Saudi Arabia Meat Processing Market Size, Share, Trends and Forecast by Product, Equipment, Meat, Mode of Operation, and Region, 2026-2034

Saudi Arabia Meat Processing Market Overview:

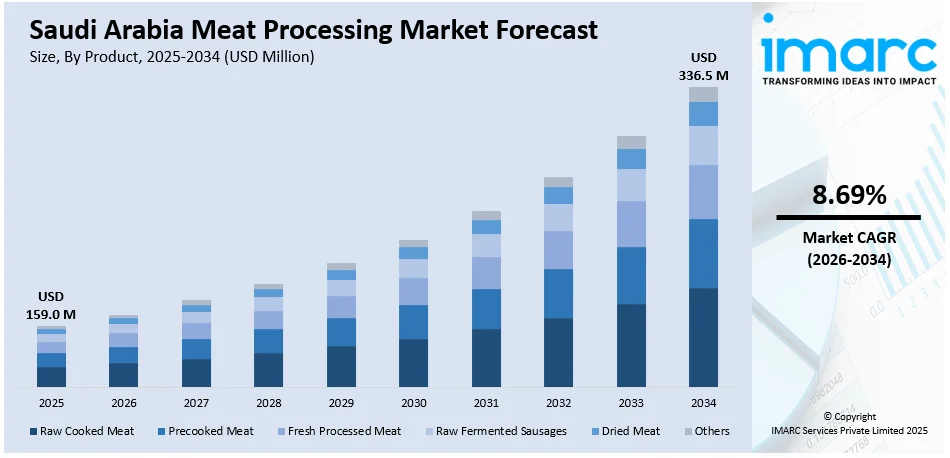

The Saudi Arabia meat processing market size reached USD 159.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 336.5 Million by 2034, exhibiting a growth rate (CAGR) of 8.69% during 2026-2034. The market is experiencing steady growth, driven by increasing demand for processed meat products due to changing consumer preferences and busy lifestyles. Key players in the industry focusing on innovations in processing technologies, along with the growing population and rising disposable income, is also fueling the Saudi Arabia meat processing market share, presenting significant opportunities for both local and international producers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 159.0 Million |

| Market Forecast in 2034 | USD 336.5 Million |

| Market Growth Rate 2026-2034 | 8.69% |

Saudi Arabia Meat Processing Market Trends:

Growth in Halal Meat Production

The Saudi Arabian market for halal meat is experiencing significant growth, both locally and globally. Locally, Saudi consumers are interested in buying the halal kind of meat in order to stay true to religious and cultural usage so that the meat is processed under Islamic law. This demand is further supported by the rising population and increased awareness of food quality and safety standards. In addition, Saudi Arabia's central role as a global leader in the halal meat market is opening new avenues of export. With its highly developed halal certification mechanisms, the nation is now a major exporter of halal meat to several geographic regions, including the Middle East, Asia, and portions of Europe. While the global demand for halal products increases, Saudi manufacturers are spending on new processing methods and international standards to provide for both domestic and export markets. For instance, in November 2024, Fam Foods, in partnership with the Kobe Beef Association, launched halal-certified Kobe beef in Saudi Arabia during an exclusive event hosted by the Japanese ambassador. The evening featured traditional cuisine, cultural performances, and the announcement of Hocho, a premium Kobe and Wagyu restaurant opening in Via Riyadh, to enhance the Japanese experience. This is what is redefining the future of meat processing in Saudi Arabia.

To get more information on this market Request Sample

Technological Advancements

Technological advancements in meat processing are playing a pivotal role in catalyzing the Saudi Arabia meat processing market growth. Automation and advanced processing technologies, i.e., robotics, AI-based systems, and intelligent machinery, are increasing production efficiency, lowering costs, and enhancing product quality consistency. For instance, in May 2025, Poulta Inc. announced its partnership with Tanmiah Food Company to transform Saudi Arabia's poultry industry digitally. The initiative will implement Poulta's AI-powered platform across TFC's operations, optimizing production and processing while enhancing animal welfare and efficiency, marking a significant step in Agri-tech innovation in the region. These technologies are especially important in addressing the growing demand for quality processed meat while sustaining food safety. In addition, packaging technology advances, such as vacuum sealing and modified atmosphere packaging, are increasing product shelf life, providing better preservation, and minimizing food wastage. The implementation of traceability systems is also picking up steam, offering openness and assurance that halal and quality standards are achieved. While Saudi meat processors are investing in the advanced technologies, they are not only addressing local requirements but also establishing themselves as players to reckon with in the international market, contributing to significant growth in the sector.

