Saudi Arabia Mobile Money Market Size, Share, Trends and Forecast by Technology, Business Model, Transaction Type, and Region, 2026-2034

Saudi Arabia Mobile Money Market Summary:

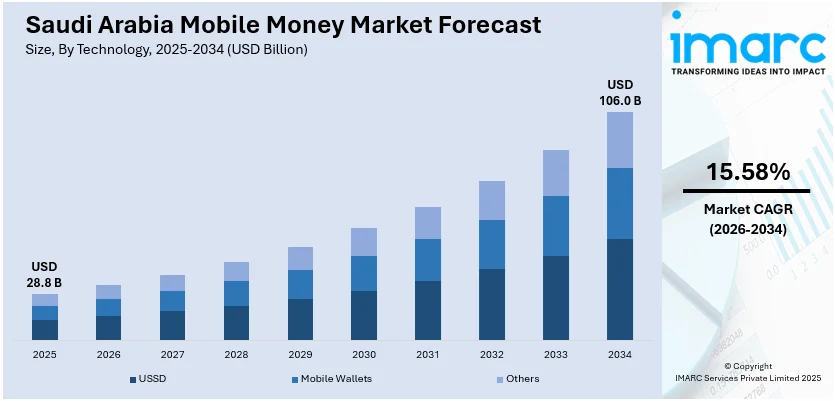

The Saudi Arabia mobile money market size was valued at USD 28.8 Billion in 2025 and is projected to reach USD 106.0 Billion by 2034, growing at a compound annual growth rate of 15.58% from 2026-2034.

The Saudi Arabia mobile money market is experiencing robust expansion as the Kingdom accelerates its digital transformation under Vision 2030. The increasing adoption of mobile wallets, contactless payment solutions, and instant payment systems is reshaping consumer financial behavior. Regulatory support from the Saudi Central Bank through fintech licensing frameworks and sandbox programs is fostering innovation and competition. Rising smartphone penetration, expanding e-commerce activities, and growing consumer preference for cashless transactions are strengthening market dynamics across the Saudi Arabia mobile money market share.

Key Takeaways and Insights:

- By Technology: Mobile wallets dominate the market with a share of 52% in 2025, owing to widespread smartphone adoption, integration with the national mada payment network, and consumer preference for convenient, secure digital payment solutions. The proliferation of wallet platforms like STC Pay, Apple Pay, and Google Pay is accelerating adoption.

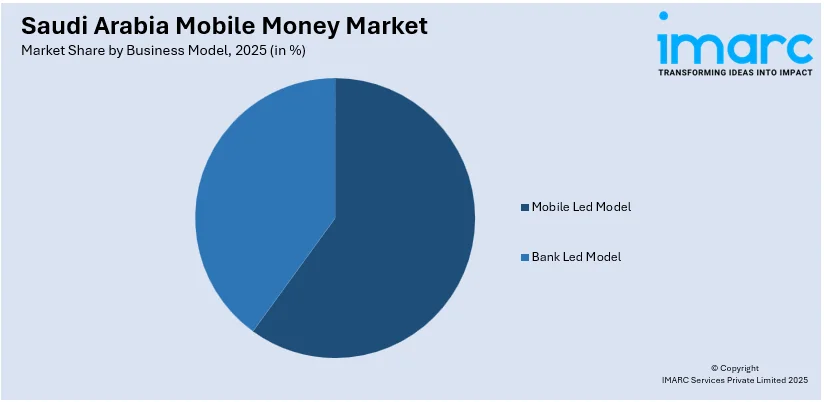

- By Business Model: Mobile led model leads the market with a share of 60% in 2025. This dominance is driven by telecom operators and fintech companies offering mobile-first financial services, leveraging their extensive subscriber bases and digital infrastructure to deliver seamless payment experiences across the Kingdom.

- By Transaction Type: Peer to peer holds the largest segment with a market share of 45% in 2025, reflecting the growing reliance on instant money transfers facilitated by the sarie real-time payment system and mobile wallet applications for personal remittances, salary disbursements, and social payments.

- By Region: Western Region represents the largest region with 30% share in 2025, driven by the commercial activities in Jeddah and the unique religious-tourism economy in Mecca, where pilgrim wallets process concentrated seasonal transaction volumes during Hajj and Umrah.

- Key Players: Market participants drive growth by expanding digital wallet capabilities, integrating cross-border payment solutions, enhancing security through biometric authentication, and forming strategic partnerships with financial institutions to strengthen market penetration and accelerate adoption across diverse consumer segments.

