Saudi Arabia Natural Sweeteners Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Saudi Arabia Natural Sweeteners Market Summary:

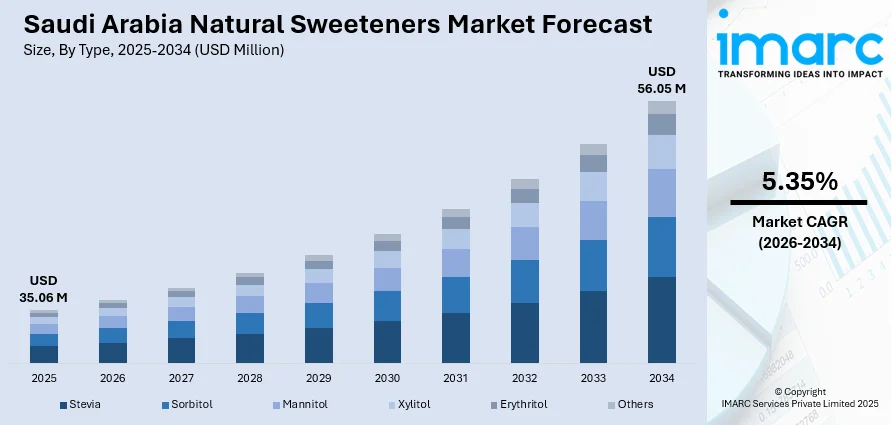

The Saudi Arabia natural sweeteners market size was valued at USD 35.06 Million in 2025 and is projected to reach USD 56.05 Million by 2034, growing at a compound annual growth rate of 5.35% from 2026-2034.

The market expansion is propelled by escalating health consciousness among Saudi consumers and mounting concerns over lifestyle diseases including obesity and diabetes. Government regulatory initiatives, particularly the implementation of sugar taxation policies and health-focused labeling requirements, are compelling food and beverage manufacturers to reformulate products with natural alternatives. Rising urban developments, increasing disposable incomes, and growing awareness about the detrimental health effects of excessive sugar consumption are accelerating adoption of plant-based sweeteners across diverse applications. The pharmaceutical and personal care sectors are emerging as significant growth contributors alongside traditional food and beverage (F&B) applications, reflecting the versatility and expanding the Saudi Arabia natural sweeteners market share.

Key Takeaways and Insights:

-

By Type: Stevia dominates the market with a share of 28% in 2025, driven by its zero-calorie profile and regulatory approvals across multiple food and beverage categories including breakfast cereals, non-alcoholic drinks, and bakery products.

-

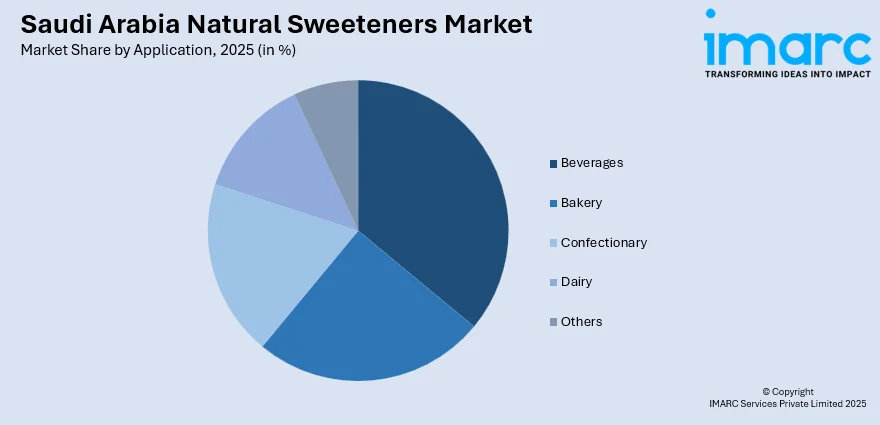

By Application: Beverages lead the market with a share of 34% in 2025, supported by substantial reformulation initiatives in response to sugar taxation policies and consumer demand for healthier drink alternatives.

-

By Region: Northern and Central Region represents the largest segment with a market share of 42% in 2025, anchored by major metropolitan centers where high population density and economic activity drive concentrated demand.

-

Key Players: The Saudi Arabia natural sweeteners market exhibits moderate competitive intensity, with multinational ingredient suppliers establishing strong distribution networks alongside regional manufacturers catering to local preferences. Regional companies are investing in local sourcing and small-batch natural syrups to reduce import reliance. Many players are also expanding e-commerce and retail reach while aligning products with clean-label trends and government efforts to cut sugar intake across packaged foods.

