Saudi Arabia Medical Tubing Market Size, Share, Trends and Forecast by Product, Structure, Application, End User, and Region, 2026-2034

Saudi Arabia Medical Tubing Market Overview:

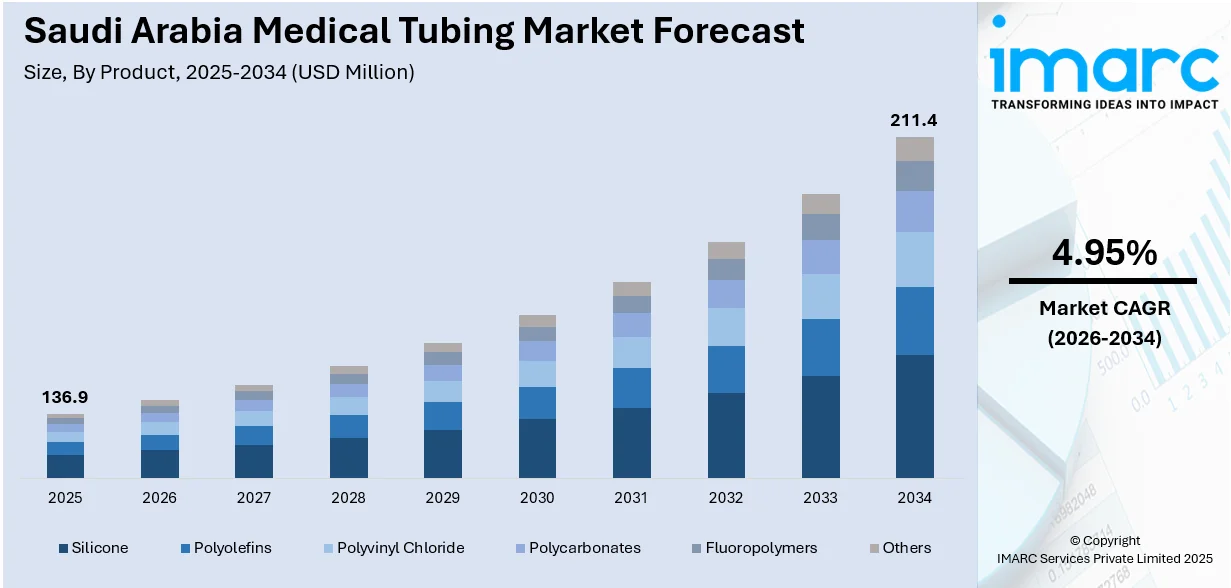

The Saudi Arabia medical tubing market size reached USD 136.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 211.4 Million by 2034, exhibiting a growth rate (CAGR) of 4.95% during 2026-2034. The market is witnessing significant growth due to the growing healthcare infrastructure, increased demand for advanced medical procedures, and government initiatives under Vision 2030. Moreover, increasing prevalence of chronic diseases, growing trend of outpatient care and home healthcare and integration of imaging and robotic-assisted surgeries represent some of the other factors contributing to the Saudi Arabia medical tubing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 136.9 Million |

| Market Forecast in 2034 | USD 211.4 Million |

| Market Growth Rate 2026-2034 | 4.95% |

Saudi Arabia Medical Tubing Market Trends:

Healthcare Sector Expansion

The rapid expansion of Saudi Arabia’s healthcare sector, driven by Vision 2030, is significantly influencing the market. This transformation includes massive investment in building new hospitals, upgrading existing medical infrastructure, and expanding specialized care services such as cardiology, nephrology, and oncology. For instance, in October 2024, Saudi Arabia announced over SR50 billion ($13.3 billion) in healthcare investments at the Global Health Exhibition in Riyadh. Key deals include SR4 billion for pharmaceuticals, SR5 billion for Fakeeh Care, and SR3 billion for Almoosa Health. The initiative aims to position the Kingdom as a global health innovation hub. The government is actively promoting private sector involvement to increase healthcare accessibility and improve service quality across urban and rural regions. This surge in infrastructure directly raises the demand for essential medical supplies, including tubing used in fluid transfer, respiratory support, and surgical applications. With increasing patient volume and procedural complexity, the need for high-performance, reliable medical tubing has intensified. As the country continues to modernize its healthcare ecosystem and attract international players, the market outlook remains highly favorable, with strong potential for growth in both demand and technological advancement.

To get more information on this market Request Sample

Advanced Medical Procedures

The rising adoption of minimally invasive and precision-based medical procedures in Saudi Arabia is creating sustained demand for specialized medical tubing. These procedures used in cardiology, endoscopy, urology, and laparoscopic surgeries require tubing with enhanced flexibility, strength, and biocompatibility to ensure safety and precision. As patient preferences shift toward faster recovery times and less invasive treatment options, healthcare providers are increasingly equipping themselves with advanced tools and consumables tailored for such interventions. For instance, in April 2025, King Faisal Specialist Hospital and Research Center in Saudi Arabia utilized a minimally invasive technique to treat below-the-knee peripheral artery stenosis. This innovative procedure involves inserting a bioresorbable stent through a catheter in the thigh, restoring blood flow, alleviating pain, and significantly reducing amputation risk for patients. Additionally, the integration of imaging and robotic-assisted surgeries is raising the technical requirements for tubing components, which must perform reliably under complex clinical conditions. The country’s strategic push to improve tertiary and quaternary care services, along with expanding surgical capabilities across public and private hospitals, is further reinforcing this demand. These factors collectively contribute to the positive trajectory of Saudi Arabia medical tubing market growth.

