Saudi Arabia Mobile Advertising Market Size, Share, Trends and Forecast by Segment and Region, 2026-2034

Saudi Arabia Mobile Advertising Market Overview:

The Saudi Arabia mobile advertising market size reached USD 2.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 5.4 Billion by 2034, exhibiting a growth rate (CAGR) of 9.66% during 2026-2034. The market is expanding due to high smartphone penetration, rising internet usage, and government-backed digital transformation under Vision 2030. Demand for personalized, data-driven ads, the popularity of social media and video content, and advancements in programmatic advertising and 5G technology are key drivers fueling industry growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.4 Billion |

| Market Forecast in 2034 | USD 5.4 Billion |

| Market Growth Rate 2026-2034 | 9.66% |

Saudi Arabia Mobile Advertising Market Trends:

Rapid Growth of Programmatic Advertising in Saudi Arabia

The significant shift toward programmatic advertising, driven by increasing digital adoption and demand for real-time ad placements is favoring the Saudi Arabia mobile advertising market. With smartphone penetration exceeding and high internet usage, advertisers are leveraging automated buying and selling of ad inventory to enhance targeting and efficiency. Saudi Arabia’s digital landscape depicts the population in 2025 with 48.1 million mobile connections (140 percent of the population), 99 percent internet penetration, and 34.1 million social media identities. The kingdom is ideal for mobile advertisers, as 99.6% of the population is engaged with social media. That near-total digital connectivity is reshaping the mobile advertising industry throughout the region. Programmatic platforms enable brands to reach specific audiences through data-driven insights, improving engagement and ROI. The rise of local and global demand-side platforms (DSPs) is further expanding the Saudi Arabia mobile advertising market share, allowing advertisers to optimize campaigns dynamically. Additionally, the government’s Vision 2030 initiative is fostering digital transformation, encouraging businesses to adopt advanced ad tech solutions. As a result, programmatic advertising is dominating the mobile ad space, with a growing preference for video and in-app ads, particularly in sectors such as e-commerce, gaming, and entertainment.

.webp)

To get more information on this market Request Sample

Rise in Mobile Video and Social Media Advertising

Mobile video and social media advertising are witnessing exponential growth in Saudi Arabia, fueled by high social media engagement and shifting consumer preferences. The influencer advertising market in Saudi Arabia is anticipated to reach USD 95.69 Million in 2025, and it is projected to reach USD 139.20 Million by 2029. Internet users spend approximately USD 3.57 on social media as key players in mobile ad strategies. This increase heralds a profound trajectory in creator-led mobile marketing across the Kingdom. Social media platforms are increasingly popular, leading brands to invest heavily in short-form video ads to capture user attention. With over 80% of internet users consuming video content daily, advertisers are prioritizing visually engaging formats such as stories, reels, and live streams. The rise of influencer marketing further amplifies this trend, as brands collaborate with local content creators to enhance authenticity and reach. Moreover, advancements in 5G technology are improving video load times and quality, making mobile video ads more effective. Therefore, this is creating a positive Saudi Arabia mobile advertising market outlook. As a result, businesses are reallocating budgets from traditional media to mobile-first strategies, driving a competitive and innovative advertising landscape in the Kingdom.

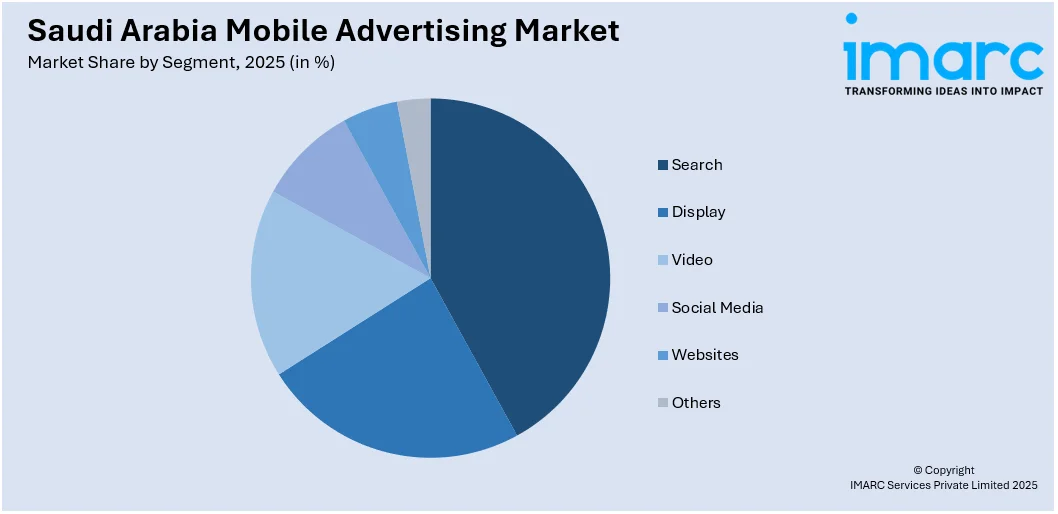

Saudi Arabia Mobile Advertising Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on segment.

Segment Insights:

Access the comprehensive market breakdown Request Sample

- Search

- Display

- Video

- Social Media

- Websites

- Others

The report has provided a detailed breakup and analysis of the market based on the segment. This includes search, display, video, social media, websites, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Mobile Advertising Market News:

- April 15, 2025: Uber partnered with Aleph to launch Journey Ads in Saudi Arabia, bringing dynamic mobile advertising directly to riders. Local brands can leverage this platform to run static and video ads, targeting their audience based on the specifics of their trips and preferences. With this initiative, Uber positions itself as a key player in the growing mobile advertising landscape in the Kingdom by enabling real-time, meaningful engagement.

- January 16, 2025: Virgin Mobile KSA launched a fun and hyper-local mobile advertising campaign aimed at promoting its new Switch Postpaid Plan that addresses points of common inefficiencies and paying too much. Leveraging cinematic storytelling and culturally illuminating scenarios, the campaign covers social media, digital, and digital out-of-home (DOOH) touchpoints intended to connect with younger consumers. Supported by metrics such as revenue increase, user engagement, and brand awareness, it is creating significant organic interest in the mobile marketing sector of Saudi Arabia.

Saudi Arabia Mobile Advertising Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Segments Covered | Search, Display, Video, Social Media, Websites, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia mobile advertising market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia mobile advertising market on the basis of segment?

- What is the breakup of the Saudi Arabia mobile advertising market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia mobile advertising market?

- What are the key driving factors and challenges in the Saudi Arabia mobile advertising market?

- What is the structure of the Saudi Arabia mobile advertising market and who are the key players?

- What is the degree of competition in the Saudi Arabia mobile advertising market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia mobile advertising market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia mobile advertising market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia mobile advertising industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)