To get more information on this market Request Sample

The market landscape reflects a fundamental shift in Saudi dietary patterns as health consciousness intensifies across demographics. Government initiatives, particularly the 50% excise tax on sugar-sweetened beverages introduced in collaboration with UAE authorities, have catalyzed widespread product reformulation throughout the food and beverage industry. Major beverage manufacturers report substantial investments in stevia-based formulations, exemplified by Coca-Cola's 11% growth in Zero Sugar product lines during Q3 2024, demonstrating commercial viability of natural sweetener applications. The pharmaceutical sector is witnessing parallel expansion as diabetes prevalence drives demand for sugar-free medications and dietary supplements. Urban centers in the Northern and Central Region command premium market positioning due to concentrated populations with elevated purchasing power and pronounced health awareness, while emerging applications in personal care products including toothpastes and cosmetics signal diversification beyond traditional food uses.

Saudi Arabia Natural Sweeteners Market Trends:

Government Regulatory Framework Accelerating Market Transformation

Saudi regulatory authorities are implementing comprehensive sugar reduction strategies through fiscal mechanisms and labeling mandates, fundamentally reshaping manufacturer formulation practices. The 50% excise tax on sugar-sweetened beverages has precipitated widespread reformulation initiatives as beverage companies seek cost-effective alternatives to mitigate tax burdens while maintaining consumer appeal. The Global Health Exhibition 2025 took place in Saudi Arabia, showcasing the country’s commitment in promoting healthy lifestyle and supporting longevity and wellness programs, associated with the objectives of Saudi Vision 2030. Food manufacturers are responding to stringent labeling requirements that mandate transparent disclosure of sugar content, prompting accelerated adoption of natural sweeteners that enable products to qualify for healthier positioning. This regulatory momentum extends beyond beverages to encompass bakery products, confectionery items, and dairy applications, creating systematic demand across multiple food categories as companies align with government health objectives.

Consumer Preference Shifting Toward Clean-Label Natural Ingredients

Saudi consumers are exhibiting pronounced skepticism toward synthetic additives, driving substantial market share gains for plant-derived sweetening solutions perceived as wholesome alternatives. The clean-label movement transcends demographic boundaries as urban professionals, health-conscious families, and diabetic consumers converge around demands for minimally processed ingredients with transparent sourcing credentials. Beverage manufacturers report that stevia-sweetened formulations command premium positioning despite higher ingredient costs, reflecting consumer willingness to invest in perceived health benefits. The Middle East ready-to-drink tea segment demonstrates this trajectory, with manufacturers reformulating products to incorporate natural sweeteners in response to health awareness among the 33.7% obese population of Saudi Arabia. Traditional concerns about aftertaste profiles are diminishing as processing technologies advance, enabling manufacturers to deliver taste experiences comparable to sugar while maintaining natural ingredient credentials that resonate with label-conscious consumers.

Technological Innovation Expanding Application Possibilities

Advanced extraction methodologies and artificial intelligence (AI)-driven formulation optimization are enabling natural sweetener integration across increasingly diverse product applications previously constrained by taste or functionality limitations. The pharmaceutical sector is leveraging these technological advances to incorporate natural sweeteners in medications and dietary supplements, addressing diabetic patient needs for sugar-free formulations without compromising palatability or therapeutic efficacy. Personal care manufacturers are exploring stevia applications in oral care products including toothpaste and mouthwashes, capitalizing on antimicrobial properties alongside sweetening functionality. These technological enablers are dissolving traditional application boundaries, positioning natural sweeteners as versatile ingredients capable of meeting complex formulation requirements across food, pharmaceutical, and personal care sectors. In 2025, Saudi Arabia revealed a significant national program aimed at transforming the global beverage market by advocating for natural sweeteners and removing artificial ingredients. In line with this initiative, Milaf Cola, a soft drink produced in Saudi Arabia from natural date extract, persists in its gradual growth into global markets.

