Saudi Arabia Material Testing Equipment Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2026-2034

Saudi Arabia Material Testing Equipment Market Overview:

The Saudi Arabia material testing equipment market size reached USD 53.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 99.8 Million by 2034, exhibiting a growth rate (CAGR) of 7.27% during 2026-2034. The market is driven by Vision 2030-led infrastructure expansion, necessitating rigorous testing of structural materials across mega-projects. Industrial diversification has heightened demand for mechanical and thermal validation in local manufacturing, especially in petrochemicals and energy, thereby fueling the market. Enhanced regulatory oversight through SASO and SALEEM ensures material compliance and audit transparency, further augmenting the Saudi Arabia material testing equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 53.1 Million |

| Market Forecast in 2034 | USD 99.8 Million |

| Market Growth Rate 2026-2034 | 7.27% |

Saudi Arabia Material Testing Equipment Market Trends:

Construction Expansion and Structural Material Compliance

Saudi Arabia’s infrastructure boom under Vision 2030, including mega-projects like NEOM, Qiddiya, and the Red Sea Project, has sharply increased demand for construction-grade material validation. Contractors and government regulators require reliable testing of concrete, steel, soil, and asphalt to ensure structural performance under desert climate and load-bearing conditions. Material testing labs are equipped with compression, flexure, and tensile machines that conform to Saudi Building Code and ASTM standards. As public and private sectors invest in smart cities, mixed-use complexes, and transport networks, real-time testing instruments with digital reporting features are gaining traction. Increasing localization of construction materials, such as prefabricated concrete blocks and steel reinforcement, calls for quality assurance before integration into key structures. Mobile testing units are also deployed on-site to expedite inspections, especially in remote or high-priority project zones. Government-mandated pre-qualification requirements for contractors further intensify the use of mechanical and nondestructive testing systems in project workflows. These evolving regulatory and structural benchmarks form a critical layer of quality assurance and operational risk mitigation, contributing steadily to Saudi Arabia material testing equipment market growth.

.webp)

To get more information on this market Request Sample

Industrial Diversification and Manufacturing Standards

Saudi Arabia’s push toward industrial diversification, particularly in sectors like mining, petrochemicals, automotive assembly, and renewable energy, has created an urgent need for material testing systems across production environments. To meet international standards such as ISO, ASME, and API, manufacturers must routinely assess the tensile strength, corrosion resistance, and fatigue limits of raw and fabricated materials. The establishment of localized manufacturing clusters, including those in Jubail and Ras Al-Khair, has resulted in higher volumes of internal quality control and third-party testing services. The country’s Vision 2030 aims to achieve a 50% localization rate in various sectors such as oil and gas and defense. Also, Saudi Arabia aims to localize 40% of its pharmaceutical industry, 50% of defense and security expenditure, and 85% of domestic food production. Manufacturers involved in precision engineering, especially in downstream oil and gas, deploy thermal and mechanical test equipment to maintain operational safety and export readiness. The national strategy to develop a domestic EV supply chain has further encouraged testing of composite materials, battery casings, and lightweight metal components. Vocational institutes and industrial labs supported by the Human Capability Development Program are also procuring modular and automated testing platforms to train future technicians. The rising demand for durable, certifiable products in both local and export markets is reinforcing the country’s testing equipment infrastructure across its non-oil manufacturing landscape.

Saudi Arabia Material Testing Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, application, and end user.

Type Insights:

- Tensile Testing Machines

- Compression Testing Machines

- Bending Testing Machines

- Hardness Testing Machines

- Impact Testing Machines

- Ultrasonic Testing Equipment

- Fatigue Testing Machines

- Creep Testing Equipment

The report has provided a detailed breakup and analysis of the market based on the type. This includes tensile testing machines, compression testing machines, bending testing machines, hardness testing machines, impact testing machines, ultrasonic testing equipment, fatigue testing machines, and creep testing equipment.

