Saudi Arabia Material Handling Equipment Market Size, Share, Trends and Forecast by Product, Application, and Region, 2026-2034

Saudi Arabia Material Handling Equipment Market Overview:

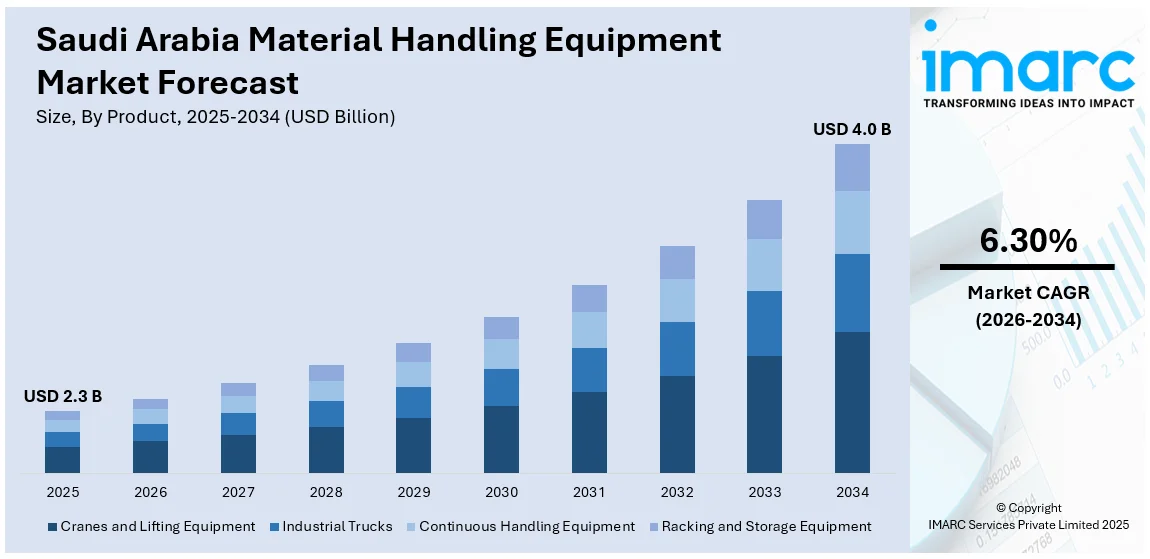

The Saudi Arabia material handling equipment market size reached USD 2.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 4.0 Billion by 2034, exhibiting a growth rate (CAGR) of 6.30% during 2026-2034. At present, the broadening of e-commerce portals is driving the demand for advanced logistics solutions, motivating warehouses to implement mechanized and automated tools for quicker and more precise deliveries. Besides this, the growing utilization of the Internet of Things (IoT) is contributing to the expansion of the Saudi Arabia material handling equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.3 Billion |

| Market Forecast in 2034 | USD 4.0 Billion |

| Market Growth Rate 2026-2034 | 6.30% |

Saudi Arabia Material Handling Equipment Market Trends:

Expansion of warehousing and logistics infrastructure

The broadening of warehousing and logistics infrastructure is positively influencing the market in Saudi Arabia. The need for effective material handling systems is growing as the nation is expanding its distribution and logistics networks to meet Vision 2030 objectives and economic diversification. In order to maximize space, expedite operations, and manage large volumes of commodities, new warehouse facilities in logistics zones, industrial hubs, and free trade areas require sophisticated equipment, including palletizers, conveyors, and automated storage systems. The growth of e-commerce is creating the need for contemporary logistics capabilities, motivating warehouses to implement automated and mechanized technology to guarantee quicker and more precise deliveries. Cold storage expansion for food products, pharmaceuticals, and perishables is driving the demand for specialized handling systems. Logistics firms are investing in scalable and intelligent equipment to reduce labor dependency and improve productivity. Government initiatives to position Saudi Arabia as a logistics hub are enhancing infrastructure spending, attracting private investments and worldwide technology providers. Rising adoption of warehouse management systems is further catalyzing the demand for integrated material handling solutions. According to the IMARC Group, the Saudi Arabia warehouse management systems market size reached USD 47.32 Million in 2024. As industries like manufacturing, automotive, and construction are thriving, the need for equipment that ensures safe and efficient movement of goods is growing.

To get more information on this market Request Sample

Increasing utilization of IoT

Rising adoption of the IoT is impelling the Saudi Arabia material handling equipment market growth. The International Data Corporation (IDC) estimated that by 2025, the Saudi Arabia IoT market will hit USD 2.9 Billion, expanding annually by 12.8%. IoT-enabled systems allow businesses to track equipment performance, inventory movement, and warehouse conditions with precision. Sensors and smart devices integrated into forklifts, conveyors, and storage systems provide data that helps optimize routes, minimize downtime, and predict maintenance needs. This predictive maintenance reduces unexpected breakdowns and increases equipment lifespan. IoT also supports the development of automated and semi-automated material handling solutions, which improve productivity and lower reliance on manual labor. In large-scale logistics centers and smart warehouses, IoT improves coordination between machinery and management systems, enabling smooth and synchronized operations. It also enhances safety by identifying equipment malfunctions and safety risks in real time. As Saudi Arabia is investing in digital infrastructure and Industry 4.0, more businesses are employing IoT to meet modern warehousing and logistics demands. This shift towards connected systems is making material handling equipment smarter, more responsive, and better aligned with national goals for industrial efficiency and technological advancement.