To get more information on this market Request Sample

The Saudi Arabia mobile money market is undergoing transformative growth as government initiatives, technological advancements, and evolving consumer behaviors converge to create a robust digital payments ecosystem. The Kingdom's Financial Sector Development Program has established ambitious targets for cashless transactions, significantly surpassing original goals ahead of schedule. The Saudi Central Bank has implemented comprehensive regulatory frameworks including fintech licensing programs, open banking standards, and instant payment systems that facilitate secure and efficient mobile money transactions. The sarie instant payment system demonstrates the infrastructure's capacity to support high-volume digital payments with real-time settlement capabilities. Strategic collaborations between local fintech companies and international payment platforms are expanding service offerings, while investments in cybersecurity infrastructure ensure consumer trust. The combination of a young, tech-savvy population with high smartphone penetration and improving digital literacy continues to strengthen the Saudi Arabia mobile money market growth trajectory.

Saudi Arabia Mobile Money Market Trends:

Expansion of Super-App Financial Ecosystems

The emergence of super-apps integrating multiple financial services within single platforms is reshaping mobile money consumption patterns in Saudi Arabia. These comprehensive applications combine payments, transfers, bill settlements, and lifestyle services to enhance user engagement and transaction frequency. Mobile wallets are evolving beyond simple payment functions to offer savings tools, investment options, and buy-now-pay-later features. In September 2024, Tabby acquired the Saudi digital wallet company Tweeq to expand its mobile-first spending accounts and financial services offerings, reflecting the consolidation trend toward integrated financial platforms.

Integration of Biometric Authentication Technologies

Mobile money platforms are increasingly incorporating advanced biometric authentication methods to enhance security and streamline user verification processes. Facial recognition, fingerprint scanning, and voice biometrics are becoming standard features across digital wallets and payment applications. The Kingdom's Unified National Access system, Nafath, has executed over 3 billion verification operations, enabling citizens and residents to access financial services through secure digital identity protocols. These technologies reduce fraud risks while improving transaction speeds and customer onboarding efficiency.

Acceleration of Cross-Border Payment Capabilities

Mobile money providers are expanding international remittance functionalities to serve Saudi Arabia's substantial expatriate population. Digital platforms are leveraging blockchain technology and direct payout APIs to reduce costs and improve transfer speeds for cross-border transactions. In October 2024, expatriate remittances from Saudi Arabia increased, marking a 2% year-on-year rise, driven partly by improved digital remittance options. Partnerships between local fintech companies and global payment networks are enabling seamless international transfers through mobile applications.

How Vision 2030 is Transforming the Saudi Arabia Mobile Money Market:

Saudi Arabia's Vision 2030 has reshaped the outlook of the mobile money market by diversifying the economy away from oil dependency and positioning the Kingdom as a regional hub for fintech innovation and digital financial services. Such regulatory reforms as the Saudi Central Bank's fintech licensing framework, the establishment of Fintech Saudi through collaboration between SAMA and the Capital Market Authority, and the streamlining of open banking regulations have boosted investor confidence and attracted global payment platforms to establish direct market presence. Demand for mobile money services is accelerated by the Kingdom's predominantly young population, rising smartphone penetration rates, and increasing preference for cashless transactions. Meanwhile, expanded digital infrastructure, alongside the sarie instant payment system, creates sophisticated payment rails that elevate the mobile money transaction experience.

Market Outlook 2026-2034:

The Saudi Arabia mobile money market outlook remains strongly positive as regulatory support, infrastructure investments, and consumer adoption continue to align with Vision 2030 objectives. The ecosystem is expected to benefit from ongoing integration of international payment platforms, expansion of merchant acceptance networks, and development of innovative financial products tailored to diverse consumer segments. Government initiatives targeting increased non-cash transactions, combined with the planned expansion of licensed fintech companies, will sustain momentum. The launch of Google Pay and planned introduction of Alipay+ will further diversify payment options and strengthen the Kingdom's position as a regional digital payments hub. The market generated a revenue of USD 28.8 Billion in 2025 and is projected to reach a revenue of USD 106.0 Billion by 2034, growing at a compound annual growth rate of 15.58% from 2026-2034.

Saudi Arabia Mobile Money Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Technology | Mobile Wallets | 52% |

| Business Model | Mobile Led Model | 60% |

| Transaction Type | Peer to Peer | 45% |

| Region | Western Region | 30% |

Technology Insights:

- USSD

- Mobile Wallets

- Others

Mobile wallets dominate with a market share of 52% of the total Saudi Arabia mobile money market in 2025.