Saudi Arabia Medical Tubing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product, structure, application, and end user.

Product Insights:

- Silicone

- Polyolefins

- Polyvinyl Chloride

- Polycarbonates

- Fluoropolymers

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes silicone, polyolefins, polyvinyl chloride, polycarbonates, fluoropolymers, and others.

Structure Insights:

- Single-Lumen

- Co-Extruded

- Multi-Lumen

- Tapered or Bump Tubing

- Braided Tubing

A detailed breakup and analysis of the market based on the structure have also been provided in the report. This includes single-lumen, co-extruded, multi-lumen, tapered or bump tubing, and braided tubing.

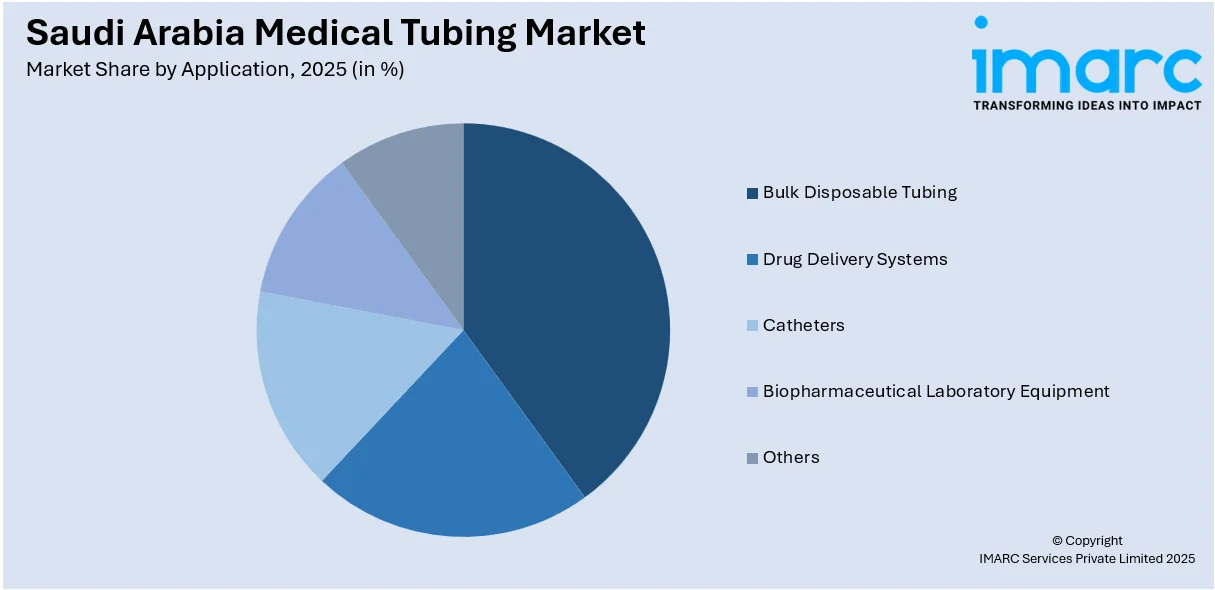

Application Insights:

Access the comprehensive market breakdown Request Sample

- Bulk Disposable Tubing

- Drug Delivery Systems

- Catheters

- Biopharmaceutical Laboratory Equipment

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes bulk disposable tubing, drug delivery systems, catheters, biopharmaceutical laboratory equipment, and others.

End User Insights:

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Medical Labs

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. this includes hospitals and clinics, ambulatory surgical centers, medical labs, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Medical Tubing Market News:

- In March 2025, the King Salman Humanitarian Aid and Relief Center (KSrelief) launched a volunteer medical project for open-heart surgery in Aden, Yemen. In collaboration with the Saudi Development and Reconstruction Program for Yemen, the initiative has successfully performed 13 open-heart surgeries, 29 catheterizations, and 3 transcatheter aortic valve implantations.

- In January 2023, ProvenMed announced its partnership with Gulf Medical Company to deliver innovative urinary incontinence solutions, including the ActivGo® catheter, in Saudi Arabia. This collaboration aims to enhance the quality of life for men suffering from incontinence, addressing the growing demand amid rising elderly populations and chronic conditions.

Saudi Arabia Medical Tubing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Silicone, Polyolefins, Polyvinyl Chloride, Polycarbonates, Fluoropolymers, Others |

| Structures Covered | Single-Lumen, Co-Extruded, Multi-Lumen, Tapered or Bump Tubing, Braided Tubing |

| Applications Covered | Bulk Disposable Tubing, Drug Delivery Systems, Catheters, Biopharmaceutical Laboratory Equipment, Others |

| End Users Covered | Hospitals and Clinics, Ambulatory Surgical Centers, Medical Labs, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia medical tubing market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia medical tubing market on the basis of product?

- What is the breakup of the Saudi Arabia medical tubing market on the basis of structure?

- What is the breakup of the Saudi Arabia medical tubing market on the basis of application?

- What is the breakup of the Saudi Arabia medical tubing market on the basis of end user?

- What is the breakup of the Saudi Arabia medical tubing market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia medical tubing market?

- What are the key driving factors and challenges in the Saudi Arabia medical tubing market?

- What is the structure of the Saudi Arabia medical tubing market and who are the key players?

- What is the degree of competition in the Saudi Arabia medical tubing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia medical tubing market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia medical tubing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia medical tubing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)