Saudi Arabia Material Handling Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product and application.

Product Insights:

- Cranes and Lifting Equipment

- Industrial Trucks

- Continuous Handling Equipment

- Racking and Storage Equipment

The report has provided a detailed breakup and analysis of the market based on the product. This includes cranes and lifting equipment, industrial trucks, continuous handling equipment, and racking and storage equipment.

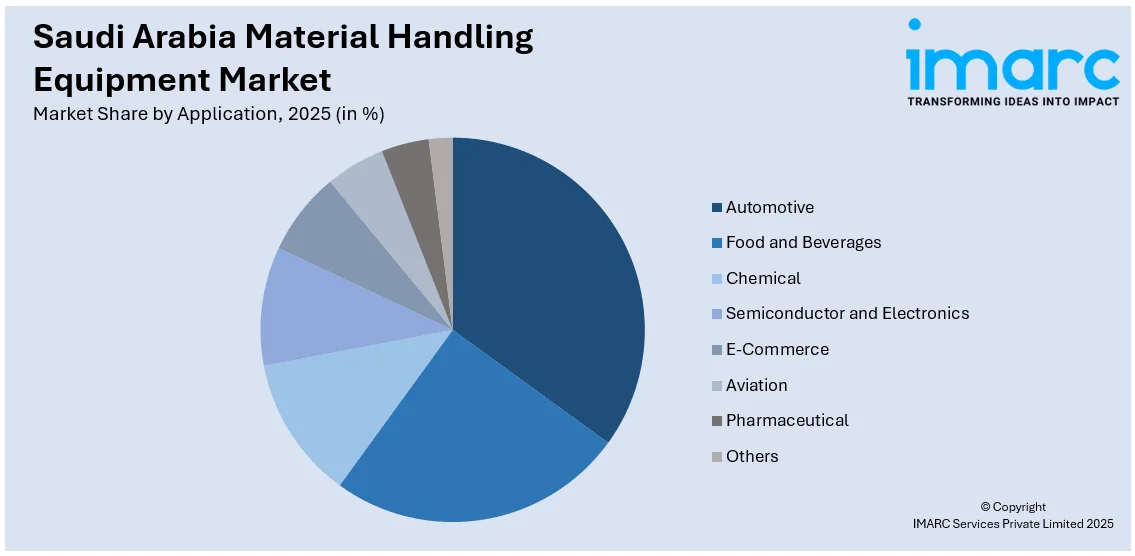

Application Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Food and Beverages

- Chemical

- Semiconductor and Electronics

- E-Commerce

- Aviation

- Pharmaceutical

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automotive, food and beverages, chemical, semiconductor and electronics, e-commerce, aviation, pharmaceutical, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Material Handling Equipment Market News:

- In September 2024, MDS, a top producer of robust rock trommels and conveyors, revealed the selection of Abdul Latif Jameel Machinery as its inaugural distributor in Saudi Arabia. Abdul Latif Jameel Machinery, located in Jeddah, was a top supplier of material handling equipment and heavy machinery. The firm aimed to create bigger aggregates for rock armor, gabion stone, and gabbro.

- In May 2024, Kanoo Machinery UAE and KSA, one of the largest privately-owned multinational companies in the Middle East, reported the signing of a partnership agreement with Combilift, the leading producer of multidirectional, sideloading, and articulated forklifts, to offer sustainable forklift solutions in the region. The partnership highlighted a mutual commitment to innovation and sustainability, ensuring that the material handling equipment meet the diverse industry demands in Saudi Arabia and the wider Middle East while supporting the region's environmental objectives.

Saudi Arabia Material Handling Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Cranes and Lifting Equipment, Industrial Trucks, Continuous Handling Equipment, Racking and Storage Equipment |

| Applications Covered | Automotive, Food and Beverages, Chemical, Semiconductor and Electronics, E-Commerce, Aviation, Pharmaceutical, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia material handling equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia material handling equipment market on the basis of product?

- What is the breakup of the Saudi Arabia material handling equipment market on the basis of application?

- What is the breakup of the Saudi Arabia material handling equipment market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia material handling equipment market?

- What are the key driving factors and challenges in the Saudi Arabia material handling equipment market?

- What is the structure of the Saudi Arabia material handling equipment market and who are the key players?

- What is the degree of competition in the Saudi Arabia material handling equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia material handling equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia material handling equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia material handling equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)