Saudi Arabia Medical Waste Management Market Size, Share, Trends and Forecast by Treatment Site, Treatment, and Region, 2026-2034

Saudi Arabia Medical Waste Management Market Overview:

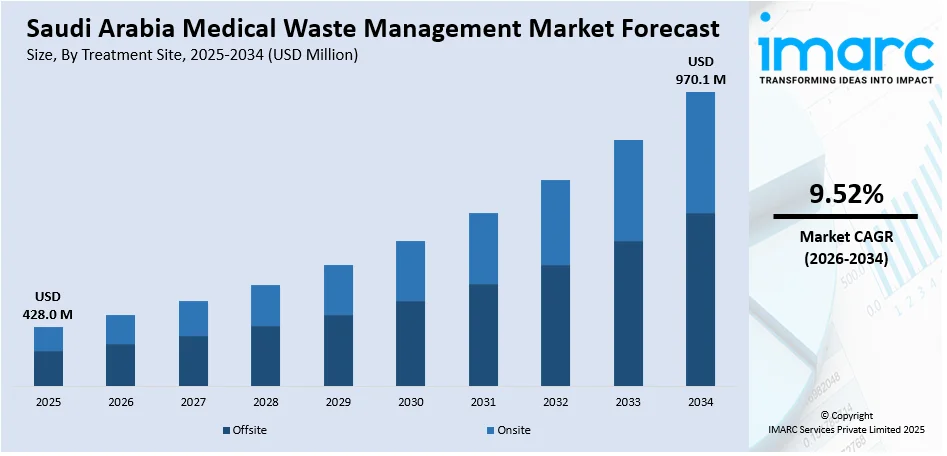

The Saudi Arabia medical waste management market size reached USD 428.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 970.1 Million by 2034, exhibiting a growth rate (CAGR) of 9.52% during 2026-2034. The market is driven by strict regulatory compliance frameworks mandating proper handling, treatment, and documentation of hazardous medical waste. Growing healthcare capacity and specialized clinical services are intensifying the generation of complex waste streams requiring customized disposal, thereby fueling the market. Sustainability policies and digital traceability expectations are reshaping industry practices, further augmenting the Saudi Arabia medical waste management market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 428.0 Million |

| Market Forecast in 2034 | USD 970.1 Million |

| Market Growth Rate 2026-2034 | 9.52% |

Saudi Arabia Medical Waste Management Market Trends:

Regulatory Oversight and Institutional Enforcement

Saudi Arabia has introduced comprehensive regulations governing the handling, transport, and treatment of medical waste under the supervision of the Ministry of Health and the Saudi Food and Drug Authority. These standards mandate separation of hazardous and non-hazardous materials, sterilization before disposal, and licensed third-party collection. As healthcare infrastructure expands, particularly in Riyadh, Jeddah, and Dammam, the volume of infectious and pathological waste rises, requiring stringent monitoring. Regulatory audits and the National Center for Waste Management’s framework enforce traceability and on-site containment, compelling hospitals and clinics to outsource services to specialized vendors. Public and private medical institutions are also required to maintain meticulous waste logs and disposal certificates, enhancing the demand for digital compliance solutions. On April 10, 2025, Lana Medical Co. was awarded a SAR 7.93 million (approximately USD 2.11 million) contract by the Saudi Ministry of Health to manage hazardous healthcare waste at Prince Mohammed bin Abdulaziz Hospital in Riyadh. The project, which will last for 60 months, will begin after the site is received and the contract is approved by the Ministry of Finance. The financial impact of the project is expected to be reflected starting from the second quarter of 2025. With increasing attention to infection control, especially post-pandemic, healthcare operators are under pressure to adopt systematic waste segregation and treatment. The demand is further elevated by the influx of medical tourists and the expansion of specialized care centers. This institutionalization of waste governance and regulatory rigidity continues to stimulate Saudi Arabia medical waste management market growth.

