Saudi Arabia Metal Powder Market Size, Share, Trends and Forecast by Material, Technology, Application, and Region, 2026-2034

Saudi Arabia Metal Powder Market Overview:

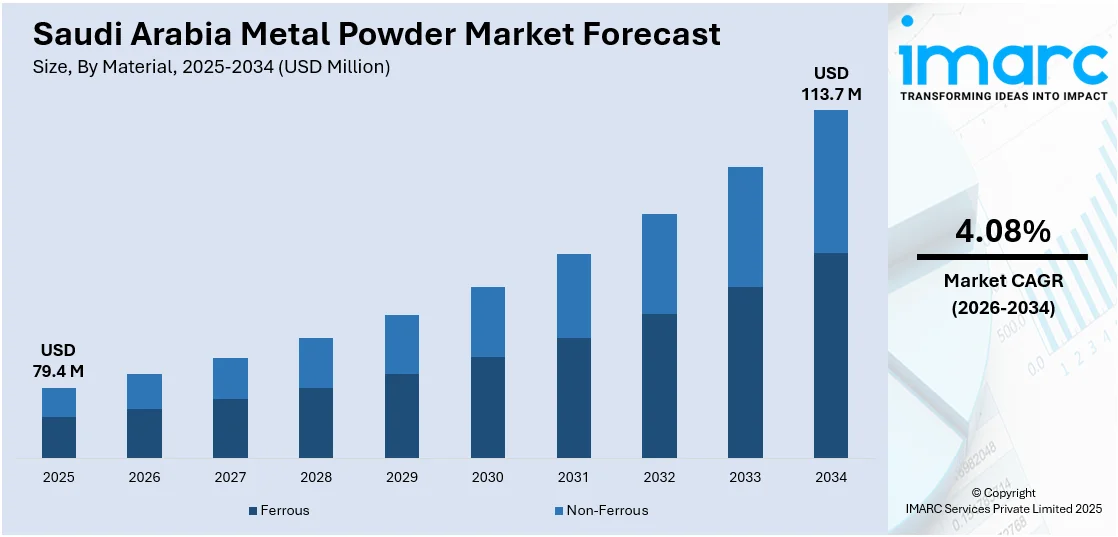

The Saudi Arabia metal powder market size reached USD 79.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 113.7 Million by 2034, exhibiting a growth rate (CAGR) of 4.08% during 2026-2034. The market is being driven by the nation's economic diversification efforts under Vision 2030, emphasizing industrial expansion and reduced oil dependency, the rising demand from automotive and aerospace sectors, substantial investments in mining and critical minerals like lithium, and the establishment of Jeddah as a London Metal Exchange delivery point.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 79.4 Million |

| Market Forecast in 2034 | USD 113.7 Million |

| Market Growth Rate 2026-2034 | 4.08% |

Saudi Arabia Metal Powder Market Trends:

Industrial Diversification under Vision 2030 & Local Manufacturing Push

Saudi Arabia’s Vision 2030 is driving rapid diversification of its economy, with advanced manufacturing and metallurgy emerging as key beneficiaries, particularly the metal powder market. Under the National Industrial Development and Logistics Program (NIDLP), the Kingdom is channeling investments into non-oil sectors, with a strong emphasis on localization to reduce reliance on imports. This strategy includes ramping up domestic production of high-demand industrial inputs like metal powders, essential for automotive, defense, and industrial machinery manufacturing. Reflecting this momentum, the Ministry of Industry and Mineral Resources issued 1,365 new industrial licenses in 2023. This was a 35% increase over 2022—highlighting surging industrial activity and corresponding demand for raw materials. The nation’s burgeoning electric vehicle sector, led by Ceer Motors and collaborations with global automakers, is also fueling demand for aluminum and copper powders used in batteries and motor components. This industrial expansion is attracting global suppliers and technology providers in additive manufacturing and powder metallurgy, fostering joint ventures and strengthening Saudi Arabia’s local supply chain ecosystem.

To get more information on this market Request Sample

Strategic Minerals and Mining Sectors Boom

Saudi Arabia’s expanding mining sector centered on its vast reserves of critical and strategic minerals such as lithium, nickel, and rare earth elements is emerging as a major catalyst for the country’s expanding metal powder market. With an estimated USD 2.5 trillion in untapped mineral wealth, the Kingdom is positioning itself as a global mining powerhouse. In line with this, an increasing number of exploration licenses are being granted to both domestic and international firms under a transparent, investor-friendly regulatory framework. These developments directly support the production of high-performance metal powders essential to aerospace, defense, and electronics manufacturing. In a significant move, Ma’aden and the Public Investment Fund (PIF) launched a mining services company in 2023 focused on battery minerals, contributing to an increase in demand for nickel and cobalt powders key components in lithium-ion batteries and advanced alloys. Further integrating into global markets, the London Metal Exchange (LME) approved Jeddah as a delivery hub for copper and zinc in 2024, enhancing investor confidence and trade efficiency. By aligning its mining ambitions with high-tech manufacturing needs, Saudi Arabia is laying the groundwork for sustained, strategic growth in its metal powder industry.

Key Growth Drivers of Saudi Arabia Metal Powder Market:

Rising investments in construction and infrastructure projects

The expansion of construction and infrastructure projects is catalyzing the demand for strong, durable, and precision-engineered metal components. Mega projects under Vision 2030, such as new industrial hubs, require advanced materials for structural parts, coatings, and machinery. Metal powders are essential in additive manufacturing and powder metallurgy, enabling the production of lightweight and high-strength components for construction equipment and infrastructure applications. The focus on modern and sustainable building designs is further supporting the use of specialized metal powders with enhanced performance characteristics. As the country continues to invest heavily in transportation networks, smart cities, and industrial facilities, the utilization of metal powders is set to rise, creating significant opportunities for manufacturers and suppliers in the sector.

