Saudi Arabia Mobility Aid Medical Devices Market Size, Share, Trends and Forecast by Product, End User, and Region, 2026-2034

Saudi Arabia Mobility Aid Medical Devices Market Summary:

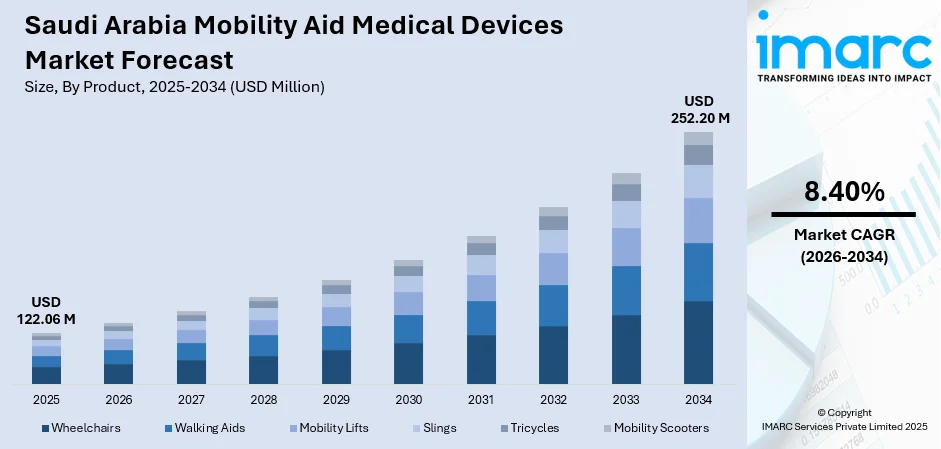

The Saudi Arabia mobility aid medical devices market size was valued at USD 122.06 Million in 2025 and is projected to reach USD 252.20 Million by 2034, growing at a compound annual growth rate of 8.40% from 2026-2034.

The Saudi Arabia mobility aid medical devices market is experiencing robust growth driven by the Kingdom's rapidly expanding elderly population and the rising prevalence of chronic conditions that impair mobility. Government initiatives under Vision 2030 are significantly enhancing healthcare infrastructure, while the expansion of home healthcare services is creating sustained demand for assistive mobility solutions. The cultural shift towards aging-in-place and the integration of advanced technologies into mobility devices are further propelling market adoption across the Kingdom.

Key Takeaways and Insights:

-

By Product: Wheelchairs dominate the market with a share of 34% in 2025, driven by widespread adoption across hospitals, rehabilitation centers, and home care settings for patients with chronic mobility impairments.

-

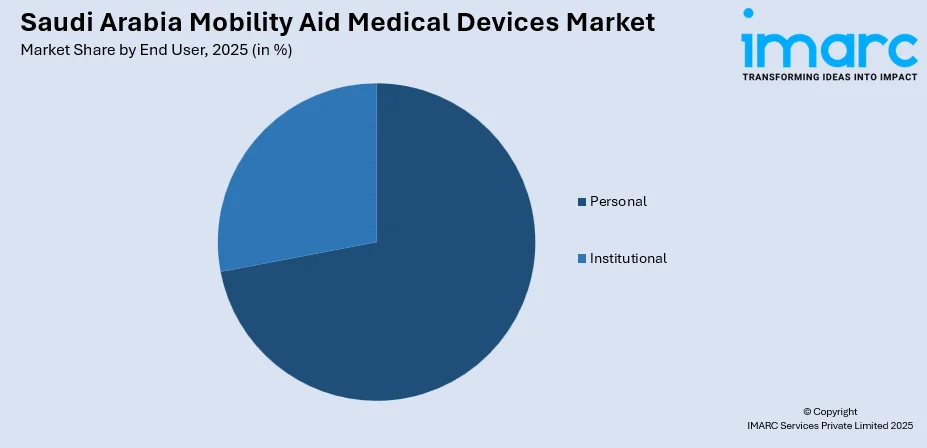

By End User: Personal segment leads the market with a share of 72% in 2025, reflecting the growing preference for home-based care and individual patient investments in mobility solutions.

