Saudi Arabia Meat Substitutes Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2026-2034

Saudi Arabia Meat Substitutes Market Overview:

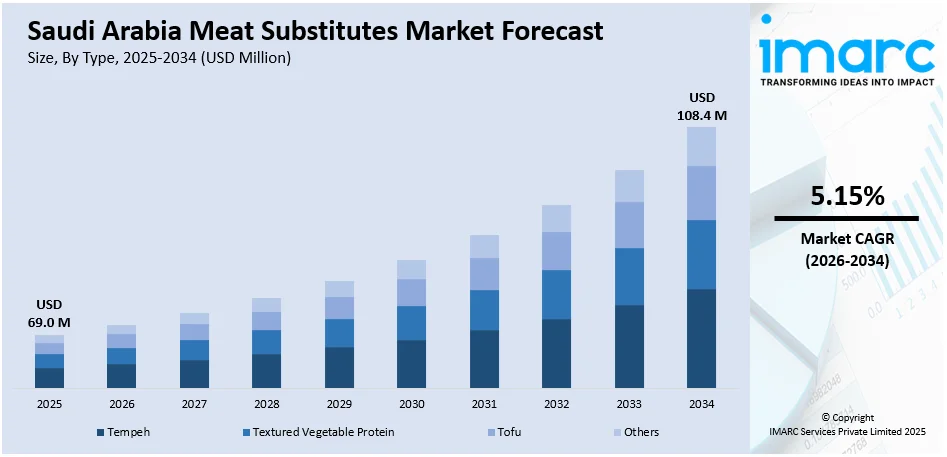

The Saudi Arabia meat substitutes market size reached USD 69.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 108.4 Million by 2034, exhibiting a growth rate (CAGR) of 5.15% during 2026-2034. People are shifting towards plant-based options that offer less fat, lower cholesterol, and higher nutritional advantages, as awareness about the health hazards linked to consuming large amounts of red and processed meat is growing. Furthermore, increasing use of product sampling, in-store promotions, and attractive packaging, which aid in promoting repeat business and stimulate trials, is fueling the Saudi Arabia meat substitutes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 69.0 Million |

| Market Forecast in 2034 | USD 108.4 Million |

| Market Growth Rate 2026-2034 | 5.15% |

Saudi Arabia Meat Substitutes Market Trends:

Increasing cases of lifestyle-related diseases

Rising prevalence of lifestyle-related ailments like obesity and diabetes are positively influencing the market in Saudi Arabia. The General Authority for Statistics (GASTAT) reported that in 2024, the obesity rate for those aged 15 and over was 23.1%, whereas 45.1% of people in this category were deemed overweight. In addition, the rate of obesity in children aged 2 to 14 years was 14.6%, with 33.3% of kids in this age group considered overweight. With the growing awareness about the health risks linked to excessive consumption of red and processed meat, people are turning to plant-based alternatives that offer lower fat, reduced cholesterol, and improved nutritional profiles. Health-conscious individuals, especially those managing weight or blood sugar levels, prefer meat substitutes made from ingredients like soy, peas, and mushrooms for their high protein and fiber content. These products aid in decreasing calorie intake while still providing essential nutrients. Doctors and nutritionists are also encouraging the inclusion of plant-based options in daily meals, further promoting the shift in consumer preferences. Educational campaigns, health apps, and wellness programs are creating awareness about the connection between diet and chronic conditions, driving the demand for meat substitutes. The market benefits from the increasing availability of diverse and convenient products that mimic the taste and texture of meat, making the transition easier for consumers. Restaurants and food outlets are also responding by adding meat-free alternatives to their menus, supporting the market growth. As concerns over obesity and diabetes are becoming more widespread, the appeal of healthier plant-based food solutions is increasing.

