Saudi Arabia Medical Implants Market Size, Share, Trends and Forecast by Product, Material, and Region, 2026-2034

Saudi Arabia Medical Implants Market Overview:

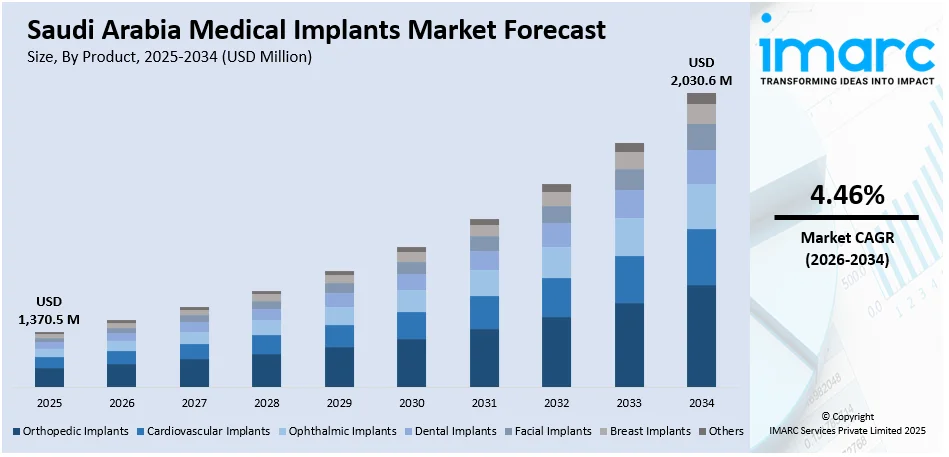

The Saudi Arabia medical implants market size reached USD 1,370.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,030.6 Million by 2034, exhibiting a growth rate (CAGR) of 4.46% during 2026-2034. The market is witnessing significant growth driven by the increasing healthcare needs, an aging population, and rising demand for advanced implant technologies. Innovations in implant materials and the expansion of healthcare infrastructure are also escalating product demand. With advancements in orthopedic, dental, and cardiovascular implants, the Saudi Arabia medical implants market share is further projected to grow substantially.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,370.5 Million |

| Market Forecast in 2034 | USD 2,030.6 Million |

| Market Growth Rate 2026-2034 | 4.46% |

Saudi Arabia Medical Implants Market Trends:

Expansion of Healthcare Infrastructure

The development of Saudi Arabia's healthcare infrastructure is greatly increasing access to advanced medical implant procedures. With continuous investment by the government in constructing new hospitals, medical centers, and specialized clinics, access to healthcare services is expanding throughout the country. This development encompasses the establishment of state-of-the-art surgical facilities, modern diagnostic tools, and enhanced patient care systems. For instance, in April 2025, Saudi Arabia announced the launch of 28 healthcare projects totaling USD 1.86 Billion, enhancing the healthcare system with over 3,000 beds. Significant additions include a 500-bed Women’s, Maternity, and Children’s Hospital and 22 dental clinics within the Al-Qassim Charitable Complex, aligning with Saudi Vision 2030’s healthcare goals. As healthcare infrastructure grows, more people can access advanced treatments, including complex orthopedic, dental, and cardiovascular implant surgeries. Specialized clinics focusing on specific procedures, like joint replacements or dental implants, are increasing in number, reducing the need for patients to travel abroad for treatments. Moreover, the establishment of cutting-edge medical technologies in these new facilities ensures better surgical outcomes and quicker recovery times. The overall improvement in healthcare access is directly contributing to the Saudi Arabia medical implants market growth, providing patients with more treatment options.

To get more information on this market Request Sample

Increasing Demand for Orthopedic Implants

The growing need for orthopedic implants in Saudi Arabia is primarily fueled by the aging population and the growing incidence of musculoskeletal disorders. According to the data published by UNFPA, Saudi Arabia faces a significant demographic shift, with the population aged 60 and over projected to rise five-fold from 2 million (5.9% of total population) in 2020 to 10.5 Million (23.7%) by 2050. With an aging population, the incidence of joint degeneration, arthritis, and spine disorders increases, necessitating orthopedic intervention. Disorders such as osteoarthritis, especially in the hip and knee joints, are common among elderly people, driving the demand for joint replacement implants. Also, lifestyle elements, such as obesity and sedentary lifestyles, have contributed to an increase in musculoskeletal disorders among all age groups, which in turn has increased the demand for corrective procedures. Orthopedic devices like knee, hip, and spine implants are increasingly becoming necessary for enhancing mobility and improving the quality of life for patients. As the materials for implants, surgical methods, and recovery increase with progress, orthopedic surgeries become more accessible and efficient, making a considerable contribution to expanding the orthopedic implant market in Saudi Arabia.