-

By Region: Northern and Central region represents the largest segment with a market share of 41% in 2025, attributable to the concentration of healthcare facilities and higher population density in Riyadh and surrounding areas.

-

Key Players: The Saudi Arabia mobility aid medical devices market exhibits a moderately competitive landscape characterized by the presence of established multinational medical equipment manufacturers alongside regional distributors. Market participants are focusing on product innovation, strategic partnerships with healthcare institutions, and expanding distribution networks to strengthen their market positioning across the Kingdom.

To get more information on this market Request Sample

The Saudi Arabia mobility aid medical devices market is undergoing a significant transformation as the Kingdom prioritizes healthcare modernization under its Vision 2030 framework. The demographic shift towards an aging population, with elderly citizens constituting a growing proportion of the total population, is creating unprecedented demand for wheelchairs, walking aids, mobility lifts, and other assistive devices. The Ministry of Health's initiatives to expand rehabilitation and long-term care services are driving institutional procurement, while rising awareness among families about available mobility solutions is fueling personal segment growth. The General Authority for the Care of the Affairs of the Grand Mosque has implemented comprehensive wheelchair services for elderly and disabled pilgrims, demonstrating the Kingdom's commitment to accessibility. Furthermore, partnerships between public and private healthcare providers are enhancing product availability and service delivery across urban and rural areas, supporting the market's sustained expansion trajectory.

Saudi Arabia Mobility Aid Medical Devices Market Trends:

Integration of Smart Technologies in Mobility Devices

The Saudi Arabia mobility aid medical devices market is witnessing accelerated adoption of technologically advanced mobility solutions featuring smart functionalities and enhanced user interfaces. Modern wheelchairs and mobility scooters are increasingly incorporating joystick controls, obstacle detection sensors, rechargeable lithium-ion batteries, and ergonomic designs that improve safety and ease of use. The Tanaqol application, launched by Saudi authorities, enables pilgrims and visitors to reserve electric vehicles and wheelchairs through smartphones, exemplifying the integration of digital platforms with mobility services and reflecting broader market trends towards connected healthcare solutions. For instance, in December 2025, King Abdullah University of Science and Technology (KAUST) is spearheading a new era of smart health innovation, translating scientific discoveries into practical solutions that bolster healthcare systems both in Saudi Arabia and worldwide. Central to this initiative is the KAUST Center of Excellence for Smart Health (KCSH), led by Professor Imed Gallouzi. The center is tackling critical medical challenges using artificial intelligence, computational biology, advanced sensors, and next-generation diagnostic technologies, positioning KAUST at the forefront of healthcare innovation.

Expansion of Home Healthcare and Aging-in-Place Services

The broadening scope of home healthcare services across Saudi Arabia is fundamentally reshaping mobility aid demand patterns and distribution channels. The Saudi Arabia home healthcare market size reached USD 4,214.4 Million in 2025. Looking forward, the market is expected to reach USD 7,583.4 Million by 2034, exhibiting a growth rate (CAGR) of 6.75% during 2026-2034. Families and caregivers are increasingly opting for home-based care solutions that enable elderly and chronically ill individuals to maintain independence and quality of life within familiar environments. This cultural preference for aging-in-place is driving demand for portable, lightweight mobility devices that can be easily used within residential settings. Insurance coverage expansion and government-supported home care programs are making these devices more accessible to a broader patient population throughout the Kingdom.