How Vision 2030 is Transforming the Saudi Arabia Natural Sweeteners Market:

Saudi Arabia’s Vision 2030 is reshaping the natural sweeteners market by pushing healthier diets, local manufacturing, and food sector diversification. Rising awareness around diabetes and obesity has encouraged food brands to cut refined sugar and adopt alternatives like stevia, date sugar, and monk fruit. Government-backed health programs and stricter labeling rules are accelerating this shift. Investment incentives under Vision 2030 are also supporting domestic processing of date-based sweeteners, reducing import dependence. At the same time, demand from beverage, bakery, and dairy producers is growing as companies align products with wellness-focused consumer preferences and national nutrition goals.

Market Outlook 2026-2034:

The Saudi Arabia natural sweeteners market is positioned for sustained expansion through 2034 as health consciousness deepens and regulatory frameworks continue pressuring sugar reduction across food categories. The market generated a revenue of USD 35.06 Million in 2025 and is projected to reach a revenue of USD 56.05 Million by 2034, growing at a compound annual growth rate of 5.35% from 2026-2034. Government health initiatives will intensify as obesity rates remain elevated, compelling manufacturers to accelerate natural sweetener adoption to maintain market access and consumer relevance. Technological innovations in extraction and blending methodologies will address historical taste limitations, enabling penetration into confectionery and bakery applications where sweetness profile fidelity remains paramount.

Saudi Arabia Natural Sweeteners Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Stevia |

28% |

|

Application |

Beverages |

34% |

|

Region |

Northern and Central Region |

42% |

Type Insights:

- Stevia

- Sorbitol

- Mannitol

- Xylitol

- Erythritol

- Others

Stevia dominates with a market share of 28% of the total Saudi Arabia natural sweeteners market in 2025.

The stevia segment commands substantial market leadership attributable to its zero-calorie composition, plant-based origin, and comprehensive regulatory acceptance across Saudi food and beverage applications. The Gulf Cooperation Council's Standardization Organization finalized regulations in 2016 regarding sweetners, providing manufacturers regulatory certainty for widespread adoption. Major beverage corporations including Coca-Cola demonstrate commercial confidence through significant formulation investments, evidenced by 11% growth in Zero Sugar product lines during 2024 reflecting stevia-based reformulations.

The segment benefits from advancing extraction technologies that minimize characteristic aftertaste profiles while preserving natural ingredient credentials that resonate with clean-label consumer preferences. Stevia's functionality extends beyond traditional sweetening applications, with pharmaceutical manufacturers incorporating it into sugar-free medications and dietary supplements targeting diabetic populations, while personal care applications in toothpastes and oral hygiene products leverage both sweetening and antimicrobial properties. In 2025, iPRO, the global leader in healthy hydration beverages, launched healthy hydration by partnering with Al Rabie Saudi Foods Company. The beverages manufactured by the company are sweetened with stevia and are devoid of artificial chemicals.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Bakery

- Confectionary

- Dairy

- Beverages

- Others

Beverages lead with a share of 34% of the total Saudi Arabia natural sweeteners market in 2025.

The beverages segment establishes dominant market positioning driven by intensive reformulation initiatives responding to Saudi Arabia's 50% excise tax on sugar-sweetened drinks and mounting consumer health consciousness. Major beverage manufacturers are systematically replacing traditional sugar with natural sweeteners to mitigate tax burdens while addressing consumer demands for healthier alternatives, with carbonated soft drinks, fruit juices, and ready-to-drink teas leading adoption trajectories. For instance, in 2025, the beverage innovation sector in Saudi Arabia is flourishing with the launch of Milaf Loumi, a functional drink made from citrus that merges traditional ingredients with contemporary biotechnology. Riding the wave of Milaf Cola, Milaf Loumi is attracting global interest as the Kingdom advances its initiative for natural, health-focused consumer goods. Created by Thurath Al-Madina, a firm functioning under the Public Investment Fund (PIF), Milaf Loumi combines extracts from dates and citrus fruits with vitamin C, antioxidants, magnesium, potassium, and polyphenols, providing a clean-label drink with acknowledged scientific health advantages. The beverage has no artificial ingredients, preservatives, or synthetic sugars.

Functional beverage formulations including energy drinks and sports hydration products increasingly feature natural sweeteners to align with wellness positioning and attract health-oriented consumer segments. The segment benefits from beverage industry's technical sophistication in managing taste profiles, with stevia blends achieving sugar-equivalent sweetness while maintaining zero-calorie nutritional profiles that enable products to command premium market positioning and regulatory compliance with health labeling requirements.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region exhibits a clear dominance with a 42% share of the total Saudi Arabia natural sweeteners market in 2025.

