Saudi Arabia Mobility as a Service Market Size, Share, Trends and Forecast by Service Type, Transportation Type, Application Platform, Propulsion Type, and Region, 2026-2034

Saudi Arabia Mobility as a Service Market Overview:

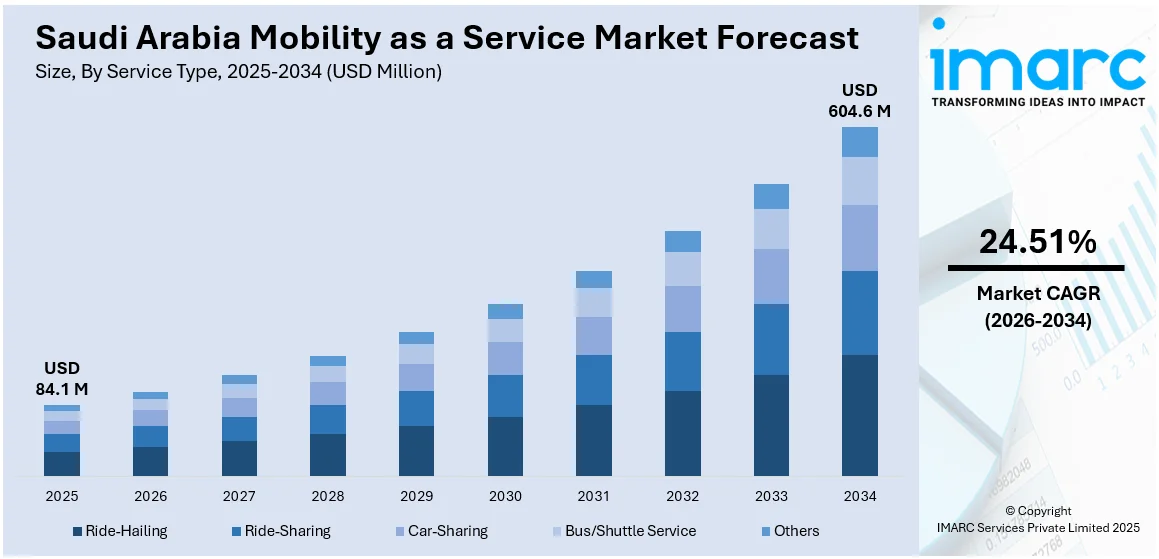

The Saudi Arabia mobility as a service market size reached USD 84.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 604.6 Million by 2034, exhibiting a growth rate (CAGR) of 24.51% during 2026-2034. The rapid urbanization, increasing smartphone penetration, implementation of supportive government initiatives under Vision 2030, rising demand for sustainable transportation, advancements in digital infrastructure, and growing consumer preference for convenient, cost-effective, and integrated mobility solutions are some of the major factors driving market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 84.1 Million |

| Market Forecast in 2034 | USD 604.6 Million |

| Market Growth Rate 2026-2034 | 24.51% |

Saudi Arabia Mobility as a Service Market Trends:

Integration of Multi-Modal Transportation Platforms

The integration of multi-modal transportation into unified digital platforms is enhancing the Saudi Arabia mobility as a service market outlook. These platforms aggregate different modes of transport, including ride-hailing, public buses, metro lines, e-scooters, and car-sharing services, into one user interface, which enables users to plan, book, and pay for their trips without any interruption. This integration is intended to provide maximum flexibility and efficiency, in line with the overall objectives of Vision 2030 to modernize urban transport and decrease reliance on private cars. With the introduction of mega-projects such as the Riyadh Metro and the development of public bus networks in major cities, there is an increasing ecosystem of transport modes that can be orchestrated digitally. Local and foreign technology providers are working with government agencies and transport operators to develop interoperable systems backed by real-time data, sophisticated route optimization algorithms, and mobile ticketing. The outcome is a more integrated user experience that fosters increased adoption rates for shared and public transport solutions.

To get more information on this market Request Sample

Growing Emphasis on Sustainable and Green Mobility

Environmental sustainability is becoming a critical focus within Saudi Arabia's MaaS ecosystem, reflecting the Kingdom's commitment to reducing carbon emissions and fostering a greener future. According to industry reports, the Kingdom targets to reduce carbon emissions by 278 mtpa by 2030. The integration of eco-friendly transportation options, such as electric vehicles (EVs), e-scooters, and hybrid buses into MaaS platforms is steadily gaining momentum. Government policies, including investments in clean energy, EV infrastructure development, and incentives for low-emission transport providers, are supporting Saudi Arabia mobility as a service market growth. Startups and established operators alike are incorporating sustainability as a core component of their services. Companies offering electric ride-hailing fleets, carbon footprint tracking for trips, and incentives for users choosing greener travel options are becoming more prevalent. Additionally, large-scale projects like NEOM and The Line are designed with sustainable mobility in mind, featuring car-free zones and AI-driven transit systems. These innovations, when integrated into MaaS offerings, contribute to the national strategy of diversifying the economy and promoting environmental stewardship through cutting-edge mobility solutions.