Mobile wallets have become the preferred mobile money technology in Saudi Arabia due to their seamless integration with the national mada payment network and widespread compatibility with international payment platforms. The technology enables users to store multiple payment cards, conduct contactless transactions, and manage digital finances through intuitive smartphone applications. With high smartphone penetration across the Kingdom, mobile wallets address the needs of a digitally connected population seeking convenient and secure payment methods.

The growth of mobile wallet adoption is supported by aggressive platform expansion and strategic partnerships between financial institutions and technology providers. Leading domestic mobile wallet platforms have accumulated substantial user bases, positioning themselves as market leaders, while international platforms have established significant market presence. The integration of global payment solutions with the national mada infrastructure continues to expand consumer access to mobile wallet services, reinforcing the technology's dominant market position and providing users with diverse options for digital transactions across the Kingdom.

Business Model Insights:

Access the comprehensive market breakdown Request Sample

- Mobile Led Model

- Bank Led Model

Mobile led model leads with a share of 60% of the total Saudi Arabia mobile money market in 2025.

The mobile led model dominates the Saudi Arabia mobile money market as telecommunications operators and fintech companies leverage their extensive digital infrastructure and subscriber bases to deliver financial services. This model enables rapid customer acquisition through existing mobile networks, simplified onboarding processes, and accessible user interfaces designed for smartphone-centric consumers. The approach particularly resonates with younger demographics and underbanked populations seeking alternatives to traditional banking channels.

Telecom-backed mobile money services benefit from established distribution networks, brand recognition, and integrated marketing capabilities that accelerate user adoption. Leading telecommunications operators were among the first fintechs to receive electronic wallet licenses from SAMA and have leveraged their telecommunications heritage to build market leadership. The transition of successful mobile wallet platforms into fully licensed digital banks demonstrates the evolution potential of mobile-led business models in the Kingdom's financial services landscape, enabling expanded service offerings including accounts, cards, and merchant solutions.

Transaction Type Insights:

- Peer to Peer

- Bill Payments

- Airtime Top-ups

- Others

Peer to peer exhibits a clear dominance with a 45% share of the total Saudi Arabia mobile money market in 2025.

Peer-to-peer transfers represent the largest transaction category as consumers increasingly utilize mobile money platforms for personal remittances, family support payments, and social transactions. The segment benefits from real-time settlement capabilities, low transaction costs, and the convenience of transferring funds using mobile phone numbers rather than complex banking details. The growing expatriate workforce and established culture of financial support within family networks sustain high P2P transaction volumes.

The sarie instant payment system has transformed peer-to-peer transactions by enabling 24/7 real-time fund transfers between individuals and businesses across the Kingdom. The infrastructure demonstrates substantial consumer adoption of digital P2P channels, processing high volumes of instant payment transactions annually. Mobile wallet applications have simplified the transfer process through features like contact synchronization, QR code scanning, and saved beneficiary management, making person-to-person payments seamless and accessible for users across all demographics.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Western Region represents the leading segment with a 30% share of the total Saudi Arabia mobile money market in 2025.

The Western Region leads the mobile money market driven by the commercial dynamism of Jeddah and the unique religious-tourism economy centered in Mecca and Medina. The region benefits from high smartphone penetration, with Jeddah achieving smartphone ownership, and established digital payment infrastructure supporting diverse consumer and business needs. Commercial activities in the region's port city and industrial zones generate substantial transaction volumes across retail, hospitality, and trade sectors.

The concentration of religious pilgrimage activities creates substantial seasonal mobile money demand as pilgrims require convenient payment solutions during Hajj and Umrah. The Nusuk Wallet processes concentrated transaction volumes from pilgrims, with the majority of retail spend inside holy sites conducted through contactless digital payments. This infrastructure investment extends benefits to local commerce outside pilgrimage windows, establishing the Western Region as a critical hub for mobile money adoption and innovation.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Mobile Money Market Growing?

Government-Led Digital Transformation Initiatives

The Saudi government's Vision 2030 initiative positions digital payment transformation as a central pillar of economic diversification and modernization. The Financial Sector Development Program establishes clear targets for cashless transactions and provides regulatory frameworks that encourage fintech innovation while maintaining financial system stability. The Saudi Central Bank has implemented comprehensive licensing programs, sandbox environments, and open banking standards that facilitate market entry and product development. Government agencies have migrated public services to digital platforms, with Absher processing 430 million e-transactions in 2024, normalizing mobile money usage across the population. These coordinated efforts create favorable conditions for sustained market expansion.