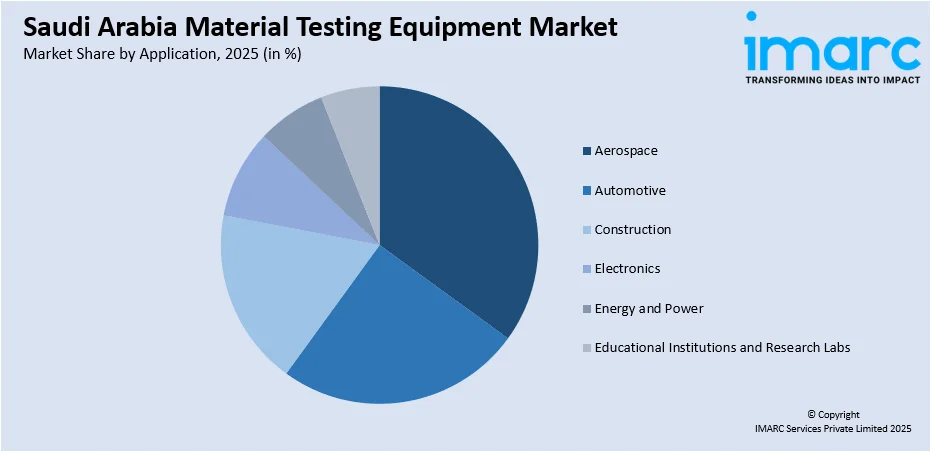

Application Insights:

Access the comprehensive market breakdown Request Sample

- Aerospace

- Automotive

- Construction

- Electronics

- Energy and Power

- Educational Institutions and Research Labs

The report has provided a detailed breakup and analysis of the market based on the application. This includes aerospace, automotive, construction, electronics, energy and power, and educational institutions and research labs.

End User Insights:

- Manufacturers

- Research and Development Laboratories

- Quality Control and Assurance Departments

- Academic Institutions

- Governmental Regulatory Bodies

The report has provided a detailed breakup and analysis of the market based on the end user. This includes manufacturers, research and development laboratories, quality control and assurance departments, academic institutions, and governmental regulatory bodies.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Material Testing Equipment Market News:

- On March 24, 2025, Aramco announced the launch of Saudi Arabia’s first direct air capture (DAC) CO2 test plant, developed in collaboration with Siemens Energy. The facility, located in Saudi Arabia, will serve as a platform for testing next-generation CO2 capture materials and aims to reduce costs and accelerate the deployment of DAC technologies in the region.

- On April 28, 2025, Saudi Arabia unveiled the Future Mobility Sandbox, a 1.56-square-kilometer testbed located at the King Abdullah University of Science and Technology (KAUST), designed to foster the development of autonomous, sustainable, and connected transport technologies. This initiative, in collaboration with the Ministry of Transport and Logistic Services (MOTLS) and the Ministry of Industry and Mineral Resources (MIM), aims to create an environment for testing vehicles, aircraft, drones, and maritime technologies, advancing the Kingdom's Vision 2030 goals.

Saudi Arabia Material Testing Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Tensile Testing Machines, Compression Testing Machines, Bending Testing Machines, Hardness Testing Machines, Impact Testing Machines, Ultrasonic Testing Equipment, Fatigue Testing Machines, Creep Testing Equipment |

| Applications Covered | Aerospace, Automotive, Construction, Electronics, Energy and Power, Educational Institutions and Research Labs |

| End Users Covered | Manufacturers, Research and Development Laboratories, Quality Control and Assurance Departments, Academic Institutions, Governmental Regulatory Bodies |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia material testing equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia material testing equipment market on the basis of type?

- What is the breakup of the Saudi Arabia material testing equipment market on the basis of application?

- What is the breakup of the Saudi Arabia material testing equipment market on the basis of end user?

- What is the breakup of the Saudi Arabia material testing equipment market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia material testing equipment market?

- What are the key driving factors and challenges in the Saudi Arabia material testing equipment market?

- What is the structure of the Saudi Arabia material testing equipment market and who are the key players?

- What is the degree of competition in the Saudi Arabia material testing equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia material testing equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia material testing equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia material testing equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)