Government-Led Accessibility and Inclusivity Initiatives

Saudi Arabia's commitment to inclusivity under Vision 2030 is generating substantial investments in accessible infrastructure and assistive device programs across the Kingdom. The National Hajj Initiative for Persons with Disabilities provides specialized accommodation, accessible transportation, and escort support services, demonstrating the government's focus on ensuring dignified participation for individuals with mobility challenges. The Ministry of Human Resources and Social Development operates residential care homes that supply wheelchairs, hospital beds, and other necessary devices to seniors, while urban planning initiatives are incorporating wheelchair-accessible pathways and ramps in public spaces. For instance, in March 2023, the General Presidency for the Affairs of the Two Holy Mosques made electric vehicles (EVs) available around the clock to assist elderly and disabled pilgrims and Umrah performers, ensuring they can complete the required rituals comfortably. More than 9,000 EVs are dedicated to serving visitors at the Grand Mosque, and they can be reserved via the Tanaqol transport smartphone application, which leverages modern technological innovations to enhance services for pilgrims and Umrah attendees.

How Vision 2030 is Transforming the Saudi Arabia Mobility Aid Medical Devices Market:

Saudi Arabia’s Vision 2030 is driving significant transformation in the mobility aid medical devices market by prioritizing healthcare infrastructure development, digital health integration, and enhanced accessibility for the aging and differently-abled population. Government initiatives are expanding rehabilitation centers, outpatient care facilities, and specialized clinics, increasing demand for wheelchairs, walkers, mobility scooters, and supportive devices. Investments in domestic manufacturing and import substitution policies are fostering local production of advanced mobility aids, while regulatory frameworks ensure quality and safety compliance. Additionally, smart technologies, such as IoT-enabled devices and sensor-integrated aids, are being increasingly adopted, improving patient independence and driving sustained growth in the Saudi mobility aid sector.

Market Outlook 2026-2034:

The Saudi Arabia mobility aid medical devices market is positioned for sustained growth throughout the forecast period, underpinned by favorable demographic trends, healthcare infrastructure expansion, and increasing awareness about assistive mobility solutions. The Health Sector Transformation Program's emphasis on rehabilitation, long-term care, and home healthcare is expected to drive institutional and personal demand for mobility devices. Public-private partnerships in healthcare are anticipated to enhance product availability and service quality across regions. The market generated a revenue of USD 122.06 Million in 2025 and is projected to reach a revenue of USD 252.20 Million by 2034, growing at a compound annual growth rate of 8.40% from 2026-2034.

Saudi Arabia Mobility Aid Medical Devices Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

Wheelchairs |

34% |

|

End User |

Personal |

72% |

|

Region |

Northern and Central Region |

41% |

Product Insights:

- Wheelchairs

- Walking Aids

- Mobility Lifts

- Slings

- Tricycles

- Mobility Scooters

The wheelchairs segment dominates with a market share of 34% of the total Saudi Arabia mobility aid medical devices market in 2025.

The wheelchairs segment continues to dominate the Saudi Arabia mobility aid medical devices market, reflecting the crucial role these devices play in assisting individuals with chronic mobility challenges, post-surgery recovery, and age-related physical limitations. Both manual and powered wheelchairs are increasingly utilized across hospitals, rehabilitation centers, and home care environments. Their widespread adoption highlights the ongoing institutional and personal demand for reliable mobility solutions that enhance independence, safety, and overall quality of life for users.

Technological advancements are reshaping the wheelchairs landscape, with manufacturers introducing models featuring lightweight materials, foldable designs, enhanced battery efficiency, and smart functionalities such as obstacle detection and automated braking systems. The growing preference for electric wheelchairs among patients requiring long-term mobility assistance is supporting premium product adoption. Healthcare facilities including rehabilitation centers, hospitals, and specialized care homes, are increasingly investing in wheelchair fleets to support patient care protocols and improve service quality.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Personal

- Institutional

The personal segment leads with a share of 72% of the total Saudi Arabia mobility aid medical devices market in 2025.