Saudi Arabia Medical Implants Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product and material.

Product Insights:

- Orthopedic Implants

- Hip Orthopedic Device

- Joint Reconstruction

- Knee Orthopedic Devices

- Spine Orthopedic Devices

- Others

- Cardiovascular Implants

- Pacing Devices

- Stents

- Structural Cardiac Implants

- Ophthalmic Implants

- Intraocular Lens

- Glaucoma Implants

- Dental Implants

- Facial Implants

- Breast Implants

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes orthopedic implants (hip orthopedic device, joint reconstruction, knee orthopedic devices, spine orthopedic devices, and others), cardiovascular implants (pacing devices, stents, and structural cardiac implants), ophthalmic implants (intraocular lens and glaucoma implants), dental implants, facial implants, breast implants, and others.

Material Insights:

Access the comprehensive market breakdown Request Sample

- Metallic Biomaterial

- Polymers Biomaterial

- Natural Biomaterial

- Ceramic Biomaterial

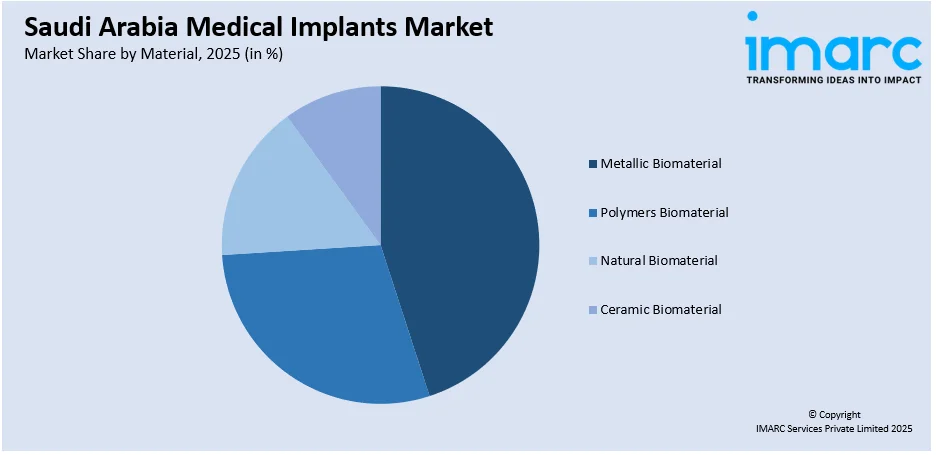

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes metallic biomaterial, polymers biomaterial, natural biomaterial, and ceramic biomaterial.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Medical Implants Market News:

- In January 2025, King Faisal Specialist Hospital in Saudi Arabia successfully performed the world's first robotic-assisted implantation of Abbott's HeartMate 3 left ventricular assist device. The innovative procedure significantly reduces recovery time, with patients expected to be discharged within 10 days, compared to the traditional 63 days for similar surgeries.

- In February 2024, Dentakay is announced its plans to expand into Saudi Arabia with its first clinic opening in Riyadh amid rising demand for dental care. The clinic will address urgent pediatric dental issues and provide a full range of services, including implants and cosmetic procedures like the “Hollywood Smile,” leveraging advanced technology to enhance patient outcomes.

- In March 2023, Osteonic announced its plans to supply USD 4.8 Million worth of orthopedic implants to Saudi Arabia's National Unified Procurement Company (NUPCO) through local partner Arab East Medical. The two-year contract includes 54 precision craniomaxillofacial products.

Saudi Arabia Medical Implants Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Materials Covered | Metallic Biomaterial, Polymers Biomaterial, Natural Biomaterial, Ceramic Biomaterial |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia medical implants market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia medical implants market on the basis of product?

- What is the breakup of the Saudi Arabia medical implants market on the basis of material?

- What is the breakup of the Saudi Arabia medical implants market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia medical implants market?

- What are the key driving factors and challenges in the Saudi Arabia medical implants market?

- What is the structure of the Saudi Arabia medical implants market and who are the key players?

- What is the degree of competition in the Saudi Arabia medical implants market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia medical implants market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia medical implants market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia medical implants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)