Innovations in technology

Technological advancements are enhancing production efficiency, material quality, and application range. Innovations in powder metallurgy, atomization processes, and additive manufacturing are enabling the creation of metal powders with uniform particle sizes, improved strength, and superior surface finish. These advancements allow industries to produce customized components with high precision for automotive, aerospace, and energy applications. The integration of artificial intelligence (AI) and automation in production ensures better quality control and reduced manufacturing costs. Moreover, 3D printing technologies are expanding the use of metal powders in complex part fabrication, reducing waste and lead time. As industries in Saudi Arabia are adopting advanced manufacturing methods, technological progress is making metal powders more versatile, affordable, and essential across various sectors.

Growing applications in healthcare industry

Rising applications of metal powders in the healthcare industry are bolstering the market growth. Titanium, stainless steel, and cobalt-chrome metal powders are widely used in 3D printing to produce dental implants, orthopedic devices, surgical instruments, and prosthetics with exceptional precision and biocompatibility. The modernization of healthcare infrastructure under Vision 2030 and the shift towards localized medical manufacturing are accelerating the adoption. Metal powders enable lightweight, durable, and corrosion-resistant medical components, improving patient comfort and recovery times. Additionally, advancements in medical 3D printing are allowing faster production of complex designs, reducing dependence on imports. As Saudi Arabia is investing in healthcare innovations, the growing integration of metal powders in medical applications is becoming a major driver of the market expansion.

Saudi Arabia Metal Powder Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on material, technology, and application.

Material Insights:

- Ferrous

- Non-Ferrous

The report has provided a detailed breakup and analysis of the market based on the material. This includes ferrous and non-ferrous.

Technology Insights:

- Pressing and Sintering

- Metal Injection Molding

- Additive Manufacturing

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes pressing and sintering, metal injection molding, additive manufacturing, and others.

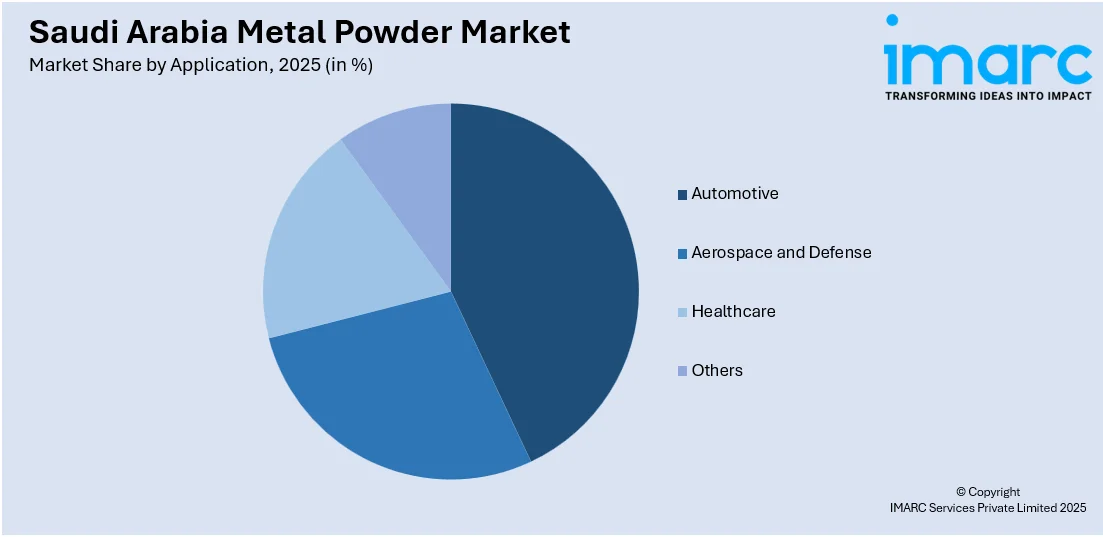

Application Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Aerospace and Defense

- Healthcare

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes automotive, aerospace and defense, healthcare, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Metal Powder Market News:

- November 2024: Saudi Arabia inked nine investment agreements in the mining and metals sector valued at SAR 35 Billion (USD 9.31 Billion). These agreements were aimed at copper, aluminum, and iron raw feedstocks that would ultimately aid in the provision of metal powder.

Saudi Arabia Metal Powder Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Ferrous, Non-Ferrous |

| Technologies Covered | Pressing and Sintering, Metal Injection Molding, Additive Manufacturing, Others |

| Applications Covered | Automotive, Aerospace and Defense, Healthcare, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia metal powder market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia metal powder market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia metal powder industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The metal powder market in Saudi Arabia was valued at USD 79.4 Million in 2025.

The Saudi Arabia metal powder market is projected to exhibit a CAGR of 4.08% during 2026-2034, reaching a value of USD 113.7 Million by 2034.

The growth in infrastructure projects and renewable energy sectors is boosting the usage of metal powder in specialized components. Rising adoption of lightweight and high-strength materials in manufacturing is driving the demand for advanced metal powder types like titanium, aluminum, and stainless steel. In addition, technological advancements in powder production, along with improved logistics and supply chains, aid in enhancing product quality and availability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)