The Northern and Central Region commands dominant market positioning anchored by major metropolitan centers including Riyadh, Jeddah, and Dammam that concentrate Saudi Arabia's population density, economic activity, and purchasing power. Riyadh, the nation's capital and largest metropolitan area, hosts sophisticated consumer segments exhibiting elevated health consciousness and willingness to invest in premium natural sweetener products despite higher price points compared to traditional sugar alternatives. Furthermore, the presence of key market players focusing on product innovation is supporting the growth of the market in the region.

The region benefits from advanced retail infrastructure including hypermarkets, specialty health food stores, and premium grocery outlets that provide consumers access to diverse natural sweetener products and enable manufacturers to command premium positioning through targeted distribution strategies. Higher disposable incomes in urban centers support market development as consumers demonstrate price elasticity for products aligned with health and wellness priorities, while concentrated food and beverage manufacturing facilities in the region facilitate efficient distribution and market penetration for natural sweetener suppliers.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Natural Sweeteners Market Growing?

Escalating Health Consciousness Amid Rising Lifestyle Disease Prevalence

Saudi Arabia confronts severe obesity and diabetes epidemics with 23.1% of the population, creating urgent consumer demand for dietary modifications including sugar reduction strategies. Urban areas report adult obesity rates, reflecting sedentary lifestyles, calorie-dense traditional diets, and rapid economic development that has transformed consumption patterns over recent decades. Growing awareness about obesity's cascading health implications including cardiovascular disease, Type 2 diabetes, and metabolic syndrome is compelling consumers to scrutinize ingredient labels and actively seek low-calorie alternatives to traditional sugar in daily dietary choices. This health crisis mobilizes both consumer behavior modification and governmental policy interventions, creating sustained structural demand for natural sweeteners as essential components of population-wide health improvement strategies.

Comprehensive Government Regulatory Support and Health Policy Framework

Saudi regulatory authorities have established systematic policy frameworks incorporating fiscal mechanisms, labeling mandates, and public health campaigns to combat sugar overconsumption and associated health complications across the population. The implementation of a 50% excise tax on sugar-sweetened beverages in coordination with UAE authorities has fundamentally altered market economics, compelling beverage manufacturers to reformulate products with natural sweeteners to mitigate tax burdens while maintaining consumer affordability and market competitiveness. In 2025, the Saudi Food and Drug Authority (SFDA) released an extensive report named “Journey of Change and Health Transformations”, highlighting its major accomplishments in fostering healthier eating habits in Saudi Arabia. The report emphasized the Authority’s continuous dedication to improving public health and promoting the Quality-of-Life Program as part of Saudi Vision 2030. Stringent labeling requirements mandate transparent disclosure of sugar content and nutritional information, enabling consumers to make informed purchase decisions while pressuring manufacturers to reformulate products to achieve healthier positioning and avoid negative health associations.

Rising Disposable Incomes and Accelerating Urban Developments

Saudi Arabia's economic development has generated substantial growth in disposable incomes and urbanization rates, creating consumer segments with enhanced purchasing power and willingness to invest in premium health-oriented products including natural sweeteners despite higher price points relative to conventional sugar. In 2024, wages for Saudis in the private sector increased by 45 per cent, as the Ministry of Human Resources and Social Development in Saudi Arabia announced remarkable progress in employment, women’s empowerment, and economic growth in line with Vision 2030 objectives. Key metropolitan centers including Riyadh, Jeddah, and Dammam concentrate populations with elevated incomes and sophisticated consumption preferences shaped by exposure to global health trends and international product standards through travel, media, and expatriate communities. Changing lifestyles associated with urban developments including hectic schedules, away-from-home consumption, and convenience preferences drive demand for packaged foods and beverages that increasingly incorporate natural sweeteners to meet health-conscious positioning requirements.

Market Restraints:

What Challenges the Saudi Arabia Natural Sweeteners Market is Facing?

Premium Production Costs and Resultant Price Disadvantages

Natural sweeteners incur substantially higher production costs compared to conventional sugar due to complex extraction processes, specialized agricultural inputs, and lower processing efficiencies that translate to premium retail pricing potentially constraining adoption in price-sensitive consumer segments. The production economics of stevia cultivation, leaf processing, and steviol glycoside purification involve sophisticated technologies and quality control protocols that elevate manufacturing costs relative to traditional cane or beet sugar production utilizing established commodity-scale processes. These cost disadvantages manifest in retail pricing where natural sweeteners command significant premiums that may deter budget-conscious consumers or limit usage rates among manufacturers seeking to maintain competitive product pricing without sacrificing profit margins.