Saudi Arabia Meat Processing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product, equipment, meat, and mode of operation.

Product Insights:

- Raw Cooked Meat

- Precooked Meat

- Fresh Processed Meat

- Raw Fermented Sausages

- Dried Meat

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes raw cooked meat, precooked meat, fresh processed meat, raw fermented sausages, dried meat, and others.

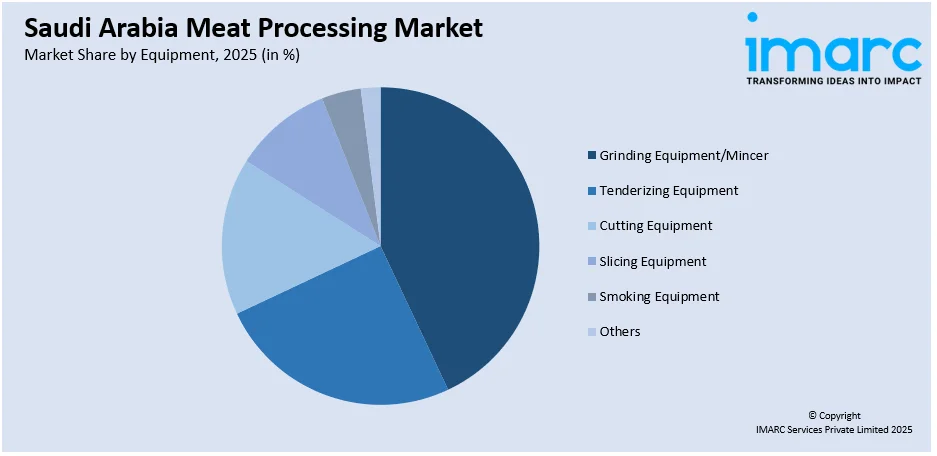

Equipment Insights:

Access the comprehensive market breakdown Request Sample

- Grinding Equipment/Mincer

- Tenderizing Equipment

- Cutting Equipment

- Slicing Equipment

- Smoking Equipment

- Others

A detailed breakup and analysis of the market based on the equipment have also been provided in the report. This includes grinding equipment/mincer, tenderizing equipment, cutting equipment, slicing equipment, smoking equipment, and others.

Meat Insights:

- Beef

- Pork

- Mutton

- Others

A detailed breakup and analysis of the market based on the meat have also been provided in the report. This includes beef, pork, mutton, and others.

Mode of Operation Insights:

- Manual

- Semi-Automatic

- Automatic

A detailed breakup and analysis of the market based on the mode of operation have also been provided in the report. This includes manual, semi-automatic, and automatic.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Meat Processing Market News:

- In April 2025, BRF announced its plan to invest up to USD 160 Million in a new poultry and beef processing plant in Jeddah, Saudi Arabia, expected to launch in mid-2026. The facility aims to produce 40,000 tons annually, generating over 500 local jobs and supporting Saudi Arabia’s halal economy and Vision 2030 goals.

- In March 2025, Hilton Foods entered a 10-year joint venture with NADEC in Saudi Arabia, focusing on meat processing and packaging. This collaboration aims to enhance food security and expand market growth in the region. Hilton will hold a 49% stake and invest £6.5 million in new facilities, targeting operational commencement by H2 2026.

Saudi Arabia Meat Processing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Raw Cooked Meat, Precooked Meat, Fresh Processed Meat, Raw Fermented Sausages, Dried Meat, Others |

| Equipments Covered | Grinding Equipment/Mincer, Tenderizing Equipment, Cutting Equipment, Slicing Equipment, Smoking Equipment, Others |

| Meats Covered | Beef, Pork, Mutton, Others |

| Mode of Operations Covered | Manual, Semi-Automatic, Automatic |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia meat processing market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia meat processing market on the basis of product?

- What is the breakup of the Saudi Arabia meat processing market on the basis of equipment?

- What is the breakup of the Saudi Arabia meat processing market on the basis of meat?

- What is the breakup of the Saudi Arabia meat processing market on the basis of mode of operation?

- What is the breakup of the Saudi Arabia meat processing market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia meat processing market?

- What are the key driving factors and challenges in the Saudi Arabia meat processing market?

- What is the structure of the Saudi Arabia meat processing market and who are the key players?

- What is the degree of competition in the Saudi Arabia meat processing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia meat processing market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia meat processing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia meat processing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)