The personal end user segment's commanding market share reflects the cultural preference for home-based elderly care and the growing willingness of families to invest in mobility solutions that enhance the quality of life for aging relatives. Individual consumers and caregivers are increasingly procuring wheelchairs, walking aids, and mobility scooters through pharmacies, medical supply stores, and online platforms. The Social Security Agency provides financial assistance and in-kind support to seniors and their families, supplying essential mobility devices such as wheelchairs and other necessary equipment.

Rising awareness about available assistive technologies, combined with expanding insurance coverage for mobility devices, is enabling broader personal segment penetration across income groups. The expansion of home healthcare services is further supporting personal purchases as trained staff visiting homes ensure proper use and maintenance of mobility aids. Product innovation focusing on lightweight, portable, and aesthetically appealing designs is encouraging earlier adoption among individuals who may have previously resisted using mobility assistance devices.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Northern and Central region exhibits clear dominance with a 41% share of the total Saudi Arabia mobility aid medical devices market in 2025.

The Northern and Central regions of Saudi Arabia are key drivers for the mobility aid medical devices market due to a combination of demographic, healthcare, and infrastructure factors. The regions host a significant population of elderly residents and patients with mobility impairments, creating sustained demand for wheelchairs, walkers, mobility scooters, and other assistive devices. Government initiatives under Vision 2030 are expanding healthcare infrastructure, including rehabilitation centers, outpatient clinics, and geriatric care facilities, directly supporting device adoption.

Urbanization and rising income levels in major cities such as Riyadh and Qassim increase access to advanced mobility solutions, while public and private hospitals, long-term care facilities, and physiotherapy centers further stimulate demand. Additionally, regulatory support for local manufacturing, import substitution policies, and the integration of smart, sensor-enabled mobility aids enhance product availability and adoption, solidifying the Northern and Central regions as growth hubs for the market.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Mobility Aid Medical Devices Market Growing?

Rapidly Expanding Elderly Population and Rising Life Expectancy

Saudi Arabia is experiencing a significant demographic transition characterized by an expanding elderly population and increasing life expectancy, fundamentally reshaping mobility aid demand patterns across the Kingdom. In Saudi Arabia, elderly individuals currently make up 5.5% of the total population, and their numbers are expected to increase steadily as improvements in quality of life and advanced healthcare continue. Advances in medical care and improvements in living standards are enabling Saudi citizens to live longer, naturally elevating the requirement for mobility assistance devices among aging individuals. The population segment comprising citizens beyond retirement age is projected to grow substantially over the coming decade, creating sustained demand for wheelchairs, walking aids, and mobility scooters that support daily activities and maintain independence. This demographic shift is prompting healthcare providers, families, and government agencies to proactively invest in mobility solutions that address the unique needs of elderly citizens.

Increasing Prevalence of Chronic Conditions and Mobility Impairments

The growing burden of chronic diseases including diabetes, cardiovascular conditions, arthritis, osteoporosis, and stroke-related disabilities is driving substantial demand for mobility aid medical devices throughout Saudi Arabia. These conditions frequently result in long-term or permanent physical limitations that necessitate ongoing mobility support for affected individuals. Lifestyle factors contributing to higher chronic disease prevalence are creating a larger patient population requiring assistive devices. Healthcare institutions are increasingly integrating mobility aids into patient care protocols and rehabilitation programs, while insurance providers are expanding coverage for assistive devices as part of comprehensive chronic disease management strategies.

Healthcare Infrastructure Expansion Under Vision 2030

The Kingdom's Vision 2030 healthcare transformation program is generating unprecedented investments in medical infrastructure, rehabilitation services, and long-term care facilities that directly support mobility aid market expansion. The Healthcare Sector Transformation Program emphasizes privatization, the creation of health clusters, and advancements in e-health solutions. Under Vision 2030, significant investments are being made in healthcare infrastructure, aiming to expand hospital capacity by 26,000 to 43,000 beds to accommodate the projected population growth, which is expected to reach 45 million by 2030. Government initiatives are prioritizing the development of medical cities, rehabilitation hospitals, and home healthcare networks across Saudi Arabia. The Health Sector Transformation Program identifies rehabilitation, long-term care, and home care as priority areas for public-private partnerships, attracting substantial private sector investment. These infrastructure developments are creating new institutional demand channels while improving the accessibility of mobility solutions to broader patient populations across urban and rural areas.

