priced based on international currencies, particularly the Swiss Franc and Euro, exchange rate volatility can make timepieces more or less affordable relative to neighboring markets. Sudden currency movements may force retailers to adjust prices, potentially making watches less competitive compared to purchases in Dubai, Bahrain, or other regional luxury shopping destinations. Retailers must carefully manage these exchange rate risks to maintain consistent pricing and competitiveness.

Competitive Landscape:

During the forecast period, the Saudi Arabia luxury watch market is projected to witness steady growth, driven by increasing disposable incomes, expanding high-net-worth population, and a strong preference for premium lifestyle products. Vision 2030 initiatives are accelerating tourism, entertainment, and retail infrastructure development, creating favorable conditions for luxury brands. International players are expected to strengthen their presence through boutique expansions, partnerships with high-end retailers, and exclusive Middle East editions tailored to local preferences. Digital transformation will also play a major role, with brands enhancing online sales channels, social media marketing, and personalized customer engagement. Demand is likely to remain robust among affluent consumers, luxury collectors, and younger buyers seeking status, craftsmanship, and heritage value. Overall, the market outlook remains positive, supported by evolving consumer aspirations and rising luxury spending in the Kingdom.

Recent Developments:

- In October 2025, Ahmed Seddiqi, the top retailer of luxury watches and jewellery in the UAE, proudly reveals its expansion into the Kingdom of Saudi Arabia by inaugurating its first boutique beyond the UAE. This strategic decision signifies an important achievement in the brand's 75-year heritage and strengthens its dedication to providing curated, refined experiences to selective customers throughout its retail presence.

- In August 2025, Arif Mohammad, the creator of the global conglomerate 4AM Group, has formally unveiled the initiation of his next significant project, an $83 million luxury timepiece brand in partnership with a renowned Swiss watch manufacturer. Aiming to enhance the worldwide watch market, this new luxury brand will provide Swiss craftsmanship and striking design, accessible via a global e-commerce site and exclusive flagship stores in London, Dubai, Riyadh, and Mumbai.

Saudi Arabia Luxury Watch Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Analog Watch, Digital Watch |

| End Users Covered | Women, Men, Unisex |

| Distribution Channels Covered | Online Stores, Offline Stores |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia luxury watch market size was valued at USD 277.3 Million in 2025.

The Saudi Arabia luxury watch market is expected to grow at a compound annual growth rate of 2.55% from 2026-2034 to reach USD 347.7 Million by 2034.

Analog watch held the largest share at 61% in 2025, driven by user preference for traditional craftsmanship, mechanical sophistication, efficient designing, and timeless heritage from prestigious brands like.

Key factors driving the Saudi Arabia luxury watch market include rising disposable incomes and wealth accumulation among high-net-worth individuals, strong cultural emphasis on status and prestige symbols, expanding tourism sector bringing affluent international visitors, growth of premium retail infrastructure in major cities, and increasing digital transformation enabling broader market access through e-commerce platforms.

The market faces heavy reliance on imports causing supply chain vulnerabilities, proliferation of counterfeit watches of degraded quality and features undermining consumer trust, and currency exchange rate fluctuations affecting pricing competitiveness and affordability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)