To get more information on this market Request Sample

Rising marketing efforts

Increasing marketing efforts are impelling the Saudi Arabia meat substitutes market growth. With the rising adoption of social media, companies are employing digital platforms to highlight the health, ethical, and environmental benefits of plant-based diets. As per industry reports, in 2024, the number of individuals with social media accounts in Saudi Arabia hit 35.33 Million. Celebrity endorsements, influencer campaigns, and engaging content help capture consumer interest, especially among younger and health-conscious populations. Marketing strategies often focus on taste, nutritional value, and product variety to reduce hesitation towards meat alternatives. In-store promotions, product sampling, and attractive packaging further encourage trial and repeat purchases. Educational campaigns provide information on how meat substitutes support lifestyle goals, such as weight management and fitness. These efforts are collectively shaping consumer perception, building brand loyalty, and increasing acceptance of plant-based products. As marketing is reaching a wider audience, it is stimulating the growth of the market in Saudi Arabia.

Expansion of retail outlets

The expansion of retail channels is positively influencing the market in Saudi Arabia. According to the IMARC Group, the Saudi Arabia retail market size was valued at USD 282.2 Billion in 2024. Supermarkets, hypermarkets, and specialty stores actively stock a variety of meat substitute products, making them more visible and convenient for consumers. Retailers offer promotional deals, attractive packaging, and informative labeling, which influence buying decisions, especially among health-conscious shoppers. Organized retail also enables product availability from both local and international brands, increasing consumer choice. As retail chains are growing, they are expanding into smaller cities and supporting the distribution of alternative protein products. The presence of these items in mainstream retail environments helps normalize plant-based eating habits. Additionally, modern retail settings are facilitating awareness campaigns that educate consumers about the health and environmental benefits of meat substitutes, thus driving overall demand.

Saudi Arabia Meat Substitutes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and distribution channel.

Type Insights:

- Tempeh

- Textured Vegetable Protein

- Tofu

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes tempeh, textured vegetable protein, tofu, and others.

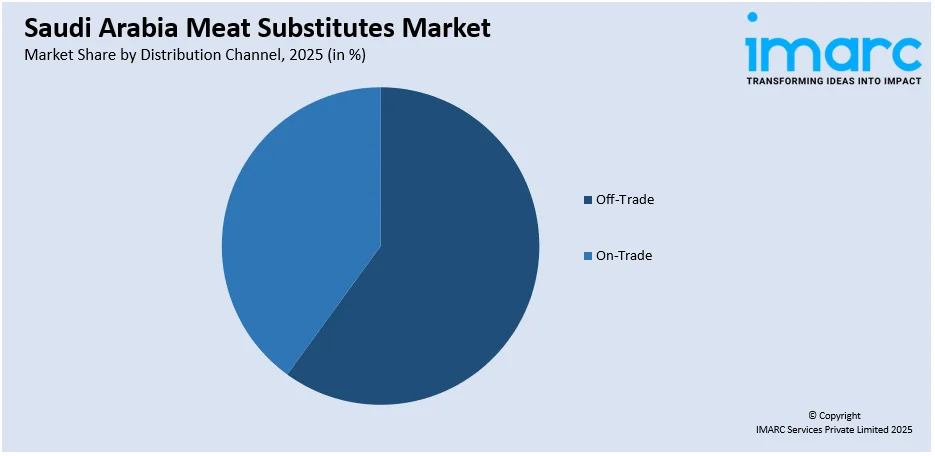

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Off-Trade

- Convenience Stores

- Online Channels

- Supermarkets and Hypermarkets

- Others

- On-Trade

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes off-trade (convenience stores, online channels, supermarkets and hypermarkets, and others) and on-trade.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Meat Substitutes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Tempeh, Textured Vegetable Protein, Tofu, Others |

| Distribution Channels Covered |

|

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia meat substitutes market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia meat substitutes market on the basis of type?

- What is the breakup of the Saudi Arabia meat substitutes market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia meat substitutes market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia meat substitutes market?

- What are the key driving factors and challenges in the Saudi Arabia meat substitutes market?

- What is the structure of the Saudi Arabia meat substitutes market and who are the key players?

- What is the degree of competition in the Saudi Arabia meat substitutes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia meat substitutes market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia meat substitutes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia meat substitutes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)