Market Restraints:

What Challenges is the Saudi Arabia Mobility Aid Medical Devices Market Facing?

High Product Costs and Affordability Constraints

The elevated costs associated with advanced mobility aid devices, particularly electric wheelchairs and technologically sophisticated mobility scooters, present affordability challenges for segments of the Saudi population. Premium products incorporating smart features and lightweight materials command higher price points that may exceed the financial capacity of some potential users, limiting market penetration among lower-income demographics.

Limited Accessibility Infrastructure in Remote Areas

Despite significant progress in urban accessibility development, remote and rural areas of Saudi Arabia continue to face infrastructure limitations that reduce the practical utility of mobility devices. Inadequate sidewalk accessibility, limited ramp availability in older buildings, and inconsistent public transportation accommodations create barriers to mobility aid adoption outside major metropolitan centers.

Shortage of Specialized Healthcare Professionals

The Saudi Arabia healthcare sector faces challenges related to the availability of specialized rehabilitation professionals and mobility aid technicians who can properly assess patient needs, recommend appropriate devices, and provide training on device usage. This workforce constraint affects service quality and may delay optimal mobility solutions for patients requiring specialized assessment and fitting services.

Competitive Landscape:

The Saudi Arabia mobility aid medical devices market exhibits a moderately fragmented competitive structure comprising established multinational medical equipment manufacturers, regional distributors, and specialized mobility solution providers. Market participants compete across product innovation, pricing strategies, distribution network expansion, and after-sales service quality. Strategic partnerships with healthcare institutions, government agencies, and insurance providers are emerging as key competitive differentiators. The market is witnessing increased participation from international manufacturers seeking to capitalize on the Kingdom's healthcare transformation initiatives. Companies are focusing on introducing technologically advanced products while establishing localized service and maintenance capabilities to strengthen customer relationships and capture market share.

Recent Developments:

-

In March 2025, The General Authority for the Care of the Grand Mosque and the Prophet’s Mosque has implemented a range of accessibility improvements to provide a more comfortable and inclusive environment for elderly visitors and individuals with disabilities throughout Ramadan.

-

In May 2024, Nahdi Medical Company teamed up with the Association for Honoring Travelers to launch an initiative that provided wheelchairs to Guests of Rahman in Makkah and Madinah. This initiative was a component of Nahdi's corporate social responsibility efforts, aimed at working with the non-profit sector via its strategic alliance with the Pilgrim Experience Program, emphasizing social responsibility and healthcare services.

Saudi Arabia Mobility Aid Medical Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Wheelchairs, Walking Aids, Mobility Lifts, Slings, Tricycles, Mobility Scooters |

| End Users Covered | Personal, Institutional |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia mobility aid medical devices market size was valued at USD 122.06 Million in 2025.

The Saudi Arabia mobility aid medical devices market is expected to grow at a compound annual growth rate of 8.40% from 2026-2034 to reach USD 252.20 Million by 2034.

The wheelchairs segment dominated the market with a share of 34% in 2025, driven by widespread adoption across hospitals, rehabilitation centers, and home care settings for patients with chronic mobility impairments and age-related physical limitations.

Key factors driving the Saudi Arabia mobility aid medical devices market include the rapidly expanding elderly population, increasing prevalence of chronic conditions affecting mobility, healthcare infrastructure expansion under Vision 2030, broadening home healthcare services, and rising awareness about assistive mobility solutions.

Major challenges include high product costs for advanced mobility devices limiting affordability, limited accessibility infrastructure in remote and rural areas, a shortage of specialized rehabilitation professionals and mobility aid technicians, and regulatory complexities for market entrants.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)