Expansion of Smart City Infrastructure and Digitalization

The acceleration of smart city development across the country is augmenting Saudi Arabia mobility as a service market share. Urban centers such as Riyadh, Jeddah, and the futuristic city of NEOM are embedding digital infrastructure into everyday life, enabling data-driven transportation systems that are both responsive and scalable. As per reports, with the support of USD 500 Billion in modernization investments, the Ministry of Municipal and Rural Affairs has initiated the Kingdom's first Smart Cities program, aiming to reach 17 cities and 72% of the population. Some of the critical aspects are 5G connectivity, AI-managed traffic flow, IoT sensors, and cloud-mobility platforms. The digital backbone facilitates the MaaS services by providing non-stop access to real-time data, including available vehicles, real-time traffic flows, and arrival times. In addition, open data programs supported by the government and interoperability standards are enabling a competitive but collaborative environment where different mobility providers are able to plug into common platforms, making for an entirely integrated and smart transport network that responds to user behavior and urban planning priorities alike.

Saudi Arabia Mobility as a Service Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on service type, transportation type, application platform, and propulsion type.

Service Type Insights:

- Ride-Hailing

- Ride-Sharing

- Car-Sharing

- Bus/Shuttle Service

- Others

The report has provided a detailed breakup and analysis of the market based on the service type. This includes ride-hailing, ride-sharing, car-sharing, bus/shuttle service, and others.

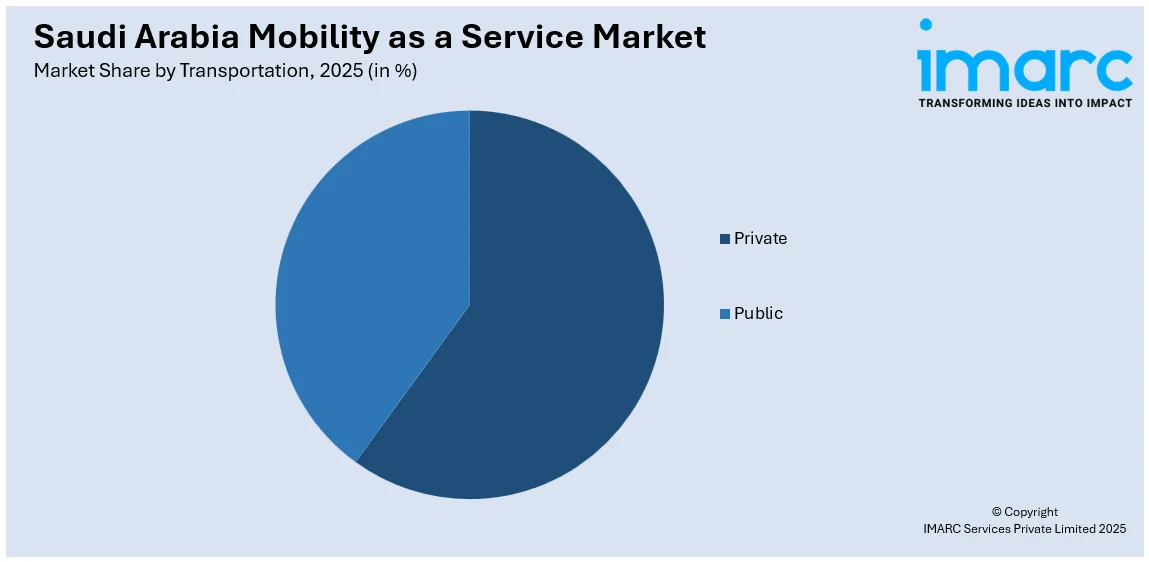

Transportation Type Insights:

Access the comprehensive market breakdown Request Sample

- Private

- Public

A detailed breakup and analysis of the market based on the transportation type have also been provided in the report. This includes private and public.

Application Platform Insights:

- Android

- iOS

- Others

The report has provided a detailed breakup and analysis of the market based on the application platform. This includes android, iOS, and others.

Propulsion Type Insights:

- Electric Vehicle

- Internal Combustion Engine

- Others

A detailed breakup and analysis of the market based on the propulsion type have also been provided in the report. This includes electric vehicle, internal combustion engine, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Mobility as a Service Market News:

- Jeddah Transport Co. announced a comprehensive public transportation expansion set to commence on April 1, 2025. The initiative includes the deployment of 91 new buses, three of which are electric, expanding bus routes from six to 14 and increasing bus stops from 46 to 383, with an annual ridership target of 9 million passengers. Additionally, the company plans to introduce an exclusive public taxi franchise featuring standardized branding, uniforms, and digital passenger interfaces to enhance service quality and operational efficiency.

Saudi Arabia Mobility as a Service Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Ride-Hailing, Ride-Sharing, Car-Sharing, Bus/Shuttle Service, Others |

| Transportation Types Covered | Public, Private |

| Application Platforms Covered | Android, iOS, Others |

| Propulsion Types Covered | Electric Vehicle, Internal Combustion Engine, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia mobility as a service market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia mobility as a service market on the basis of service type?

- What is the breakup of the Saudi Arabia mobility as a service market on the basis of transportation type?

- What is the breakup of the Saudi Arabia mobility as a service market on the basis of application platform?

- What is the breakup of the Saudi Arabia mobility as a service market on the basis of propulsion type?

- What is the breakup of the Saudi Arabia mobility as a service market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia mobility as a service market?

- What are the key driving factors and challenges in the Saudi Arabia mobility as a service market?

- What is the structure of the Saudi Arabia mobility as a service market and who are the key players?

- What is the degree of competition in the Saudi Arabia mobility as a service market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia mobility as a service market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia mobility as a service market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia mobility as a service industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)