High Smartphone Penetration and Digital Infrastructure

Saudi Arabia's world-leading telecommunications infrastructure provides the foundation for mobile money adoption across the Kingdom. Smartphone penetration ranks among the highest globally, ensuring widespread access to mobile payment applications and digital financial services. The country's extensive 5G coverage enables advanced features including biometric authentication, real-time transactions, and rich media payment experiences. Major metropolitan areas including Riyadh, Jeddah, and Dammam host robust 5G networks and dense point-of-sale infrastructure. This connectivity foundation supports seamless user experiences that drive consumer adoption and transaction frequency throughout the Kingdom.

Expanding Fintech Ecosystem and Competitive Innovation

The rapid growth of Saudi Arabia's fintech sector intensifies competition and accelerates product innovation across mobile money services. The number of licensed fintech companies has expanded significantly in recent years, with cumulative investments reaching substantial levels. This ecosystem growth introduces diverse service offerings, improved user interfaces, and competitive pricing that benefit consumers while expanding market penetration. New digital wallet startups continue to demonstrate strong consumer appetite for innovative mobile money solutions and the potential for rapid market share gains.

Market Restraints:

What Challenges the Saudi Arabia Mobile Money Market is Facing?

Cybersecurity Threats and Fraud Concerns

The increasing digitalization of financial transactions exposes mobile money platforms to sophisticated cyberattacks and fraud schemes. Payment-related fraud losses have prompted significant cybersecurity investments across the industry. Phishing attacks, account takeover attempts, and identity theft incidents create consumer concerns that can slow adoption rates. The persistent threat landscape facing digital payment providers highlights the need for continuous enhancement of security measures and consumer protection frameworks.

Regional Infrastructure Disparities

Despite significant national progress, rural and secondary city areas experience lower mobile money adoption due to infrastructure limitations. Patchy broadband connectivity and reduced merchant readiness in areas outside major metropolitan centers create barriers to consistent service delivery. Cash transactions continue to account for substantial payment volumes in these regions, requiring targeted investment in network coverage, device affordability, and merchant enablement programs to achieve nationwide digital payment inclusion.

Consumer Trust and Digital Literacy Gaps

Segments of the population remain hesitant to fully embrace mobile money services due to limited digital literacy and concerns about transaction security. Surveys indicate that portions of consumers lack awareness of the risks and protections associated with digital transactions, potentially limiting utilization of available security features. Building consumer confidence requires sustained investment in education programs, transparent communication about security measures, and consistent service reliability to overcome psychological barriers to mobile money adoption.

Competitive Landscape:

The Saudi Arabia mobile money market exhibits dynamic competition as established telecommunications operators, traditional financial institutions, and emerging fintech startups vie for market share. Players differentiate through service breadth, user experience quality, security features, and ecosystem partnerships. The market structure is evolving with digital-only banks entering the space, international payment platforms expanding presence, and incumbent players enhancing digital capabilities. Strategic alliances between payment providers, merchants, and technology companies are creating integrated value propositions. Regulatory frameworks encouraging innovation while ensuring consumer protection maintain competitive intensity and drive continuous improvement across the ecosystem.

Saudi Arabia Mobile Money Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | USSD, Mobile Wallets, Others |

| Business Models Covered | Mobile Led Model, Bank Led Model |

| Transaction Types Covered | Peer to Peer, Bill Payments, Airtime Top-ups, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia mobile money market size was valued at USD 28.8 Billion in 2025.

The Saudi Arabia mobile money market is expected to grow at a compound annual growth rate of 15.58% from 2026-2034 to reach USD 106.0 Billion by 2034.

Mobile wallets dominated the market with a share of 52%, driven by widespread smartphone adoption, seamless integration with the mada network, and consumer preference for convenient contactless payment solutions.

Key factors driving the Saudi Arabia mobile money market include Vision 2030 digital transformation initiatives, high smartphone penetration, expanding fintech ecosystem, real-time payment infrastructure, and growing consumer preference for cashless transactions.

Major challenges include cybersecurity threats and fraud risks, regional infrastructure disparities limiting rural adoption, digital literacy gaps among certain population segments, and the need for sustained consumer education to build trust in digital payment solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)