Saudi Arabia Molecular Diagnostics Market Size, Share, Trends and Forecast by Product, Technology, Application, End User, and Region, 2026-2034

Saudi Arabia Molecular Diagnostics Market Overview:

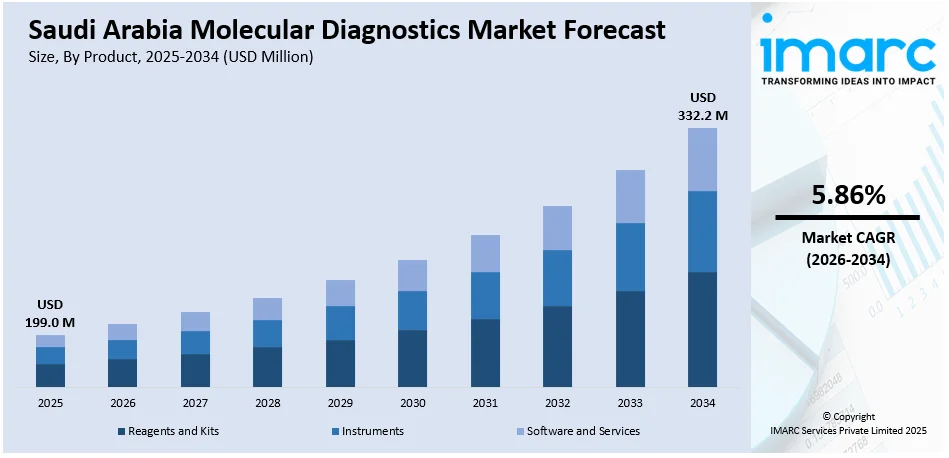

The Saudi Arabia molecular diagnostics market size reached USD 199.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 332.2 Million by 2034, exhibiting a growth rate (CAGR) of 5.86% during 2026-2034. Saudi Arabia is rapidly advancing molecular diagnostics through major healthcare investments and strategic reforms under Vision 2030. Emphasis on early disease detection and preventive care is expanding testing capacity across public and private sectors, including regional centers. Additionally, the growing medical tourism ambitions are encouraging providers to meet international diagnostic standards. These trends, supported by technology partnerships and accreditation drives, are expanding the Saudi Arabia molecular diagnostics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 199.0 Million |

| Market Forecast in 2034 | USD 332.2 Million |

| Market Growth Rate 2026-2034 | 5.86% |

Saudi Arabia Molecular Diagnostics Market Trends:

Government Commitment to Healthcare Modernization

The extensive healthcare investments by the Saudi Arabian governing body through Vision 2030 are speeding up the incorporation of molecular diagnostics in both public and private healthcare institutions. This national agenda emphasizes early disease detection and preventive care, both of which rely on fast, precise testing, driving the demand for molecular tools that can identify infections, cancers, and genetic disorders at early stages. Hospitals and clinics, even in rural locations, are being outfitted with sophisticated diagnostic systems to achieve this aim, broadening accessibility beyond large cities. For instance, in 2025 AKDITAL Group announced a $200 million investment to build private hospitals in Riyadh and Jeddah, in partnership with local associates Wataniah and Namaya. The project, set to conclude by 2027, closely aligns with Saudi Arabia’s Vision 2030 plan to upgrade healthcare and improve service quality. Such centers are anticipated to include advanced diagnostic features, such as molecular testing as an integral part of standard care. These initiatives enhance infrastructure while also generating opportunities for skill development, research, and technology sharing through collaborations with international diagnostics companies. By developing local capabilities and reducing reliance on foreign laboratories, these initiatives are transforming the diagnostic environment. As a result, the implementation of molecular diagnostics is consistently growing within clinical, academic, and public health settings, strengthened by both governmental policies and private industry dynamics. This robust investment and commitment to healthcare advancement are key drivers of the Saudi Arabia molecular diagnostics market growth.

To get more information on this market Request Sample

Growing Medical Tourism and Specialized Care

Saudi Arabia’s aspiration to be a top choice for medical tourism is motivating healthcare providers to enhance diagnostic standards, with molecular diagnostics becoming a key element. As patients from the Gulf Cooperation Council (GCC) and broader Middle East and North Africa (MENA) region seek specialized services, particularly in oncology, fertility, and genetic counseling, accurate, high-throughput molecular testing is becoming a core requirement in treatment pathways. Tertiary hospitals and emerging medical cities are focusing on incorporating advanced diagnostics to handle intricate cases and draw international patients. This requirement is not only enhancing the acceptance of worldwide testing standards but also encouraging local establishments to conform to international accreditation and quality criteria. Saudi Arabia's medical tourism sector showcases this growth, estimated at USD 1,341.1 million in 2024, and anticipated to rise to USD 7,918.6 million by 2033, expanding at a CAGR of 21.80% from 2025 to 2033, as reported by IMARC Group. To accommodate this anticipated surge, healthcare organizations are partnering with international diagnostics companies, which grants access to advanced platforms and enhances the skills of laboratory personnel. These partnerships guarantee that molecular diagnostic abilities align with the standards anticipated by international patients, while simultaneously improving local testing facilities. As a result, molecular diagnostics are no longer limited to domestic demand and are increasingly being positioned as a competitive differentiator in Saudi Arabia’s broader healthcare offering, supporting both clinical excellence and the strategic economic diversification through the medical tourism sector.