Supply Chain Vulnerabilities and Raw Material Price Volatility

Natural sweetener markets confront inherent supply chain complexities stemming from agricultural input dependencies where raw material availability fluctuates based on weather patterns, crop yields, and geographic concentration of production sources. Stevia and monk fruit prices demonstrate volatility attributable to harvest variations, climate disruptions, and supply-demand imbalances that challenge manufacturers' ability to maintain stable ingredient costs and consistent product pricing across planning horizons. These price oscillations complicate procurement strategies and financial forecasting, particularly for smaller manufacturers lacking scale advantages or long-term supply contracts that could buffer against spot market volatility. Supply chain disruptions including transportation bottlenecks, geopolitical tensions affecting trade flows, and pandemic-related logistics constraints periodically constrain ingredient availability and elevate costs beyond planned budgets.

Limited Consumer Awareness and Educational Deficits

Despite growing health consciousness, substantial consumer segments in Saudi Arabia and the broader Middle East region maintain limited knowledge regarding natural sweetener benefits, appropriate usage applications, and taste expectations that may constrain purchase intentions and repeat consumption patterns. Natural sweeteners exhibit lower market penetration rates in Middle Eastern markets compared to developed Western nations where decades of health education and product familiarity have normalized consumption, suggesting opportunity for awareness-building initiatives but also indicating current educational gaps constraining market expansion. Consumer misconceptions about taste profiles, particularly historical concerns about stevia's characteristic aftertaste, persist despite technological advances that have substantially improved sensory characteristics, requiring manufacturers to invest in product sampling, marketing communications, and point-of-sale education to overcome legacy perceptions.

Competitive Landscape:

The Saudi Arabia natural sweeteners market exhibits moderate competitive intensity characterized by multinational ingredient suppliers leveraging global scale advantages alongside specialized regional manufacturers serving local market preferences. Major international corporations command substantial market presence through comprehensive product portfolios, established distribution networks, and technical support capabilities that enable food and beverage manufacturers to reformulate products with confidence in ingredient consistency and regulatory compliance. These global leaders invest heavily in research and development to advance extraction technologies, optimize taste profiles, and expand application possibilities, positioning natural sweeteners as versatile ingredients capable of meeting diverse formulation requirements across food, beverage, pharmaceutical, and personal care sectors. Regional players capitalize on proximity advantages, cultural market understanding, and flexibility to customize offerings for local taste preferences and pricing requirements, often focusing on specific application niches or geographic markets where relationship-based distribution models provide competitive advantages.

Saudi Arabia Natural Sweeteners Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Stevia, Sorbitol, Mannitol, Xylitol, Erythritol, Others |

| Applications Covered | Bakery, Confectionary, Dairy, Beverages, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia natural sweeteners market size was valued at USD 35.06 Million in 2025.

The Saudi Arabia natural sweeteners market is expected to grow at a compound annual growth rate of 5.35% from 2026-2034 to reach USD 56.05 Million by 2034.

Stevia leads the market by type, capturing 28% share, driven by its zero-calorie composition, comprehensive regulatory acceptance across food and beverage applications, and growing consumer preference for plant-based sweetening solutions aligned with clean-label dietary trends.

Key factors driving the Saudi Arabia natural sweeteners market include escalating health consciousness amid rising obesity and diabetes prevalence, comprehensive government regulatory support including 50% excise taxes on sugar-sweetened beverages and health labeling mandates, rising disposable incomes and urbanization creating consumer segments willing to invest in premium health-oriented products, expanding applications beyond traditional food and beverages into pharmaceutical and personal care sectors, and technological innovations in extraction and formulation methodologies improving taste profiles and functional performance.

Major challenges include premium production costs resulting from complex extraction processes and specialized agricultural inputs that elevate retail pricing potentially constraining adoption in price-sensitive segments, supply chain vulnerabilities and raw material price volatility creating procurement uncertainties for manufacturers, limited consumer awareness and educational deficits about natural sweetener benefits and appropriate usage applications, taste profile inconsistencies across production batches requiring careful quality control and formulation adjustments, and regulatory complexity across different product categories requiring manufacturers to navigate varying approval processes and labeling requirements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)