To get more information on this market Request Sample

Healthcare Sector Expansion and Service Diversification

Saudi Arabia’s Vision 2030 outlines significant investments into public health infrastructure, driving the construction of new hospitals, rehabilitation centers, dialysis units, and outpatient clinics. On June 4, 2025, Saudi Arabia's healthcare sector continues to expand with plans to open five new hospitals by 2025, therefore adding a total of 963 beds across key provinces. This expansion is part of a broader SAR 260 billion (USD 69.3 billion) budget allocated for healthcare and social development, aimed at improving infrastructure and increasing bed capacity to 23 per 10,000 residents. The new hospitals, including a mental health facility in Riyadh, align with Saudi Vision 2030's goals to enhance healthcare access and services nationwide. This expansion not only increases patient volume but also diversifies the types of medical waste generated, including radioactive, pharmaceutical, cytotoxic, and sharps waste. The introduction of advanced surgical and diagnostic equipment has led to higher volumes of single-use disposables and biohazards requiring specialized containment. Urban healthcare clusters are being developed with integrated waste handling systems, and even smaller facilities are transitioning to automated disposal models. With the rise in elective surgeries and chronic disease management, the frequency and complexity of clinical waste collection have grown, necessitating routine, scalable logistics. Furthermore, specialized healthcare providers, oncology, fertility, and dental centers, now contribute distinct waste streams needing customized treatment protocols. These shifts require third-party vendors to offer tailored, high-capacity waste solutions, including mobile incinerators and cold storage for biohazardous materials. As patient care services broaden, the requirement for agile, compliant waste management becomes a fixed operational priority for healthcare institutions.

Saudi Arabia Medical Waste Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on treatment site and treatment.

Treatment Site Insights:

- Onsite

- Collection

- Treatment and Disposal

- Recycling

- Others

- Offsite

- Collection

- Treatment and Disposal

- Recycling

- Others

The report has provided a detailed breakup and analysis of the market based on the treatment site. This includes onsite (collection, treatment and disposal, recycling, and others) and offsite (collection, treatment and disposal, recycling, and others).

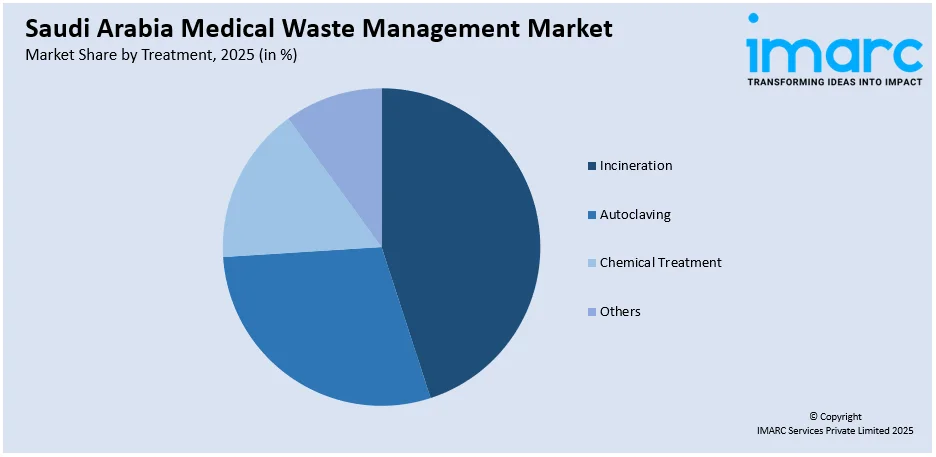

Treatment Insights:

Access the comprehensive market breakdown Request Sample

- Incineration

- Autoclaving

- Chemical Treatment

- Others

The report has provided a detailed breakup and analysis of the market based on the treatment. This includes incineration, autoclaving, chemical treatment, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Medical Waste Management Market News:

- On December 4, 2024, the Saudi Investment Recycling Company (SIRC) and SUEZ announced a new Framework Strategic Partnership aimed at fostering a circular economy in Saudi Arabia. The collaboration focuses on the development of waste-to-energy infrastructure and waste treatment solutions for medical, municipal, and hazardous waste, aligning with the Kingdom’s Vision 2030. The partnership also includes decarbonization initiatives such as biochar production, supporting the Kingdom’s low-carbon economy and climate goals.

Saudi Arabia Medical Waste Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Treatment Sites Covered |

|

| Treatments Covered | Incineration, Autoclaving, Chemical Treatment, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia medical waste management market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia medical waste management market on the basis of treatment site?

- What is the breakup of the Saudi Arabia medical waste management market on the basis of treatment?

- What is the breakup of the Saudi Arabia medical waste management market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia medical waste management market?

- What are the key driving factors and challenges in the Saudi Arabia medical waste management market?

- What is the structure of the Saudi Arabia medical waste management market and who are the key players?

- What is the degree of competition in the Saudi Arabia medical waste management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia medical waste management market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia medical waste management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia medical waste management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)