Saudi Arabia Molecular Diagnostics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product, technology, application, and end user.

Product Insights:

- Reagents and Kits

- Instruments

- Software and Services

The report has provided a detailed breakup and analysis of the market based on the product. This includes reagents and kits, instruments, and software and services.

Technology Insights:

- Polymerase Chain Reactions (PCR)

- Hybridization

- DNA Sequencing

- Microarray

- Isothermal Nucleic Acid Amplification Technology (INAAT)

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes polymerase chain reactions (PCR), hybridization, DNA sequencing, microarray, isothermal nucleic acid amplification technology (INAAT), and others.

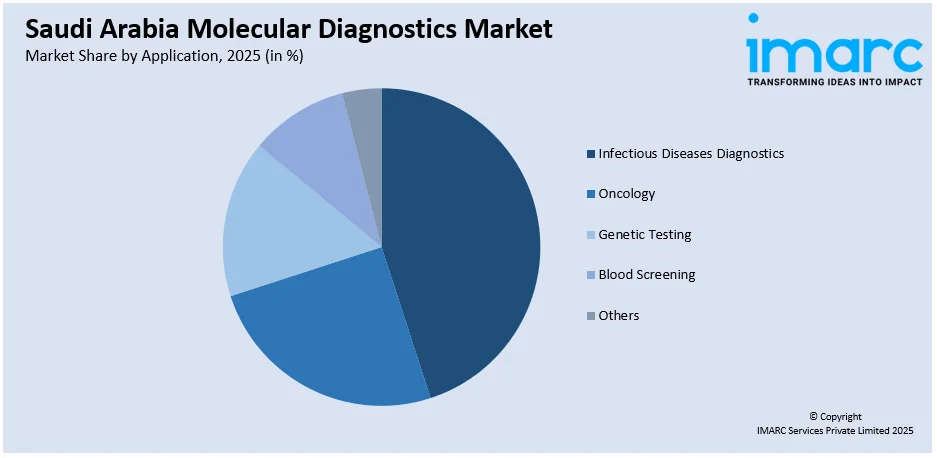

Application Insights:

Access the comprehensive market breakdown Request Sample

- Infectious Diseases Diagnostics

- Oncology

- Genetic Testing

- Blood Screening

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes infectious diseases diagnostics, oncology, genetic testing, blood screening, and others.

End User Insights:

- Hospitals

- Laboratories

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals, laboratories, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Molecular Diagnostics Market News:

- In December 2024, King Abdulaziz University launched Saudi Arabia’s first Alzheimer’s diagnostic service using PET/MRI at its Molecular Imaging Center. The service enables early detection through Amyloid PET/MRI imaging with the (18F-FBB) tracer. It is part of the I-One Molecular Imaging Center’s advanced healthcare initiatives.

- In November 2024, King Faisal Specialist Hospital & Research Centre partnered with the University of Birmingham to enhance bladder cancer diagnosis. The project introduced advanced molecular diagnostics using a 23-gene panel and liquid biopsy technology. It also promoted research collaboration and knowledge exchange between Saudi Arabia and the UK.

Saudi Arabia Molecular Diagnostics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Reagents and Kits, Instruments, Software and Services |

| Technologies Covered | Polymerase Chain Reactions (PCR), Hybridization, DNA Sequencing, Microarray, Isothermal Nucleic Acid Amplification Technology (INAAT), Others |

| Applications Covered | Infectious Diseases Diagnostics, Oncology, Genetic Testing, Blood Screening, Others |

| End Users Covered | Hospitals, Laboratories, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia molecular diagnostics market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia molecular diagnostics market on the basis of product?

- What is the breakup of the Saudi Arabia molecular diagnostics market on the basis of technology?

- What is the breakup of the Saudi Arabia molecular diagnostics market on the basis of application?

- What is the breakup of the Saudi Arabia molecular diagnostics market on the basis of end user?

- What is the breakup of the Saudi Arabia molecular diagnostics market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia molecular diagnostics market?

- What are the key driving factors and challenges in the Saudi Arabia molecular diagnostics market?

- What is the structure of the Saudi Arabia molecular diagnostics market and who are the key players?

- What is the degree of competition in the Saudi Arabia molecular diagnostics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia molecular diagnostics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia molecular diagnostics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia molecular diagnostics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)